Chapter 10 The Ramsey model

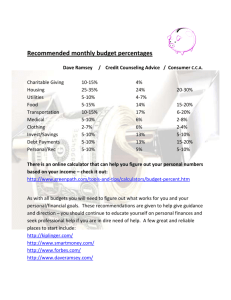

advertisement