Real-Time Analytics

advertisement

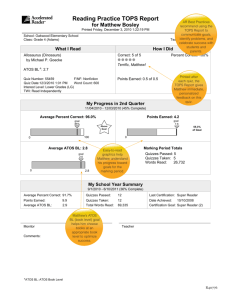

bullion™ for real time analytics Real-time analytics Appliance for timely decision-making in finance! Following the financial crisis and the strengthening of regulations, banks must better manage risks in terms of market, credit and liquidity. Atos partners with Quartet FS to develop a new real-time analytics Appliance based on bullion to bring to the users a solution “in the box” able to handle advanced analytics in-memory with maximum performance. Finance industry: impacted by change With digital transformation, analyzing huge sets of data helps businesses identify risks, detect new opportunities and enables fast-decision making for quick action. This timely decision making based on reliable information requires performance and very low latency. In the finance industry, following the 2008 financial crisis and the strengthening of regulations, banks must not only calculate risks but also be able to check their computations results at any moment. This requires that, on one hand, traders and risk managers run an increasing number of simulations on the fly over large amounts of data that change continuously. On the other hand, controllers must be able to drill down to the most detailed level of calculus in order to detect and explain any potential anomaly. Being able to calculate all types of risk metrics with data visualization both aggregated and very detailed is a real challenge that can only be met with inmemory computing. We will detail 2 use cases where real-time analytics makes all the difference. Risk management use-case: Credit Valuation Adjustment (CVA) To close a deal, a trader needs to propose a competitive pricing while still covering the associated risk. The Credit Valuation Adjustment (CVA) is a standardized tool, already used and calculated on individual financial products to measure risk exposure. Nowadays, due to the duration of calculus, the CVA is often processed after a decision has been taken. And over provisioning risk means less competitive pricing and likely results in lost deals. Better risks management means interactive CVA supervision through a simulation engine integrating constantly evolving data. The answer is a real-time analytics platform. Adapting to drastic changes of the Trading Book Review Rules Following the recent financial crisis, the Basel Committee, is conducting the Fundamental Review of Trading Book (FRTB) rules. One important paradigm change is that pre-aggregated data will not be allowed anymore; the data volume to be processed will therefore be drastically increased in order to keep all the data associated with each transaction and each type of risk (to be able to decompose each and every P&L vector by type of risk). Moreover, different liquidity profiles will have to be taken into account in stress scenarios. This will result in more stress scenarios to execute and thus more processing power needed in addition to the increase in data volumes. For a fast answer, data must be stored inmemory to provide fast response time and interactive drill down. More data means of course a larger memory footprint. Classical IT solutions based on scale-out commodity servers generating huge lags are not appropriate due to shared memory/network latency constraints. You need an in-memory scale-up server with a huge memory footprint. This is now possible with Atos new real-time analytics Appliance based on Active PivotTM and powered by the platform Java Booster by bullion. ActivePivot from Quartet FS is an innovative java in-memory database, aggregation & calculation engine that enables financial institutions to calculate all types of risk metrics. Thus a company has the capability to manipulate massive amounts of evolving data, coming from various systems and apply its own business/aggregation logic. Users can run an unlimited number of parallel what-ifs scenarios and calculations, visualize their data and build their dashboards. In-memory technology completes all operations, no matter how complex, in a matter of seconds instead of minutes or hours and ensures a fluid end-user experience. Changes in the data streams surface in real time and monitoring is vastly simplified. The Java Booster platform is based on bullion, high-end enterprise x86 servers from Bull (the Atos brand for technology products and software) and the Zing Java Virtual Machine (JVM) from Azul Systems. Bullion servers have a unique memory capacity (up to 24 TB). Their modular and scalable architecture, from 2 to 16 processors (up to 288 cores) enables to fully guarantee your investments. Hence, you can start small and with the same technology and without any architecture change, evolve in your needs simply by adding compute modules or memory blades. In addition, bullion meets the highest standards of availability, performance, and quality of service making it a server of choice for in-memory applications. Another key component is the Java Virtual Machine (JVM) from Azul. Zing is designed to remove memory limitations enabling to break the classical Java 150/300 GB memory limit and expand it further without performance impact. Allowing heap sizes of hundreds of GBs without pauses, Zing allows you to meet even the most demanding service level agreements whatever the data volume and without depending upon JVM tuning experts. This bullion–Azul combination is a best of breed for in-memory java enabling very detailed in-memory data analysis (up to 10 TB useful data). This brochure is printed on paper combining 40% eco-certified fibers from sustainable forests management and 60% recycled fibers in line with current environment standards (ISO 14001). Powered by Java Booster by bullion A Big Data Appliance to make it simple Bull has designed together with Quartet FS a new appliance, providing a solution “in a box” with unmatched scalability and performance. This appliance itself provides the values of a fully integrated system: uu uu uu uu uu Pre-tested, validated and integrated Easy and fast deployment Simplified management One-stop shopping, one-stop support Optimized TCO. ActivePivot and Java Booster by bullion : a whole range 1,5TB: S2 3TB: S4 6TB: S8 All trademarks are the property of their respective owners. Atos, the Atos logo, Atos Consulting, Atos Worldgrid, Worldline, BlueKiwi, Bull, Canopy the Open Cloud Company, Yunano, Zero Email, Zero Email Certified and The Zero Email Company are registered trademarks of the Atos group. Intel, the Intel logo, Intel Inside, the Intel Inside logo, Xeon, Xeon Inside are trademarks of Intel Corporation in the U.S. and/or other countries. Atos reserves the right to modify this document at any time without notice. Some offerings or parts of offerings described in this document may not be available locally. Please contact your local Atos office for information regarding the offerings available in your country. This document does not represent a contractual commitment. - February 2016 © 2016 Atos In-memory software for finance: ActivePivot from Quartet FS Scalability, Guaranteed performance, Flexibility F-Real-time analytics Appliance-en The benefits of bullion real-time analytics appliance: • • • • • • Easy capacity expansion to follow business growth and evolution Ready for massive data usage An innovative software stack to deliver real-time results for finance data-based decision making Simple: pre integrated stack with guaranteed performance High Performance and pauseless operations One stop shopping, single point of support Your business technologists. Powering progress www.bull.com/bullion 12 TB: S16