classified balance sheet

advertisement

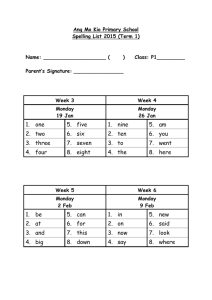

Chapter 5 - Unit 10 Classified Financial Statements Monday, April 12, 2010 Look at Figure 5.6 Page 173 Monday, April 12, 2010 Look at Figure 5.6 Page 173 ✦ Which debts must be paid in a year? Monday, April 12, 2010 Look at Figure 5.6 Page 173 ✦ Which debts must be paid in a year? ✦ Is there sufficient cash to pay debts? Monday, April 12, 2010 Look at Figure 5.6 Page 173 ✦ Which debts must be paid in a year? ✦ Is there sufficient cash to pay debts? ✦ Which debts must be paid in future years? Monday, April 12, 2010 ✦ Need to classify data on financial statements, this way more information is provided in a way that is easily interpreted Monday, April 12, 2010 Classified Balance Sheet Monday, April 12, 2010 Classified Balance Sheet ✦ Assets - current and fixed Monday, April 12, 2010 Classified Balance Sheet ✦ ✦ Assets - current and fixed Current - an asset that in the normal course of operations will be converted to cash, sold or consumed during the year (cash, government bonds, A/R, prepaid expenses) Monday, April 12, 2010 Classified Balance Sheet ✦ ✦ ✦ Assets - current and fixed Current - an asset that in the normal course of operations will be converted to cash, sold or consumed during the year (cash, government bonds, A/R, prepaid expenses) Still listed in order of liquidity Monday, April 12, 2010 Monday, April 12, 2010 ✦ Prepaid Expenses - expenses that are paid in advance - ie. rent, insurance Monday, April 12, 2010 ✦ ✦ Prepaid Expenses - expenses that are paid in advance - ie. rent, insurance Fixed - assets that have a long life, over a year - ex building, land, trucks, etc. Monday, April 12, 2010 ✦ ✦ Prepaid Expenses - expenses that are paid in advance - ie. rent, insurance Fixed - assets that have a long life, over a year - ex building, land, trucks, etc. ✦ Monday, April 12, 2010 Assets with the longest life are generally listed first (land, building, equipment, trucks) Monday, April 12, 2010 ✦ Liabilities - current and long-term Monday, April 12, 2010 ✦ ✦ Liabilities - current and long-term Current - due to be paid within one year listed in order to be paid (a/p, taxes payable, salaries payable, loans payable) Monday, April 12, 2010 ✦ ✦ ✦ Liabilities - current and long-term Current - due to be paid within one year listed in order to be paid (a/p, taxes payable, salaries payable, loans payable) Long-Term - liabilities that are not due to be paid in a year - longer term (mortgages and long-term long bank loan Monday, April 12, 2010 Franklin Corporation Balance Sheet October 31, 2005 Assets Current assets Cash Short-term investments Accounts receivable Inventories Supplies Prepaid insurance Total current assets Long-term investments Investment in stock of Walters Corp. Investment in real estate Property, plant, and equipment Land Office equipment $24,000 Less: Accumulated depreciation5,000 Intangible assets Patents Total assets $6,600 2,000 7,000 4,000 2,100 400 $22,100 5,200 2,000 7,200 10,000 19,000 29,000 3,100 $61,400 Liabilities and Stockholders' Equity Current liabilities Notes payable Accounts payable Salaries payable Unearned revenue Interest payable Total current liabilities Long-term liabilities Mortgage payable Notes payable Total long-term liabilities Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Monday, April 12, 2010 $11,000 2,100 1,600 900 450 $16,050 10,000 1,300 11,300 27,350 14,000 20,050 34,050 $61,400 Monday, April 12, 2010 ✦ Remember - Owner’s Equity - the value increases as the business profits and decreases as it doesn’t Monday, April 12, 2010 ✦ ✦ Remember - Owner’s Equity - the value increases as the business profits and decreases as it doesn’t Instead of having all the effects of OE on the balance sheet - you can prepare a Statement of Owner’s Equity Monday, April 12, 2010 ✦ ✦ ✦ Remember - Owner’s Equity - the value increases as the business profits and decreases as it doesn’t Instead of having all the effects of OE on the balance sheet - you can prepare a Statement of Owner’s Equity This is a supporting statement prepared separately from the Balance Sheet - the total is put on the balance sheet Monday, April 12, 2010 Accounts Receivable Monday, April 12, 2010 Accounts Receivable ✦ Many businesses have lots of Accounts Receivables - as they have many customers Monday, April 12, 2010 Accounts Receivable ✦ ✦ Many businesses have lots of Accounts Receivables - as they have many customers The Balance Sheet will become very cluttered if you put all the accounts receivable on it Monday, April 12, 2010 Accounts Receivable ✦ ✦ ✦ Many businesses have lots of Accounts Receivables - as they have many customers The Balance Sheet will become very cluttered if you put all the accounts receivable on it Schedule of Accounts Receivable - a supporting schedule that provides details about every A/R account - put the final total on the Balance Sheet Monday, April 12, 2010 ✦ page 182 Q 15,16 ✦ Ex 4-6, 9, 10 Monday, April 12, 2010