Wilfrid Laurier University

advertisement

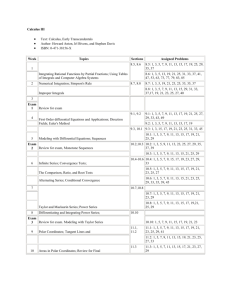

BU393 Fall 2015 Page 1 of 7 BUSINESS 393: FINANCIAL MANAGEMENT II, Fall 2015 Section B1 (MW, 8:30-9:50am, Arts 2C3) Section B4 (MW, 10-11:20am, Arts 2C3) Section B7 (MW, 11:30am-12:50pm, Arts 2C3) Instructor: Name Office Phone Michael Brolley P3064 519 884-0710 Ext. 4836 SBE 2201 519 884-0710 Ext. 2063 (Email: mbrolley@wlu.ca) Faculty Assistant: Jane Thomas Office Hours: Wed, Thu 2:30pm-3:30pm or by appointment Course Website: MyLearningSpace (MLS) Prerequisites: BU383, Financial Management I Textbook: Custom bind of selected chapters from Corporate Finance (7th Canadian Edition), S.A. Ross, R.W. Westerfield, J.F. Jaffe, G.S. Roberts, 2015. McGraw-Hill Ryerson Ltd. Alternatively, you may use the 6th edition of the custom book. The main difference is that the 7th edition custom book includes Chapter 30 Mergers & Acquisitions, while the 6th edition does not. Or, you may use the full book: Corporate Finance (either 6th or 7th Canadian Edition), S.A. Ross, R.W. Westerfield, J.F. Jaffe, G.S. Roberts, 2011. McGraw-Hill Ryerson Ltd. We do not use “Connect” and thus the “Connect Access Card” is not required for the course. Course Website: All course materials are available on mylearningspace. BU393 Fall 2015 Page 2 of 7 Course Description: This is the second part of the financial management core course. It focuses primarily on the analysis of long-term financial management decisions and the application of appropriate techniques. Topics covered include capital budgeting, cost of capital, long-term financing, capital structure, payout policy, leasing, and mergers & acquisitions. A calculator is required for this course. Any calculator is good for the course. You may use a financial calculator. However, instructions for any calculator will not be provided in class. Teaching Method: Lectures and discussion of solutions to in-class examples will comprise the primary teaching methods employed in this course. Students are strongly urged to attempt all the problems in the BU393 question bank (which is posted in myLearningSpace), and to do so without first reviewing the solutions. Grading Schemes: BBA Students Option A Option B In-class quizzes (best 2 out of 3) 10% Midterm Examination 40% 45% Final Examination 50% 55% 100% 100% Quizzes: In order for students to stay current with the class material, there will be three in-class quizzes. Quiz dates are noted in the course outline. Students completing the in-class quizzes, will receive the higher of the grade calculated under Option A or B. There will be no deferred or early quizzes under any circumstances. Exams: The midterm exam will be held on Friday, Oct 30th from 6-8pm (2 hours). The mid-term will cover chapters 7, 8, 9, 13, 14, and 15, and last for two hours. There will be no deferred or early mid-term exams under any circumstances. The date of the final examination is yet to be determined. The final exam will be comprehensive, i.e., its coverage being the entire course, with somewhat more emphasis on topics not covered in the midterm exam. In quizzes and the midterm and final exams, students will be provided with a formula sheet. The sample formula sheet is posted on myLearningSpace for students to use. Present Value tables will NOT be provided neither allowed. Students will need to bring a calculator to quizzes and exams. Academic Accommodation: Students requiring academic accommodations are advised to contact the Accessible Learning Centre for information regarding services and resources. Students are encouraged to review the Calendar for information regarding all services available on campus. BU393 Fall 2015 Page 3 of 7 Student Privacy Statement: Students' names may be divulged in the classroom, both orally and in written form, to other members of the class. Students who are concerned about such disclosures should contact the course instructor to identify whether there are any possible alternatives to such disclosure. Academic Misconduct: Students are to adhere to the Principles in the Use of Information Technology. These Principles and resulting actions for breaches are stated in the current Undergraduate Calendar. Wilfrid Laurier University uses software that can check for plagiarism. Students may be required to submit their written work in electronic form and have it checked for plagiarism. Students are expected to be aware of and abide by University regulations and policies, as outlined in the current on-line Undergraduate Calendar (see http://www.wlu.ca/calendars). The University has an established policy with respect to cheating on assignments and examinations, which the student is required to know. Students are cautioned that in addition to a failure in the course, a student may be suspended or expelled from the University for cheating and the offence may appear on one's transcript, in which event the offence can have serious consequences for one's business or professional career. For more information refer to the current Undergraduate calendar (University Undergraduate Regulations). BU393 Fall 2015 Page 4 of 7 Tentative Class Schedule (I may go slower or faster than suggested in the schedule below). Monday & Wednesday Classes Class Date 1 Sep 14 2 Sep 16 3 Sep 21 4 Sep 23 5 Sep 28 6 Sep 30 7 Oct 5 8 Oct 7 9 Oct 19 10 Oct 21 11 Oct 26 Topic Text Chapter Practice Problems Investment Rules 7 (omit 7.4) Question bank Q1-Q3 NPV, Capital Budgeting and Risk Analysis 8 (including 8A) and 9 (omit 9.3) Question bank Q4–Q8 In-class Quiz 1 – Investment Rules NPV, Capital Budgeting and Risk Analysis 8 (including 8A) and 9 (omit 9.3) Question bank Q4–Q8 Risk, Return and Capital Budgeting 13 (omit 13.2) (13.3 will be discussed with Chap 16&17) Question bank Q9-Q13 Capital Budgeting & Corporate Financing Decisions 13 and 14 In-class Quiz 2 – NPV, Capital Budgeting and Risk Analysis Long Term Financing – Intro and Equity 15 and 20 (omit 15.4) BU393 Fall 2015 12 Page 5 of 7 Oct 28 Review Class Midterm: Friday, Oct 30, 6-8pm (cover chapters 7, 8, 9, 13, 14, and 15) 13 Nov 2 Long Term Financing – Intro and Equity (cont.) 15 and 20 (omit 15.4) 14 Nov 4 Long Term Financing – Debt 21 Question bank Q14-Q16 15 Nov 9 16 and 17 (omit 17.9) Question bank Q17-Q20 16 Nov 11 Taxes and Capital Structure 17 Nov 16 18 Nov 18 Leasing 22 Question bank Q25, Q26 19 Nov 23 In-class Quiz 3: Taxes and Capital Structure Leasing 22 Question bank Q25, Q26 Payout Policy 19 (omit 19.5, include 19A) Question bank Q21-Q24 30 Question bank Q27 20 Nov 25 21 Nov 30 22 Dec 2 M&A 23 Dec 7 M&A 24 Dec 9 Final Review