Pinnacle Prospectus 4_05.qxd - The Davlin Philanthropic Fund

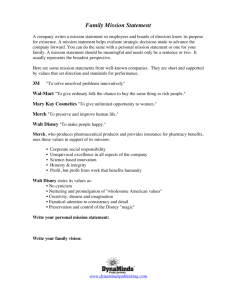

advertisement