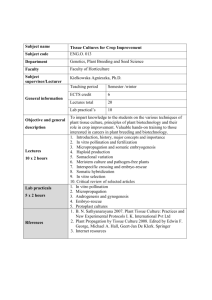

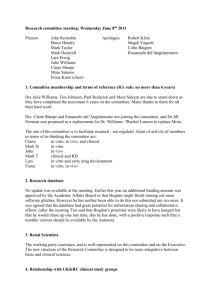

an in-depth look at the vitro bankruptcy proceedings

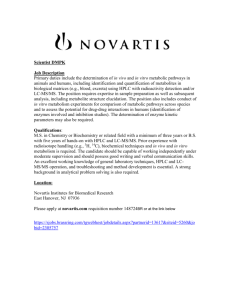

advertisement