I o. - Oxfam America

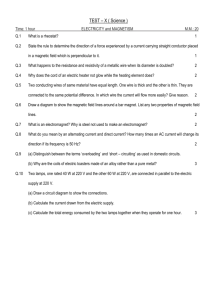

advertisement

990

Form

O MS No. 1545-0047

Return of Organization Exempt From Income Tax

2013

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

Department of the Treasury

I

..

Do not enter Social Security numbers on this form as it may be made public.

Open to Public

Inspection

.... Information about Form 990 and its instructions is at www.irs.aov/form990.

A For the 2013 calendar year, or tax year beginning

APR l , 2013

and ending MAR 31 , 2014

Internal Reve nue Service

C Name of organization

B Check if

applicable:

DAddress

change

o Name

change

olnitial

OXFAM-AMERICA,

INC.

Doina Business As

23-7069110

IRoom/suite

Number and street (or P.O. box if mail is not delivered to street address)

return

OTerminate d

DAmended

return

DApplication

pending

D Employer identification number

226 CAUSEWAY STREET

5TH FLOOR

City or town, state or province, country, and ZIP or foreign postal code

617 - 482-1211

G Gross receipts $

89,416,981 .

BOSTON

H(a) Is this a group return

MA

02114

F Name and address of principal officer:RAYMOND OFFENHEISER

SAME AS C ABOVE

I Tax-exemot status:

501(c)(3) D

soHcH

00

)<11111

(insert no.) D

4947(a)( 1) or

for subordinates? ...... 0

K Form of oraanization:

[X] Corporation

D

Trust

D

Yes

00 No

H(b) Are all subordinates included?D Yes D

No

If "No," attach a list. (see instructions)

I 527

I

H(c) Grouo exemotion number ....

J Website: .... WWW. OXFAMAMERI CA . ORG

I Part 1I

E Telephone number

Association

I

I Other •

I L Year of formation:

19 7 4 1M State of leaal domicile: MA

Summary

1

Briefly describe the organization's mission or most significant activities: CREATE LASTING

c

cu

...c

2

GLOBAL POVERTY 1 HUNGER 1 AND INJUSTICE.

Check this b ox .... D

if the organization discontinued its operations or disposed of more than 25% of its net assets.

>

0

3

Number of voting members of the governing body (Part VI, line 1a)

............................................................

3

a!S

4

Number of independent voting members of the governing body (Part VI, line 1b) .. .. ....... ................... ............

4

18

5

6

Total number of individuals employed in calendar year 2013 (Part V, line 2a) .............. ............ .... ... ..... ..........

5

308

GI

CJ

GI

(!)

fl)

...·:;:

...

GI

~

SOLUTIONS

18

Total number of volunteers (estimate if necessary) .. ... ....................................... .. ....... ........................ ..... .....

7 a Total unrelated business revenue from Part VIII, column (C), line 12 ............................................................

6

1846

7a

0.

b Net unrelated business taxable income from Form 990-T, line 34 .......................................................... ........

7b

o.

Prior Year

GI

::I

c

?tGI

a:

8

Contributions and grants (Part VIII, line 1h) ................ .................... ...... .....................

9 Program service revenue (Part VIII, line 2g) ...................... .......................... ...............

10 Investment income (Part VIII, column (A), lines 3, 4, and 7d) ..... ...... ............ ...... ..........

11 Other revenue (Part VIII , column (A), lines 5, 6d, 8c, 9c, 10c, and 11e) ... ........ ........ ... ..

63,705

1. 535

181

12 Total revenue· add lines 8 through 11 (must eaual Part VIII, column IA), line 12) .... .....

13 Grants and similar amounts paid (Part IX, column (A), lines 1·3)

.................................

Current Year

258.

66

575

765.

593.

473.

1

203

316.

179

399.

65.422

324.

67

958

480.

fl)

fl)

Benefits paid to or for members (Part IX, column (A), line 4) ....................... ................

15 Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10) .........

20,898

248.

24

145

497.

0 •

31

218,548.

0.

31 , 050

866 .

16a Professional fund raising fees (Part IX, column (A), line 11 e) .......................... ................

b Total fundraising expenses (Part IX, column (D), line 25)

12,3221330 •

1,576,916.

w 17 Other expenses (Part IX, column (A), lines 11a·11 d, 11f-24e) .. ... .................... ... ... .......

24,437,856.

18 Total expenses. Add lines 13·17 (must equal Part IX, column (A), line 25) .....................

77.963.886.

19 Revenue less exoenses. Subtract line 18 from line 12 ....................... ......... ........ ........

- 12,541,562.

c

8.

)(

0.

0.

14

GI

TO

2,018,594.

....

~"'

OQ)

24,385,717.

81 768

-13,809

Beainnina of Current Year

356.

876.

··· ····························· ····························· ··············· ·· •·····

88,914.901.

End of Year

78,312.112.

Total liabilities (Part X, line 26) .................................................................................

z LL

=> 22 Net assets or fund balances. Subtract line 21 from line 20 ................................. ........

11. 493. 975.

11. 696. 688.

77,420,926.

66,615.424 .

u

(/) C:

Ci)~

"'"'

~

Q;c:

20 Total assets (Part X, line 16)

21

I Part II I Signature Block

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true. correct. and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge

Sign

~

Here

~ MARK KRIPP

Signature of officer

Date

CFO

Type or print name and title

IPreparer's signature

Print/Type preparer's name

Paid

Preparer

Use Only

I Date

CRAIG KLEIN

Firm's name ..,.. CBIZ TOFIAS

Firm's address ..,.. 5 0 0

~elf-employed

Firm's EI N..,.

b

PTIN

00734640

26-3753134

BOYLSTON STREET

BOSTON

MA

Phone no. 61 7 - 7 6_1 - 0_QJ)_O_

02116

May the IRS discuss this return with the preparer shown above? (see inst ructions)

332001 10-29- 13

I Check LJ

........................ ·"" . ~·-....... ·"~'~" ...... ..

LHA For Paperwork Reduction Act Notice, see the separate instruct ions.

D

_

OOYes

No

Form 990 (2013)

OXFAM- AMERICA

Form990 2013

INC .

23-7069110

Pa e 2

Part Ill Statement of Program Service Accomplishments

Check if Schedule 0 contains a response or note to any line in this Part Ill ........... ................. ..... .... ..... . ...................... ................ ..

Briefly describe the organization 's mission:

CXJ

OXFAM AMERICA IS AN INTERNATIONAL RELIEF AND DEVELOPMENT ORGANIZATION

THAT CREATES LASTING SOLUTIONS TO POVERTY, HUNGER, AND INJUSTICE. WITH

INDIVIDUALS AND LOCAL GROUPS IN MORE THAN 90 COUNTRIESL OXFAM SAVES

LIVESL HELPS PEOPLE OVERCOME POVERTY AND FIGHTS FOR SOCIAL JUSTICE.

2

Did the organization undertake any significant program services during the year which were not listed on

the prior Form 990 or 990-EZ? ...... .. .......... .............. ......... ... .. .......... .... .. . .. .. ....... ....... .. . ......... .... .. .......... . ... .......... . ...........

If "Yes," describe these new services on Schedule 0 .

3

4

O

ves [][] No

CXJ No

Did the organizat ion cease conducting, or make significant changes in how it conducts, any program services?..... ............. O ves

If "Yes," describe these changes on Schedule 0 .

Describe the organization 's program service accomplishments for each of its three largest program services, as measured by expenses.

Section 501(c)(3) and 501 (c)(4) organizations are required to report the amount of grants and allocations to others, the total expenses, and

revenue, if any, for each program service reported.

4a

) (Expenses$

2 4 9 3 5 14 2 • including grants of$

9 , 3 5 6 , 6 9 8 • ) (Revenue$

0• )

PROGRAMS TO OVERCOME POVERTY AND INJUSTICE: IN ETHIOPIAL OXFAM IS

WORKING WITH LOCAL MINISTRIES TO MODERNIZE THE AGRICULTURAL EXTENSION

SYSTEM - A NETWORK OF 215 TRAINING CENTERS ACROSS 10 REGIONS - BUILDING

THE SKILLS OF 645 EXPERTS TO PROMOTE GOOD FARMING PRACTICES THAT WILL

ENSURE GREATER FOOD SECURITY . IN GHANAL OXFAM HAS BEEN WORKING WITH

PARTNERS TO CONVINCE THE GOVERNMENT TO INVEST MORE OF ITS OIL REVENUES

IN AGRICULTURE . 15% OF OIL REVENUES GOING TO THE 2014 BUDGET IS NOW

PLEDGED FOR AGRICULTURE MODERNIZATION, 94 . 5% OF WHICH WILL BE ALLOCATED

TOWARD AGRICULTURAL INITIATIVES THAT ALLEVIATE POVERTY FOR SMALL- SCALE

FARMERS SUCH AS INCREASED QUALITY OF FERTILIZER AND SEED, MORE ACCESS

TO PROCESSING AND STORAGE FACILITIESL AND AFFORDABLE CREDIT.

4b

) (Expenses $

2 0 , 6 3 8 313 • including grants of$

11 5 7 4 4 6 5 • ) (Revenue$

)

SAVING LIVES - EMERGENCY RESPONSE AND PREPAREDNESS: TYPHOON HAIYAN LEFT

MORE THAN 14 . 1 MILLION PEOPLE IN NEED OF IMMEDIATEL LIFE-SAVING

ASSISTANCE AND PUSHED MILLIONS FURTHER INTO POVERTY . RICE CROPSL

COCONUT TREES, AND FISHING BOATS WERE WIPED OUT, LEAVING PEOPLE

STRUGGLING TO GROW FOOD AND EARN AN INCOME. OXFAM DISTRIBUTED HYGIENE

KITS, PROVIDED RICE SEED TO FARMERS, PROVIDED CASH FOR WORK, AND WITH

LOCAL AUTHORITIES PROVIDED ACCESS TO CLEAN WATER. WORK ALSO CONTINUED

IN CAMPS OF INTERNALLY DISPLACED PEOPLE IN SUDAN AND WITH SYRIAN

REFUGEES TO PROVIDE HYGIENE KITS AND ACCESS TO CLEAN WATER. WORK WITH

PARTNERS CONTINUED IN CENTRAL AND SOUTH AMERICA TO SUPPORT LOCAL TEAMS

OF WATER, SANITATION, AND HYGIENE VOLUNTEERS TO BUILD THE CAPACITY OF

VULNERABLE COMMUNITIES TO BE BETTER PREPARED FOR A DISASTER .

(Code:

) (Expenses$

12 2 8 7 8 2 6 • including grants of$

3 , 179 , 8 4 0 • ) (Reve n u e $ - - - - - -CAMPAI GNI NG FOR SOCIAL JUSTICE: OXFAM'S GROW CAMPAIGN WORKED TO FIX A

BROKEN FOOD SYSTEM AND ADDRESS THE ROOT CAUSES OF HUNGER . WITH THE

SUPPORT OF 225,000 CONSUMERS AND ACTIVISTS, GROW WORKED TO PASS

LIFESAVING REFORMS TO U.S. FOOD AID LAWSL AND SUCCESSFULLY PERSUADED

SOME OF THE WORLD'S BIGGEST FOOD COMPANIES TO IMPROVE THEIR POLICIES ON

POVERTY AND HUNGER ISSUES. WORKING WITH ALLIESL OXFAM FURTHERED THE

DEBATE IN WASHINGTON ON HOW TO IMPROVE U.S. DEVELOPMENT AID INCLUDING

"USAID FORWARD," A FLAGSHIP REFORM AGENDA BUILT ON THE ACKNOWLEDGEMENT

THAT LOCAL PEOPLE AND INSTITUTIONS MUST PLAY THE LEADING ROLE IN

TRANSFORMING THEIR COUNTRIESL AND ENSURING THE TRANSPARENCY OF U. S .

FOREIGN ASSISTANCE THROUGH A PUBLIC WEBSITEL BIPARTISAN- SUPPORTED

LEGISLATIONL AND INDEPENDENT INTERNATIONAL RANKINGS.

4c

(Code:

1

(Code:

1

1

1

Other program services (Describe in Schedule 0 .)

4e

Total program service expenses~

5 4 01 362 •

1

1

1

1

4d

{Expenses $

1

including gants of $

3 4 4 9 4 •) (Revenue $

1

63 , 2 6 2 , 64 3 •

Form 990 (2013)

332002

10 · 29·13

2

11000807 756948 23796.000

2013.04010 OXFAM-AMERICA, INC.

23796 01

Form 990 (20131

OXFAM-AMERICA, INC.

23-7069110

I Part IV I Checklist of Required Schedules

Paoe3

Yes I No

1

Is the organization described in section 501 (c)(3) or 4947(a}(1) (other than a private foundation)?

x

x

If "Yes," complete Schedule A ....... .... ............ ...... .. .. ...... ... .. .................... .. ...... ...... ...... .... ........... ......... ...... ... .. ... .. .... . ....... .

1

2

3

Is the organization required to complete Schedule B, Schedule of ContributorS? .. .... ..... ..... .. ... .... .................................... ..

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates for

public office? If "Yes," complete Schedule C, Part I .... .... .. .. ... .. ... ... ..... .. ..... ... . .. ..... .... ... ..... .. ... .... ....... ... ....... ... ... .. ........ ...... .

Section 501(c)(3) organizations. Did the organization engage in lobbying activities, or have a section 501 (h} election in effect

3

4

during the tax year? If "Yes," complete Schedule C, Part II ...... .. ... .. ... .. ... ... .. .... . .... .. .. .... ... .... ... ........................................... .

Is the organization a section 501 (c}(4), 501 {c)(5), or 501 {c)(6) organization that receives membership dues, assessments, or

4

5

similar amounts as defined in Revenue Procedure 98·19? If "Yes," complete Schedule C, Part Ill ... ..... .. ............. ... .... ... ...... .. .

Did the organization maintain any donor advised funds or any similar funds or accounts for which donors have the right to

5

x

6

provide advice on the distribution or investment of amounts in such funds or accounts? If "Yes," complete Schedule D, Part I

6

x

2

x

x

7

Did the organization receive or hold a conservation easement, including easements to preserve open space,

the environment, historic land areas, or historic structures? If "Yes," complete Schedule D, Part If.... . ... ............. .

. ... ......... .

Did the organization maintain collections of works of art, historical treasures, or other similar assets? ff "Yes, " complete

7

x

8

Schedule D, Part Ill ....... .. .... .... ... ...... .................... .. ....... ... ... ... ............. .. ......... ... .... .. ... ... .... ........ ... ........ ...... ................. .

8

x

9

x

Did the organization report an amount in Part X, line 21 , for escrow or custodial account liability; serve as a custodian for

9

amounts not listed in Part X; or provide credit counseling, debt management, credit repair, or debt negotiation services?

If "Yes, " complete Schedule D, Part IV

.. .. .... .. ... .. ...... .. ... .... .. ..... .... .. .. .... ....... .. ..... .. .... .................... ........ .. ......... .. .. .. .. ... ..... ..

10

Did the organization , directly or through a related organization , hold assets in temporarily restricted endowments, permanent

11

endowments, or quasi-endowments? If "Yes," complete Schedule D, Part V .. .. .... .. .... ... .... .... ... ... .. .. ... .. .. ... .. ... .. . .. .. . ... .. ... .

If the organization's answer to any of the following questions is "Yes, " then complete Schedule D, Parts VI, VII, VIII , IX, or X

I 10 I X

as applicable.

a Did the organization report an amount for land, buildings, and equipment in Part X, line 1O? If "Yes," complete Schedule D,

Part VI

11a

I X

b Did the organization report an amount for investments · other securities in Part X, line 12 that is 5% or more of its total

assets reported in Part X, line 16? If 'Yes," complete Schedule D, Part VII .. ................ ..... ........... ....... .... ... .... ... .. .. ........ ... ... .

11b

c Did the organization report an amount for investments · program related in Part X, line 13 that is 5% or more of its total

assets reported in Part X, line 16? If ' Yes," complete Schedule D, Part VIII . . .. . .. . ... .. ... . .. . ... .... .... ... .. . ... . .. . ... ... ... ... .. . .. ... . .... .

d Did the organization report an amount for other assets in Part X, line 15 that is 5% or more of its total assets reported in

Part X, line 16? If "Yes," complete Schedule D, Part IX .. ... ...... .. .... ... .......... .................... .............. ........... ... ... ... ... .. .... .... ....... .

e Did the organization report an amount for other liabilities in Part X, line 25? If "Yes," complete Schedule D, Part X ... .. ..... ...... .

f

11c

11d

11e

x

11f

x

Did the organization 's separate or consolidated financial statements for the tax year include a footnote that addresses

the organization's liability for uncertain tax positions under FIN 48 {ASC 740)? If "Yes," complete Schedule D, Part X

x

x

x

12a Did the organization obtain separate, independent audited financial statements for the tax year? If "Yes," complete

Schedule D, Parts XI and XII

.... ... . .... . . . .. . .. ... ... .. ... ... ... .. . .. . .. . .. ... .. . .. ... .. . .. .. . .. . .. ... . .. ... . .. . .. . .... ... .... ... . ... . .. . ... ... ... . .. .. . .. ....... .... .

x

12a

b Was the organization included in consolidated , independent audited financial statements for the tax year?

13

If "Yes, " and if the organization answered "No " to line 12a, then completing Schedule D, Parts XI and XII is optional ........... ... .

12b I

Is the organization a school described in section 170{b)(1)(A)(ii)? If "Yes," complete Schedule E

13

............... ... ...... .. .. .. .... .... ... .

14a Did the organization maintain an office, employees, or agents outside of the United States? ....... .. .. ....... .. ... ........ .. . ... . ... ... . ..

X

I 14a I X

x

b Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising, business,

investment, and program service activities outside the United States, or aggregate foreign investments valued at $100,000

I 14b I X

15

or more? If "Yes, " complete Schedule F, Parts I and IV .. .. ... ... ... ... .. ... .. .. . ... .. ... . .. ... . .. .... .. .. .. .... ... .... ... .. .. . .. .. .. ... .. . .. ... .. .. . .. . ... .. . .

Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or other assistance to or for any

foreign organization? If "Yes, " complete Schedule F, Parts II and IV ........ ........ .... .. .......... .... ... .. .. .. ..... ... ... ................... ... ..

Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or other assistance to

15

16

orfor foreign individuals? If "Yes," complete Schedule F, Parts Ill and IV ........ ........ .......... ..... ...... ........... ...... ...... .. ... ..... ... .. . .

Did the organization report a total of more than $15,000 of expenses for professional fundraising services on Part IX,

16

17

column (A), lines 6 and 11 e? If "Yes, " complete Schedule G, Part I ... .. .... .... ..... ...... ...... .... .... ... ............. ..... ... ..... ... ........ .. . .

Did the organization report more than $15,000 total of fundraising event gross income and contributions on Part VIII, lines

17

18

1c and Ba? If "Yes, " complete Schedule G, Part II . ... ... ... ... ... .. ...... ..... ........ ...... ...................... .............. .. ....... ..... ... .... ...

Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a? If "Yes,"

18

19

complete Schedule G, Part Ill ... ........ .... ... .... ... ...... .. .. ... ... ... ... ...... ... ... .. .. ........ .... ... ... .... ...... .. ..... ... ..... .. ... ... ... .. .... ........ .. ... .

20a Did the organization operate one or more hospital facilities? If "Yes," complete Schedule H ... .. .. .. .. ...

.. ... ..... .... .. ... ... ...... .

b If "Yes" to line 20a, did the oroanization attach a copy of its audited financial statements to this return? ............... ..... .. ... ... .

19

I X

x

x

x

x

x

20a

20b

Form 990 (2013)

332003

10-29-13

11000807 756948 23796.000

3

2013.04010 OXFAM- AMERICA, INC.

23796 01

Form 990 (2013)

OXFAM-AMERICA, INC.

23-7069110

f Part IV I Checklist of Required Schedules (continued)

Paae4

Yes

21

Did the organization report more than $5,000 of grants or other assistance to any domestic organization or

government on Part IX, column (A), line 1? If "Yes," complete Schedule I, Parts I and II .. ........ ..... ... ... ... .. .... .. . ....................

Did the organization report more than $5,000 of grants or other assistance to individuals in the United States on Part IX,

21 I X

22

column (A), line 2? If ' Yes, • complete Schedule I, Parts I and Ill ......................................................... ... ..... ........................ .

Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the organization's current

and former officers, directors, trustees, key employees, and highest compensated employees? If ' Yes, ' complete

22

ScheduleJ ....................................................................................................................................................................... .

231X

23

24a Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than $100,000 as of the

last day of the year, that was issued after December 31 , 2002? If ' Yes,' answer lines 24b through 24d and complete

~~:::::r:~~~z;~~ ;n~:~:i:~y :;oc~~d;·~f·~~:~·~~~~~· b~~d~.b~~~~·d ~· ~~~~~;~~·~~~i~ci·~~~~~~i~~·?· ::::·:::::::::: ::::::::::::::::: I ~::

2

b

..

c Did the organization maintain an escrow account other than a refunding escrow at any time during the year to defease

d

~~: ::-:;;:;:a~i:~d:~ ~;·~~·::~~ b~h~lf.~f::·i~;~~~·f~~·b~~d;·~·~~·~~~~d;~·~·~~·~~~..;i~~·d~·;i·~~·~h~.~~~~1·::: :::::::::::::::::::::::::::::: I ~::

I No

Ix

I

II

X

II

25a Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in an excess benefit transaction with a

disqualified person during the year? If "Yes," complete Schedule L, Part I ............................................ ... .. .. ... ... ........ ...... .. . .

b Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a prior year, and

that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ? If ' Yes,' complete

Schedule L, Part I

26

Did the organization report any amount on Part X, line 5, 6, or 22 for receivables from or payables to any current or

former officers, directors, trustees, key employees, highest compensated employees, or disqualified persons? If so,

complete Schedule L, Part II ............................................................................................................. ................................

Did the organization provide a grant or other assistance to an officer, director, trustee, key employee, substantial

27

25a

x

25b

x

I 26 I I X

contributor or employee thereof, a grant selection committee member, or to a 35% controlled entity or family member

ofanyofthesepersons?/f ' Yes," completeScheduleL, Part/I/ ...................... .................................................................... j 21

Was the organization a party to a business transaction with one of the following parties (see Schedule L, Part IV

28

instructions for applicable filing thresholds, conditions, and exceptions):

a A current or former officer, director, trustee, or key employee? If "Yes, " complete Schedule L, Part IV ... ... .. ..... ... .. ..... ... .. .....

b A family member of a current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L, Part IV . . .. ..

c An entity of which a current or former officer, director, trustee, or key employee (or a family member thereof) was an officer,

III

director, trustee, or direct or indirect owner? If "Yes, " complete Schedule L, Part IV ............... ..... ....................... .......... ...... .. ..

Did the organization receive more than $25,000 in non-cash contributions? If "Yes," complete Schedule M .. ... ..... ..... ... ... .... ..

Did the organization receive contributions of art, historical treasures, or other similar assets, or qualified conservation

28c

contributions? If "Yes, " complete Schedule M .. ... ........ ................................................................. ... ... ... ...... ..... .. ... ............. .

Did the organization liquidate, terminate, or dissolve and cease operations?

30

31

If ' Yes,• complete Schedule N, Part I . ........................ ............................................................................................ ........... .

Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets? If ' Yes, • complete

31

32

Schedule N, Part II ............................... ........................................................................................................... ................. .

32

29

33

Did the organization own 100% of an entity disregarded as separate from the organization under Regulations

sections 301 .7701 -2 and 301 .7701 -3? If ' Yes, • complete Schedule R, Part I .............................. ......................................... .

Was the organization related to any tax-exempt or taxable entity? If "Yes, ' complete Schedule R, Part II, Ill, or IV, and

33

34

Part V, line 1 ... .... ........ ...................... ........................ ....... ....... ........... ................ ................. ..... ........ .. .... ... .. .. ... ................ .

35a Did the organization have a controlled entity within the meaning of section 512(b)(13)? ........ ..... .. ........... .......... .......... ....... .

b If "Yes" to line 35a, did the organization receive any payment from or engage in any transaction with a controlled entity

34

35a

within the meaning of section 512(b)(13)? If "Yes, " complete Schedule R, Part V, line 2 ....... ....... ... .... ................................... .

Section 501(c)(3) organizations. Did the organization make any transfers to an exempt non·charitable related organization?

35b

If "Yes," complete Schedule R, Part V, line 2 . ........... ........ .......... ........................................ .... ... ... ............... ........................ .

36

37

Did the organization conduct more than 5% of its activities through an entity that is not a related organization

38

and that is treated as a partnership for federal income tax purposes? If "Yes," complete Schedule R, Part VI .................... ... .

Did the organization complete Schedule 0 and provide explanations in Schedule 0 for Part VI, lines 11 band 19?

Note. All Form 990 filers are required to complete Schedule 0 ............. .......... ... ........................................ .............. .... .

X

X

28a

28b

29

30

36

I IX

x

IX

x

x

x

x

x

x

x

x

37

1x

x

38

Form 990 (2013)

332004

10-29-13

4

11000807 756948 23796.000

2013.04010 OXFAM- AMERICA, INC.

23796_01

OXFAM-AMERICA, INC.

Form 990 (2013\

Part VI

23-7069110

Paae5

Statements Regarding Other IRS Filings and Tax Compliance

Check if Schedule 0 contains a response or note to any line in this Part V

CXJ

1a Enter the number reported in Box 3 of Form 1096. Enter ·O· if not applicable

b Enterthe number of Forms W·2G included in line 1a. Enter ·O· if not applicable··:. ::: ··:::::: .: ·:: : ..::

Yes

I ~: I

7

l

I

No

61

c Did the organization comply with backup withholding rules for reportable payments to vendors and reportable gaming

(gambling) winnings to prize winners? .............................. ......... ... ... .... ..... ... ........ ..... ... ......... .. .... ........... . ...... ... ................

2a Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax Statements,

filed for the calendar year ending with or within the year covered by this return . .. . .. .. .. . .. . . . .. . .. ... . .. ...

I I

2a

1c

x

2b

x

I

308

b If at least one is reported on line 2a, did the organization file all required federal employment tax returns? .. . ....... ..... ........ ..... .

Note. If the sum of lines 1a and 2a is greater than 2SO, you may be required to e-file (see instructions) ...... ............. ...... .. ... ...

3a Did the organization have unrelated business gross income of $1 ,000 or more during the year? .. . .. . .. . .. . . . .. . .. . .. ... .. . ... .. .. . .. ...

b If "Yes," has it filed a Form 990-T for this year? If "No, " to line 3b, provide an explanation in Schedule O .. . .. . .. . .. ... .. . .. . .. .. . .. ...

4a At any time during the calendar year, did the organization have an interest in, or a signature or other authority over, a

I 3a I I X

3~

financial account in a foreign country (such as a bank account, securities account, or other financial account)? .. .... .

b If "Yes," enter the name of the foreign country: .... _S_E_E

__S_C_H_E_D_U_L_E_ O

_ ________ _ ______

See instructions for filing requirements for Form TD F 90·22.1, Report of Foreign Bank and Financial Accounts.

Sa Was the organization a party to a prohibited tax shelter transaction at any time during the tax year? .. . .. . .. . .. . .. . .. .. .. . .. . .. .. ... ...

b Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction?... ........................

4a

x

I I IX

Sa

Sb

X

5c

c If "Yes," to line Sa or Sb, did the organization file Form 8886·T? .. .. ............ .......... ...... ..... .. ........ .................. ...... ... .. ... ...... .. ...

6a Does the organization have annual gross receipts that are normally greater than $100,000, and did the organization solicit

any contributions that were not tax deductible as charitable contributions?

x

6a

b If "Yes, " did the organization include with every solicitation an express statement that such contributions or gifts

were not tax deductible?

7

6b

Organizations that may receive deductible contributions under section 170(c).

a Did the organization receive a payme nt in excess of $75 made partly as a contribution and partly for goods and services provided to the payor?

LTu..J_x

b If "Yes, " did the organization notify the donor of the value of the goods or services provided? .. ... ... ..................................... ~

c Did the organization sell, exchange, or otherwise dispose of tangible personal property for which it was required

to file Form 8282?

. ... ... .. . . .. ... ... ... . ... ... ... ... ... ... ... ... ... ... ... ... . .... . .. . .. . ... ..... . . .. ... ... .. . .. .. . .. .. ... ... ... .. . .. . .. . .. . ... .. . ... ...

d If "Yes," indicate the number of Forms 8282 filed during the year

... ....... ........ .. ..... ........ .. .. ......... .

. ... ..... ..... . .

I 7d I

7c

I

e Did the organization receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? ...... ............. .

f

Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract? ... ... .. ...... ... .. .. ... .. .

g If the organization received a contribution of qualified intellectual property, did the organization file Form 8899 as required? ..

h If the organization received a contribution of cars, boats, airplanes, or other vehicles, did the organization file a Form 1098-C?

8

Sponsoring organizations maintaining donor advised funds and section 509(a)(3) supporting organizations. Did the supporting

organization, or a donor advised fund maintained by a sponsoring organization, have excess business holdings at any time during the year?

9

Sponsoring organizations maintaining donor advised funds.

7e

7f

79

I I I

-'-7-'-'h-+-.--+. __

1-.

I

8

a Did the organization make any taxable distributions under section 4966? ........ .. .. ... ............... ............ ........... ....... .. ....... ...... .

b Did the organization make a distribution to a donor, donor advisor, or related person?

10

Section 501(c)(7) organizations. Enter:

a Initiation fees and capital contributions included on Part VIII, line 12 .......... .......................... ... .. .. .

b Gross receipts, included on Form 990, Part VIII , line 12, for public use of club facilities

11

x

x

x

I

9a

9b

~

10b

Section 501{c)(12) organizations. Enter:

a Gross income from members or shareholders

11a

b Gross income from other sources {Do not net amounts due or paid to other sources against

12a

~:t~:~s4~~~;)~~~~i;~~ef~::~~::~ri~~b~~ -~~~~~~. i~: ~-h~· ~~~~~i~~~i·~·~· f.i i_~~-F~~~ ·99·(; ;~.Ii~~ -~f ·F~·;m: 1~~;

I 12a I

I

b If Yes, enter the amount of tax-exempt interest received or accrued dunng the year ... ............... ·'-""

12

'°'b"'--'-j- -- -------i·

13

Section 501(c)(29) qualified nonprofit health insurance issuers.

a Is the organization licensed to issue qualified health plans in more than one state? ...... .... .. .. ... ....... .................. .. ... .. .... ...... .. .

Note. See the instructions for additional information the organization must report on Schedule 0.

b Enter the amount of reserves the organization is required to maintain by the states in which the

organization is licensed to issue qualified health plans . ... ... . .... .... ... .. ... .. .... ... .. .. . ... .. . .. ... .. ... .. . .. . .. ... .

c Ent" thoamouot ohe,,Neo oo h~d . . .. .. . .. . .. . .. . .. . .. . .. . .. . .. . ... .. .. . ... .. .. .. . ... .. . .. . .. . .. . ... . .. . .. . .. . .. . ... . ..

14a Did the organization receive any payments for indoor tanning services during the tax year?

i 13b I

I 13c I

. ... ... ... ... ... .. .. ... .. .. . ... .. .. ... .. ...

b If "Yes, " has it filed a Form 720 to reoort these payments? If "No." provide an explanation in Schedule O ... . . .. . . ... ... ..... .. ..

13a

I

I I IX

14~

14a

Form 990 (2013)

3320 05

10-29 -13

5

11000807 756948 23796.000

2013 . 04010 OXFAM-AMERICA, INC .

23796 01

2 3-7 0 6 9110 Pa e 6

"Yes" response to lines 2 through 7b below, and fora "No " response

to line Ba, 8b, or 1Ob below, describe the circumstances, processes, or changes in Schedule O. See instructions.

Form 990 2013

OXFAM-AMERICA

INC.

Part VI Governance, Management, and Disclosure For each

[X]

Check if Schedule 0 contains a response or note to any line in this Part VI

Section A. Governina Bodv and Manaaement

1a Enter the number of voting members of the governing body at the end of the tax year . ...... ... .. ......

Yes

I 1a I

181

I

181

I

No

If there are material differences in voting rights among members of the governing body, or if the governing

body delegated broad authority to an executive committee or similar committee, explain in Schedule 0.

2

I

b Enter the number of voting members included in line 1a, above, who are independent ........ ...... ... .

1b

Did any officer, director, trustee, or key employee have a family relationship or a business relationship with any other

officer, director, trustee, or key employee? ..................................................................... ... ... ........................... .... ............. .

Did the organization delegate control over management duties customarily performed by or under the direct supervision

3

2

of officers, directors, or trustees, or key employees to a management company or other person? .......... .... .................... ...... ..

3

4

Did the organization make any significant changes to its governing documents since the prior Form 990 was filed? ....... ....... .

4

5

Did the organization become aware during the year of a significant diversion of the organization's assets? ..... ...... ............... .

5

6 Did the organization have members or stockholders? .... .... .... ... ... ......... ....... ...... ....... ..................... ................................. .. ..

7a Did the organization have members, stockholders, or other persons who had the power to elect or appoint one or

6

more members of the governing body? ............. ................ .. ...... .... ........ ............... ................... ...... ....................... ..... ........ .

b Are any governance decisions of the organization reserved to (or subject to approval by) members, stockholders, or

7a

persons other than the governing body? ............ ........... .............. ............................. ........ .................. ... .......... ............. .. .

Did the organization contemporaneously document the meetings held or written actions undertaken during the year by the following:

7b

a The governing body? ........... .......... ................ .................. ......... ...................................................................... ........ .. ....... . .

b Each committee with authority to act on behalf of the governing body? ............. .................. ... ..................... ........... ...... .... ..

9

Is there any officer, d irector, trustee, or key employee listed in Part VII , Section A, who cannot be reached at the

Sa

Sb

8

oraanization 's mailina address? If ' Yes, • orovide the names and addresses in Schedule 0

.................................................. .

I

x

x

x

x

x

x

x

x

x

9

Section B. Policies (This Section B requests information about oolicies not required by the Internal Revenue Code.)

I Yes I No

10a Did the organization have local chapters, branches, or affiliates? ........................................... ...... ........................................ .

b If "Yes," did the organization have written policies and procedures governing the activities of such chapters, affiliates,

10a

and branches to ensure their operations are consistent with the organization 's exempt purposes? ..... ......... ...... ..... ............. .

11a Has the organization provided a complete copy of this Form 990 to all members of its governing body before filing the form?

10b

x

x

U!.. _x

b Describe in Schedule 0 the process, if any, used by the organization to review this Form 990.

12a Did the organization have a written conflict of interest policy? If "No, ' go to line 13 ...... .. ................... ......................... ...... .

b Were officers, directors, or trustees, and key employees required to disclose annually interests that could give rise to conflicts? .............. ... .

IX

12a

1~

c Did the organization regularly and consistently monitor and enforce compliance with the policy? If "Yes, ' describe

in Schedule 0 how this was done

12c

13

Did the organization have a written whistleblower policy? ................... ...................... .. ...... .. ............................................... .

13

14

15

Did the organization have a written document retention and destruction policy? .. .......... ......... ........................ .................... .

Did the process for determining compensation of the following persons include a review and approval by independent

14

persons, comparability data, and contemporaneous substantiation of the deliberation and decision?

a The organization's CEO, Executive Director, or top management official .... ..... .... ...... ........... ... ...... ...................... ....... ......... .

15a

b Other officers or key employees of the organization .. ................. ...... ... ......... ..... ... ....... ............................ ........... ................ .

If "Yes " to line 15a or 15b, describe the process in Schedule 0 (see instructions).

15b

x

_x

x

x

x

x

x

16a Did the organization invest in, contribute assets to, or participate in a joint venture or similar arrangement with a

taxable entity during the year? ... ................................. ... ... .... ............................. ... .. ....... .. ..... ........ .............. ........ ............ ..

b If "Yes, " did the organization follow a written policy or procedure requiring the organization to evaluate its participation

16a

x

in joint venture arrangements under applicable federal tax law, and take steps to safeguard the organization's

exemot status with resoect to such arranaements? .... ............................................................................... ...... .... .............. IJ6b

Section C. Disclosure

17

List the states with which a copy of this Form 990 is required to be filed .... MA, AL,

18

Section 6104 requires an organization to make its Forms 1023 (or 1024 if applicable), 990, and 990·T (Section 501 (c)(3)s only) available

AK, AZ , AR, CA, CT, DE, FL, GA, HI , ID

for public inspection. Indicate how you made these available. Check all that apply.

[X] Own website

D

[X] Upon request

Another's website

D

Other (explain in Schedule 0 )

19

Describe in Schedule 0 whether (and if so, how), the organization made its governing documents, conflict of interest policy, and financial

20

State the name, physical address, and telephone number of the person who possesses the books and records of the organization: ..... _ _ __

statements available to the public during the tax year.

MARK KRIPP - 617 - 728-2558

226 CAUSEWAY STREET. 5TH FLOOR, BOSTON, MA 02114-2206

3 32oo e 10 -2 9.13

SEE SCHEDULE 0 FOR FULL LIST OF STATES

Form990(2013)

6

11000807 756948 23796.000

2013.04010 OXFAM-AMERICA, INC.

23796 01

OXFAM-AMERICA, INC.

Form99012013l

23-7069110

Paae

7

Part VII I Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated

Employees, and Independent Contractors

Check if Schedule 0 contains a response or note to any line in this Part VII

Section A.

D

........ ... ... .... .... .

Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

1a Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the organization's tax year.

• List all of the organization's current officers, directors, trustees (whether individuals or organizations), regardless of amount of compensation.

Enter -0- in columns (D), (E), and (F) if no compensation was paid.

•List all of the organization's current key employees, if any. See instructions for definition of "key employee."

• List the organization 's five current highest compensated employees (other than an officer, director, trustee, or key employee) who received reportable compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the organization and any related organizations.

• List all of the organization 's former officers, key employees, and highest compensated employees who received more than $100,000 of

reportable compensation from the organization and any related organizations.

•List all of the organization 's former directors or trustees that received, in the capacity as a former director or trustee of the organization,

more than $10,000 of reportable compensation from the organization and any related organizations.

List persons in the following order: individual trustees or directors; institutional trustees; officers; key employees; highest compensated employees;

and former such persons.

D

-

-

·-- · ·

-

··- - - .. . ---·-·--·

-·· -

-'M'- ----- · - ·· ··-· -··

(A)

Name and Title

(1) LOUGHREY, JOSEPH

CHAIR

(2) SINGH, SMITA

VICE CHAIR

( 3) HAMILTON, JOE H.

TREASURER AND SECRETARY

(4) ALI, MOHAMAD

DIRECTOR

( 5) BAPNA, MANISH

DIRECTOR

( 6) BECKER, ELIZABETH

DIRECTOR

( 7) BELL, WALTER

DIRECTOR

( 8)

BROWN, L. DAVID

DIRECTOR

( 9)

CONWAY, ROSALIND

DIRECTOR

(10) DONIGER, DAVID

DIRECTOR

(11) DOWN, JAMES

DIRECTOR

(12) FOX, JONATHAN

DIRECTOR

(13) GABERMAN, BARRY

DIRECTOR

(14) GARRELS, ANNE L.

DIRECTOR

(15) GLANTZ, GINA

DIRECTOR

(16) GLICKMAN, DAN

DIRECTOR

( 17 ) MAKINO, SHIGEKI

DIRECTOR

·-·-----'~'-···---·-··--·"I"'-··------ ··

(8)

Average

hours per

week

(list any

hours for

related

organizations

below

line)

(C)

Position

(do not check more than one

0

~

0

~

~

=

.,.~

~

4.50

1n

j;

j

~

~

0

;;:;

;E

0

!

~

~

-···--·1 _ .. ,,....,. . ..,,., _.. "....,...,. ....,,_.,

(0)

box, unless person is both an

officer and a director/trustee)

'C

--··-··-

iE"

Reportable

compensation

from

the

organization

(W-2/1099-MISC)

(E)

Reportable

compensation

from related

organizations

(W-2/1099-MISC)

8~

~.2'

=~

~~

I

(F)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

o.oo x

x

0.

0.

0.

2 . 50

0.00

2.50

x

x

0.

0.

0.

o. oo x

x

0.

0.

o.

x

0.

0.

0.

o.oo x

0.

0.

x

0.

0.

o.oo x

0.

0.

0.50

0.00

1. 50

x

0.

0.

o.

o.

o.

o.

o.oo x

0.

0.50

0.00

2.00

x

0.

o.oo x

0.

1.50

0.00

2.00

x

0.

x

0.

x

0.

x

0.

x

o.

o.

o.

o.

o.

o.

o.

o.

o.

o.

o.

0.50

0.00

2.50

1. 90

0.10

0.50

o.oo

2.50

o.oo

1.00

o.oo

0.80

o.oo

2.00

o.oo

x

0.

0.

0.

0.

0.

0.

0.

0.

0.

Form 990 (2013)

332007 10-29- 13

7

11000807 756948 23796.000

2013.04010 OXFAM-AMERICA, INC.

23796 01

-- -

---

IPart VII ISection A. Officers

--- --- - - --

--

-- -

.

--- - -

Directors Trustees Key Em:>loyees and Hiahest Comoensated Employees (continued)

(B)

(C)

(A)

(D)

(E)

Position

Average

Name and title

Reportable

Reportable

(do not check more than one

hours per

compensation

box, unless person is both an

compensation

officer and a director/trustee)

week

from

from related

(list any

the

organizations

~

hours for

'i5

organization

(W-2/1099-MISC)

related

(W-2/ 1099-MISC)

~

,,

organizations ~

~ e

Ci 8~

below

!

~£' ~

~ .c

line)

~ ~

~ ~~ .2

(F)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

~

1

0

...

.,.

Ii

~

1. 00

( 18) NGUYEN, MINH- CHAU

DIRECTOR

(19) REISS, STEVEN

DIRECTOR

( 20) SEWALL, SARAH

DIRECTOR

(21) WIDMANN, ROGER

DIRECTOR

(22) OFFENHEISER, RAYMOND C.

PRESIDENT (NON- VOTING)

(23) KRIPP , MARK

CHIEF FINANCIAL OFFICER

(2 4 ) JACOBS, DIDIER

ASSISTANT CLERK

( 25) STAHLKOPF, CHRISTINA

ASSISTANT CLERK

(26) DANIELL, JAMES

CHIEF OPERATING OFFICER

o.oo x

o.oo x

0.

0.

0.

0.

0.

0.

0.

0.

o.

o.

437 699.

0•

38.052.

196 778.

o.

35.482.

95 498.

0.

23.728.

51 190 .

0.

14.569.

1. 30

0.00

2.50

x

o.oo x

39 . 90

0.10

39.90

0 . 10

39.90

0.10

39.90

0.10

40.00

x

x

x

x

o.oo

x

294,627.

1 075 792.

1,554,562.

2 630 354.

1 b Sub-total ............... ............ ..... ... ...... ... ................................... ...... ..... ......... ~

c Total from continuation sheets to Part VII, Section A ............ ......... ..... .... ~

2

0.

1. 30

d Total (add lines 1b and 1cl ... .... ...... .......... ... ... ........ ... ...... ... ...... ...... ... ... .. .. ~

Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportable

--· ··

-· ·---·-· ... -· .. -· ·- - ·--· ··--.--··

0.

0 • 38.456.

0 . 150.287.

0. 216.513.

0. 366.800.

-Yes

3

Did the organization list any former officer, director, or trustee, key employee, or highest compensated employee on

3

4

line 1a? If ' Yes," complete Schedule J for such individual ......... ........... ............................................... .. .. ... ............ .............

For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organization

and related organizations greater than $150,000? If ' Yes, • complete Schedule J for such individual ......... .................... ..........

4

5

x

x

Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for services

rendered to the oroanization? If ' Yes • comolete Schedule J for such oerson ............. .. ... .... .. ................................ .......... ..

Section B. Independent Contractors

--

No

5

x

Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation from

-

-

_ _ LJ _

_ _ __ _ _ _ _

••

•

· -.--·-

- - ···. - - · · - -

-· - · ·

·-·

-··-

--·-· · --·

--·

-· · -

· ··"""

·· ·-··

-·

···-

••••

- ··-

- · : - . - · · ·- - - · - · ·

(A)

Name and business address

--·

-

••

(B)

Description of services

GRASSROOTS CAMPAIGNS

1321 15TH ST. SUITE 100. DENVER. CO 80202

O'BRIEN, MCCONNELL & PEARSON, INC. 1133

19TH ST. NW. SUITE 300 WASHINGTON DC

COMMUNITY COUNSELING

P.O. BOX 27462. NEW YORK. NY 10087

REDHEAD MEDIA, LLC

80 STANDISH AVENUE OUINCY. MA 02170

TELEFUND, INC.

P.O. BOX 2366. DENVER, co 80201

I

2

-

(C)

Compensation

l<'UNDRAISING

fUNDRAISING &

CONSULTING

504.114.

"'UNDRAISING

390.000.

~DVERTISING

402.819.

&

PUBLICITY

342.896.

TELEMARKETING

341.616.

Total number of independent contractors (including but not limited to those listed above) who received more than

14

SEE PART VII, SECTION A CONTINUATION SHEETS

$100 000 of comoensation from the oraanization ..._

332008

10-29- 13

Form 990 (2013)

8

11000807 756948 23796.000

2013.04010 OXFAM- AMERICA, INC .

23796 01

OXFAM-AMERICA, INC .

Form 990

IPart VII I Section A.

23-7069110

Officers Directors Trustees Kev Employees and Highest Compensated Emplo\ ees (continued)

(A)

(C)

(8)

Name and title

Average

Position

hours

(check all that apply)

per

week

~

(list any

hours for

0

related

~

~

~

organizations ~ =

5!

8

0

~

=

below

:;;

~

~

"5'

= ~

:2line)

~ c

0

:z:

&

~

!

i

~

(2 7 ) LANGEVIN, ADELE

SR DIRECTOR GLOBAL HUMAN RESOURCES

(28 ) KURZINA, STEPHANIE O.

VP DEVELOPMENT & COMUNICATIONS

( 29) O'BRIEN, DANIEL PAUL

VP POLICY AND ADVOCACY

(30) TETER , DARIUS

VP OF PROGRAMS

(31 ) DELANEY, MICHAEL

DIR OF HUMANITARIAN ASSISTANCE

( 32 ) DELGADO , LINDA

DIRECTOR OF GOVERNMENT AFFAIRS

(33) HAYES , RACHEL

SR DIRECTOR OF COMMUNICATIONS

( 34) MURIU , MUTHONI

SR DIRECTOR OF REGIONAL PROGRAMS

( 35 ) POLICELLI, MAURA

CHIEF OF STAFF

Total to Part VII Section A line 1 c

40.00

0.00

39.60

0.40

40.00

o.oo

40.00

0.00

40.00

o.oo

40.00

0.00

40.00

o.oo

40.00

0.00

40.00

o.oo

-

(D)

(E)

(F)

Reportable

compensation

from

the

organization

ry.J-2/ 1099-MISC)

Reportable

compensation

from related

organizations

ry.J-2/1099·MISC)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

e

""

x

x

179 075.

0•

9.172.

253,224.

0.

27 292.

x

x

192,887.

0.

33 630.

218,119.

0.

34,877.

x

x

134,942.

0.

32,822.

133 290.

0.

20.176.

x

x

148 611.

0.

31.484.

143 778.

0.

15 239.

x

150 636.

0.

11 821.

··· ········ ··· ···· ···· ·· ·· ·· ··· ·· ··· ··· ····· ························· · ·····

1 554.562.

216 513.

3322 0 1

05·0 1-13

9

11000807 756948 23796.000

2013.04010 OXFAM-AMERICA, INC .

23796_ 01

OXF AM - AMER I CA

Form 990 120131

Part VIII

I

Check if Schedule 0

-Cl) Cl)

·-·

--

-·

----

1 a Federated campaigns

b Membership dues

··················

························

1b

=

..

a~

c Fund raising events ................... .....

d Related organizations ................ ..

1d

ui E

§(jj

e Government grants (cont ributions)

1e

CV :::J

~E

Cl)<

·-- ....41

:::l..c

"°".EO

c-o

oc

0 CV

41

()

-~

41

41 :::J

"' c

E~

CV 41

~

...

0

Q.

f

23-7069110

·-

- - - --

- -

-

-·

5

..

--

-

--- -

..................... ....... .... .... ................................. ... ..

(A)

Total revenue

(B)

Related or

exempt function

revenue

(C)

Unrelated

business

revenue

D

--

(0)

Revenue excluded

from tax under

sections

512 - 514

1c

All other contributions, gifts, grants, and

similar amounts not included above ...... 1f

66 575 765

g Noncash contributions included in lines 1a·1f: $

2 007 203,

h Total. Add lines 1a·1f .......................... ... ...... ............ ......

Business Code

2 a

b

c

d

e

f All other program service revenue ...............

a Total. Add lines 2a·2f .... ......... .. ...... .. .. ... .... ... .. ... ... ..... ....

3

Investment income (including dividends, interest, and

4

Paae9

1a

... 0

Cc

INC.

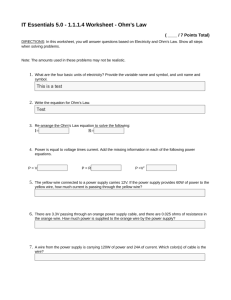

Statement of Revenue

66 575 765

other similar amounts) ................................................... ....

Income from investment of tax-exempt bond proceeds

893 777

893 777 .

Royalties .... ................................................ ........ ... ......

(i) Real

(ii) Personal

176 731

176 731.

309 539

309 539.

2 668

2 668.

....

....

6 a Gross rents

.....................

b Less: rental expenses .........

c Rental income or (loss) .. ... .

d Net rental income or (loss)

.... ..... ....... ... ..... .. ... . .. ...... .. .

....

7 a Gross amount from sales of

(i) Securities

assets other than inventory

21 735 394

32 646

21 430 852_

27 649

(iil Other

b Less: cost or other basis

and sales expenses

..... .. ..

c Gain or (loss) ... .............. ....

304 542

4 997

d Net gain or (loss) .... ....... .. ........ ....................................

8 a Gross income from fundraising events (not

including$

of

....

41

:::J

c

~

contributions reported on line 1c). See

41

cc:

...41

-

..c

0

Part IV, line 18

······································· a

b Less: direct expenses .............................. b

c Net income or (loss) from fundraising events ············· ··

9 a Gross income from gaming activities. See

Part IV, line 19 ... .................................... a

....... ... ... ... . ... ... . ... b

c Net income or (loss) from gaming activities ............•..••

b Less: direct expenses

....

....

10 a Gross sales of inventory, less returns

and allowances ....................................... a

b Less: cost of goods sold ·· ······ ·· ·············· b

c Net income or Closs) from sales of inventorv .

Miscellaneous Revenue

11 a MISCELLANEOUS REVENUE

b

.. ...... ..

900099

c

d All other revenue .......................................

e Total.Add lines 11a·11d ..••.•..•...•.... ............................

12

Total revenue. See instructions. . ............................

332009

10-29-13

11000807 756948 23796.000

~

Business Code

....

....

2 668

67 958 480

0

0

1 382 715

Form 990 (2013)

10

2013 . 04010 OXFAM- AMERICA, INC.

23796_ 01

OXFAM-AMERICA, INC.

Form 990 (2013)

23-7069110

Part IX I Statement of Functional Expenses

Paoe

10

Section 501 (c)(3) and 501 (c)(4) organizations must complete all columns. All other organizations must complete column (A).

Check if S

- --

------ - -- -------- - ·--'- - · -- -

Do not include amounts reported on lines 6b,

lb, Bb, 9b, and 10b of Part VIII.

Grants and other assistance to governments and

organizations in the United States. See Part IV, line 21

Grants and other assistance to individuals in

the United States. See Part IV, line 22 .. .... ...

Grants and other assistance to governments,

organizations, and individuals outside the

United States. See Part IV, lines 15 and 16 ...

1

2

3

4

5

- -- - -

- -·.

. ..

-

..

(A)

Total expenses

- - - .. ...... .... ........ ... ... ......... ... .. ... ................. ........... ...... ...

-· ··-

(8)

Program service

expenses

594,564.

(C)

Management and

oeneral expenses

JD)

Fun raising

D

-

expenses

594 564.

23 550 933. 23.550 933.

Benefits paid to orfor members .....................

Compensation of current officers, directors,

trustees, and key employees ........................

Compensation not included above, to disqualified

persons (as defined under section 4958(f)(1)) and

persons described in section 4958(c)(3)(B) .. ..... ..

6

7

8

Other salaries and wages ..............................

Pension plan accruals and contributions (include

section 401(k) and 403(b) employer contributions)

9

10

11

Other employee benefits ..............................

Payroll taxes ................................................

Fees for services (non-employees):

a

b

c

d

e

Management ............................... .................

Legal .... ..................................... ...................

Accounting ...................................................

Lobbying .............................................. .. ......

Professional fundraising services. See Part IV, line 17

Investment management fees ............ ..... ...... .

g Other. (If line 11 g amount exceeds 10% of line 25,

column (A) amount, list line 11g expenses on Sch 0.)

12 Advertising and promotion ...........................

13 Office expenses .... ......... ........... .......... .......... .

14 Information technology .................................

15 Royalties ..................................................... .

16 Occupancy ...... .... ................... ...... ......... ..... ..

17 Travel ····· ····················································

18 Payments of travel or entertainment expenses

for any federal, state, or local public officials

19 Conferences, conventions, and meetings ......

20 Interest ......................................................

f

21

22

23

24

a

b

Payments to affiliates ....................................

Depreciation, depletion, and amortization ......

Insurance .......... ... ...................... ........ .. ......

Other expenses. Itemize expenses not covered

above. (List miscellaneous expenses in line 24e. If line

24e amou nt exceeds 10% of line 25, column (A)

amount, list line 24e expenses on Schedule 0.) ......

DESIGN AND PRINTING

MEMBERSHIPSLDUESLSUBS.

MAILINGLPOSTAGE

SUPPLIES

c

d

e All other expenses

25 Total functional exoenses. Add lines 1 through 24e

26 Joint costs. Complete this line only if the organization

reported in column (B) joint costs from a combined

educational campaign and fundraising solicitation.

Check here ...

D

743,131.

1 260,821.

227 011.

20 551.273 . 16,393,079.

1 687,992 .

2 470 202 .

2 230,963.

1 167,468.

5 565.311.

1,703.533 .

925.709.

3,968,456.

1.248.828.

121. 342 .

834.499.

233,734.

120 417.

762 356.

220 971.

144.939.

161,446.

212.868 .

2,018,594.

128 . 076 .

79.623.

72.335.

212,868.

65.544.

89,111.

- 228.

4.887.501 .

1.200.530.

2,581,325.

2.138.347.

105 782.

2 018 594 .

22 294 .

4 231.312 .

594,357.

278.713.

1.489,914.

330 101.

18.

65,013.

167,763.

326 088 .

606 155 .

2,237,599 .

480 670 .

2.612,848.

3,738,001 .

2 013.437.

3,303,597.

334 502.

306,437.

264 909.

127 967 .

1.145,552.

1 070.259.

45,265.

30,028.

868 209.

113,588.

709.544.

54,050.

86 011.

56,600.

72.654.

2,938.

1.277 113 .

881,883.

738 816.

9,359 .

1 545 316.

81,768,356. 63

263,093.

665.449.

160,242.

9.359.

629 791.

262.643.

4.798.

97,222.

276.

1 009 222.

119,212.

578 298 .

I

290 552.

624 973.

6,183,383. 12 322,330.

if followina SOP 98-2 fASC 958- 720\

Form 990 (2013)

332010 10-29- 13

11000807 756948 23796 . 000

11

2013.04010 OXFAM-AMERICA, INC.

23796 01

Form 990 12013)

IPart X I Balance Sheet

OXFAM -AMER I CA , INC •

2 3 - 7 0 6 9_1 l_Q_____£>age 11

................ ........................ ............................................. 0

Check if Schedule 0 contains a response or note to any line in this Part X

(B}

(A}

Beginning of year

1

Cash · non-interest-bearing ........ ... ..... ..... ... ................................ .... ...... ... ..... .

2

Savings and temporary cash investments ...................... ................. ....... ....... .

3

Pledges and grants receivable, net ............................................................. .

4

6,069.928.

1

13,432,868.

2

14,830,128.

376,407.

Accounts receivable, net ................ .......................... .................................. ..

Loans and other receivables from current and former officers, directors,

5

End of year

3

4

10,797.172.

1 022,934.

trustees, key employees, and highest compensated employees. Complete

Part II of Schedule L

5

Loans and other receivables from other disqualified persons (as defined under

6

section 4958(f)(1 )), persons described in section 4958(c)(3)(B), and contributing

....

VI

Cl>

VI

VI

<(

I

employers and sponsoring organizations of section 501 (c)(9) voluntary

employees' beneficiary organizations (see instr). Complete Part II of Sch L .... . .

I

7

Notes and loans receivable, net ..... ... ....... ... ................................................. .

8

Inventories for sale or use ........................ .... ......... .......... ...... .......... ... ... ...... . .

9

Prepaid expenses and deferred charges

.......... ............... ......... ... ................ .

10a Umd, build;og•, aod oqu;pmeot "'" o• othe•

basis. Complete Part VI of Schedule D .... .....

b Less: accumulated depreciation

10b

8 0 8 9 8 61 •

6 '. 5 8 0 '. 4 5 8 •

11

Investments - publicly traded securities ........................................................ .

Investments - other securities. See Part IV, line 11 ........................................ ..

14

Intangible assets ......... ...... ..... ... ........................................................... ... .... .

15

Other assets. See Part IV, line 11 ................................................................ ..

Total as.s.e.t~, />.d.9Ji1J.es 1through15 (must equal line 34) ~ -~~·-·~,~~~ · ~

18

Investments - program-related . See Part IV, line 11

Accounts payable and accrued expenses ....................................... .. ........... ..

Grants payable ... ... .... ... .......... ... ... .. .. ...................................... .. ................. ...

Deferred revenue ............ ...... .. ... ............ ... ................. ............. ..................... .

20

Tax-exempt bond liabilities .. ... .... ... ........................ ......... .... .... ......... ............ .

Escrow or custodial account liability. Complete Part IV of Schedule D ......... .. .

122

~

7

398 978.

8

I

1,527,779 .

I

9

?. , __

~07

_

. , 004.

___ • 1n.·--

63 019 163 .I

96 271 .

I

...................................... .

19

21

11

12

1 509 403.

48 689,933.

0.

13

14

174,748.

88 914 . 901.

5 540.846.

2,517,458.

180, 500.

1,959 777.

15

16

17

18

19

276,839.

224 208.

78.312 112.

5.309 065.

2,234,020.

484,945.

20

_gi

Loans and other payables to current and former officers, directors, trustees,

key employees, highest compensated employees, and disqualified persons.

:c

IV

:i

10a

12

13

16

17

VI

Cl>

.. .... .. ... .......

I I

6

513,473 .

' 23

24

25

22

23

24

Complete Part II of Schedule L ... ........... ................ ............................. ......... .

Secured mortgages and notes payable to unrelated third parties ..................

Unsecured notes and loans payable to unrelated third parties ..... .................. .

Other liabilities (including federal income tax, payables to related third

parties, and other liabilities not included on lines 17-24). Complete Part X of

Schedule D

T

26

Organizations that follow SFAS 117 (ASC 958), check here.....

CXJ

3,255,171.

11, 493. 975.

25

41. 84 7, 542.

33,777,484.

1,795.900.

27

26

and

c:

iV

27

Unrestricted net assets ............. ...... .. ....... .................... .. ........ .................... ..

28

Temporarily restricted net assets .... .. ... .... .............. ... ........ ......................... ..

"O

29

Permanently restricted net assets .. ....... ..... .. ................. ....... ........... ......... .. .

Organizations that do not follow SFAS 117 (ASC 958), check here .....

30

Capital stock or trust principal, or current funds ......................................... ... .

30

31

Paid-in or capital surplus, or land, building, or equipment fund ... ............. ....... .

Retained earnings, endowment, accumulated income, or other funds ........... .

32

IV

co

c:

:::J

..

LL.

VI

Cl>

VI

VI

<(

....Cl>

z

D

28

29

35,367 899.

29,450 965.

1,796,560.

and complete lines 30 through 34.

0

...

3,668 658.

11. 696 688.

complete lines 27 through 29, and lines 33 and 34.

VI

Cl>

0

Total liabilities. Add lines 17 through 25 ..................................................... .

32

33

34

Total net assets or fund balances ......... ...... .................................................. .

Total liabilities and net assets/fund balances

31

77 420 926.

88 914 901.

33

34

66 615 424.

78 312 112.

Form 990 (2013)

332011

10-29- 13

11000807 756948 23796.000

12

2013.04010 OXFAM-AMERICA, INC.

23796 01

OXF AM-AMERICA

Form 990 12013\

INC.

2 3 - 7 0 6 9110

Paoe

12

Part XI I Reconciliation of Net Assets

[][]

Check if Schedule O contains a response or note to any line in this Part XI

1

Total revenue (must equal Part VIII, column (A), line 12)

2

3

Total expenses (must equal Part IX, column (A), line 25)

5

6

Net unrealized gains (losses) on investments .............. .............. .

Donated services and use of facilities

2

3

4

5

6

7

Investment expenses

............ .... ....... ....... ..... ....... ........... ... .......... ..... ........ ..... ......... .... ...... ...... ............ .. .

7

8

Prior period adjustments .............. ......... .. .............................................. ........ .. ........ ....... ... ...... ............ ... .

Other changes in net assets or fund balances (explain in Schedule 0) ........................... .... ... ........ .

Net assets or fund balances at end of year. Combine lines 3 through 9 (must equal Part X, line 33,

8

column (8))

10

Revenue less expenses. Subtract line 2 from line 1 .. ..................... .. ..................... ..

Net assets or fund balances at beginning of year (must equal Part X, line 33, column (A))

4

9

10

... ........ .. ... .... ............ .... .. ............................... ......... ........... .... ...... ..... ... ............. ......... .. .. .. .

I Part XIII Financial Statements and Reporting

67,958,480.

81,768.356.

-13,809.876.

77,420.926.

3.003,817.

557.

9

66.615.424.

D

Check if Schedule 0 contains a response or note to any line in this Part XII

Yes

1

Accounting method used to prepare the Form 990:

D

Cash

CXJ Accrual D

I

No

Other

If the organization changed its method of accounting from a prior year or checked "Other, " explain in Schedule O.

2a Were the organization's financial statements compiled or reviewed by an independent accountant?

x

2a

If "Yes, " check a box below to indicate whether the financial statements for the year were compiled or reviewed on a

separate basis, consolidated basis, or both:

D

Separate basis

D

Consolidated basis

D

Both consolidated and separate basis

b Were the organization's financial statements audited by an independent accountant? ...... .. .. ........................... ...................

I 2b I

X

I 2c I

X

If "Yes," check a box below to indicate whether the financial statements for the year were audited on a separate basis,

consolidated basis, or both:

D

Separate basis

CXJ Consolidated basis

D

Both consolidated and separate basis

c If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit,

review, or compilation of its financial statements and selection of an independent accountant? ................ .... .. ......................

If the organization changed either its oversight process or selection process during the tax year, explain in Schedule 0 .

3a As a result of a federal award , was the organization required to undergo an audit or audits as set forth in the Single Audit

Act and OMB Circular A133? ..................................................................................................................... .. .. .. .... ............ .

b If "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the required audit

or audits, explain why in Schedule 0 and describe anv steps taken to underoo such audits

I 3a I I X

3b

Form 990 (2013)

332012

10-29-13

11000807 756948 23796.000

13

2013.04010 OXFAM-AMERICA, INC.

23796 01

SCHEDULE A

(Form 990 or 990-EZ)

Department of the Treasury

OMB No. 1545-0047

Public Charity Status and Public Support

I