Factor-endowment theory

advertisement

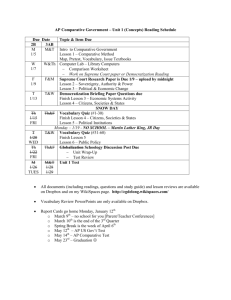

Chapter 3. Sources of Comparative Advantage Advantage Factor Endowments as a Source of Comparative Advantage (1) (1) Ricardian theory takes for granted that relative labor productivity, labor costs and product prices differed in 2 countries before trade. But Ricardo’s assumption of labor as the only factor of production ruled out an explanation of how trade affects the distribution of income among factors of production within a nation, & why some favor trade, and some oppose it. Factor Endowments as a Source of Comparative Advantage (2 ) Heckscher & Ohlin formulated a theory to answer these questions – The factor-endowment theory: The immediate basis for trade is the difference between pre-trade relative product prices of trading nations. Prices depend on the production possibilities curves and tastes and preferences (demand conditions) in the trading countries Assumption: technology and demand are approximately the same between countries Production possibilities curves depend on technology and resource endowments Factor Endowments as a Source of Comparative Advantage (3) Factor-endowment theory ◦ Capital/Labor Ratio Determines comparative advantage ◦ A country exports a good that uses a large amount of its relatively abundant resource ◦ A country imports a good which (in production) uses its relatively scarce resource Factor Endowments as a Source of Comparative Advantage (4) Effect of resource endowments on comparative advantage Factor Endowments as a Source of Comparative Advantage: example Chinese Manufacturers Beset by Rising Wages and a Rising Yuan (or Renmimbi) Developing labor shortage and rising wages because of: ◦ China’s one-child policy: fewer young adults ◦ Land policies discourage migration from country, since must tend family plots or lose them ◦ Cannot enroll children in city schools or gain other government services until they have been officially declared urban dwellers; takes years Table 3.23.2-Total Capital Stock per Worker of Selected Countries… Factor Price Equalization (1 of 3) • Factor-Price Equalization • Redirects demand away from the scarce resource towards the abundant resource in each nation • Trade leads to factor-price equalization • The cheap resource becomes relatively more expensive • The expensive resource becomes relatively less expensive • Eventually, price equalization occurs Figure 3.23.2- The Factor Factor-Price Equalization Theory Factor Price Equalization (2 of 3) The effect of trade is to equalize the price of capital in the two nations American demand for Chinese textiles leads to increased demand for labor in China; wages increase; more imports Reverse happens in U.S. til equalization But in real world, no full factor-price equalization Table 3.43.4- Indexes of Hourly Compensation for Mfg. Workers.. Factor Price Equalization (3 of 3) In real world – no full factor-price equalization (cont.) ◦ Uneven ownership of human capital Education, training, skill, and the like ◦ Not all countries use the same technology New and better technology replaces older technologies – faster in developed countries ◦ Transportation costs and trade barriers Reduce the volume of trade Is International Trade a Substitute for Migration? Immigrants contribute to the economy: ◦ Increase the size of the labor force ◦ Fill low-skilled jobs which few native-born citizens are willing and available to do ◦ Bring jobs that contribute to technological innovation But critics say: ◦ ◦ ◦ ◦ They take jobs away from the guest country’s citizens Suppress domestic wages Consume sizable amounts of public services Need legal restrictions to lessen flow Is International Trade a Substitute for Migration? Can trade reduce immigration? Factor-endowment model: • International movements in resources are not essential • International trade in products can achieve the same result • Complement labor migration, short and nearlong terms • Expanding trade – some unemployed workers • Forced to seek employment abroad Is the FactorFactor-Endowment Theory a Good Predictor of Trade Patterns? Wassily Leontief: 1st attempt to research the factor-endowment theory empirically ◦ Given: U.S. has relatively abundant capital, relatively labor scarce ◦ According to theory, U.S. will: Export capital-intensive goods Import-competing goods will be labor intensive Leontief tested capital / labor ratios for 200 export industries & import-competing industries in U.S. in 1947 Is the FactorFactor-Endowment Theory a Good Predictor of Trade Patterns? Leontief’s findings: ◦ Capital / labor ratio for U.S. exports lower than that of it’s import-competing industries ◦ Concluded that exports were less capitalintensive than import-competing goods ◦ Findings contradicted the predictions of the factor-endowment theory: Leontief paradox Further studies mixed. Economies of Scale and Comparative Advantage (1) Economies of Scale (increasing returns to scale) exist when – ◦ Expansions of the scale of production cause total production costs to increase less proportionately than output. ◦ Long-run average costs of production decrease Economies of scale classified as – ◦ Internal ◦ External Economies of Scale and Comparative Advantage (2) Internal Economies of Scale ◦ At the firm-level as output increases (triggered by increase in demand from exports), the average cost decreases ◦ Provide additional cost incentives for specialization in production ◦ Home market effect: Industries locate near largest market, to exclusion of small market areas, which may become unindustrialized Figure 3.5 - Economies of Scale as a Basis for Trade Economies of Scale and Comparative Advantage (3) External Economies of Scale The average cost of the typical firm decreases as the output of the whole industry in this area increases Concentration of an industry’s firms in a particular geographic attracts larger pools of a specialized type of worker; New knowledge about production technology spreads among firms in the area Expanding industry as a source of growth, tax revenues; R&D at universities benefit businesses Clusters of component suppliers close to center of manufacturing Overlapping Demands as a Basis for Trade (1(1)) Theory of overlapping demands: ◦ Factor-endowment theory - explains trade in primary products and agricultural goods Not the trade in manufactured goods ◦ Force influencing manufactured-good trade Domestic demand conditions ◦ Firms within a country – manufacture goods for which there is a large domestic market A nation’s exports - extension of the production for the domestic market Overlapping Demands as a Basis for Trade (2 ) Theory of overlapping demands (cont.) ◦ Consumer demand - conditioned strongly by income levels A country’s average or per capita income will yield a particular pattern of demand Nations with high per capita incomes will demand high-quality manufactured goods (luxuries) Nations with low per capita incomes will demand lower-quality goods (necessities) Inter-Industry trade vs. Intra InterIntra--Industry Trade Inter-industry trade ◦ The exchange between nations of products of different industries ◦ Based on inter-industry specialization Each nation specializes in a particular industry in which it enjoys a comparative advantage Industrial countries have practiced intraindustry specialization: ◦ Focusing on the production of particular products within a given industry Intra--Industry Trade Intra Advanced industrial nations emphasize intra-industry trade ◦ Two way trade in a similar commodity Existence of intra-industry trade is incompatible with models of comparative advantage discussed ◦ Intra-industry trade involves flows of goods with similar factor requirements ◦ Most such trade conducted among industrial countries Table 3.53.5Intra--Industry Trade Examples… Intra Technology as a Source of Comparative Advantage… Technological innovations ◦ Different nations, at different rates of speed ◦ Result in: New methods of producing existing commodities Production of new commodities Commodity improvements ◦ Often transitory Such dynamic changes have given rise to a another explanation of international trade -- Technology as a Source of Comparative Advantage… The product life cycle theory ◦ Manufactured goods undergo a predictable trade cycle: 1. Manufactured good introduced to home market 2. Domestic industry shows export strength 3. Foreign production begins 4. Domestic industry loses competitive advantage 5. Import competition begins Radios, Pocket Calculators, and the International Product Cycle The experience of radios and pocket calculators illustrate the product life cycle model. Pocket calculators: Invented in 1961 in U.S.; marketed for $1,000 By 1970, competing pocket calculators from several U.S. & Japanese firms; price dropped to $400 More firms entered market; some assembled product in foreign countries with lower labor Still more firms entered, improved technology; by mid 1970’s pocket calculators sold for $10-$20, sometimes less Dynamic Comparative Advantage: Industrial Policy Dynamic comparative advantage ◦ Comparative advantage in a particular industry ◦ Can be created Mobilization of skilled labor, technology and capital Industrial policy: ◦ Government is actively involved in creating comparative advantage ◦ Strategy to revitalize, improve and develop an industry Figure 3.6 - Trade Effects of Governmental Regulations Transportation Costs & Comparative Advantage (1) Transportation costs ◦ ◦ ◦ ◦ ◦ ◦ Costs of moving goods Freight charges Packing and handling expenses Insurance premiums An obstacle to trade Impede the realization of gains from trade liberalization Transportation Costs & Comparative Advantage (2) Differences across countries in transport costs ◦ A source of comparative advantage ◦ Affect the volume and composition of trade Trade effects of transportation costs ◦ The high-cost importing country Produce more, consume less, and import less ◦ The low- cost exporting country Produce less, consume more, and export less Figure 3.73.7- Free Trade Under Increasing Cost Conditions Transportation Costs & Comparative Advantage (3) Transportation costs • Reduce the volume of trade • Reduce the degree of specialization in production • Reduce the gains from trade • One possible reason for international wage differential