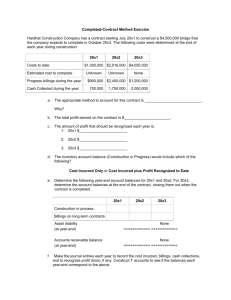

2265 Stock Compensation (Share-Based Payments)

219

2264.46

Miscellaneous additional provisions of FASB ASC 960 ( Plan Accounting—Defined Benefit

Pension Plans ) are as follows: a.

Information regarding net assets is to be prepared on the accrual basis. (FASB ASC 960-

30-25-1) b.

Plan investments (excluding contracts with insurance companies) are to be presented at fair value. Contracts with insurance companies are to be presented in the same way as in the plan’s annual report to certain governmental agencies pursuant to the Employee

Retirement Income Security Act of 1974 (ERISA). Plans not subject to ERISA are to account for their contracts with insurance companies as if they also filed that annual report. (FASB ASC 960-325-35) c.

Participants’ accumulated plan benefits are those future benefit payments that are attributable under the plan’s provisions to employee services rendered to the benefit information date. The primary information regarding participants’ accumulated plan benefits reported in plan financial statements is their actuarial present value. (FASB ASC

960-20-25)

2264.47

The FASB requires a defined benefit pension plan to report an investment contract issued by either an insurance enterprise or other entity at fair value. It permits a defined benefit pension plan to report only contracts that incorporate mortality or morbidity risk at contract value.

2265 Stock Compensation (Share-Based Payments)

2265.01

Corporations often provide various types of stock options and other equity plans for their officers and key employees. FASB ASC 718-10-30 requires enterprises to use the fair value method.

Intrinsic Value Method

2265.02

Under the intrinsic value method, the amount of compensation cost is the excess of the market price of the stock at the measurement date (usually the grant date) over the exercise price (the amount the employee must pay for the stock at the date of exercise). a.

Substantially all full-time employees meeting limited employment qualifications may participate. b.

Stock is offered to eligible employees equally or based on a uniform percentage of salary or wages. c.

The time permitted for exercise of an option or purchase right is limited to a reasonable period. d.

The discount from the market price of the stock is no greater than would be reasonable in an offer of stock to stockholders or others.

2265.03

The compensation cost, if any, is allocated to the periods in which the employee performs the related services .

Example – Intrinsic Value Method

2265.04

On January 1, 20X1, Company X grants options to key employees that may be exercised after

December 31, 20X3, to purchase 10,000 shares of $10 par common stock at an exercise price of $30 per share. The stock is selling at $45 per share on January 1, 20X1. The options are granted for services to be performed during the period 20X1-20X3.

© 2012 ExamMatrix Section 2200

220

2265.05

The total compensation cost is $150,000, computed as follows:

Market price per share

Exercise price per share of stock

Excess of market price over exercise price

Number of shares of stock that the options allow the employees to acquire

Total compensation cost

$ 45

– 30

15 u

10,000

$ 150,000

2265.06

The total compensation cost of $150,000 should be recognized in the amount of $50,000 in each of the three years in the service period (20X1, 20X2, and 20X3). The entries to recognize the compensation expense are:

Dec. 31, 20X1, 20X2, and 20X3 – to accrue compensation expense:

Compensation Expense

Additional Paid-in Capital – Stock Options

$50,000

$50,000

2265.07

Assuming all of the options are exercised on January 1, 20X4, when the market price of

Company X’s stock is $58 per share, the entry to record the exercise is:

Jan. 1, 20X4 – all options exercised when market price of stock is $58:

Cash (10,000 x $30)

Additional Paid-in Capital – Stock Options

Common Stock (10,000 shares x $10 par)

Capital in Excess of Par – Common

$300,000

150,000

$100,000

350,000

2265.08

Notice that the total amount credited to equity (Common Stock and Capital in Excess of Par –

Common) is $450,000 or $45 per share ($450,000 ÷ 10,000 shares), which is based on the $45 market price of the stock on the measurement date (January 1, 20X1) rather than the $58 market price of the stock on the exercise date. Stated differently, the $450,000 represents the exercise price of the stock (10,000 x $30 = $300,000) plus the total compensation cost recognized over the 3-year service period ($150,000).

Fair Value Method

2265.09

FASB ASC 718-10-30-2 requires the fair value method. It applies to all share-based payment plans except equity instruments held by an employee stock ownership plan (ESOP), which is covered by FASB ASC 718-40-25.

2265.10

The fair value method recognizes the cost of consideration received for employee services at the fair value of the equity instruments issued. The objective of the measurement process is to estimate the fair value at the grant date of the stock options and other equity instruments to which employees are entitled when they have rendered the required services and satisfied all other conditions necessary to earn the right to benefit from the instruments.

Example – Fair Value Method

2265.11

On January 1, 20X1, Company F grants 10,000 stock options to employees in which the $50 exercise price is equal to the market price of the stock on the grant date. Each option entitles its holder to acquire one share of stock at the exercise price provided the employee is still employed by Company F at the close of business December 31, 20X3. Applying an appropriate option pricing model, a fair value of $18 per option is determined. Company F expects 5% of the options to be forfeited each year during the 3-year vesting period.

Section 2200 © 2012 ExamMatrix

221

2265.12

The number of stock options expected to be exercised is determined as follows, applying the assumption of 5% forfeitures each year:

10,000 × 0.95 × 0.95 × 0.95 = 8,574

2265.13

The estimated compensation cost for the 3-year vesting period is $154,332 (8,574 options ×

$18 fair value per option). The servicing period is the 3-year vesting period. The total compensation expense of $154,332 should be recognized in the amount of $51,444 in each of the three years in the service period. The entries to recognize compensation expense are:

Dec. 31, 20X1, 20X2, and 20X3 – to accrue compensation expense:

Compensation Expense

Additional Paid-in Capital – Stock Options

$51,444

$51,444

2265.14

Assuming all of the options remaining at January 1, 20X4 (i.e., those not forfeited), when the market price of Company F’s stock is $65 per share, the entry to record the exercise is:

Jan. 1, 20X4 – 8,574 options remaining exercised when market price of stock is $65:

Cash (8,574 x $50 exercise price)

Additional Paid-in Capital – Stock Options

(8,574 x $18 fair value 1/1/X1)

Common Stock (8,574 shares x $10 par)

Capital in Excess of Par – Common

$428,700

154,332

$85,740

497,292

2265.15

Notice that the $583,032 total amount credited to equity (i.e., $85,740 to Common Stock and

$497,292 to Capital in Excess of Par – Common) is the $428,700 exercise price plus the

$154,332 fair value of the options that were exercise on January 1, 20X4. It is not based on the $65 market price of the stock on the date of exercise. In other words, the total amount credited to equity is the sum of the exercise price and the fair value at the January 1, 20X1, grant date of the options that were not later forfeited.

2265.16

If the forfeiture rate used to estimate the number of options that will be exercised is determined to be inaccurate, a revised estimate of the amount of compensation expense is made on a prospective basis. For example, if on December 31, 20X2, the forfeiture rate is changed to 7% per year over the 3-year period, compensation expense for 20X2 and 20X3 would be as follows:

Total compensation cost estimate under the 7% forfeiture assumption:

(10,000 × .93 × .93 × .93 = 8,044 options; 8,044 options × $18)

Compensation cost recognized in 20X1 (see section 2265.13

)

Total compensation cost to be recognized in 20X2 and 20X3

Annual compensation expense, 20X2 and 20X3:

($93,348 ÷ 2 years)

$144,792

51,444

$ 93,348

$ 46,674

2265.17

Entries to reflect this change in estimate are as follows:

Dec. 31, 20X2 and 209X3 – to accrue compensation expense:

Compensation Expense

Additional Paid-in Capital – Stock Options

$ 46,674

$ 46,674

© 2012 ExamMatrix Section 2200

222

2265.18

If all of the remaining 8,044 options were exercised on January 1, 20X4, the entry to record their exercise is:

Jan. 1, 20X4 – 8,044 remaining options exercised:

Cash (8,044 x $50)

Additional Paid-in Capital – Stock Options (8,044 x $18)

Common Stock (8,044 x $10 par)

Capital in Excess of Par – Common

Determining Fair Value

$402,200

144,792

$80,440

466,552

2265.19

The fair value of an equity share (for example, a stock option) should be based on the observable market price of a share with the same or similar terms and conditions, if one is available. If an observable market price is not available, which is the usual case, the fair value should be estimated using an acceptable valuation technique. FASB ASC 718-10-55-11 specifies that the valuation technique should be one that: a.

is applied in a manner consistent with the fair value measurement objective of

FASB ASC 718-10-30-6, b.

is based on established principles of financial economic theory and generally applied in that field, and c.

reflects all substantive characteristics of the instruments.

2265.20

The FASB notes that a lattice model and a closed-form model are among the valuation techniques that meet the criteria specified in FASB ASC 718-10-20. A lattice model is one that produces an estimated fair value based on the assumed changes in prices of a financial instrument over successive periods of time. The binomial model is an example of a lattice model. A closed-form model is one that uses an equation to produce an estimated fair value.

The Black-Scholes-Merton formula is an example of a closed-form model.

2265.21

For a share option or similar instrument, the valuation technique or model must meet the criteria specified in section 2265.19

above and must take into account, at a minimum, the following six items (FASB ASC 718-10-55-21):

1. Exercise price of the option

2.

Expected term of the option

3.

Current price of the underlying share

4.

Expected volatility of the price of the underlying share for the expected term of the option

5.

Expected dividends on the underlying share for the expected term of the option

6.

Risk-free interest rate for the expected term of the option

Liability Awards

2265.22

Some awards of share-based compensation necessitate the recognition of a liability by the issuing entity because the employees can require the entity to settle the award by transferring assets (e.g., cash) to employees rather than by issuing equity instruments. For example, a share-based compensation plan may require the entity to pay an employee, either on demand or at a specified date, an amount to be determined by the increase in the entity’s share price from a specified level. In this case, the entity needs to recognize the related liability.

Section 2200 © 2012 ExamMatrix