Make your mark in the finance industry.

advertisement

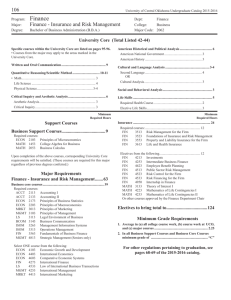

Make your mark in the finance industry. Our M.B.A. in Corporate Finance is a 36-credit program that prepares you to obtain a high-level corporate financial position such as treasurer, comptroller, chief financial officer, or a position as one of their principal assistants. Through our program, you will learn extensively about the roles and responsibilities of corporate finance professionals as well as what it takes to achieve excellence in financial management and practice. By the time you graduate, you will be ready to apply theory to practice as you encounter real-world corporate financial problems and further develop the skills you need to become a leader. Earn your degree on your terms. We understand that you have a busy lifestyle and we want to allow you to earn your M.B.A. in Corporate Finance in a way that’s convenient for you. In addition to our traditional degree options, you may also choose to enroll in our 16-month Saturday Accelerated M.B.A. Program (with Saturday-only classes) and earn your degree in just three semesters! Classes are conveniently located at our Rudolph-Oakdale Campus, our Brookhaven Campus, and our Melville Center. Business core. ACC 6241 or 6242* Managerial Accounting or Governmental and Nonprofit Accounting CIS 6261 Information Technologies for Managers FIN 6212 Financial Management FIN 6223 or MGT 6233*Macroeconomics in Financial Markets or Quantitative Methods in Business MKT 6252 Marketing Management *If you are planning to take the New York CPA exam, contact the School of Business for advisement. Program requirements. To earn your M.B.A. in Corporate Finance, you must complete the following coursework, 36 credits. Please see reverse for complete course descriptions. Corporate Finance concentration. FIN FIN FIN FIN FIN 6224 6313 6321 6323 6327 Money and Capital Markets Global Corporate Finance Financial Analysis and Valuation Global Investment Analysis Corporate Financial Policy Select one 6-credit capstone course from the list below. FIN 6392/6393 FIN 6397/6398 FIN 6399 Internship Thesis Corporate Finance Simulation For more information contact 631.244.3266 or mbaopenhouse@Dowling.edu M.B.A. in Corporate Finance course descriptions. (All courses are 3 credits unless otherwise noted.) ACC 6241 Managerial Accounting MGT 6233 Quantitative Methods in Business This course introduces the accounting procedures This course focuses on the advanced application of This course uses a case method approach to apply tech- and concepts used to meet the information needs of quantitative reasoning methods in management science niques that help to attain corporate objectives by means management. Stress is placed on the identification, as required to support decision-making situations in of effective financial policies. Major topics to be covered accumulation, reporting, and interpretation of cost business organizations. Emphasis is on the application include financial statement analysis, financial planning information for decision-making and control in the general of linear programming techniques, simulation methods, and forecasting, working capital management, capital context of a manufacturing operation. In addition, this decision theory, inventory control models, queuing theory, budgeting, long-term financing and dividend policy, and course enables the student to evaluate and utilize the and forecasting methods from an accountant’s or financial comprehensive financial policy analysis. Prerequisites: information supplied to management by the accounting manager’s perspective. ACC 6241, FIN 6212, and FIN 6323. course is to make the non-accounting major able to MKT 6252 Marketing Management FIN 6392/6393 Internship, 6 credits total understand and use the accountant’s tools. Prerequisite: This course focuses on the challenge and decisions facing For those students desiring to gain practical experience 6 credits of undergraduate accounting or completion the marketing executive. Emphasis is on examination of in business, Dowling College’s graduate business program of accounting/finance seminar. marketing problems, practices, and principles. Areas of offers an internship experience for two semesters under discussion and analysis include product positioning, strategy, the supervision of the instructor and sponsorship of a FIN 6327 Corporate Financial Policy department of a business concern. The purpose of this ACC 6242 Governmental and Nonprofit Accounting buying behavior, and developing a marketing plan. The purpose of this course is to provide students with firm. Internship options are limited in number depending on the needs of the sponsoring firms. In the Internship an opportunity to investigate the decision-making FIN 6224 Money and Capital Markets Project, the student will be required to identify, analyze, environment from the public sector or nonprofit entity Bank management, profitability, structure, and competition and offer alternative solutions to a business problem in an perspective. Emphasis will be placed on analyzing the will be explored. Regulation of financial institutions actual business environment. The student’s performance consequences and impact of regulations and pronounce- and non-bank financial institutions will be emphasized. will be evaluated by the firm’s management and the ments established by the Governmental Accounting Contemporary problems affecting financial institutions business faculty. Grading is pass/fail. AVM 6392 is the Standards Board, the U.S. Comptroller, and the Federal including changes that have occurred and continue to first course toward an internship experience. Prerequisite: General Accounting Office. Emphasis will be placed on occur within the industry will be studied through case 24 graduate credits in business studies. fund accounting, budget and control issues, revenue analysis. and expense recognition, and issues of reporting for both FIN 6397/6398 Thesis, 6 credits total government and nonprofit organizations. Prerequisite: FIN 6313 Global Corporate Finance The student who wishes to conduct advanced research 6 credits of undergraduate accounting or completion of The course explores most aspects of international bank in an area of interest may elect to write a thesis under accounting/finance seminar. management including profile of organizational forms faculty supervision. This enhances the student’s powers used to conduct international banking, the foreign ex- of quantitative and qualitative analysis as well as formal CIS 6261 Information Technologies for Managers change market, the Euro currency markets and especially exposition. The topic for research must ordinarily be a This course studies the application of computer-based the Euro dollar market, the financial management of a current problem in business and must lend itself to empirical information technology to the solution of business bank or bank affiliate, and the review of international analysis. Library research, personal interviews, opinion problems. The course will provide the student with the lending activities of U.S. banks. Prerequisite: FIN 6212. surveys, and other methods will be used to analyze the FIN 6321 Financial Analysis and Valuation committee and be kept on permanent file in the library. background, concepts, and skills necessary for informed professional use of computer resources. Students will problem. The finished thesis will be evaluated by a faculty demonstrate the application of business software to This course offers a comprehensive study of the application Grading is pass/fail. MGT 6397 is the first course toward support personal, group, and organizational productivity. of analytical tools to the analysis of financial statements. a final thesis project. Prerequisite: 24 graduate credits in It includes extensive review of accounting principles, business studies. FIN 6212 Financial Management financial statements, and Securities Exchange Commission This course is designed to provide a broad understanding reports (10-K’s, etc.). Prerequisite: FIN 6212. of financial management. Topics include financial analysis, FIN 6399 Corporate Finance Simulation, 6 credits total capital management, capital budgeting, long-term financ- FIN 6323 Global Investment Analysis ing, valuation, the measurement of capital costs, determi- This is a course in which students will learn the valuation course in which the responsibilities and actions of the nation of capital structures, and analysis of problems techniques of financial assets. Emphasis will be placed on chief financial officer within a multinational corporation relating to growth and reorganization. Prerequisite: fixed income, equities, and derivative securities valuation. are replicated. In the simulation, the students have financial ACC 6241 or equivalent. The discussion of these techniques will be applied within control of a hypothetical company over numerous periods the different global financial markets. Prerequisites: FIN of operation. Students have control of major financial and 6212 and FIN 6347 or FIN 6313. operating decisions of their company including working FIN 6223 Macroeconomics in Financial Markets This is a comprehensive multiple period finance simulation This course is an examination of the determination of capital management, capital structure decisions, treasury employment, income, and economic growth. Attention decisions, and capital budgeting decisions. Students is given to both the real and monetary sectors of the develop and enhance skills in financial management, economy, with specific attention on the role of govern- financial accounting statement analysis, and general mental entities in fiscal and monetary policy. financial decision-making. Internet access by the instructor and student is required. Prerequisites: FIN 6327 and 24 graduate credits.