Balance Sheet & Statement of Cash Flows

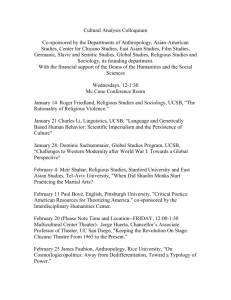

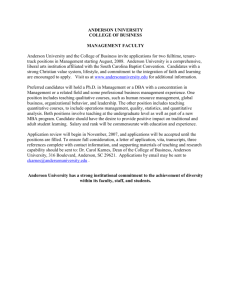

advertisement

Learning Learning Objectives Objectives Balance Sheet & Statement of Cash Flows Slide 5-1 Chapter 5 UCSB, Anderson 1. 2. 3. 4. 5. 6. 7. 8. 9. Slide 5-2 Balance Sheet Basics What Whatis isaabalance balancesheet? sheet? –– Tells Tellswhere wherethe theentity entitystands standsfinancially; financially; –– “AS “ASOF”; OF”; –– Better way to think of it is as a Better way to think of it is as a“Statement “Statementof ofFinancial FinancialPosition” Position” Transaction Transaction based. based. Important ImportantFact: Fact: Inherently Inherentlyrelies reliesupon uponestimates. estimates. Example: Example: –– Something Somethinghas hasto toactually actuallyHAPPEN HAPPENfirst first –– Historical Historicalcost costbasis basis –– Valuation Valuationof ofreceivables receivablesand andinventories; inventories; –– Goodwill Goodwillvaluation; valuation; –– Completeness Completenessof ofreported reportedimpairments; impairments; Slide 5-3 Comparative Comparative balance balancesheet sheet analysis analysisis isaasubstantial substantial tool toolin inunderstanding understandingwhether whetherthe theCompany Companyis is improving improvingor ordeteriorating. deteriorating. UCSB, Anderson Identify the uses and limitations of a balance sheet. Identify the major classifications on the balance sheet. Prepare a classified balance sheet using the account format. (Not using the report format from the text) Identify balance sheet information requiring supplemental disclosure. Identify major balance sheet disclosure techniques.font Explain the purpose of the statement of cash flows. Identify the content of the statement of cash flows. Not preparing a statement of cash flows as per text. Understand the usefulness of the statement of cash flows. UCSB, Anderson No Statement Stands on it’ it’s Own ALL OF THE STATEMENTS AND NOTES ARE INTERDEPENDANT The balance sheet needs an income statement and a statement of cash cash flows and note disclosure to tell a complete picture… picture… Think of the “self balancing” balancing” aspect. If you debit a/r and credit sales, then you need to see the balance sheet AND the income statement to have the the complete picture. For instance if a Company generates $1,000,000 of net income, and and their total average equity for the year was $1.75, would you be impressed?.... What about if their average equity was $100 billion? billion? What if a Company had operating income on the income statement but but showed negative cash flows from operating activities on the statement statement of cash flows– flows– might you want to know why? Slide 5-4 UCSB, Anderson Balance Sheet Limitations Some important balance sheet tools and terms LiquidityLiquidity- How How fast fast can can an an asset asset turn turn into into cash? cash? SolvencySolvency- How How able able is is the the Company Company to to pay it’s debts? pay it’s debts? Combined Combined (Liquidity (Liquidity and and Solvency) Solvency) represents the Company’s represents the Company’s “financial “financial flexibility” flexibility” –– IfIf aa company company is is dependant dependant upon upon lenders lenders for for working working capital, capital, they they typically typically must must comply comply with with “restrictive “restrictive covenants” covenants” Slide 5-5 UCSB, Anderson Historical HistoricalCost Cost Based. Based. Transaction-based: Transaction-based: something something has hasto tohappen happenfirst first SUCH SUCH AS: AS: Most Most current current assets assets and and liabilities liabilities and and Debt. Debt. NOT: NOT: Fixed Fixed assets, assets, intangible intangible assets. assets. Slide 5-7 UCSB, Anderson –– Omits Omitsmany manyitems itemsthat thathave havevalue value(but (butare arenot notbased basedon onaa past pasttransactiontransaction-remember rememberthe thestatements statementsare aretransactiontransactionbased) based)Example: Example: »» Human Humanresource resource »» Technological Technologicaldiscoveries discoveries Requires Requires estimation/ estimation/Judgment. Judgment. –– INSTRUCTOR INSTRUCTORNOTE: NOTE: RP RP Slide 5-6 WHAT’ WHAT’S A FINANCIAL INSTRUMENT DEFINITION: DEFINITION: Cash, Cash, an an ownership ownership interest, interest, or or aa contractual contractual right right to to receive receive or or obligation obligation to to deliver deliver cash cash or or another another financial financial instrument. instrument. –– Newhall NewhallLand Landand andFarming FarmingCompany Companypurchased purchasedland landin inlate late 1800’s. 1800’s. On Ontheir their2002 2002annual annualreport, report,their theirNet NetAssets, Assets,at at historical cost were $136,000,000 VS conservative appraisal historical cost were $136,000,000 VS conservative appraisal value valueof of$389,000,000. $389,000,000. They Theywere werelater laterpurchased purchasedby byLennar Lennar for for$1 $1billion! billion! UCSB, Anderson FAIR VALUE OF FINANCIAL INSTRUMENTS FASB FASBNo. No.157: 157: Provides Providesguidance guidanceon onHOW HOWto tomeasure measurefair fair value value –– Uses Usesaamarket marketparticipant participantapproach approach »» Results Resultsin inmore morecomparable comparable(potentially (potentiallyless lessaccurate) accurate)data data –– NOT NOTWhen Whento toapply... apply...Only Onlyapplicable applicableififother otherliterature literaturerequires requires measurement measurementat atfair fairvalue. value. FASB FASBNo. No.159: 159: Makes Makespresentation presentationof offinancial financial instruments instrumentsat atfair fair value value optionaloptional- very veryunusual unusualand and very verycontradictory contradictoryto tothe the notion notionof of“comparability” “comparability” NOTE: NOTE: IfIfpresented presentedat atcost coston onthe thebalance balancesheet, sheet,then thenfair fair value valueis isdisclosed disclosedin inthe thenotes. notes. Therefore Therefore the thefair fair value value of all financial instruments is presented somewhere of all financial instruments is presented somewhere within withinthe thefinancial financialstatements! statements! Slide 5-8 UCSB, Anderson INTERESTING ABOUT FAIR VALUES − How long have fair value measurements been in f/s’s? − How many people will come to the same fair value est.? − How many people will come to the same cost basis? What impact does FAS 157 have on items previously accounted for at cost? These points add up to the need for FAS 157 − It “Blends” additional information of fair value with consistency of cost basis. If you remember one point, remember this: − FAS 157 looks to use data which is going to result in two companies coming to as close to the exact same valuation of fair value for similar items as possible. Fas 157… 157… levels of inputs Which Data are they using? stop BALANCE SHEET SUMMARY DEFINED: Probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. events. FLOW: Current assets Noncurrent assets Intangibles Other assets Slide 5-11 = Liabilities Probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. FLOW: Current liabilies Noncurrent liabilites UCSB, Anderson UCSB, Anderson CLASSIFICATIONCLASSIFICATION- CURRENT VS NONCURRENT Equity + DEFINED: LEVEL 3- Unobservable/ Company Generated Slide 5-10 UCSB, Anderson Assets LEVEL 2- Quoted Market Price for the type of item stop Slide 5-9 LEVEL 1- Quoted Market Price for the item DEFINED: Residual interest in the assets of an entity that remains after deducting its liabilities. In a business enterprise, the equity is the ownership interest. CurrentCurrent- expected expected to to “convert” “convert” in in one one year year or or operating operating cycle cycle (whichever (whichever is is longer). longer). Otherwise Otherwise itit is is non-current non-current Some Some company’s company’s don’t don’t need need aa “classified” “classified” balance balance sheet, sheet, which which means means that that the the balance balance sheet sheet does does not not distinguish distinguish current current from from longlongterm term –– Real Realestate estate CompanyCompany- because because the themajority majorityof of what whatwould wouldbe betheir their“operating” “operating”assets assetsare arenonnoncurrent currentin in nature. nature. FLOW: Capital stock APIC Retained earnings AOCI Treasurey Stock Don’t Don’t forget forget to to check check debt debt for for the the “current “current portion” portion” Slide 5-12 UCSB, Anderson Contra Account presentation Certain Certain assets assets have have reductions reductions called called “contra-asset” “contra-asset” accounts: accounts: –– Accounts Accounts receivable/ receivable/ allowance allowance –– Fixed Fixed assets/ assets/ accumulated accumulated depreciation depreciation –– Intangible Intangible assets/ assets/ accum. accum. amortization. amortization. Can Can present present as as aa line-item line-item or or as as part part of of the description. Examples on next the description. Examples on next slide. slide. Slide 5-13 UCSB, Anderson ContraContra-Asset Presentation Examples Accounts Accountsreceivable receivable Allowance Allowancefor fordoubtful doubtfulaccounts accounts Accounts receivable, Accounts receivable,net net OR OR Accounts Accountsreceivable, receivable,net netof of $2,500 allowance for $2,500 allowance fordoubtful doubtful accounts accounts Slide 5-14 Based Basedon onthe thefollowing followinginformation, information,prepare preparethe thebalance balancesheet sheetfor forXYZ, XYZ, Inc. Inc.:: 10,000 10,000shares sharesoutstanding, outstanding,$1 $1par parwhich whichwere weresold soldto toinvestors investorsfor for $110,000; $110,000; Debt in the amount of $1,000,000 outstanding. Principal matures Debt in the amount of $1,000,000 outstanding. Principal maturesat at $250,000 $250,000per peryear yearuntil untilrepaid; repaid; Cash Cashof of$125,000; $125,000; Accounts Accountsreceivable receivable$250,000, $250,000,excluding excludingthe theallowance allowancefor fordoubtful doubtful accounts accounts$25,000; $25,000; Prepaid insurance of $175,000 Prepaid insurance of $175,000 PP&E PP&E$2,000,000. $2,000,000. Accumulated Accumulateddepreciation depreciationisis$200,000. $200,000. Capitalized Capitalizedcommissions commissionspaid paidto toleasing leasingagents agents$115,000. $115,000. Accumulated Accumulatedamortization amortization$15,000. $15,000. Accounts Accountspayable payable$58,000 $58,000 Retained Retainedearnings earnings$757,000 $757,000 Accumulated Accumulatedother othercomprehensive comprehensiveincome income$500,000 $500,000 PP&E Accumulated depreciation Net PP&E Intangible asset, net of accumulated amortization of $15,000 TOTAL ASSETS 2,000,000 (200,000) 1,800,000 100,000 LIABILITIES & STOCKHOLDERS EQUITY Accounts payable current maturities of LTD Total current liabilities 58,000 250,000 308,000 Long-term debt, less current maturities 750,000 TOTAL LIABILITIES & EQUITY UCSB, Anderson 125,000 225,000 175,000 525,000 2,425,000 EQUITY Common stock (10,000 SHARES $1 PAR) APIC Retained Earnings Accumulated Other Comp Income Slide 5-16 $7,500 $7,500 UCSB, Anderson ASSETS Cash Accounts receivable, net of $25,000 allowance Prepaid expenses Total current assets InIn-Class Exercise Slide 5-15 $10,000 $10,000 $$ (2,500) (2,500) $$ 7,500 7,500 UCSB, Anderson 10,000 100,000 757,000 500,000 1,367,000 2,425,000 Additional balance sheet information Disclosure Disclosure may may be be parenthetical parenthetical or or in in notes. notes. –– Parenthetical Parentheticaldisclosure disclosure example: example: Held for sale investments ($100,000 cost), $128,000 Held for sale investments ($100,000 cost), atatestimated estimatedfair fairvalue value $128,000 –– Note Notedisclosure disclosure example: example: Property, plant and equipment (Note 7) Property, plant and equipment (Note 7) $1,750,000 $1,750,000 Note Note77Property Propertyplant plantand andequipment equipment Property Propertyplant plantand andequipment equipmentare arecarried carriedatatcost, cost,less lessaccumulated accumulateddepreciation. depreciation. Plant Plantisis depreciated depreciatedon onaastraight straightline linebasis basisover over35 35years. years. All Allother otherdepreciable depreciableequipment equipmentisis depreciated depreciatedon onaastraight straightline linebasis basisover over77years. years. Property, Property,plant, plant,equipment equipmentand and accumulated accumulateddepreciation depreciationatatDecember December31, 31,200X 200Xwas: was: Land Land Building Building Equipment Equipment Less Lessaccumulated accumulateddepreciation depreciation Property Propertyplant plant&&equipment, equipment,net net Slide 5-17 $800,000 $800,000 $300,000 $300,000 $750,000 $750,000 $1,850,000 $1,850,000 $(100,000) $(100,000) $1,750,000 $1,750,000 UCSB, Anderson Statement of Cash Flows As As stated statedin in previous previouslectures, lectures,the thestatement statementof of cash cash flows flowsfills fillsin inthe thegap gapcreated created by byapplying applyingaccrual accrual accounting. It tells the users where the cash went accounting. It tells the users where the cash wentto to and andcame camefrom. from. ItItalso alsobreaks breaksthose thosesources sourcesand and uses usesinto intothree three broad broadcategories: categories: –– Cash Cashflows flowsfrom fromoperations operations »» Net Netincome incomeand andchanges changesin incurrent currentassets assets&&liabilities liabilities –– Cash Cashflows flowsfrom frominvesting investing »» Cash Cashflows flowsfrom frompurchase purchaseand andsale saleof oflong longterm termassets assets »» Presented Presented“Gross”“Gross”-i.e i.epurchase purchaseand andsale saleseparate separate –– Cash Cashflows flowsfrom fromfinancing financing »» Cash Cashflows flowsfrom fromlong-term long-termdebt debtand andequity equityactivity activity »» Presented Presented“Gross”– “Gross”–i.e i.eborrowing borrowingand andrepayment repaymentseparate separate Covered Covered in ingreater greaterdetail detail in inchapter chapter23. 23. Slide 5-19 UCSB, Anderson Investments/ Securities Long-term Long-term investments investments may may be be carried carried at: at: FAS FAS 115115- ifif do do not not have have significant significant influence influence (generally (generally <20% <20% ownership) ownership) EquityEquity- ifif have have significant significant influence influence (generally (generally 20-50% 20-50% ownership) ownership) Consolidated Consolidated ifif “Controlled”“Controlled”- separate separate equity equity item item for for “non-controlling “non-controlling interest” interest” (generally (generally >50% >50% ownership) ownership) Slide 5-18 UCSB, Anderson