The Future of the Savory Snacks Market in Australia to 2017

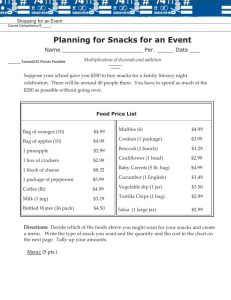

advertisement