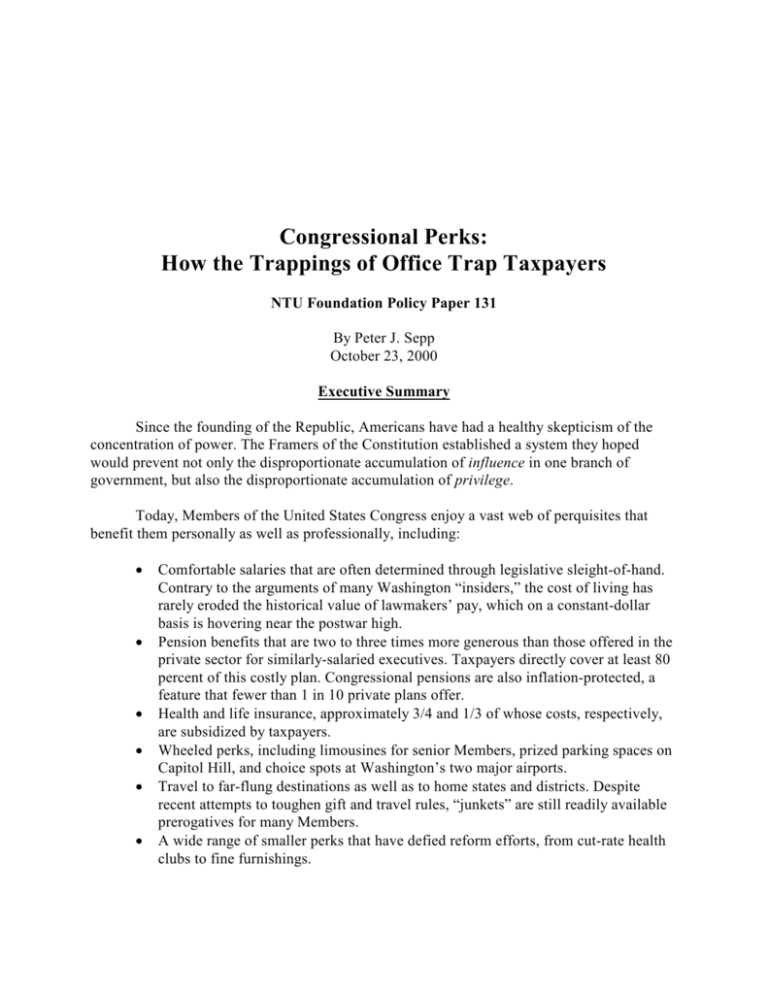

Congressional Perks: How the Trappings of Office Trap Taxpayers

advertisement