Changes to Discretionary Benefits - Peterborough Social Planning

advertisement

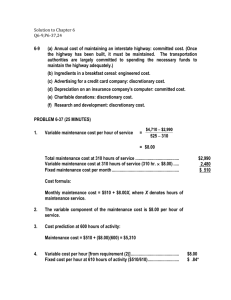

Changes to Discretionary Benefits Abstract In this year’s budget, the Ontario Government put a cap on the amount of money the province provides to municipalities to fund discretionary benefits for Ontario Works and ODSP recipients. These benefits cover things such as funerals, glasses, transportation, dental care, cribs and baby supplies. Discretionary benefits, are any services for social assistance recipients that the city is not provincially mandated to provide. They are divided into two categories: health-related and non-health-related. Previously, the province limited its contribution for non-health-related discretionary benefits at $8.75 per caseload per year. But it did not have a limit on health-related discretionary benefits, meaning the city was guaranteed to get provincial cash. Now, however, the province has capped its contribution at $10 for health-related and non-healthrelated discretionary benefits combined. The change does not affect health-related benefits for people on ODSP. However, it will affect any adult dependent of ODSP recipients (for example, the 19-year-old child of someone receiving support from that program). Key Questions: What are discretionary benefits? Discretionary benefits are additional health-related or non-health related supports for recipients of Ontario Works (OW) or the Ontario Disability Support Program (ODSP) and low income earners and seniors to help improve their quality of life, health, wellness, safety and self-sufficiency. Eligibility is determined on a case-by-case basis and by the municipal social services department determines the benefits, the amounts and the frequency they are provided. Examples of health related discretionary benefits include: • Dental care for adults • Vision care for adults • Prosthetic appliances (e.g. back braces, surgical stockings, artificial limbs, inhalators, hearing aids) Discretionary Benefits, June, 2012 Page 1 • Funerals and burials • Heating payments and payments for low-cost heating energy conservation measure Examples of non-health related benefits include: • Vocational training and retraining • Travel and transportation that is not for health-related purposes • Moving expenses • Any other special service, item or payment authorized by the Director What is the change to discretionary benefits? Changes to provincial funding As part of the 2012 Ontario provincial budget the province announced there will be changes to the Provincial funding formula for discretionary benefits to cap funding for all benefits at $10 per OW/ODSP case load. When will these changes take effect? July 2012 What could this mean for marginalized citizens who depend on these benefits? If the City no longer provides these benefits, recipients would be forced to seek these supports outside of the social assistance framework with another service provider, which may have limits or be less responsive to the urgent need. Is Peterborough unique in providing these discretionary services to its citizens? Other municipalities also provide discretionary services to their residents on a cost shared basis with the province. Each municipality has had discretion as to the level of nature of services that are provided. Discretionary Benefits, June, 2012 Page 2 What will the City do to ensure that OW, ODSP and low earning citizens are not impacted by this change? In June, Council will consider options to continue providing discretionary benefits to marginalized citizens for the remainder of 2012. The detailed impact on the municipality: • In 2012, the monthly cost per case for the Discretionary Benefit Program is budgeted at $24.60. This results in a gross program budget of $2,480,049, with the provincial share of $2,109,333 and an approved municipal share of $370,716 ($315,383 City; $55,333 County, based on projected). • To comply with the province’s new $10 per month cost per case for the balance of the year, with no change to the range of discretionary benefits, would result in projected gross expenditures of $1,950,438, with a revised provincial share of $1,189,670. Including Transit revenue of $75,544, this would require a municipal contribution of $685,224 ($615,523 City and $69,701 County or an additional $300,140 and $14,368 respectively). • The additional municipal cost for each month a decision is deferred will be $50,023 for the City and $2,395 for the County. • The full impact in 2013 would result in a program budget reduction by approximately $1.5 million to $924,000. • The elimination of transportation subsidies from the Discretionary Benefit Program effective July 1, 2012 would result in a transit revenue loss of $294,912 but would require no additional funds from the City for this service as a discretionary benefit. • If the current subsidy program is ended September 1st, 2012, there will be a loss of $196,608 to the transit division and would cost the City an additional $56,304, which covers the cost of the subsidy for July and August. • If the cost of the bus pass for OW/ODSP clients is reduced from the current $55 per month to $33 effective September 1st, the Transit division will lose $88,000 in revenue and would cost the City an additional $104,304, which covers the cost of the higher subsidy for July and August and the reduced subsidy for the balance of the year. Under this scenario, the client continues to pay $21 for the pass, and the Social Services Division provides a subsidy of $12. • Total elimination of the transit subsidy for 2013 would result in an annual loss of approximately $600,000 in City transit annual revenue. Discretionary Benefits, June, 2012 Page 3 • Based on January to April 2012 Mandatory Benefit Program expenditures, staff project a City surplus of $135,000 and County surplus of $30,000 at year end. These funds could be used to cover costs that in excess of the approved municipal share for Discretionary Benefits. For the balance of 2012, if there is not enough municipal savings from mandatory benefits, the remaining municipal share should be taken the City Social Services Reserve and the County general operating budget. Change in formula for determining the provincial share: • The existing formula for determining the maximum provincial share of non-health related discretionary benefits will be replaced with a new formula of $10 per case of the combined Ontario Works and ODSP caseload for all non-health and health related discretionary benefits effective July 1, 2012. • It is still unclear which caseload numbers the Ministry will consider for use to determine the monthly cap. Until this is confirmed, staff has projected the cap based on estimates from the province. The cost share of this cap amount in 2012 is 82.8% provincial and 17.2% municipal and will continue to be uploaded fully to the province by 2018. Any cost above the cap will require 100% municipal funding. • With the provincial funding changes, the program cannot be is sustained without major changes in policy or significant municipal investment. Council has the discretion to decide whether to deliver this program at all and what benefits to provide. The discretionary program allows municipalities to leverage the cost shared dollars, which will be part of the upload, to provide important benefits to residents. Community Start-Up and Maintenance Benefit (CSUMB) ends Jan 2013 • Government will end the Community Start-Up and Maintenance Benefit (CSUMB) as of January 1, 2013. CSUMB helps people on assistance with costs like first and last month’s rent deposits, buying or replacing furniture, deposits for utilities, overdue utility bills, and other similar expenses. Currently, across the province there are about 16,000 OW and ODSP recipients rely on CSUMB every month to pay for costs like these. • This move will have a large negative impact on many people – for example, on women trying to move from transition shelters into permanent homes after experiencing domestic violence, on men trying to move from homelessness or the shelter system into permanent homes, on people dealing with bedbug infestations and other problems associated with poor quality housing, and many others. • The government has said that half of the $110 million ($55 million) for the province that currently goes to CSUMB will be moved to the Ministry of Housing and folded in with funding from five other programs, which were already slated to be consolidated under the government’s Long-Term Affordable Housing Strategy. The new consolidated money will be given to Discretionary Benefits, June, 2012 Page 4 municipalities to fund housing and homelessness programs for all low-income people. New criteria for the way municipalities will deliver these programs have not yet been created. Home Repairs Benefit ends Jan 2013 • The Home Repairs Benefit will also be cut as of January 1, 2013. The Home Repairs Benefit helps people pay for things like emergency plumbing repairs, patching a leaky roof, or repairing damage from fire or floods, but only if there’s no other source of funds that people can use. The $3 million for this benefit is not being moved into the Ministry of Housing. Locally the implications to housing: • • In 2011, total expenditures for Community Start-up in Peterborough were $1.9 M for Ontario Works clients and $0.6 M for ODSP clients. The proposed 50% reduction will result in $1.25 M less to address housing related needs. This is also a significant loss of supports to people in Peterborough given that 50.43% of renters that are defined as having core housing needs, the highest in Canada (according the Statistics Canada’s definition of Core Housing need 30% and over of income spend on Housing Costs) Resources: City of Peterborough, Report CSSSJSSC12-004 Discretionary Benefit Report, June 14, 2012 http://www.thespec.com/news/local/article/701941--hamilton-social-assistance-benefits-atrisk-with-provincial-cutbacks https://frontenac.civicweb.net/FileStorage/2B3EEA448825478295C0D8646FDCEC33Workspace12-03-27%20MCSS%20Administrative%20Memo%20Re%202012.pdf Income Security Advocacy Centre, Ontario Budget 2012: Analysis After Budget Negotiations. Discretionary Benefits, June, 2012 Page 5 For more information about our InfoNotes contact: Dawn Berry Merriam at 705-743-5915 or email dawnbm@pspc.on.ca. Discretionary Benefits, June, 2012 Page 6