Tangible benefits for CPOs and CFOs

advertisement

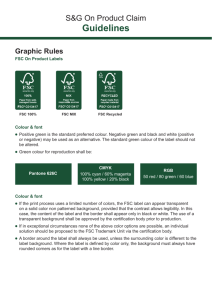

collaboration Tangible benefits for CPOs and CFOs Integration will lead to collaborative financial supply chain solutions Overcoming the challenges presented by a tough economic climate and capitalising on emerging opportunities depends on close partnerships between the procurement and finance functions. In turn, the benefits of such partnership can be leveraged by the implementation of value-added financial supply chain (FSC) solutions. Deutsche Bank understands how integration throughout the corporate supply chain can lead to tangible benefits. Operational advantages – such as enhanced visibility over company cash-flow and profitability positions – are the first of such benefits. Second, FSC solutions can provide alternative sources of working capital funding. Third, they can be implemented globally. This is an advantage in today’s highly interconnected world – particularly from a procurement perspective. Finally, they can be extended to a corporation’s suppliers – thereby helping to improve stability throughout the end-to-end supply chain. Indeed, this latter point is proving to be the main driver for many corporate CFOs and CPOs when assessing the benefits of FSC programmes. Deutsche Bank has worked with a US home appliance manufacturer that is a case in point, having implemented a FSC solution that spanned Italy, Poland, Slovakia and France which aimed to improve payment terms, generate cash for reinvestment and strengthen the supply chain. This solution was then extended to the company’s suppliers and has led to improved working capital and cash flow for the manufacturer and – among other benefits – early visibility with regards to attractive margins for its suppliers. As current market challenges show clear signs of easing, FSC solutions are likely to become important to commercial success. With this in mind, CPOs and CFOs – and indeed their banking partners – should explore the ways in which FSC solutions may be leveraged to the benefit of their organisations, especially against a backdrop of constrained liquidity and global economic uncertainty. 17 Alexander Mutter is director of trade & cash solutions advisory for EMEA, global transaction banking at Deutsche Bank March/April 2013 UK_PL43_016-017_Collaboration.indd 17 procurementleaders 14/3/13 12:53:58