Nikeplus Ecosystem Strategy

advertisement

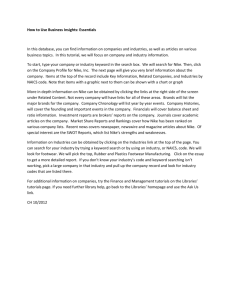

Nikeplus Ecosystem Strategy John Cristando Bryan Lodigiani Christopher Surdo 1 Introduction In May 2006, Nike and Apple, two of the most globally recognized brands, teamed up to create a line of products that bridged the gap between sports, electronics and entertainment. Prior to this partnership, Nike noticed that many of its customers who ran liked to listen to music and track the results of their runs, but they lacked a product that allowed them to do both. Nike contacted Apple to create a line of products under the name of Nikeplus, with the first product being a Nike + iPod Sport Kit. This kit consisted of an electronic sensor inserted under the inner sole of a Nike running shoe and a receiver that connected to an iPod Nano. After a run users could upload their run results to a computer via Apple’s iTunes and share data with other runners through the Nikeplus.com website that complemented the Sport Kit. Value vision underlying the initiative Whether intentional or not, the creation of Nikeplus was really what Venkat Ramaswamy calls a “co-creation” of value, benefitting the companies as well as the consumer. Consumers received value from Nikeplus through new engagement experiences and more productive outcomes. Nikeplus was used by consumers to track runs, store data, take part in a social network of runners, reduce search costs for running buddies and receive training tips. Nike and Apple’s benefit was more than just financial. The Nikeplus innovation gave them a competitive advantage by building deeper relationships and trust with the community of runners they created, learning information about customers that did not previously exist and leveraging this new found customer information to mitigate the risk in the introduction of new products. Nikeplus is a good example of how companies can not only add value by thinking laterally and partnering with other firms to create innovations but also how the consumer can be used to create value for the companies as well. Company rationale for partnership Why did Nike and Apple enter into this partnership and what were their intentions? Nikeplus was important to Nike because it allowed it to recover some of its reputation for cutting edge technology. In 2004, Adidas launched Adidas I, a technologically advanced 2 shoe which cushioned or dampened the shock to a runner depending on the terrain. It was important to Nike to respond to Adidas and maintain its reputation as the technology leader in sports apparel and footwear. Furthermore, Nikeplus allowed Nike to leverage the growth of the hugely successful iPod Nano. For Apple, the partnership was important because it would allow for a platform extension of the iPod technology so that it did not become just another portable media player. Partnering with Nike on Nikeplus would also help Apple create stronger brand identification. Lastly, Nikeplus gave both Nike and Apple access to customers that they would be unable to reach by themselves. Nike had access to the customers who wanted to track the results of their runs but did not have access to the customers who wanted to listen to music while they ran. On the other hand, Apple did have access to customers who wanted to listen to music while they ran but did not have access to those customers who wanted to track the results of their run. By partnering together, Nike and Apple could access the customer segment who wanted to both listen to music and track results during their runs. Customers who wanted to listen to music during runs Customers who wanted to track results of run Nikeplus technology Ecosystem map and analysis of risks Nike and Apple were able to effectively manage the Nikeplus ecosystem in the development and introduction of Nikeplus. Their control over the value chain, the power of the Nike and Apple brands, and the product’s obvious value proposition to consumers mitigated execution risk, innovation risk and adoption risk. 3 The following diagram illustrates the complexities of the Nikeplus ecosystem and how the partnership was able to deliver the product to market within eighteen months of conception. Apple -Semiconductors -Software Piezoelectric accelerometer Receiver to transmit to IPOD Distribution Channels Focal Initiative: The NikePlus Nike/Apple existing direct channels Right sized battery with 1K hours External software developers Online Operating software -NikePlus device -ipod nano Complementary new Nike shoe Air Zoom Moire Diverse retail (specialty, big box) Complementary custom band for other shoe brands Consumer Nike -Precision molding -Thin film technologies Software upgrade to Apple itunes Development of NikePlus website 18 MONTHS Execution and innovation risk Developing the product presented a significant hurdle as execution and innovation risk was high. Nike and Apple were working together to develop the product, having to coordinate with each other as well as multiple third parties that provided parts for each component of the Nikeplus. The Nikeplus device consisted of four major components: the piezoelectric accelerometer (which collected and processed the data on the runner), the receiver to transmit the data to an iPod, a battery which was sized appropriately to fit in a running shoe and which had sufficient power to support the data processing, and operating software for the device and the iPod. Some of the technical issues that had to be overcome were making sure the sensor was not too big for the Nike designers yet not too small for the Apple designers, ensuring that the battery had sufficient life and working through the difficulties behind the wireless technology. The companies developed some of these technologies in-house but also relied on outside developers and manufacturers. In addition, the two firms had to coordinate with each other. Since Nike and Apple are both technology-driven companies, each was able to 4 contribute in a meaningful way to product development. The partnership leveraged Nike’s expertise in precision molding and Apple’s expertise in semiconductors and software. With so many parts and parties involved in creating the Nikeplus device (the focal initiative), the partnership’s careful execution enabled it to meet its aggressive timeline of eighteen months. Once Nike and Apple accomplished the focal initiative, innovation risk declined as they progressed within the ecosystem. The complementary piece to the Nikeplus device itself would be something that attached the device to the runner. For this, Nike developed a shoe in-house called the Air Zoom Moire. Given Nike’s expertise in fitness technology, this was not a difficult task for the firm. Nike developed a shoe that consisted of a compartment within the sole that would store the device. Nike wanted to also present an alternative to the Air Zoom Moire to consumers. If consumers were required to purchase this special pair of shoes, the total cost of the Nikeplus would reach $200. Without having to buy the shoes, the device itself would cost only $29. As a result, Nike coordinated with outside parties to develop a band that would attach the Nikeplus to the laces of running shoe brands other than Nike. Establishing this complementary product proved critical in driving significant consumer adoption of the product. Once the means to holding the device was established through these two alternatives, Nike and Apple were in a position to push the product through their distribution networks. Adoption risk Distribution channels Adoption risk did not pose a significant problem for the Nikeplus. This product was viewed as an exciting opportunity for distribution channels because of the consumer demand expected as these strong brands combined forces. Nike and Apple chose various distribution channels for this device. Both firms had direct distribution through companyowned retail locations and company websites. In addition, Nike and Apple sold the Nikeplus to a diverse range of retail outlets such as specialty running stores, electronic stores, and “big-box” retail. They also leveraged online channels such as Amazon.com. The similarities in the customer bases for all of these parties made these relationships a win- 5 win situation for everyone involved. Providing sufficient value to these channels enabled Nike and Apple to gain adoption of Nikeplus in their multiple channels. Nikeplus.com and iTunes To ensure strong consumer adoption, Nike and Apple had to achieve effective distribution, offer the device at an attractive price, and provide a positive experience for the consumer. Effective distribution was accomplished by leveraging the firms’ brands and the profit opportunity associated with the device. Nike and Apple could offer an attractive price through an efficient production system and through offering the consumer the option of not having to purchase a customized Nike shoe for the device. To create a great customer experience, however, the firms had to innovate further outside of the device. iTunes required a software upgrade to make it compatible with the Nikeplus. Likewise, Nike created a new Nikeplus website synchronizing with iTunes where runners could track their runs and interact with other runners in an online community. With these additional innovations, Nikeplus went beyond serving a beneficial function for consumers, and became an “experience.” External software developers Nike and Apple gave software developers access to data through open sourcing. This was important to the companies because if developers were able to design software around Nikeplus then Nike and Apple would be able to sell more gear. An example of one piece of software designed for Nikeplus was an application called Twiike, which would automatically post a runner’s run to his / her Twitter account once that run was loaded onto Apple’s iTunes. End consumer Nike was also able to mitigate some of the adoption risk by the end customer through its positioning of the product. Instead of positioning Nikeplus as a revolutionary product that would change the way runners run, they instead positioned it as an incremental innovation. Throughout the product’s early phases, Nike and Apple constantly conveyed the message that people are already listening to music and tracking results while running; Nikeplus just makes it easier for them to do so. 6 Public perception Nike and Apple also had to manage the public perception of Nikeplus as issues arose throughout the life of the product. For example, a report was released six months after the launch of Nikeplus alleging the transmitter that was placed in the sneaker raises privacy concerns because it could be read up to 60 feet away. Managing technology challenges like these were critical to both Nike and Apple in order to achieve successful adoption of Nikeplus. Apple and Nike were able to deliver the Nikeplus product to the market in only eighteen months from conception. Both firms’ competencies in technology facilitated this in addition to effective coordination ensuring that they were on the same page in terms of what the product should look like and represent. Outside of the core partnership between the two, they also effectively managed third party relationships within the ecosystem by providing sufficient value to these parties such as outsourced manufacturers and retailers. Assessment of strategy deployed to align the actors There are a few notable elements of the alignment between Apple and Nike. In some instances, alignment was achieved by the specific actions the companies took during the development of the partnership. Additionally, there were pre-existing characteristics of both companies that promoted alignment from the start, even before any partnershipspecific actions were taken to support alignment. This is not surprising, as companies that share similar cultures are naturally more inclined to work together. Four key aspects of Nike and Apple’s alignment are worthy of mention: (1) the similar customers that each company served, (2) the realization of the benefits from creating a community of runners, (3) the long-term view of the partnership and (4) aligning risk with reward. Similar Customers An important element of the project that contributed to alignment was the similarity of Nike and Apple’s target markets. Nike and Apple are iconic brands known for innovative design that serve a customer base that trends younger and ‘cooler’ than the general population. This is significant because it allowed scope for continued product and process innovation. The two companies had similar needs in terms of what they wanted to deliver 7 to customers. This is in stark contrast to the Pixtech alliance in which process innovation was difficult to achieve because of the different target markets of the companies involved. It should be noted, however, that when news of the Apple and Nike partnership first emerged, some observers did not see much overlap in the pools of customers the companies’ attracted. At the time, Nike was still responding to the public outcry over its labor practices in Asia. Some analysts questioned the logic of Apple willingly linking itself with Nike. Apple had long cultivated an image as the “charming outsider,” in the words of one commentator. But by the mid 2000s it was clear that this vision of Apple was becoming a relic of the past as the company moved aggressively into mass market consumer electronics. This fact, along with Nike’s good faith response to criticisms of its labor practices, help explain why Apple was willing to work with Nike. Creating a community of runners In order to have a significant impact on the customer, Nike and Apple both agreed to create an entire customer experience that went beyond the actual Sport Kit which involved the Nikeplus.com website and the integration of iTunes. Both companies realized how much the success of the Nikeplus line depended on this complete customer experience and also how much more they could benefit by creating an online community of runners. The companies used the Nikeplus.com / iTunes community to (1) sell Nikeplus products as well as lines of their other products and (2) better identify customer needs so that they could design more products around those needs. Long-term view of partnership Nike and Apple expected their partnership to become more valuable over time, as they learned more about how customers were responding to the products they were creating and introduced new products that satisfied unmet needs. For example, they eventually began incorporating Nikeplus technology into fitness equipment and health clubs, created Nikeplus products that measured heart rate and expanded the Nikeplus application to other iPod devices besides the Nano. It is likely that Apple and Nike didn’t pursue these opportunities at the outset of the project because they wanted to tackle less complex undertakings first. Instead, they first focused on meeting the basic need of making 8 it easier for runners to enjoy music and track their workouts. This innovation simplicity also gave Nike and Apple flexibility in the design of the product as it matured in the market. This decision by Apple and Nike brings to mind one of the lessons of HP and the Kittyhawk. If innovations are to be commercially successful, managers must not lose sight of what their customers truly want (and what they are willing to pay for). Nike + iPod was not a perfect technological tool that gave runners everything they could ever possibly want. Why then did the Nike + iPod technology succeed when there were more accurate and sophisticated products on the market such as the Garmin Forerunner? It succeeded because, like the iPod, it met major customer needs and provided a streamlined user experience, all at a lower cost compared to competitor products. Aligning risk with reward In 2006, Apple was riding the growth of the highly successful iPod while Nike was losing its reputation in the marketplace as the technology leader in footwear and apparel to Adidas. Needless to say, Nike had more to gain from this partnership than Apple did and therefore took on more risk. Nike was responsible for marketing, leading endorsements and running the Nikeplus.com website. Nike realized that partnering with Apple was an unbelievable opportunity to uphold its reputation as the technology leader in footwear and apparel. Apple certainly wanted to see Nikeplus succeed but they knew people were still going to go out and buy iPods without Nikeplus, maybe just not as many if the project was a flop. But by taking on more risk of the Nikeplus innovation, Nike also reaped more of the rewards. Results and Impact of Nikeplus In measuring the actual rewards from Nikeplus that Nike was able to garner, Nikeplus products posted sales of $56 million for Nike in 2008, which is peanuts at a company that posted close to $19 billion in total sales. However, the true benefits to Nike’s bottom line are somewhat harder to gauge. Many say that Nikeplus renewed the popularity of Nike’s running shoes. SportsOneSource, a market research firm, said that in 2006 Nike accounted for 48% of all U.S. running shoe sales, but by the end of 2008 its share was 61%. 9 Furthermore, Nike realized that they could replicate the success of the Nikeplus innovation across other categories. The basic idea behind Nikeplus was using technology to enhance someone’s performance and coupling this with a community angle that provided social interaction. In 2008, Nike teamed up with Dime magazine and Facebook to create a Facebook application called Ballers Network that allows basketball players to organize real-world games and manage their teams online. For Apple, its foray into Nikeplus did ultimately allow it to extend the platform of its increasingly successful iPod technology while also reinforcing its reputation for meeting customer needs many customers did not even realize existed. For both companies, the overall results of Nikeplus were in line with what they expected them to be. Clearly, the Nike and Apple partnership to create Nikeplus showed that value for both the consumer and partnering companies can be created and project expectations can be met if an ecosystem to support such an innovation is managed properly. 10 Bibliography Berger, Warren. “The Four Phases of Design Thinking”. Harvard Business Review. July 29, 2010. http://blogs.hbr.org/cs/2010/07/the_four_phases_of_design_thin.html Carofano, Jennifer. “Running Retailers Optimistic on Nike, iPod Deal”. Footwear News. May 29, 2006. Vol. 62. Issue 22. p.8. Dalrymple, Jim and Honan, Mathew. “Nike to Add iPod-Integration”. Macworld. August 2006. Vol. 23. Issue 8. pp. 22-23. Espiner, Tom. “Nike+iPod raises RFID privacy concerns”. CNET News. December 13, 2006. Fitness Business Pro. “Four Manufacturers Help Nike, Apple Make iPod Nanos Compatible with Fitness Equipment”. 2008. p.22. Greene, Jay. “How Nike's Social Network Sells to Runners”. BusinessWeek. November 6, 2008. Hesseldahl, Arik and Holmes, Stanley. “Apple and Nike, Running Mates”. BusinessWeek. May 24, 2006. http://www.businessweek.com/print/technology/content/may2006/tc20060523_ 569911.htm McClusky, Mark. “The Nike Experiment: How the Shoe Giant Unleashed the Power of Personal Metrics”. Wired Magazine. June 22, 2009. http://www.wired.com/print/medtech/health/magazine/17-07/lbnp_nike Opensource.association. “Online Community Around A Running Shoe?”. January 8, 2007. http://freethinkr.wordpress.com/2007/08/01/online-community-around-arunning-shoe/ Ramaswamy, Venkat. “Co-creating value through customers’ experiences: the Nike case”. Strategy and Leadership. Vol. 36 No. 5. pp. 9-14. Ryan, Thomas J. “Nike Teams Up With Apple on Wireless Training Device”. SGB. July 2006. Vol. 39. Issue 7. p.9. 11 Stevens, Chris. “Apple and Nike partnership: A brand too far?”. CNET UK. May 25, 2006. http://crave.cnet.co.uk/digitalmusic/apple-and-nike-partnership-a-brand-too-far49273533/ Street and Smith’s Sports Business Daily. “Apple, Nike Team Up To Offer iPod Linked Shoe For Runners”. May 24, 2006. Vella, Matt. “Nike + iPod Equals Smooth Runnings”. BusinessWeek Online. January 3, 2007. p.19. 12