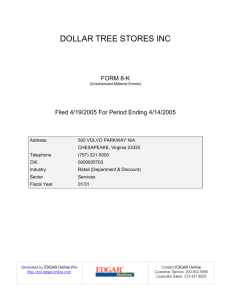

Keeping Current with Form 8-K

advertisement