Community Trust Company Registered Account Arm's Length

advertisement

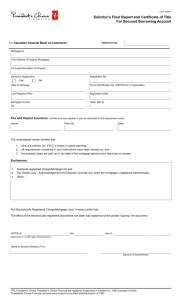

Community Trust Company Registered Account Arm's Length Mortgage Package Send all pages of this original completed package to: Community Trust Company Self-Directed Registered Account Administration 2325 Skymark Avenue Mississauga, ON L4W 5A9 CTC Registered Product Arm’s Length Mortgage Package Page 1 of 21 Table of Contents 1. Professional Investment Advice Recommended................................................................................ 3 2. Mortgage Terms ................................................................................................................................. 3 3. Mortgage Registered Accounts Qualifications ................................................................................... 4 4. Administration .................................................................................................................................... 5 5. Documentation and Funding Requirements ...................................................................................... 6 6. Transfer-In of an Existing Mortgage (In-Kind) .................................................................................... 7 7. Maturity. Renewals. Transfers-Out and Discharges. .......................................................................... 8 8. Mortgage Arrears and Legal Action.................................................................................................... 8 9. Address for Service ............................................................................................................................. 9 10. Fees .................................................................................................................................................... 9 11. Forms/Fee Schedule ........................................................................................................................... 9 CTC Registered Product Arm’s Length Mortgage Package Page 2 of 21 Registered Account Arm's Length Mortgage Package The enclosed general information package contains information required to fund and/or renew an arm's-length mortgage out of the proceeds of your Registered Account. 1. Professional Investment Advice Recommended Under the Indemnity & Undertaking you are indemnifying Community Trust Company from and against any losses, therefore, we strongly advise that you obtain all the information necessary to make an informed investment decision. In particular, you should obtain information on: the investment itself - including the fair market value of the property (by a recent independent appraisal), the value of the mortgage and any other existing mortgages on the property, the risks associated with your investment and your ability to recover your capital; the mortgagor- in particular, the mortgagor's credit rating and ability to make payments under the mortgage; any continuing responsibilities or obligations of the mortgagor or the mortgage broker after your investment has been made; and all of the risks associated with making a mortgage investment. If you have any questions or doubts about a particular mortgage investment, you should seek the advice of a qualified and independent professional. IMPORTANT NOTICE: Community Trust Company does not authorize their employees or agents to give such advice to investors, and does not authorize any other person to do so on its behalf. The accepting of your instructions in respect of an investment in no way should be taken as an endorsement that the investment is sound or appropriate. 2. Mortgage Terms You are solely responsible for determining the terms and conditions of the mortgage. It will be your responsibility to ascertain the credit worthiness of the mortgagor, the value of the property and the mortgagor's equity in the property and all other matters relevant to your decision to make the mortgage investment. You must provide instructions to your Lawyer to prepare and register the mortgage documents and to disburse the mortgage proceeds. Should the lawyer also represent the mortgagor, we strongly recommend for you to retain an independent lawyer to advise you on your transaction. CTC Registered Product Arm’s Length Mortgage Package Page 3 of 21 3. Mortgage Registered Accounts Qualifications To hold an arm's-length mortgage in your Registered Accounts as a qualified investment, you must meet all the requirements of the Income Tax Act, as amended from time to time. The Community Trust Company may be required to deem the mortgage to be a non-qualified investment and issue a statement to Annuitant/Plan holder and to Canada Revenue Agency (CRA) advising of the nonqualified status. The Annuitant/Plan holder will be required to complete and to file certain forms with CRA, including RC339. In general: Mortgages of residential and commercial real estate are acceptable. Chattel mortgages, collateral mortgages, and promissory notes are not qualified for Registered Accounts investments. You must be at arm’s-length from the mortgagor as per IT-320R3 Bulletin. The mortgage must be on property situated in Canada. In addition to any legislative requirements, we also require that any arm's-length mortgage that you wish to hold in your account as a qualified investment meets the following additional requirements: Your loan to value ratio must be no more than 100% - this means that your mortgage loan cannot be for more than the appraised value of the property in question at the time of acquisition. Liquidity requirements : For us to accept the mortgage in your Registered Account, you must have the following amount of liquid assets in your account: 2% of the value of the mortgage(s) for mortgage loans held in the Registered Account (subject to value of the account & the Investment performance). Minimum Annual Payment plus 2% of the value of the mortgage(s) for mortgage loans held in the Registered Account1 (only applicable to RRIF, LIF and LRIF). These liquidity requirements last throughout the life of the mortgage and are not just applicable upon funding which means that ongoing monitoring by you is required. We accept the Pre-Authorized Payments (PAP) free of charge for mortgage payments. Also, we accept the cheques, however, a service charge fee will apply as per Administration fee Schedule. We reserve the right to question, and subsequently refuse, at our sole discretion, any mortgage we consider unacceptable for placement in your account. You agree to provide us with any and all information that we may reasonably request in this regard. 1 Minimum Payment – means the amount that is required to be paid out of the Fund to the Annuitant each year as prescribed by Applicable Tax Legislation. CTC Registered Product Arm’s Length Mortgage Package Page 4 of 21 4. Administration We are responsible for processing payments made by the mortgagor on the mortgage to your Community Trust Company Registered Account. We do not accept any form of payment from a third-party (with the exception of a solicitor's trust account or Third Party Administrator). If legal action or the courts have directed a third-party to administer a mortgage, we must be in receipt of all documents relevant to the legal action or court order for review and our approval. You are responsible for: Ascertaining the credit worthiness of the mortgagor, the value of the property and the mortgagor’s equity Negotiating the terms of the mortgage transaction (provided the market terms and conditions are met); Instructing your solicitor to prepare the mortgage (or transfer of mortgage) documents and informing your solicitor of our requirements; Ensuring that the mortgage is properly prepared , signed and registered with the correct priority and that all the mutually agreed upon arrangements of the mortgage are clearly defined; Ensuring that mortgage payments are made directly to us through a Pre-Authorized Debit (PAD) from the mortgagor's bank account so that we may remit the appropriate sums to your Registered Account; Ensuring that the property is adequately and properly insured at all times ; Collecting payments in arrears; Instituting legal proceedings when necessary to recover monies owed by the mortgagor; To instruct our office to stop further payments and when to reinstate them; Providing us with all documentation requested; Adhering to all other terms and conditions contained in the relevant Community Trust Company Registered Plan Application and Declaration of Trust. Please note that if we do not hear from you or any involved parties upon maturity of the mortgage we will continue with the same terms and conditions until we are notified. Dealing with the Mortgagor: You are responsible for conducting all communications with the mortgagor. You should advise your mortgagor how to contact you (or your agent/broker) for any information about the mortgage. We will not engage or respond to the mortgagor and any communications or documents received by us from the mortgagor will be forwarded to you. CTC Registered Product Arm’s Length Mortgage Package Page 5 of 21 5. Documentation and Funding Requirements You must have sufficient funds in your Community Trust Company Registered Account in order to fund the mortgage and meet liquidity requirements. Should you require us to redeem existing assets in your Registered Account, please allow sufficient time for processing as it may vary. Community Trust Company can only advance funds provided all documentation is received in good order. To do this, we require the following information a minimum of 3 business days prior to the funding date (subject to processing volumes): Pre-Funding of an Arm's-Length Mortgage The entire Community Trust Company Arm's-Length Mortgage Package that includes: The Mortgage Direction form completed and signed by you and witnessed; The Acknowledgement, Authorization, Direction, Release, Indemnity & Undertaking signed by you and witnessed; The Solicitor's Certificate of Disclosure and Undertaking Regarding Arm's-Length Mortgages as Investments in a Registered Account completed and signed by you and your solicitor; All pages initialed by you; Draft Direction Re: of Funds from the Borrower; Conflict of Interest if applicable; If the mortgagor is a numbered company/corporation please supply a notarized list of principal holders, certificate of incumbency and the certificate of status (or the equivalent). Please also provide us with a statutory declaration that you do not hold a controlling interest in said mortgagor; A draft copy of your Mortgage/Charge document from your solicitor. The mortgage should be registered as follows: Community Trust Company in trust for Registered Account Plan Type _______ Account #________ Annuitant/Holder Name__________________________ For the Electronic Fund Transfer (EFT) the instructions with a void trust cheque must be provided. If the Electronic Fund Transfer (EFT) instructions are not received, the cheque will be issued for pick up from our office. CTC Registered Product Arm’s Length Mortgage Package Page 6 of 21 Post Funding an Arm's-Length Mortgage You or your Solicitor must also provide us with a duplicate of the registered executed mortgage or registered executed assignment of mortgage document within thirty (30) days of the closing; The Solicitor's Final Report On Title form completed and signed by your solicitor ; Evidence of insurance coverage showing Community Trust Company as the L oss P ayee; The Community Trust Company Pre-Authorized Payment (PAP) Form signed by the mortgagor(s) and a VOID cheque or a series of post-dated cheques. You and your solicitor are solely responsible for the preparation and registration of the mortgage. Incorrect, illegible and incomplete documentation will be returned and could delay the mortgage advance or even result in us preventing you from holding the mortgage in or removing the mortgage altogether from, as the case may be, your Community Trust Company Registered Account and issue the applicable tax slip. 6. Transfer-In of an Existing Mortgage (In-Kind) In addition to funding a new mortgage, you may also transfer your existing an arm’s length mortgage in your Registered Account at another Financial Institution to your Registered Account at Community Trust Company. Should you wish to do so, you need to provide us with the following documentation at least sixty (60) days prior to it maturing or coming up for renewal: A Transfer Authorization Form for Registered Account Administration completed and signed by you; A statement of the mortgage account (provided by relinquishing institution) showing that the mortgage is in good standing (payments are current) and the current balance; The Community Trust Company Pre-Authorized Payment (PAP) Form signed by the mortgagor(s) and a VOID cheque or a series of post-dated cheques. Evidence of the insurance coverage showing Community Trust Company as the Loss Payee; If the mortgagor is a numbered company/corporation please supply a notarized list of principal holders, certificate of incumbency and the certificate of status (or the equivalent). We also ask to provide us with a statutory declaration confirming a controlling interest in said mortgagor; A copy of the original duplicate registered mortgage/charge; If the mortgage has been renewed, we require a copy of the latest renewal agreement ; The Transfer/Assignment of mortgage documents should be registered as follows: Community Trust Company in trust for Registered Account Plan Type _______ Account #________ Annuitant/Holder Name__________________________ Please note that you/your solicitor are solely responsible for the preparation and registration of the Transfer/Assignment mortgage document. CTC Registered Product Arm’s Length Mortgage Package Page 7 of 21 7. Maturity, Renewals, Transfers-Out and Discharges Notices will be sent to you approximately thirty (30) and sixty (60) days prior to the mortgage maturity date. We will accept informal renewal agreements if signed by all parties concerned or you can choose to have your solicitor draw up an Amending and/or Extending Agreement for the mortgagor(s) and/or guarantor(s) to sign. We will sign this agreement only upon receipt of a signed direction from you to do so. Should you wish to discharge the mortgage, you must send us your request in writing. Upon receipt of the request, a discharge statement will be prepared and forwarded to you for approval. To transfer-out the mortgage in-kind you must send us a Transfer Authorization Form for Registered Account Administration, a Letter of Acceptance from the receiving institution and if applicable a cheque to cover fees if there is no cash or liquid asset in the account. Please note that you/your solicitor are solely responsible for the preparation and registration of the Discharge/Assignment mortgage document. 8. Mortgage Arrears and Legal Action Under the terms of the Mortgage Acknowledgement, Authorization, Direction, Release, Indemnity & Undertaking form completed and signed by you, you confirm that you are ultimately responsible for all collections of outstanding payments of arrears and for undertaking any legal actions, if warranted, to protect your mortgage security. You must therefore hire your own solicitor to act on your behalf and are responsible for all fees, disbursements and other expenses associated with any legal action taken. However, given that the name of Community Trust Company will appear on title, you must obtain our written authorization before proceeding. Also, you are solely responsible for delivering to Community Trust Company all documents concerning the Legal Action taken. Pursuant to the Income Tax Act, we are required to take reasonable steps to ensure that your mortgage investment remains a qualified investment under the Act. Should you decide for whatever reason not to undertake legal action to protect your mortgage security or refuse to do so upon receiving a notice to that effect from us, we might consider to take whatever actions are necessary on your behalf, including liquidating the mortgage, in order to protect your mortgage security and/or to avoid any possible adverse tax consequences. You further agree to, in advance of any legal action, compensate us for any fees , costs, expenses, penalties or charges incurred by us in connection with taking such actions and agree to reimburse or make up for any shortfall in the your Plan if proceeds from our actions prove to be insufficient. Finally, you acknowledge and accept that any actions taken by us on your behalf may adversely affect your security and could have tax consequences. Legal action may not be an option in all cases. Should you wish to pursue other options, please direct your written correspondence to our office. CTC Registered Product Arm’s Length Mortgage Package Page 8 of 21 9. Address for Service If you need to contact us or send us any documents in relation to your mortgage investment, please use the contact information below: Community Trust Company Self-Directed Registered Account Administration 2325 Skymark Avenue Mississauga, ON L4W 5A9 Phone: 416-763-2291 Fax: 416-763-2444 Online information: clientweb@communitytrust.ca 10. Fees We charge you fees to hold a mortgage in your Community Trust Company Registered Account. Currently these fees are charged quarterly per account, provided there is no specific arrangement in place. The fees are not prorated and are entirely payable, whether or not the mortgage is administered for less than three months during any calendar year. The fees are not based on the amount of activity, value, quality or standing of a mortgage. If a mortgage is split between more than one account, the mortgage fees apply to each account even though the holder of the Registered Account is the same. We invite you to consult our current fee schedule on our website at www.communitytrust.ca. All fees are subject to applicable federal and provincial taxes and are subject to change. 11. Forms/Fee Schedule We have attached our most commonly-used forms and the fee schedule for your convenience. CTC Registered Product Arm’s Length Mortgage Package Page 9 of 21 Solicitor's Certificate of Disclosure and Undertaking Regarding Arm's-Length Mortgages as Investments in a Registered Account I, _______________________, of the firm of ______________________________ practicing in the City of_______________________, Province of, _______________________ acknowledge that my services have been retained by (please initial appropriate box (es) if applicable and complete): The mortgagor, namely___________________________ and _________________________ I have disclosed to the lender/investor that Ido not represent him/her and cannot protect his/her interests in connection with this transaction and I have advised the lender/investor to seek independent legal advice, in accordance with the Rules of Professional Conduct of the Law Society of this province; The lender/investor, namely ___________________________________________________ Both the mortgagor and the lender/investor named above; to prepare and register a 1st, 2nd, 3rd or other (circle one) mortgage on the following property: In favour of Community Trust Company in trust for Registered Account (RRSP/RRIF/TFSA/RDSP) # ____________________________ I have no interest, direct or indirect, in the mortgage or the property. I understand that Community Trust Company will upon receipt of a duly executed "Mortgage Direction and Undertaking" from the lender/investor, advance funds to me, in trust, from the lender/investor's Registered Account. I undertake to hold these funds in escrow until registration on the appropriate Land Title Register of a valid and enforceable___________ (rank) mortgage on the property described above. I further undertake to provide Community Trust Company with a copy of the mortgage, duly registered, within 30 days of the advance of the funds to the mortgagor. I acknowledge that this Certificate of Disclosure and Undertaking is a requirement of intended for the sole use and benefit of the lender/investor and further declare that I am not acting for Community Trust Company, that I am not taking instructions from Community Trust Company have no obligation towards me or the mortgagor in connection with this transaction . If the transaction contemplated is not completed, I undertake to return the funds to Community Trust Company, for deposit in the lender/investor Registered Account. Signed this _____________day of__________________, 20____ Solicitor's signature I have read the foregoing and I am satisfied with its content. I understand that this certificate is required by Community Trust Company for my benefit only and that Community Trust Company make no representation as to the veracity and/or accuracy of its content nor has any obligation to make any verification or investigation in this regard. Signed this _____________day of__________________, 20____ Lender/Investor's signature CTC Registered Product Arm’s Length Mortgage Package Page 10 of 21 Direction TO: COMMUNITY TRUST COMPANY 2325 Skymark Avenue Mississauga, Ontario L4W 5A9 FROM: RRIF/RRSP/TFSA/RDSP # __RRIF/RRSP/TFSA/RDSP # ( ( %) %) Details of existing Mortgage(s) in priority: Amount Mortgagee (Name of trust company, financial institution etc.) _____________ ___________________________________________________________________________ _____________ ___________________________________________________________________________ _____________ ___________________________________________________________________________ I the undersigned do hereby authorize and direct Community Trust to pay the sum of ________________ to my solicitor _______________________________________________________________________________ “In Trust" for the purpose of funding the mortgage described herein, registered as follows: Mortgagee: COMMUNITY TRUST COMPANY IN TRUST FOR RRIF/RRSP/TFSA/RDSP #_______________ - ________________________ If more than 1 party as to an undivided ______________ % interest and COMMUNITY TRUST COMPANY IN TRUST FOR RRIF/RRSP/TFSA/RDSP #_______________ - ________________________ as to the remaining undivided ___________% interest Mortgagor : __________________________________________________________________ Address of Property : __________________________________________________________________ Funding Date: __________________________________ First Payment Date: _______________________Interest Adjustment Date: ____________________________________ Priority: First Second Third Other Interest Rate: __________ Term: _________ Amortization: ______________ Repayment: ________________ Payment Frequency: Monthly Quarterly Bi - weekly Interest Calculation: Annually Semi-Annually Monthly Special Conditions: 1. Do you have a current Appraisal? Estimate current market value of property. Yes No 2. Are you satisfied that the mortgagor(s) has/have sufficient cash flow to service his/her debt? Yes No 3. Should the mortgage not be paid, is there enough equity in the property to redeem your mortgage Yes No If you answered NO to any of these questions, your investment may be speculative and losses could occur. If you have any questions, please ask our staff. The undersigned hereby confirms that the mortgagors are not relatives and that this transaction is being conducted at arm’s length. Dated at __________, (City) this _________ day of , 20 . (Province) RRIF/RRSP/TFSA/RDSP Annuitant/Plan Holder Signature_________________________________________ CTC Registered Product Arm’s Length Mortgage Package Page 11 of 21 Acknowledgement, Authorization, Direction, Release, Indemnity & Undertaking TO: Community Trust Company (“Community”) RE: Community Trust Company Self-Directed RRSP/RRIF/TFSA/RDSP Account # ______________ (____________________ “Annuitant”/”Holder”) (Annuitant/Holder name) Direction for Mortgage Advance. Mortgagor: _______________________________________ Property Address: ___________________________________________________ The undersigned Annuitant/Holder hereby acknowledges that he/she has requested and hereby directs Community Trust Company to advance the sum of $___________________ as an investment to be secured by ___________________mortgage or charge over_________________________________________________. (Position of mortgage) (Property address) The Annuitant/Holder hereby acknowledges that he/she has requested and hereby directs that all funds be advanced on behalf of the above RRSP/RRIF/TFSA/RDSP account to his/her solicitor _________________________________________________________________“In Trust” (Name as solicitor) For so doing this shall be your good and sufficient authority. The Annuitant/Holder hereby confirms that he/she deals with the mortgagor at arm’s length. The Annuitant/Holder hereby undertakes to deliver, or cause to be delivered, to Community Trust Company copies of the solicitors’ reporting letter, mortgage and other security documents, evidence of insurance and any other documents that may be requested by Community Trust in connection with the mortgage advance directed to be made herein. Annuitant/Holder, does hereby remise, release and forever discharge Community Trust from all actions, causes of action, suits, debts, duties, covenants, claims, and demands whatsoever which the Annuitant /Holder could or might have against Community Trust for, or by reason of, or in any way arising out of any cause, matter or thing whatsoever which may arise out of the advance of funds as authorized and directed by Annuitant/Holder. Annuitant/Holder further covenants and agrees not to make any claim or maintain any action or proceeding against any person, corporation or entity in which anything hereby released could be claimed by way of contribution or indemnity or otherwise, including the directors, management, employees and agents of Community Trust. Annuitant/Holder hereby agrees to indemnify and save harmless Community Trust from and against any and all losses, costs, damages, claims, demands, proceedings, charges and expenses of any nature whatsoever which may at any time be claimed or brought against Community Trust by any person, corporation, regulatory agency or body, Her Majesty in the Right of Canada or of any Province of Canada, and which may in any way whatsoever arise out of or be connected in any way by Community Trust acting as Trustee of the above mentioned RRSP/RRIF/TFSA/RDSP account or in any way acting it accordance with any authorizations and directions and instructions received from Annuitant/Holder. Dated at __________, (City) this _________ day of , 20 . (Province) CTC Registered Product Arm’s Length Mortgage Package Page 12 of 21 Witnessed By: _______________________________ ___________________________________ (Signature of Witness) (Signature of Annuitant/Holder) __________________________________ Name of Witness (please print) Community Trust Company Self – Directed RRSP/RRIF/TFSA/RDSP Account #_____________ Address of Witness: __________________________________ __________________________________ __________________________________ CTC Registered Product Arm’s Length Mortgage Package Page 13 of 21 Solicitor’s Final Report on Title Community Trust Registered Account Administration Department Mortgagor Name (s): Phone #. Work # Mortgaged Property Address: Legal Description: Mortgage Loan Mortgage amount: Interest rate: Maturity date: Privileges: Monthly payment amount: Payment day: First payment date: Additional Covenantor(s) Name(s): Address(es): Easements Please include details (if space is insufficient please use separate sheet). Encroachments Right Of Way And Leases CTC Registered Product Arm’s Length Mortgage Package Page 14 of 21 Fire Hazard Insurance We verify that fire/hazard insurance and extended coverage has been placed on the mortgaged property, and that loss is payable to Community Trust as _____ mortgagee pursuant to your mortgage commitment and includes a mortgage clause approved by the Insurance bureau of Canada Company: Policy No.: Amount: Expiry Date: Agency: Realty Taxes Realty taxes for the current calendar year are: Realty taxes for the previous calendar year are: All outstanding realty taxes have been paid in full to the date of advance of funds and a copy of the receipted tax bill is enclosed Survey Existing survey Surveyor: Date: Up to date plan of survey Surveyor: Registration Details Executions Date: Registration date: Registration Number: Registration time: Registry Office: List, if prior to registration, there were outstanding writs of execution on file with the Sheriff against the mortgagor(s), or the guarantor(s) or any predecessor on title which would affect the security. Please enclose a Sheriff’s Certificate. CTC Registered Product Arm’s Length Mortgage Package Page 15 of 21 Restrictions ByLaws Indicate if all municipal by-laws, Provincial Statues and registered restrictions affecting the property have been complied with. List any work orders on record and state if the use of the mortgaged property for its present purposes is in compliance with municipal zoning laws. Special Terms Indicate any special terms such as Prepayment Options. Independent Legal Advice (Name(s) of Individuals) was/were referred to (Name of Solicitor) Barrister and Solicitor practicing at: who gave independent legal advice prior to the execution of the documents Title: We the undersigned have investigated the title to the lands and premises described in the mortgage and hereby certify that at the time of registration for the mortgage and advance of funds, the mortgagor(s) had a good and marketable title in fee simple to the said lands and premises and Community Trust’s_______ mortgage constitutes a valid ______ Mortgage thereof subject only to the encroachments and easements as herein before set out. We confirm that all realty taxes have been paid to date and there are no executions files in the Office of the Sheriff or in the Land Titles Office in jurisdiction where the lands are registered. Date: Name of Firm: Address of Firm: Per (Signature of Solicitor): CTC Registered Product Arm’s Length Mortgage Package Page 16 of 21 Enclosures: Please check appropriate boxes: Duplicate Registered Mortgage Fire Insurance Policy Tax Certificate – Realty Tax Bill (Paid) Copy of Survey or Declaration Building Department Report Declaration of Canadian Residency Sheriff’s Certificate Warranty Other – Please Specify CTC Registered Product Arm’s Length Mortgage Package Page 17 of 21 Annuitant/Holder Instructions Concerning the Power of Sale Proceedings T O: COMMUNITY TRUST COMPANY 2325 Skymark Avenue Mississauga, On., L4W 5A9 RE : PROPERTY ADDRESS: _______________________________________________ COMMUNITY TRUST COMPANY IN TRUST FOR RRSP/RRIF/TFSA/RDSP #_______________ _____________________________ (Annuitant/Holder Name) I/We, _________________________________, confirm that power of sale proceedings are being commenced on the property located at____________________________as a result of default of the payments with respect to the Mortgage above-noted. I/We hereby authorize and direct Community Trust Company in Trust for RRSP/RRIF/TFSA/RDSP #_______________________ to stop all future payments that the Mortgagor may attempt to submit with respect to the above-noted Mortgage. I/We, the undersigned hereby agree to indemnify and save harmless Community Trust from and against any and all losses, costs, damages, claims, demands, proceedings, charges and expenses of any nature whatsoever which may at any time be claimed or brought against Community Trust by any person, corporation, regulatory agency or body, Her Majesty in the Right of Canada or of any Province of Canada, and which may in any way whatsoever arise out of or be connected in any way by Community Trust acting as Trustee of the above mentioned account or in any way acting it accordance with this Direction. Dated this __________ day of ______________ , 20____ _____________________________ Annuitant/Holder (Print name) ________________________________________ (Signature) _____________________________ Witness (Print name) ________________________________________ (Signature) CTC Registered Product Arm’s Length Mortgage Package Page 18 of 21 Confirmation, Authorization & Indemnity Concerning the Power of Sale Proceedings T O: COMMUNITY TRUST COMPANY 2325 Skymark Avenue Mississauga, On., L4W 5A9 RE : PROPERTY ADDRESS: _______________________________________________ COMMUNITY TRUST COMPANY IN TRUST FOR RRSP/RRIF/TFSA/RDSP #________________ ____________________________ (Account #) (Annuitant/Holder Name) I/We,______________________________, confirm that I/We have retained ____________________, Barrister & Solicitor to act as solicitor for record on my behalf with respect to the above-noted loan. I/We hereby authorize and direct Community Trust Company in Trust for RRSP/RRIF/TFSA/RDSP # _________________ to sign the enclosed retainer with respect to the said ________________ carrying out any and all necessary actions required in this matter and in addition, would ask that you supply _____________ as soon as possible, with an information statement for the purpose of commencing power of sale proceedings. I/We understand that all legal expenses incurred as a result of this action will be my full responsibility. I/We, the undersigned hereby agree to indemnify and save harmless Community Trust from and against any and all losses, costs, damages, claims, demands, proceedings, charges and expenses of any nature whatsoever which may at any time be claimed or brought against Community Trust by any person, corporation, regulatory agency or body, Her Majesty in the Right of Canada or of any Province of Canada, and which may in any way whatsoever arise out of or be connected in any way by Community Trust acting as Trustee of the above mentioned account or in any way acting it accordance with this Direction and Authorization. Dated this _________ day of _____________ , 20____ _____________________________ Annuitant/Holder (Print name) ________________________________________ (Signature) _____________________________ Witness (Print name) ________________________________________ (Signature) CTC Registered Product Arm’s Length Mortgage Package Page 19 of 21 Retainer T O: _________________________________________________________________ (Solicitor’s Name) _________________________________________________________________ (Solicitor’s address) RE : PROPERTY ADDRESS: _______________________________________________ COMMUNITY TRUST COMPANY IN TRUST FOR RRSP/RRIF/TFSA/RDSP #________________ ___________________________ (Annuitant/Holder Name) I/We, ___________________________ and COMMUNITY TRUST COMPANY in Trust for RRSP/RRIF/TFSA/RDSP #_______________ confirm that it is our intention to retain your law firm as our solicitor of record and authorize you to carry out any and all actions that are necessary or required in this action. Dated this ____________ day of _____________, 20____ _____________________________ Annuitant/Holder (Print name) ________________________________________ (Signature) COMMUNITY TRUST COMPANY IN TRUST FOR RRSP/RRIF/TFSA/RDSP#___________– _______________ Per: _________ Per: __________ *We have the authority to bind the corporation. CTC Registered Product Arm’s Length Mortgage Package Page 20 of 21 Effective July 1, 2012 Self-Directed RRSP/RRIF/RDSP/TFSA/RESP Fee Schedule 1. Annual Adminstration Fee: 2. Additional Fees: $150.00 2.1 Transfer Out / Partial Withdrawals Etc.: 2.2 Transfer Out In Kind: 2.3 Duplicate Tax / Deposit Receipt: $10.00 2.4 Delivery Against Payment Including Safekeeping: $35.00 2.5 Swap Transaction: 3. $25.00 $150.00 $150.00 Mortgage Administration Fees: 3.1 3.2 Mortgage Administration Annual Fee: (Non-Arm’s Length or Arm’s Length) Set Up Fee – Arm’s Length: – Non-Arm’s Length: $200.00 $125.00 $300.00 3.3 Renewal Fee: $100.00 3.4 NSF Fee: $50.00 3.5 Legal Notices / Arrears Letters: $50.00 3.6 Processing Post-Dated Cheques: $15.00 3.7 Pre-Authorized Payments (PAP): Free 3.8 PAP Payments (Irregular) 3.9 Discharge Fee: (Execution Fee and Statement Fee, Excluding Preparation of Documentation) 3.10 Research: $15.00 $200.00 $50.00 / Hour Note: Your account will automatically be debited. If you re-imburse your account outside of the plan, we will issue a receipt for income tax purposes. Subject to HST. CTC Registered Product Arm’s Length Mortgage Package Page 21 of 21