Advertising Campaign Proposal Presented to Frito

advertisement

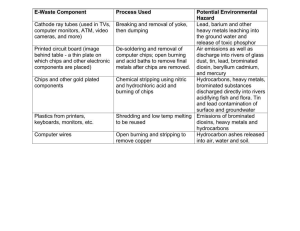

Advertising Campaign Proposal Presented to Frito-Lay Inc. April 10, 2001 As Prepared By: Michelle Despins Audrey Hanna Adrienne Mattia Kerry Milton Trina Sharp Marketing 432: Section B2 1 Table of Contents EXECUTIVE SUMMARY .........................................................................................................................................4 SITUATION ANALYSIS............................................................................................................................................5 The History of Frito-Lay Inc................................................................................................................................... 5 The Snack Food Industry: ...................................................................................................................................... 5 Trends in the Snack Food Industry: .......................................................................................................................6 Industry Challenges:............................................................................................................................................... 6 The Competition: ...................................................................................................................................................... 7 The Snack Food Consumer: .................................................................................................................................... 7 Demographics:...........................................................................................................................................................8 SWOT Analysis.......................................................................................................................................................9 OBJECTIVES..............................................................................................................................................................9 STRATEGY ...............................................................................................................................................................10 Repetition ................................................................................................................................................................10 Sex Appeal...............................................................................................................................................................10 Promotions ..............................................................................................................................................................10 BUDGET ....................................................................................................................................................................11 Budget Allocation...................................................................................................................................................11 Point of Purchase Displays ..................................................................................................................................12 Magazine Advertising ...........................................................................................................................................12 Television Advertising ..........................................................................................................................................12 MEDIA EXECUTION ..............................................................................................................................................13 Television: .............................................................................................................................................................. 13 Third Watch..........................................................................................................................................................14 Ally McBeal ..........................................................................................................................................................14 ER ........................................................................................................................................................................15 Once and Again ...................................................................................................................................................15 CBC National .......................................................................................................................................................15 Magazines: ............................................................................................................................................................ 16 Canadian Living ...................................................................................................................................................16 Maxim ..................................................................................................................................................................16 Television & Magazine: CPM, Reach, Frequency, and GRP .............................................................................. 16 Point of Purchase Displays:................................................................................................................................... 16 CREATIVE EXECUTION .......................................................................................................................................17 Packaging.............................................................................................................................................................. 17 Television ................................................................................................................................................................19 Magazines ............................................................................................................................................................. 20 Point of Purchase Display ..................................................................................................................................... 21 EVALUATION ..........................................................................................................................................................22 APPENDIX 1: ............................................................................................................................................................23 SWOT Analysis.................................................................................................................................................... 23 Strengths:.............................................................................................................................................................23 Weaknesses:........................................................................................................................................................23 Opportunities:.......................................................................................................................................................24 Threats: ................................................................................................................................................................24 2 APPENDIX 2: ............................................................................................................................................................25 Competitive Analysis ............................................................................................................................................ 25 APPENDIX 3: ............................................................................................................................................................26 APPENDIX 4: ............................................................................................................................................................27 APPENDIX 5: CPM, REACH, FREQUENCY AND GRP...................................................................................28 Television ............................................................................................................................................................... 28 Magazines ............................................................................................................................................................. 30 Summarizing Chart: ............................................................................................................................................ 31 APPENDIX 6: ............................................................................................................................................................32 APPENDIX 7: ............................................................................................................................................................32 APPENDIX 8: ............................................................................................................................................................32 APPENDIX 9: ............................................................................................................................................................33 APPENDIX 10: ..........................................................................................................................................................33 EXHIBIT’S 1 & 2 ......................................................................................................................................................34 EXHIBIT 3: APPLES ..............................................................................................................................................34 EXHIBIT 4: CHEDDAR CHEESE.........................................................................................................................35 EXHIBIT 5: HERBS ................................................................................................................................................35 EXHIBIT 6: GARLIC..............................................................................................................................................36 EXHIBIT 7: POTATO CHIPS................................................................................................................................36 EXHIBIT 8: FIREPLACES.....................................................................................................................................37 EXHIBIT 9: FAMILY OF OLD DUTCH ..............................................................................................................38 EXHIBIT 10:..............................................................................................................................................................39 EXHIBIT 11:..............................................................................................................................................................40 EXHIBIT 12A:...........................................................................................................................................................41 EXHIBIT 13 ...............................................................................................................................................................41 EXHIBIT 14:..............................................................................................................................................................41 REFERENCES...........................................................................................................................................................42 3 Executive Summary The purpose of this communication plan is to determine how Bistro Gourmet Chips will break into the snack food market. Bistro Gourmet Chips will be produced by Frito-Lay Inc., which has had considerable success with several of its other products in the snack food industry. The snack food market in characterized by easy entry and can be highly rewarding. However, it is highly competitive, therefore, Bistro Gourmet Chips must make strategic moves in order to obtain the objectives it is striving for. Bistro Gourmet Chips will aim toward two short run objectives in the short run. These include awareness of the brand and stimulating trial. In the long run, Bistro Gourmet Chips hopes to achieve brand loyalty, however, this might prove challenging as the snack food industry is characterized by low brand loyalty. The budget, which has been set a $4 million, will allow Bistro Gourmet Chips to utilize several different media vehicles in order to obtain the objectives of awareness and trial. Television and magazines, along with point-of-purchase displays and promotions, will be used extensively to describe the brands identity to the target audience. With the use of the tag line “Succumb to the Sensation”, it is hoped the audience will be captivated and want to try the new brand of chips. Depending on the media vehicle, the strategies involved include repetition, sex appeal and promotions. It is through these strategies that Bistro Gourmet Chips will achieve the objectives of awareness and trial. The duration of the advertising campaign is six months, beginning in November. The effectiveness of the campaign will be evaluated using tracking studies to determine if the objectives of awareness and trial had been achieved. 4 Situation Analysis The History of Frito-Lay Inc. Frito-lay Inc. is the largest potato chip and snack food manufacturer in North America, with sales of $5.865 billion in 1999. The company manufactures seven of North America’s top twenty selling potato chip brands in the United States and is one of the three largest chip manufacturers in Canada. Frito-Lay Inc.’s strength today is a result of a long history in the snack food industry. The company’s roots date back to the 1923 inception of the Frito Company and the founding of H.W. Lay & Company in 1938. Both innovative companies were market leaders in the snack food industry, producing such well-known brands as Lay’s potato chips in 1942, Fritos corn chips in 1945 and Chee.Tos cheese snacks in 1948. The companies’ 1961 merger was simply a natural progression in their expansion. In 1965 PepsiCo Inc. merged with Frito-Lay Inc., forming what is now one of the most powerful snack food and beverage manufacturers in the world. The Snack Food Industry: In North America, changes to daily life such as dual income families, long workdays and highpressure jobs have lead to significant market opportunity in the snack food industry. According to AgriFood Canada, 2001, the snack food industry consists of the manufacturing of salty snacks such as potato chips, tortilla chips, pretzels, and popcorn. Corn and cheese snacks are also included in the category (Agri-Food Canada, 2001). The snack food industry has seen dramatic growth in the 1990s, a trend that is expected to continue in the new millennium. In 1999, Americans spent $19.38 billion dollars on these products (Snack Food Association, 1999). Snacking grew 88% between 1988 and 2000. In Canada, the 1996 per capita consumption of snacks was 1.82 kg, up from 1.36 kg in 1982 (Agri-Food Canada, 2001). The snack food industry in Canada is big business employing 2.6% of working people in the 1997 food and beverage sector, while 1.7% of food and beverage shipments where for snack food. Of the total $947.90 billion in snack food shipments that year, potato chips made up just over half (Agri-Food Canada, 2001). 5 International opportunities for the Canadian industry have also expanded with snack exports rising by 309% between 1988 and 1999. The majority of Canadian snack exports travel to the United States (Agri-Food Canada, 2001). Trends in the industry are expected to increase this number. Trends in the Snack Food Industry: Several strong consumer trends have marked the snack food industry in the 1990s and the new millennium. A growing awareness in healthy living has led to the production of several low or non-fat snack food alternatives. These products sell to a niche market made up of 10% of the snack consuming population. Chips made from root vegetables such as sweet potatoes and beets have been introduced in the market with significant success (Agri-Food Canada, 2001). Stoutly flavoured snacks such as chili cheese, fish and chips, chicken burger and shrimp cocktail have entered the market, as have novelty shaped and cut snacks. Ethnically flavoured snacks have also immerged. Industry Challenges: With the tremendous growth in the industry have come several challenges for snack food manufacturers. New labeling laws have lead to costly changes in packaging (Agri-Food Canada, 2001). Questions about nutritional fortification have also been raised. Changing consumer demographics have kept producers on their toes in meeting new needs and demands. Among these increasing demands are lower fat, more nutritious and tasty products. Another challenge concerns product packaging. It is a key point in protecting the fragile product during transport. Unfortunately, the cost of such packaging is considerably higher than the actual contents of the package, so finding a balance between the cost of damaged product and packaging is a continuous effort for the industry. Several retail chains have consolidated, increasing competition for shelf space within retail stores. These distribution difficulties have been lessened to some degree by new channels of distribution such as drug stores and warehouse outlets (Agri-Food Canada, 2001). Unfortunately, 44.8% of potato chips are 6 still distributed to supermarkets, while convenience stores make up 13 %, and smaller grocery stores 10.8% (Snack Food and Wholesale Bakery, 2000). The Competition: According to Pomar International the snack food market in Canada is characterized by easy entry, low risk and is highly rewarding but the competition is extremely tight. Pomar recommends entering the market only if the represented product is unique or only small gains are expected. Competition in the snack food market is based on branding, advertising and promotion, distribution, product quality, health claims and price. Using one or more of these elements, brands can distinguish themselves within this highly aggressive market. Brand loyalty within the industry is low, so companies must continuously work at maintaining their customers through shelf image and promotion (Agri-Food Canada, 2001). Three major snack food producers, Hostess Frito-Lay Inc., Small Fry Snack Foods Inc. and Old Dutch Foods Ltd. make up the majority of shipment value in Canada (Agri-Food Canada, 2001). Several smaller firms operate in Canada and most often serve regional markets with specialty products (Agri-Food Canada, 2001). (See Appendices 2) In the US, Cape Cod potato chips, made by Lance Inc., is a leader in the premium chip market with $500 million in sales in 1999. It is also the 12th largest chip manufacturer in the US. Following in the trend for natural foods and robust flavoured chips, Cape Cod offers an all-natural chip (Snack Food & Wholesale Bakery, 2000). Cape Cod’s marketing has been carefully considered in developing Bistro Gourmet Chips’ advertising campaign and identifying its target market. The Snack Food Consumer: Not only do consumer preferences affect snack food producers and retailers, they affect the food industry as a whole. A.C. Neilson Inc. reported in 1997 that snack food consumers are important elements in the retail food industry as they: (Snaxpo 1997) a). Generate store traffic and loyalty. 7 b). Spend 78% more money in a store than non-snack consumers, due to purchases of complimentary products such as soda, salsa and dip. c). Attract key demographic groups into stores. These groups include young affluent families with children. Demographics: Considering a reported 97 % of all consumers purchase snack foods, the industry serves a wide variety of people (Snaxpo. 1997). Although this vast market base is encouraging to any manufacturer, Bistro Gourmet Chips is a specialty product and must determine a specific market to serve. See Appendices 3. Frito-Lay Inc.’s Bistro Gourmet Chips will be thick-cut and robustly flavoured, in an effort to position the brand as a premium product. As a new product in the premium chip market, the primary goals identified for Bistro Gourmet Chips’ debut marketing campaign are to increase awareness and stimulate trial. A well-defined target market has been identified in order to achieve these goals. In designing its advertising campaign, Bistro Gourmet Chips has considered several market factors, these include heavy chip user demographics; Cape Cod chips, its major US competitor; as well as the nature of the product itself. Because women make the largest portion of household purchases but men are strong influencers of these purchases, Bistro Gourmet Chips will target male and female consumers ages 25 - 44. Due to its higher price and “choice” characteristics, the premium chip will be targeted to educated consumers who are employed full-time and have a household income of $60,000 and up. Cape Cod’s principle consumers are well educated, married, and work full-time. They have a significant household income and are willing to pay for a product of higher quality. Bistro Gourmet Chips will target a similar market in Canada. The market represents consumers of premium, gourmet food products. They enjoy entertaining but do not have the time to cook lavish foods. Therefore, they will settle for the convenience of store bought goods such as Bistro Gourmet Chips to serve to guests. They also want good tasting snacks for themselves. 8 In its advertising campaign, Bistro Gourmet Chips will reinforce the feelings rendered in eating its chips. In buying a bag of chips, consumers are buying an experience. Although Bistro Gourmet Chips has a well-identified market, it will face some significant challenges. SWOT Analysis Please refer to Appendix 1. Objectives As indicated in the Situation Analysis, the snack food industry is faced with tight competition and low brand loyalty. Due to these factors, Bistro Gourmet Chips’ short-term objectives are to increase consumer awareness and stimulate trial in order to reach the ultimate long-term objective of creating brand loyalty. Due to the tight competition the snack food industry faces, increasing consumer awareness of Bistro Gourmet Chips is vital to the success of this brand. It is important that consumers are aware of Bistro Gourmet Chips and their attributes in order to exist in consumers’ evoked sets. Once in the evoked sets of consumers, there will be a greater chance these consumers will choose Bistro Gourmet Chips over other competing brands. Because snack food consumers have low brand loyalty, Bistro Gourmet Chips has the opportunity to stimulate trial among many consumers, especially variety seekers. Stimulating trial is critical for the introduction of this new product as it can lead to repeat purchases (if consumers like Bistro Gourmet Chips) and ultimately lead to brand loyalty. Since Bistro Gourmet Chips is a new product, there is no consumer awareness about the brand and there has been no trial. A reasonable yet challenging goal is to increase awareness from 0 to 40% of the target market. Following the six-month advertising campaign, tracking studies will be used to see if consumers’ awareness of Bistro Gourmet Chips has increased. In terms of trial, the goal is to increase trial to 20% of the target market. This goal is consistent with that of awareness. If 40% of consumers are aware of Bistro Gourmet Chips, than about half of these people will try the brand. Because Bistro 9 Gourmet Chips has never been on the market, keeping track of sales within the six-month campaign will be a good indicator of trial usage. Strategy Throughout the advertising campaign for Bistro Gourmet Chips strategies such as repetition, sex appeal, and promotions will be used. These strategies will be employed to achieve the objectives of creating awareness and stimulating trial. Repetition Television, magazines, and point of purchase displays will all be used to create awareness of Bistro Gourmet Chips. The tag line Succumb to the Sensation will be present in all the above media vehicles. Repeating the tag line and the Bistro Gourmet Chips brand name with each airing ad will create awareness amongst consumers. Airing 228 television commercials, placing 12 full-page magazine advertisements, and having point of purchase displays in 360 IGA stores across Canada is a promising way of creating awareness of this brand of chips. Sex Appeal The creative aspect of the television commercials consists of sexual innuendoes. Sexual appeals are attention getting and occasionally arousing, which may affect how consumers feel about a product (O’Guinn ET AL, 2000). Using sex appeal will attract attention, which will create awareness and even trial. Viewers of the ad are likely to associate Bistro Gourmet Chips with a pleasurable experience and remember this brand when shopping for chips. Promotions Another strategy used to create awareness and stimulate trial is to use promotional techniques. Coupons will be placed in magazines and on in-store point of purchase displays. 10 Having coupons in magazine advertisements will catch attention and lead to an increase in awareness. Since chip consumers are generally not brand loyal, the discount provided will give consumers a reason to choose Bistro Gourmet Chips over competing brands. When consumers are shopping for chips in grocery stores, the in-store point of purchase displays will attract attention and once again increase awareness. The coupons provided on the displays will give shoppers an added incentive to buy Bistro Gourmet Chips. Budget For the American debut of Bistro Gourmet Chips, Frito-Lay Inc. had an advertising budget estimated at $25 million US (Advertising Age, 2001). Following the American budget, the Canadian debut advertising campaign for Bistro Gourmet Chips will require a budgeted $4 million Canadian. Since the Canadian population is approximately 10% of that in the United States, 10% of the American budget was taken to determine how much should be spent for the Canadian campaign. Therefore the Canadian advertising budget will be $2.5 million US or $4 million Canadian. Budget Allocation Because of the two campaign objectives of increasing awareness and trial, it is extremely important that the campaign achieves high target market frequency and reach. In order to achieve this it is felt that appropriate media vehicles to be used are television, magazines, and point of purchase displays. The following table allocates the costs associated with using these three types of media to the budget. Cost of Point of Purchase Displays Cost of Magazine Advertising Cost of Television Advertising Cost of Producing TV Advertisements 124,500 54,815 3,697,920 70,000 TOTAL 3,947,235 11 Point of Purchase Displays Numbers given from Janine van Essen of Palmer Jarvis have been used to determine the cost of point of purchase displays. According to van Essen, placing point of purchase displays in all Canadian Safeway stores will cost approximately $35,000. However, the majority of Safeway stores are located in Western Canada, so nation-wide IGA stores will be used instead. There are approximately 3 times more IGA stores than Safeway stores in Canada, so a factor of 2.5 (because the more stores used, the less the placement cost) was multiplied against $35,000. It is felt that placing POP displays in over half (60%) of IGA stores will be effective in creating awareness and stimulating trial. Therefore, 360 IGA stores throughout Canada will have a point of purchase display at a cost of $200/display. Magazine Advertising The advertising campaign will utilize two magazines, one targeted at women and the other at men, to achieve the campaign’s objectives. For the six months of the campaign, each magazine will have one advertisement, and make up twelve magazine advertisements in total. A full-page ad run six times costs $25,380 for Maxim and $29,435 for Canadian Living (CARD, 2001). Television Advertising Janine van Essen of Palmer Jarvis quoted the average cost of producing a television advertisement at $70,000. The cost of television advertising was determined from information given by sales representatives of CFRN-TV and CBC. program will air one ad per episode. For the six months of the campaign, each television Because the CBC National News airs five times per week, advertisements on this show will run a total of 120 times. The CBC rates given per show were at a national rate of $5000, so this number was simply multiplied by 120. The shows airing on CTV (Ally McBeal, Third Watch, ER, and Once and Again) air once a week. Once and Again will air for the first three months and 12 times in total. The remainder of the shows will each have 24 advertisements. The rates obtained for advertising on chosen programs came from CFRNTV of Edmonton, an affiliate of CTV. In order to determine the national advertising rate, the Edmonton 12 rate was multiplied by a factor of 20. This factor was determined on the basis that Canada has 30 times more people than Edmonton, however advertising on a national scale generally results in a lower cost of air time. Please see Appendix 4 for a more detailed analysis of the budget. Media Execution Television: According to the 1999 BBM sweep surveys (Media Digest, 2000), 99% of Canadian households are equipped with a television set, with the majority owning two or more sets. Of all media, television is the quickest way to reach a large audience. The primary media used during the campaign will be television. Since our target market is composed of both females and males aged 25-44, pursuing advertising through the television medium will be the best way to reach this broad market. Overall, television offers extensive reach, which is an important element in achieving our goal of increasing awareness in the market. The television campaign will coincide with the upcoming season premiers; generally, season premiers are launched in early November. Therefore, the media campaign will commence November 2001 and conclude six months later at the end of April 2002. Five television programs were chosen for the campaign. The attributes examined when choosing these programs included: z the day of the week they aired z the time of day they aired z the primary target market of the program. Based on statistical information (PMB database, 2000), Monday - Friday evenings between the hours of 7 p.m. and 11 p.m. are the most popular television viewing hours. Twenty-five to 34 year olds spend 33% of their television viewing hours during this time frame; 35-49 year olds spend 35% of their viewing hours during this time frame. Therefore, the television shows chosen for this campaign will be aired during the peak hours of 7 p.m. and 11 p.m. Monday through Friday. To promote Bistro Gourmet, one 30-second commercial will run one time per airing of all shows selected. 13 Third Watch Third Watch is a primetime drama aired at 8 p.m. Monday on CTV and has a national viewing audience of approximately 560,000 (28,000 viewers in Edmonton multiplied by 20 to account for national viewing audience; as per representative from CFRN). It has been assumed the majority of the viewing audience is males over 18 years. The 30-second Bistro Gourmet Chips commercial will be aired once per episode of Third Watch for six months. In total, 24 commercials will be placed on Third Watch over the six-month campaign, and will cost $758,400 (CFRN representative, 2001). Ally McBeal Ally McBeal is a primetime program aired Monday at 10 p.m. on CTV and has a national viewing audience of 1,992,000 individuals over 18 years (Nielson Media Research, 1999). Although unsubstantiated, it is assumed a majority of the viewing audience is female. The 30-second Bistro Gourmet Chips commercial will be aired once per episode of Ally McBeal for six months. In total, 24 commercials will be placed on Ally McBeal during the six-month campaign for a cost of $954,720 (CFRN Representative). An commercial on Ally McBeal will compliment the earlier run on Third Watch. Both programs are aired on the same channel, only an hour apart, so there is a possibility of increasing the frequency of the commercial. The viewers of Third Watch may continue watching the same channel and be tuned into Ally McBeal an hour later where they would be exposed to the Bistro Gourmet Chips advertisement once again. In the above scenario, a certain amount of the same viewing audience would be captured through overlap, however, we feel that the two shows target a different audience. Whereas Third Watch may attract a high percentage of males, Ally McBeal attracts a high percentage of females. Based on this information, we decided an commercial on both programs would be a sufficient way of capturing both the female market and the male market whilst still providing a certain degree of overlap. 14 ER ER is a primetime drama aired Thursday at 8 p.m. on CTV and has a national viewing audience of 2,842,000 individuals over the age of 18 (Nielson Media Research, 1999). The 30-second Bistro Gourmet Chips commercial will be aired once per episode of ER for six months. In total, twenty-four commercials will be placed on ER over the six-month campaign for a total cost of $1,219,200 (CTV Representative). ER was chosen because its demographics are similar to that of our target market. Furthermore, a commercial on ER would help to increase the reach of our television campaign because it is on a different night than Ally McBeal and Third Watch, therefore a completely different viewing audience. Once and Again Once and Again is a primetime CTV drama aired on varying weekday evenings at differing times. It has a national viewing audience of 240,000 (12,000 viewers in Edmonton multiplied by 20 to account for national viewing audience; as per representative from CFRN). The 30-second Bistro Gourmet Chips commercial will be aired once per episode of Once and Again for the first three months of the campaign only. In total, twelve commercials will be placed on Once and Again over the six-month campaign for a total cost of $165,600 (CTV Representative). CBC National CBC National is aired at 10 p.m. weekday evenings on CBC, and has a national viewing audience of 1,298,000 (PMB Database, 2001). The 30-second Bistro Gourmet Chips commercial will be aired once per episode for six months. In total, 120 commercials will be placed on CBC National over the six-month campaign and will cost of $600,000 (CTV Representative). By placing commercials on CBC National, reach will be extended to include those people ages 30-44. 15 Magazines: Placing an advertisement in specific magazines will enable marketing to a more select audience. Bistro Gourmet Chips will run a one-page advertisement in all magazines selected and will include a “$.10 off” coupon. A major goal of the campaign is to stimulate trial, and the coupon will help Frito-Lay maximize this goal. Canadian Living The one-page advertisement will be placed in six issues (one every month) of Canadian Living Magazine at a cost of $29,435. Readers of Canadian Living are predominantly female aged 25-54. Canadian living caters to working women and features articles on health, money management, fashion and cooking. It is a good fit with the vibrant female market Bistro Gourmet Chips is targeting. Maxim The one-page advertisement will be placed in six issues (one every month) of Maxim at a cost of $25,380. Maxim targets males between the ages of 21 and 34 and features articles on sexuality, sports, health and humor. Maxim speaks directly to the educated and hard-working male market Bistro Gourmet Chips is targeting. Between Canadian Living and Maxim, a good portion of both our female and male market will be considered. Television & Magazine: CPM, Reach, Frequency, and GRP Please see Appendix 5. Point of Purchase Displays: To encourage consumers to remember Bistro Gourmet Chips when making their chip-purchasing decisions, point of purchase (POP) displays will be placed in IGA stores across Canada. The POP display units will be located in 60% of IGA stores nationwide, totaling 360 stores (these display units will 16 be primarily in urban stores). The POP display units stand 5 feet high, 3 feet wide and 2 feet deep with plenty of shelving. There will also be coupons attached to further encourage trial purchase. Each unit will cost $200 and there will be a placement fee of approximately $52,500 (Janine van Essen, Palmer Jarvis, 2001). Please see budget section for details. Creative Execution One of the objectives for the advertising campaign is to increase awareness of Bistro Gourmet. In order to increase awareness, people have to see our ads and see them often. Concurrently, our main message strategy objective is to promote brand recall. The methods that will be used to satisfy this objective will be that of repetition and the use of a slogan. The brand name Bistro Gourmet will be illustrated once in each of our three media vehicles. Plus the advertisements themselves will be repeated several times within each media vehicle. The advertising campaign’s slogan is “Succumb to the Sensation”. This slogan helps to portray that Bistro Gourmet are not just ordinary chips. It tries to insinuate that when a consumer tries this brand, they will surrender to an exhilarating sensation of flavor. The slogan encompasses the method of sex appeal to instill a brand preference, our second message strategy objective, increasing awareness of the brand. Bistro Gourmet is satisfying to the senses. Because potato chips are a low price, low involvement product, little copy will be used in any of the advertisements, whether it is placed on television or in a magazine. Consumers do not want to take the time to read an ad that is for a convenience product like potato chips. It is for this reason that image advertising (almost exclusively visual) will be used as opposed to claim-based advertising (more copy). The media vehicles that will be used include: television, magazines, and point-of-purchase displays. Packaging The packaging is the core element for the message strategy. As mentioned previously, chips are considered to be a low involvement product. This means that people usually do not spend a long time in the snack isle deciding on which bag of chips to snack on. Consequently, the packaging can be the key to having Bistro Gourmet chosen from others. (Exhibit’s 1 & 2) 17 We will be producing two flavors of Bistro Gourmet chips: applewood & smoked cheddar and roasted herb & garlic. Even though the two flavors are completely unique, we wanted to have an overall theme connecting them. Therefore, we designed a basket that would hold the flavors. On both of the bags, the flavors look as if they are overflowing out of the basket onto the ground beneath. We laid chips amongst the fallen flavors and spread in front of the basket in an attempt to link the flavors with the chips taste. The two aspects of flavor in the chips, smoked versus roasted, are combined in our bags by using logs and fire coming up in behind a basket of flavors. We also incorporated the image of fire around the logo to further emphasize the roasted or smoked essence of the chips. The copy on the bag is essential to describe exactly what the product is. We wanted the copy of the flavors to be the same on both bags and be slightly larger than the words Gourmet Chips underneath. We made the word “GOURMET CHIPS” all in capital letters to distinguish it from the upper and lower cases of the flavor copy above it. We also used a blocked approach to separate flavor (eg. roasted herb & garlic) and the product itself (gourmet chips). The logo of “Bistro Gourmet Chips” is the same on both bags. We placed a flame around the logo to symbolize the smoked/roasted essence of the flavor. Under the “Bistro”, “GOURMET CHIPS” is the same font and capital letter case as in the upper part of the bag just smaller. The font remains the same in order to create continuity and repetition of the product. “Bistro” is designed in a unique font. We wanted it to be a different word graphic illustrating a creative and sophisticated look. Lastly, our ideas for the design of the bag were inspired from pictures found on the Internet from Yahoo’s website: www.yahoo.com. Examples of these pictures can be found in Exhibit’s 3-8. Overall, we wanted to make the front of the bag stand out from the rest of the other chip bags on supermarket shelves. In order to differentiate ourselves we looked at both the image and copy aspects of the packaging design. If you look at Exhibit’s 9 and 10, they show multiple variations of our competitor’s packaging. As you can see, their bags contain very little image graphics. The other brands incorporate individual company logo, the specific flavor, and “potato chips.” Some have pictures of chips on the bags for some form of image related to the product (eg. Pringles, Rachel’s, etc.) The only brand that would come close to our image emphasis would be Miss Vickies. However, our packaging has greater color quality. Therefore, the combination of color superiority and detailed graphical imagery helps give our 18 packaging a more professional, sophisticated look. We hope this will attract the attention of our target audience (25-44 years) and increase their awareness of the brand. Second, our brand logo is unique from our competitors. Exhibit 11 illustrates some of the competing brands. Doritos, Sun Chips, and 3D brands probably have the closest creative decorative logo in relation to ours. However, ours stands alone thanks to the combination of two different fonts and sizes inside a ball of fire. Again, the creative font of Bistro is meant to give a sophisticated, professional look hopefully catching the eye of our target audience. The logo of “Lays” will be illustrated on the back of the bag. We did not want to place it on the front because of misconception that could arise regarding the brand name (Bistro Gourmet Chips or Lays). Television The tactics that will be used for the advertisement placed on television will involve the use of sex appeal and a slogan. A storyboard has been created in order to illustrate what the final commercial will look like. (Exhibit 12a & 12b) The television format that will be used for this commercial will be that of music and song. Throughout the entire commercial, the music of Barry White will be playing. This is to reinforce the mood of romance and sensuality that follows the theme of sex appeal. The commercial will take place in a wood cabin during a cold winter night. (1st slide) The music of Barry White will be playing in the background as the shot goes from outside the cabin to the inside. Once inside, there will be sounds of moaning and groaning. The audience will be lead to wonder what type of ad it is because of the sensual nature. Once inside, the camera will do a quick scan of the floor inside (hardwood floors), from the door entrance to where a couch will be. The camera will then focus on two pairs of feet with slippers. (2nd slide) The camera will be at an angel that will be looking at the feet from underneath the couch. Therefore, all the audience sees is the slippers and hears the romantic music in the background containing the sexual sounds of moaning. Next, the camera will move up to see the back of both a female and male head with a roaring fireplace in the background. (3rd & 4th slide) No faces will be visible, leaving it to the imagination of the audience as to what the couple is actually doing. Finally, the suspense is ended when the camera turns to focus on the couple from the front. What will be revealed will probably not be what the audience is expecting: the couple thoroughly enjoying a bag of 19 Bistro Gourmet Chips. (Keep in mind that during this entire time there is only the music containing moaning sounds along with the visual. There has been no talking or words placed on the screen as of yet.) The second last shot of the commercial will involve an announcer saying (in a seductive voice) “Succumb to the Sensation” as the words dissolve on the screen. (5th slide) The final shot will contain the image of the two bags along with the brand logo appearing onto the screen for 2-3 seconds. We are placing the image of the bags last in order to capture the last thought in the consumers mind about what the ad is about. It is sometimes hard to get the attention of the audience as a result of so much advertising that appears on television today and people’s tendency to tune out when the commercials come on. With the implication of sex and pleasure, we want to try and grab the attention of the audience so that they will be attentive long enough for the announcer to introduce the brand name and the slogan. By repeating the commercial, we hope that the slogan is rehearsed by the target audience in order for them to have some sort of retrieval cue to remember Bistro Gourmet the next time they go to buy a bag of chips. Also, we are hoping that our second message strategy objective of instilling a brand preference will be accomplished by insinuating that eating these bags of chips would result in a sensational experience (slogan “succumb to the sensation” and sounds of moaning in pleasure). Magazines The magazine article was designed to reinforce slides 3-6 of the television commercial. (Exhibit 13) The illustration of two people eating delicious chips on the couch with the words “Succumb to the sensation” underneath and the logo in the bottom left corner in the magazine; is done in the same text and visual images as in the commercial in the hopes of accomplishing the message strategy objective: promoting brand recall through the use of repetition and a slogan. There is also a coupon for $.10 off on a bag of chips. This is used in order to stimulate trial. Lastly, the website is displayed on the bottom of the article in order for people to find more information about our brand Bistro Gourmet Chips. For example: a) see the commercial, b) which locations they can get the bags from, c) the ingredients of the chips, etc. 20 Point of Purchase Display The displays are designed with the logo and slogan at the top, layers of actual bags in rows in the middle, and a picture of a log fire in the bottom. (Exhibit 14) The logo and slogan are placed at about eye level in order to increases awareness of the brand and to reinforce repetition in hopes of promoting brand recall. The bags are placed in the middle for easy access: applewood and smoked cheddar on the first shelf and roasted herb and garlic on the second shelf. Since potato chips are such a low-involvement, convenience food, consumers are likely to spend little time searching. If you provide the product in front of them, it reduces their search time significantly. Therefore, the easy accessibility for customers helps stimulate trial. The fire illustration on the bottom is the same log fire in the television commercial and in the magazine advertisement. This further demonstrates repetition amongst the different media vehicles. The fire emphasizes the smoked/roasted flavor of the chips and can be used as a retrieval cue to remember the brand name (if people see this first). Special Thanks Lastly, we want to give special thanks to Jamie Holloway who helped draw our packaging, pointof-purchase displays, and magazine advertisement. His extraordinary creative talent was instrumental in bringing our ideas to life. 21 Evaluation Several types of posttests will be administered to assess whether the ad campaign was a success. To determine if the campaign accomplished the objectives of increasing awareness and stimulating trial, tracking studies will be conducted. A sample of the target market will be surveyed at different intervals during and after the campaign, so any changes in brand awareness will be detected. This method will be used to determine the effectiveness of both the television and magazine advertisements. Unfortunately, this method is not without flaws. Changes with regards to awareness could have come from sources other than the advertising campaign, such as friends or media reports. These sources may not be directly related to the campaign. The surveys will be valuable in determining trial, as participants will be asked if they have tried the product. Sales figures are generally less valuable in measuring this objective, as new and repeat purchases are not distinguished from one another. Sales may also be affected by factors unrelated to the advertising campaign. These may include factors such as market conditions, competitors or a host of other factors. The second method of evaluation involves selecting individuals from the target audience who watch the television programs containing the advertisement. The day following the program, the individuals will be contacted and asked questions such as: “Did you see an ad for potato chips?” If so, “Do you remember the brand?” Depending on the response, the interviewer will use follow-up questions to determine whether the ad was effective. This method will also be used to establish the value of the magazine advertisement by giving individuals a copy of either Maxim or Canadian Living. Participants will then be asked similar questions to determine recall. A contingency plan has been developed in the event the advertising campaign does not meet the objectives of increased brand awareness and stimulating trial. In this case, to achieve increased awareness we would run the advertising campaign for longer than anticipated, while making minor adjustments to the placement of the advertisements. The ads would be placed on different television channels or programs in an attempt to increase audience reach. Changing the magazine featuring the advertisement would also help in increasing brand awareness. With regards to stimulating trial, sampling may prove to be an effective method if our original efforts have failed. 22 Appendix 1: SWOT Analysis Strengths: • Frito-Lay Inc. represents 7 of the top 20 selling brands of chips in the United States with sales reaching $5.865 billion in North America in 1999. This success and experience offers Bistro Gourmet Chips, backing from a strong market force that knows customer likes and dislikes. • Frito-Lay Inc. has recently launched more robust flavours in its successful Flavour Rush Ruffles line, offering Bistro Gourmet Chips background knowledge into marketing a spicier chip. • Bistro Gourmet Chips follows a market trend for more robust, crunchier and uniquely flavoured chips. • Upscale positioning will set it apart from other brands. • Higher price point is justified because of added apparent value to the customer. Higher prices will allow Lay’s to increase its profit margin. • Lays spent $91 million on measured media in 1999 (Competitive Media Reporting, 2000). This large amount of spending shows the company believes in advertising and will most likely provide the funds to support a full-scale media launch of Bistro Gourmet Chips in Canada. Weaknesses: • Bistro Gourmet Chips has yet to be launched in the US, therefore no previously published marketing or sales data about the product is available. • Lay’s most recent product offering, low-fat WoW chips, didn’t do well in the market, and might be a signal the company is losing track of customer wants (Advertising Age, Oct. 30, 2000). • Due to the flop of the WoW chip, Frito-Lay Inc. might be more conservative in spending to market Bistro Gourmet Chips. • The upscale image and higher price of Bistro Gourmet Chips might turn off consumers. • By minimizing the Frito-Lay Inc. brand name, brand recognition will be minimized and consumers will have little experience from which to base their decision. 23 Opportunities: • There has been a demand for more robust flavoured chips, offering a new market for Lay’s to service. • Television media offers extensive reach and frequency and allows for the quick formation of awareness. • Purchases of snack foods are growing in Canada due to changes in lifestyle and demographics. Those areas of largest growth include low fat and fat free, as well as special flavours (Snaxpo, 1997). This provides Lays with increasing market opportunity. Threats: • Cape Cod potato chips currently lead the specialty chip market with sales up 22% in October of 2000 in non-convenience retailers (Advertising Age, Oct. 30, 2000). This company marks Bistro Gourmet Chips’ greatest threat, and the company must set itself apart from the current competitors. • There are several regional competing brands that have a local identity and market. Lay’s will be marketing nationally and must design a campaign to attract all Canadians (Advertising Age, Oct. 30, 2000). • Television is a costly means of advertising. • Competition for shelf space is high. • Packaging and marketing is high for a low margin product. 24 Appendix 2: Competitive Analysis Brand and Advertising Expenditure And Sales Parent Co. Competing Products Advertising Distinguishing Factors Pringles advertising expenditure $55 million in 1999, sales were $350 million Procter & Gambel Spicy Cajun Popping Pringles and Singing chip can appeals to teens and young adults “Once you pop, you can’t stop.” Unique flavour (Advertising Age, 1999) (www.pringles.com) Ridges Thick chip with robust flavour Long time on the market, familiar Unique flavour, made in Canada Regular Humpty Dumpty Small Fry (www.humptydumpty.com) Old Dutch (www.kettlefoods.com) Lance. Inc. chips Salsa with Mesquite; New York Cheese Style; Yoghurt and Green Onion potato chips Reduced fat; Yukon Gold; Sea Salt Popcorn US sales of $500 Million (Snack Food and Wholesale Bakery, 2000 and www.capecodchips.com) Terra Chips Variety of flavours, unique shape No Figures available Kettle Chips Cape Cod potato Smokey Bacon, and Roast Chicken chips Ridgies The Hain Celestial Group Inc. Terra Chips Organic, thin and crispy texture Several unique flavours Sponsoring middle school art classes in their creation of replica tall ships. Each school receives several cases of chips. Major sponsor of Sail Boston More gourmet type image. Sold mostly in health food specific food aisles and stores. Made from various root vegetables; no artificial colourings, flavours or preservatives 25 Appendix 3: User Category Employment Age Income Education Level Radio Genre TV Show Genre (Prime Time) TV-Viewing Time Cape Cod Potato Chips *** Used as comparison, because product is similar to Bistro Gourmet Chips Top % of female, heavy potato chip consumers (more than 3 packages in the last 30 days) 50.1% employed full-time 36.0% not employed 13.9% employed part-time 30.6% ages 35-44 23.7% ages 25-34 19.2% ages 45-54 17.1% household income of $75,000 or more 14.4% $30,000 - 39,000 14.0% 20,000 - 29,000 39.7% high school graduate 26.3% attended college 16.8% college grad 24.9% listen to adult contemporary 23.0% listen to country 15.9 % listen to rock 13.9% early evening news 11.5% watch general drama 9.2% watch police docudramas 42.4% watch between 8 p.m. and 11 p.m. 35.4% watch between 7:30 p.m. and 8 p.m. The largest group of female users are married college graduates, ages 35-44 followed by ages 45-54; employed full-time in a clerical, sales or technical position; with a household income of $75,000 or more; Mediamark Research Inc., 1998 26 Appendix 4: Advertising Budget Cost of Magazines Maxim (6 full-page advertisements) $ 25,380 Canadian Living (6 full-page advertisements) $ 29,435 Total Cost of Magazine Advertisements $ 54,815 $ 52,500 Point of Purchase Displays IGA Store Space Cost Per Safeway Store X 2.5**=Cost Per IGA Store $35,000 X 2.5=$87,500 Cost Per IGA Store X 60% of Stores $87,500 X .60=$52,500 Cost Of Manufacturing Displays Total IGA Stores X 60% = 60% of IGA Stores 600 X .60=360 60% of IGA Stores X $200 per display unit 360 X $200=$72,000 $ 72,000 POP Total= IGA Store Space X Cost of Manufacturing Displays $52,500+$72,000=$124,500 $ 124,500 $ 70,000 Cost of Television Production Costs Ally McBeal (once a week for 6 months=24 times) X 20 National Rate $1989 X 24 X 20= $ 954,720 Third Watch (once a week for 6 months=24 times) X 20 National Rate $1580 X 24 X 20= $ 758,400 ER (once a week for 6 months=24 times) X 20 National Rate $2540 X 24 X 20= $ 1,219,200 Once and Again (once a week for 3 months=12 times) X 20 National Rate $690 X 12 X 20= $ 165,600 CBC National News (five times a week for 6 months=120 times) 5000 X 120= $ 600,000 Total Cost of Advertising on Television $ 3,767,920 TOTAL COST OF ADVERTISING CAMPAIGN $ 3,947,235 **Janine van Essen of Palmer Jarvis provided the cost for store space at $35,000. This rate was giving based on Safeway stores. Since there are three times more IGA stores than Safeway stores in Canada, this number was multiplied by 2.5. We chose 2.5 over 3 because of discounts for high volume purchases. Appendix 5: CPM, Reach, Frequency and GRP The following calculations do not take into account within vehicle duplication or between vehicle duplication. Television Where: CPM = cost of advertisement / number of people exposed (viewers) Reach = number of viewers / number of people in target market Frequency = please see appendices 6, 7, and 8 GRP = reach x frequency Third Watch: CPM $31,6001 / 560,0001 x 1000 =$56.50 Reach 560,000 / 9,699,7402 =5.78% Frequency Please see appendix 6 =4 GRP 5.78 x 4 =23.12 CPM $39,7801 / 1,992,0003 x 1000 =$20.00 Reach 1,992,000 / 9,699,7402 =20.54% Frequency Please see appendix 6 =4 GRP 20.54 x 4 =82.16 Ally McBeal: 1 CFRN Sales Representative Statistics Canada, CANSIM, Matirx 6367 3 Nielsen Media Research 1999 2 28 ER: CPM $50,8001 / 2,842,0003 Reach 2,842,000 / 9,699,7402 =29.3% Frequency Please see appendix 6 =4 GRP 29.3 x 4 =117.20 CPM $138001 / 240,0001 x 1000 =$57.50 Reach 240,000 / 9,699,7403 =2% Frequency Please see appendix 7 =1 GRP 2x2 =4 CPM $50001 / 1,298,0001 x 1000 =$3.90 Reach 1,298,000 / 9,699,7402 =13.39% Frequency Please see appendix 8 =11.25 GRP 13.39 x 11.25 =150.64 x 1000 =$17.90 Once and Again: CBC National: 1 CFRN Sales Representative Statistics Canada, CANSIM, Matirx 6367 3 Nielsen Media Research 1999 2 29 Magazines Where: CPM = cost of advertisement / (circulation x RPC) or CPM = cost of advertisement / total paid sales Reach = number of people exposed / number of people in target market Frequency = please see appendices 9 and 10 GRP = reach x frequency Canadian Living: CPM $29,4354 / (563,0005x3.55) x 1000 $29,435 / (1,970,500) x 1000 = $14.90 Reach 1,970,500 / 9,699,740 = 21% Frequency Please see Appendix 9 =5 GRP 21 x 5 = 105 The following CPM-TM calculation for Canadian Living is based on the number of female readers. Although the target audience is made up of females and males, the campaign will target female readers through Canadian Living and target male readers through Maxim. CPM – TM = (cost of ad / number of people in target market exposed) x 1000 = ($29,435 / 1,568,000) x 1000 = $18.70 Maxim: CPM $25,3806 / 1,663,6866 x 1000 = $15.30 Reach 1,663,686 / 9,699,740 = 18% 4 CARD January 2001 Volume 74 Number 1 Rogers Media Pg 162-163 PMB 2000 Readership Volume 1 Page 1 6 CARD January 2001 Volume 74 Number 1 Rogers Media Pg 132-133 5 30 Frequency Please see Appendix 10 =4 GRP 18 x 5 = 90 Although RPC and male vs. female readers are not available for Maxim, the primary target audience of Maxim is males between the ages of 21-346. The two magazines combined will cover a good portion of our target market. Summarizing Chart: Television Third Watch $ CPM 56.50 Reach 6% Frequency 4 GRP 23 Ally McBeal $ 20.00 21% 4 82 ER $ 17.60 29% 4 117 Once and Again $ 57.50 2% 1 4 CBC National $ 3.90 13% 11.25 151 $ 14.90 21% 5 105 $ 15.30 18% 4 90 Magazines Canadian Living Maxim 31 Appendix 6: The frequency rates for Third Watch, Ally McBeal and ER were determined in the following manner: The total frequency is equal to the total runs of the advertisement, over the specified time frame, of 24. However, of the 24 potential exposures, only half of the audience will be loyal followers bringing down the frequency number to 12. Of these loyal followers, presumably half of those watching the show will stay on the same channel (the other half will surf), bringing the frequency down to 6. Of those who haven’t changed the channel, probably one quarter will get up and walk away. Therefore, a realistic frequency will be 4. Appendix 7: The total frequency for Once and Again will be equal to the total runs of the advertisement, over the specified time frame, of 12. However, of the 12 potential exposures, only a third of the audience will be loyal followers (less loyal following than the more popular shows demonstrated above) bringing down the frequency number to 4. Of these loyal followers, presumably half of those watching the show will stay on the same channel (the other half will surf), bringing the frequency down to 2. Of those who haven’t changed the channel, one quarter will most likely get up and walk away. Therefore, a realistic frequency will be 1. Appendix 8: The total frequency for CBC National will be equal to the total runs of the advertisement, over the specified time frame, of 120. However, of the 120 potential exposures, half of the audience will be loyal followers bringing down the frequency number to 60. Of these loyal followers, probably half of those watching the show will stay on the same channel (the other half will surf), bringing the frequency down to 30. Of those who haven’t changed the channel, probably one quarter will get up and walk away. Therefore, a realistic frequency will be 22. 32 Appendix 9: The total frequency for Canadian Living magazine would be equal to the total runs of the advertisement, over the specified time frame, of six months. The total subscriptions are 399,019 out of a total circulation of 545,024; this is 73%. Therefore, 73% of readers are receiving every copy of Canadian Living; 73% if readers will be exposed to all six advertisements. Because of this strong loyal following to the magazine, it is assumed that out of single copy sales, there will also be a high percentage repeat sales. Accordingly, a frequency of 5 is suitable. Appendix 10: The total frequency for Maxim magazine equals to the total runs of the advertisement, over the specified time frame, of six months. The total subscriptions are 850,143 out of a total circulation of 1,663,686; this is only 51%. Therefore, 51% of readers are receiving every copy of Maxim; 51% if readers will be exposed to all six advertisements. However, Maxim also has a loyal following and many of the single copy sales are probably from repeat customers. Therefore, a frequency of 4 is suitable. 33 Exhibit’s 1 & 2 Please refer to the two mock-ups mounted on matte board. Exhibit 3: Apples http://search.gallery.yahoo.com/search/corbis? p=apples&b=301&strip= http://search.gallery.yahoo.com/search/corbis? p=apples&r=all http://search.gallery.yahoo.com/search/corbis? p=apples&b=325&strip= http://search.gallery.yahoo.com/search/corbis? p=apples&b=133&strip= http://search.gallery.yahoo.com/search/corbis? p=apples&b=49&strip= http://search.gallery.yahoo.com/search/corbis? p=apples&b=121&strip= http://search.gallery.yahoo.com/search/corbis? p=apples&b=217&strip= 34 Exhibit 4: Cheddar Cheese http://search.gallery.yahoo.com/search/corbis? p=cheese&b=61&strip= Off the internet http://search.gallery.yahoo.co m/search/corbis?p=cheese& b=157&strip= Exhibit 5: Herbs http://search.gallery.yahoo.com/search/corbis? p=herbs&b=13&strip= http://search.gallery.yahoo.com/search/corbis? p=herbs&b=37&strip= http://search.gallery.yahoo.com/search/corbis?p= herbs&r=all http://search.gallery.yahoo.com/search/corbis?p= herbs&r=all 35 Exhibit 6: Garlic http://search.gallery.yahoo.com/search/corbis?p=garlic&r =all http://search.gallery.yahoo.com/search/corbis?p= garlic&b=13&strip= http://search.gallery.yahoo.com/search/corbis?p= garlic&b=25&strip= http://search.gallery.yahoo.com/search/corbis?p=garlic&r =all Exhibit 7: Potato Chips http://search.gallery.yahoo.com/search/corbis?p=potato+chips&r=all 36 Exhibit 8: Fireplaces http://search.gallery.yahoo.com/search/corbis?p=fireplaces&b=37&strip= http://search.gallery.yahoo.com/search/corbis?p=fireplaces&b=25&strip= 37 Exhibit 9: Family of Old Dutch http://www.htinfo.com/secure/bobsproduce/olddutch/ 38 Exhibit 10: http://www.pringles.com/meet.shtml http://www.go-rachels.com/ http://www.zapps.com/ http://www.lays.com/ 39 Exhibit 11: http://www.htinfo.com/secure/bobsproduce/olddutch/ http://www.pringles.com/meet.shtml http://www.zapps.com/ http://www.go-rachels.com/ http://www.lays.com/ 40 Exhibit 12a 1. http://search.gallery.yahoo.com/search/corbis?p=log+cabins&b=49&strip= 2. found on the internet 3. http://www.lhdi.com/ 4. http://search.gallery.yahoo.com/search/corbis?p=fire&b=61&strip= 5. Bradley Hand ITC font in red 6. Illustration scanned right off our magazine article Exhibit 13: Please refer to the mock-up mounted on matte board. Exhibit 14: Please refer to the mock-up mounted on matte board. 41 References: Alberta Agriculture Food and Rural Development (March, 1997) Snaxpo ‘97 Advertising Age, (October 30, 2000) Frito hopes gourmet chip will fatten profits. Crain Communications Inc., USA. Agri-Food Canada (2000) All about Canada's snack food industry. www.agr.ca Food Bureau, Market & Industry Services Branch Agriculture & Agri-Food Canada American Institute of Food Distribution, Inc. (Nov 6, 2000), Snack Giant Frito-Lay Hopes Premium Potato Chips Will Fatten Sales. COPYRIGHT 2000 American Institute of Food Distribution, Inc. CARD Jan 2001, Vol 74, Number 1, Rogers Media Food & Wholesales Bakery, (2000) Top 20 Potato Chips by Sales in Year Ended 1 / 2 / 2000. Stagnito Publishing Co, USA. LNA / Media Watch Multi-Media Service. (1999) Ad $ Summary Jan - Dec 1999. Media Digest (1999 - 2000) Estimated Cost of Network Comercials: Prime Time 1999 - 2000. Media Digest (1999 - 2000) Television: General Information Mediamark Research Inc. (1998) Baked Goods, Snack and Deserts Report Spring 1998. Nielson Media Research, (1999) Top Programs. TV Basics 1999 O’Guinn et al, (2000) Advertising 2. United States: South-Western College Publishing Perry, Jack. (1999) Cape Snack Makers Cash in Their Chips. The Cape Cod Times Snack Food Association (1999), Healthy Increases Seen in 1998 Snack Food Sales. www.sfa.org Statistics Canada, CANISM, Matrix 6376, (2000) Population By Sex and Age. Government of Canada www.fritolay.com (2000), The Story of Frito-Lay Inc. www.smallfry.ca (2000), The Big Success of Humpty Dumpty Snack Foods. Small Fry Snack Foods Holloway, J., 8716 151 Street, Edmonton, Alberta, T5R I8P. (780) 481-1659 42