general tax figures and details – 2009

advertisement

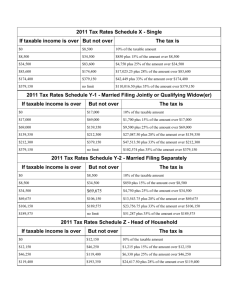

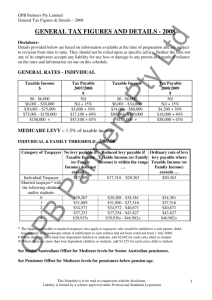

GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d GENERAL TAX FIGURES AND DETAILS – 2009 Disclaimer: Details provided below are based on information available at the time of preparation and are subject to revision from time to time. They should not be relied upon as specific advice. Neither the firm nor any of its employees accepts any liability for any loss or damage to any person as a result of reliance on the rates and information set out on this schedule. Taxable Income $ $0-$6,000 $6,001 - $35,000 $35,001 - $80,000 $80,001 - $180,000 $180,000 + Tax Payable 2009/2010 $ Nil Nil + 15% $4,350 + 30% $17,850 + 38% $55,850 + 45% er $0 - $6,000 $6,001 - $34,000 $34,001 - $80,000 $80,001- $180,000 $180,000 + Tax Payable 2008/2009 $ Nil Nil + 15% $4,200 + 30% $18,000 + 40% $58,000 + 45% sP Taxable Income $ ty GENERAL RATES - INDIVIDUAL MEDICARE LEVY – 1.5% of taxable income rtn INDIVIDUAL & FAMILY THRESHOLD GP B Pa Category of Taxpayer No levy payable if Reduced levy payable if Ordinary rate of levy Taxable Income Taxable Income (or Family levy payable where (or Family Income) is within the range Taxable Income (or Income) does not … Family Income) exceed … 20% of excess exceeds … Individual Taxpayer $17,794 $17,795 - $20,934 $20,934 Married taxpayer* with the following children and/or students: 0 $30,025 $30,026 - $35,323 $35,323 1 $32,782 $32,783 - $38,567 $38,567 2 $35,539 $35,540 - $41,810 $41,810 3 $38,296 $38,297 - $45,054 $45,054 4 $41,053 # $41,054 - $48,297 @ $48,297 * The figures applicable to married taxpayers also apply to taxpayers who would be entitled to a sole parent, childhousekeeper or housekeeper rebate if entitlement to such rebates had not been restricted from 1 July 2000. # Where there are more than four dependent children or students, add $2,682 for each extra child or student. @ Where there are more than four dependent children or students, add $3,155 for each extra child or student. See Senior Australians Offset for Medicare levels for Senior Australian pensioners. See Pensioner Offset for Medicare levels for pensioners below pension age. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 1 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d EXTRA MEDICARE SURCHARGE 1% Is applied to taxpayers whose taxable income and reportable fringe benefits for the year total more than $70,000 (single) or $140,000 (married) where the person(s) are not covered by private patient hospital cover. Surcharge Thresholds Single 2009/2010 Couples sP ty 2008/2009 Single Couples $70,000 $140,000 $140,000 $140,000 $141,500 $141,500 $1,500 $1,500 No of Dependent Children 0 1 2 Each extra child SENIOR AUSTRALIANS TAX OFFSET • Senior Australian DVA Male 65 years or more 60 years or more Female 63.5 years or more 58.5 years or more Australian resident for age pension purposes If taxpayer has been an Australian resident for less than 10 years, they have a qualifying residence. Must not have been in prison for whole of the year. er • • Age Test Age at 30.6.09 rtn • Taxable Income Thresholds – rebate reduces 12.5 cents for each dollar over minimum threshold. Thresholds take into account Low Income Tax Offset. Maximum Rebate available Lower Threshold Upper Threshold Combined Taxable Income $2,230 $28,867 $46,707 N/A $2,040 $27,600 $43,920 $87,840 $2,040 $27,600 $43,920 $87,840 $1,602 $24,680 $37,496 $74,992 $1,602 $24,680 $37,496 $74,992 Pa Category Single, Widowed, Separated GP B Married, living apart due to illness – both eligible Married, living apart due to illness – spouse not eligible Married, living together – both eligible Married, living together – spouse not eligible *Where the taxpayer has a spouse (married or defacto) this eligibility test is based on the combined taxable income. If the couple’s taxable income exceeds their combined taxable income level (above) then neither partner is eligible for the Senior Australians Tax Offset. *The rebate is calculated based on the actual individual taxable income. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 2 Lt d GPB Partners Pty Limited General Tax Figures & Details – 2009 Low income Medicare Levy Threshold for persons qualifying for the Senior Australians Tax Offset er sP ty Category of Taxpayer No levy payable if Reduced levy payable if Ordinary rate of levy Taxable Income Taxable Income (or Family payable where (or Family Income) is within the range Taxable Income (or Income) does not … Family Income) exceed … exceeds … Individual Taxpayer $28,867 $28,868 - $33,961 $33,961 Married taxpayer* with the following children and/or students: 0 $42,000 $42,001 - $49,412 $49,412 1 $44,757 $44,758 - $52,655 $52,655 2 $47,514 $47,515 - $55,898 $55,898 3 $50,271 $50,272 - $59,142 $59,143 4 $53,028 $53,029 - $62,385 $62,385 PENSIONER TAX OFFSET rtn Pensioner Tax Offset is available if taxpayer: • receives assessable pension, payment or government allowance AND • is not eligible for SATO If entitled to both SATO and Pensioner Tax Offset, the taxpayer will receive the one which provides the highest offset. Pa Taxable Income Thresholds – rebate reduces 12.5 cents for each dollar over minimum threshold. Maximum Rebate available Lower Threshold Upper Threshold Combined Taxable Income Single, Widowed, Separated $2,240 $20,934 $38,854 N/A Married, apart due to illness $2,086 $19,907 $36,595 $73,190 $1,699 $17,327 $30,919 $61,838 B Category Married, living together GP *Where the taxpayer has a spouse (married or defacto) this eligibility test is based on the combined taxable income. If the couple’s taxable income exceeds their combined taxable income level (above) then neither partner is eligible for the offset. * The rebate is calculated based on the actual individual taxable income Low income Medicare Levy Threshold for persons qualifying for the Pensioner Offset Medicare levy threshold $25,299 Medicare levy shade-in for this group is 10 cents for every $ between $25,300 and $29,763 Over $29,764 Medicare Levy is 1.5% of taxable income. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 3 MATURE AGE WORKER TAX OFFSET To be eligible for the mature age worker tax offset the taxpayer must: • Be an Australian resident for tax purposes • Be 55 years or more at the end of the income year; and • Have received net income from working >$63,000 TAX OFFSETS Maximum Rebate Spouse – with child Child Housekeeper with no dependent child NOT ELIGIBLE $1,759 $2,108 Pa Child housekeeper with dependent child Invalid Relative Parent or parent-in-law GP B Sole Parent (notional) Low Income (Offset ceases when taxable income exceeds $60,000 in 2009) Medical Expenses Exclusions exist see following page Private Health Insurance Premiums Maximum SNI Shading out Taxable (separate net income) Income $8,917 Reduced by $1 for every $4 where net income exceeds $282 FOR REBATE WHERE FAMILY TAX PART B ELIGIBLE $7,317 Reduced by $1 for every $4 where net income exceeds $282 $8,713 Reduced by $1 for every $4 where net income exceeds $282 $3,449 Reduced by $1 for every $4 where net income exceeds $282 $6,613 Reduced by $1 for every $4 where net income exceeds $282 FAMILY TAX PART B Reduced by 4 cents for N/A every $1 exceeds $30,000 er $2,159 rtn Spouse with no dependent child Mature Age Worker Tax Offset 5 cents per dollar from 0 - $9,999 $500 $500 max is reduced by 5 cents per dollar over $53,000 Nil ty Net Income from Working <$10,000 $10,000 - $53,000 $53,001 - $62,999 sP Year 2007/08 & Beyond Lt d GPB Partners Pty Limited General Tax Figures & Details – 2009 $792 $1,583 REPLACED $1,200 (2009) $1,350 (2010) $1,500 (2011) 20% of excess of net medical expenses over $1,500 <65 years old 20% 65 – 70 yrs old 35% >70 years old 40% - - - - This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 4 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d MEDICAL EXPENSES TAX OFFSET The tax offset is calculated as 20% of the excess of net medical expenses over the threshold of $1,500. ty The following exclusions now exist when calculating the medical expenses tax offset: • Cosmetic operations which have no Medicare benefit payable • Solely cosmetic dental services SMALL BUSINESS ENTITY REGIME sP From 1 July 2007 the Small Business Entity (SBE) regime replaced the Simplified Tax System (STS). A small business entity is an individual, partnership, company or trust that: • carries on a business for all or part of the income year, and • has less than $2 million aggregated turnover. er A small business entity is eligible for the following concessions: Pa rtn Income tax concessions • Entrepreneurs' tax offset • Simplified depreciation rules • Simplified trading stock rules • Capital gains tax concessions o 50% active asset reduction o 15-year exemption o Retirement exemption o Roll over Relief Pay as you go instalments concessions • GDP adjusted PAYG and GST instalment amounts Goods and services tax concessions • Cash accounting • GST and annual private apportionment • GST instalments B A small business entity does not need to elect to enter the small business entity regime and may select those concessions it wishes to use. GP ENTREPRENUERS’ TAX OFFSET (ETO) The entrepreneurs’ tax offset (ETO) is a tax offset equal to 25% of the income tax payable on business income if the business’ aggregated turnover of $50,000 or less. If the business aggregated turnover is more than $50,000, the ETO is phased out so that the offset stops once the turnover reaches $75,000. In the 2008 Budget, the government announced that an additional income test will apply to the Entrepreneurs' tax offset (ETO). For most taxpayers the change will apply from the 2008-09 income year and will further restrict access to the ETO for taxpayers with high alternative sources of income. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 5 EDUCATION TAX REFUND Primary School $750 $375 Expense Limit Maximum Refund Lt d GPB Partners Pty Limited General Tax Figures & Details – 2009 Secondary School $1,500 $750 ty Limited to 50% of actual expenditure for lower amounts and covers computer (purchase and ongoing costs), home internet, education software, school textbooks and materials, trade tools. Tax Payable Nil 66% of excess over $416 45% of total tax income $2,667 er Net Income Nil - $416 $417 - $1,307 $1,308 + No tax if only income equals sP CHILDRENS TAX rtn HELP (Higher Education Loan Programme) On 1 June 2006 all accumulated HECS debts became an Accumulated HELP debt. Repayment rate (of HRI) GP B Pa HELP repayment income (HRI) $ 2008/09 $0 - $41,594 $41,595 - $46,333 $46,334 - $51,070 $51,071 - $53,754 $53,755 - $57,782 $57,783 - $62,579 $62,580 – $65,873 $65,874 - $72,492 $72,493 - $77,247 $77,248+ Nil 4% 4.5% 5% 5.5% 6% 6.5% 7% 7.5% 8% HELP repayment income (HRI) $ 2009/10 $0 - $43,149 $43,150 - $48,066 $48,067 - $52,980 $52,981 - $55,764 $55,765 - $59,943 $59,944 - $64,919 $64,920 - $68,336 $68,337 - $75,203 $75,204 - $80,136 $80,127 + Repayment rate (of HRI) Nil 4% 4.5% 5% 5.5% 6% 6.5% 7% 7.5% 8% HRI = Taxable income + any net rental losses + total reportable fringe benefits + exempt foreign employment income. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 6 GPB Partners Pty Limited General Tax Figures & Details – 2009 Repayment rate SFSS repayment income (RI) 2009/10 Nil 2% 3% 4% Repayment rate (of RI) ty SFSS repayment income (RI) 2008/09 $0 - $41,594 $41,595 - $51,070 $51,071 - $72,492 $72,493+ Lt d SFSS (Student Financial Supplement Scheme) GP B Pa rtn er sP RI = Taxable Income + any net rental losses + reportable fringe benefits + exempt foreign employment income. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 7 ENERGY GRANTS SCHEME Fuel tax credit rates from 1 Jan 2009 Lt d GPB Partners Pty Limited General Tax Figures & Details – 2009 Eligible Fuel In a vehicle greater than 4.5 tonne GVM travelling on a public road (diesel vehicles acquired before 1 July 2006 can equal 4.5 tonne GVM). Emergency vehicles greater than 4.5 tonne GVM travelling on a public road (diesel vehicles acquired before 1 July 2006 can equal 4.5 tonne GVM). Specified activities eligible since 1 July 2006 in: • agriculture • fishing • forestry • mining • marine transport • rail transport • nursing and medical. Burner applications. All taxable fuels – for example, diesel and petrol. ty Activity/business use sP All taxable fuels – for example, diesel and petrol. er All taxable fuels – for example, diesel, petrol and fuel oil. All taxable fuels – for example, diesel, petrol, heating oil, kerosene and fuel oil. All taxable fuels – for example, kerosene, fuel oil, toluene, mineral turpentine and white spirit. Mineral turpentine, white spirit, kerosene and certain other fuels. Heating oil and kerosene. All taxable fuels – for example, diesel, petrol, heating oil, kerosene and fuel oil. All taxable fuels for example diesel, petrol and fuel oil. All taxable fuels – for example, diesel and petrol. rtn B Pa Non-fuel uses such as: • fuel used directly as a mould release, and • fuel used as an ingredient in the manufacture of products. Packaging of fuels in containers of 20 litres or less for non-internal combustion engine use. Supply of fuel for domestic heating. Electricity generation by a commercial generation plant, a stationary generator or a portable generator. Emergency vessels. Rate (Cents per litre) 17.143* 17.143* 38.143 38.143 38.143 38.143 38.143 38.143 38.143 GP All other activities, machinery, plant and 19.0715** equipment are eligible from 1 July 2008. Examples of activities are: • construction • manufacturing • wholesale/retail • property management • landscaping. * This rate accounts for road user charge, which is subject to change. ** The rate of 19.0715 cents per litre is 50% of the full rate of 38.143 centre per litre. The full rate will apply to all these activities from 1 July 2012. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 8 Lt d GPB Partners Pty Limited General Tax Figures & Details – 2009 Energy grants credits scheme (EGCS) rates for alternative fuels Following the introduction of fuel tax credits on 1 July 2006, the rates for fuel grants for alternative fuels reduce yearly until 2010. From 1 July 2008 7.404 centre per litre 8.324 cents per litre 4.770 cents per litre 3.252 cents per litre 5.047 cents per cubic metre ty From 1 July 2007 11.106 cents per litre 12.485 cents per litre 7.155 cents per litre 4.878 cents per litre 7.570 cents per cubic metre sP Fuel Biodiesel Ethanol LPG LNG CNG There are no changes to the way you claim alternative fuels and you should continue to use the Energy grants credits scheme claim form. MOTOR VEHICLE RATE PER KILOMETRE Rotary Drive Cars rtn Up to 1600 cc Up to 800 cc 1601 – 2600 cc 801 - 1300 cc 2601 - + cc 1301 - + cc Luxury Car Limit (DCL) Rate per kilometre 2008/2009 2009/2010 63.0 cents 74.0 cents 75.0 cents $57,180 er Ordinary Cars Pa PAYROLL TAX – NSW 1 July 2008 – 31 December 2008 Nil 6.0% B Threshold $623,000 Yearly >$623,000 1 January 2009 – 30 June 2009 Nil 5.75% 1 July 2009 – 31 December 2009 Nil 5.75% Threshold $638,000 Yearly >$638,000 1 January 2010 – 30 June 2010 Nil 5.65% GP Threshold $638,000 Yearly >$623,000 This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 9 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d NSW LAND TAX For the 2007 and future land tax years the land tax threshold will be averaged. The threshold will be the average of the 'indexed amount' for the new tax year and the previous two land tax years. The threshold cannot fall below that of the previous year and where the average threshold is less than the previous year's threshold, the previous year's threshold will continue to apply. ty The land tax rate for 2009 is % (plus $100) on the combined value of all taxable land in excess of the threshold. sP The average threshold for the last three years is calculated as follows: Threshold Year For the 2007 land tax year For the 2008 land tax year For the 2009 land tax year Average er Indexed amount $356,000 $369,000 $380,000 $368,000 rtn Principal place of residence is exempt. Primary production land is exempt. Discretionary trusts, certain unit trusts & non-concessional companies taxed at 1.6% on the combined value of the taxable land value. PRIMARY PRODUCERS – STOCK VALUE Pa Tax assessed on average income – can elect out Sheep Cattle Emus Goats $ 4 $20 $ 8 $ 4 Horses Pigs Poultry Deer $20* $12 $0.35 $20 GP B * Minimum of “service” fee paid if appropriate See Regulation 1997 70/55.01 TRAVEL ALLOWANCES – DOMESTIC AND OVERSEAS Each year the ATO publish limits of amounts expended on travel by employees that do not have to be substantiated. The 2009 limits are detailed in TD 2008/18. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 10 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d FRINGE BENEFITS TAX Grossed up taxable values of fringe benefits provided to employees during the FBT year, where the value exceeds $2,000 must be shown on PAYG Withholding Payment Summaries (From 1 April 2007). If a taxpayer’s FBT liability last year was $3,000 or more, they will need to pay four quarterly instalments. FBT tax rate for year is 46.5% er rtn Year ended 31 March 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 sP BENCHMARK INTEREST RATES (for FBT purposes) % 5.85 9.0 8.05 7.30 7.05 7.05 6.55 6.05 7.55 7.30 6.50 26% 20% 11% 7% GP B Pa STATUTORY FORMULA Less than 15,000 kms 15,000 – 24,999 kms 25,000 – 40,000 kms 40,000 kms + 1.8692 2.0647 ty Gross Up Rate – Type 2 – No GST Gross Up Rate – Type 1 – employer entitled to GST Input Tax Credit This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 11 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d SUPERANNUATION QUARTERLY SUPERANNUATION CONTRIBUTIONS From 1 July 2003 employers are required to remit superannuation guarantee contributions quarterly. The contributions are required to be made within 28 days of the end of the quarter with ATO reporting by the 28th of the next month. sP ty Advisors should identify those small businesses which employ its owners as staff and as such are required to comply with the SG legislation. While in the past contributions made on an adhoc basis met SG requirements this will need to be more co-coordinated to ensure compliance with the quarterly regime. The SG reporting requirements have changed; employer SG contributions made on or after 1 January 2005 no longer have to be reported to employees however some employers under the new Workplace Relations Regulations 2006 and employers under award agreements that require them to report superannuation contributions to employees must still comply with SG reporting requirements. er The super choice initiative has been extended to workers under state awards from 1 July 2006. TIMETABLE SG Quarter rtn From 1 July 2008 you must use ordinary times earnings (OTE) as defined in the superannuation guarantee law, and not employment awards, to calculate the superannuation guarantee. Pa 1 July – 30 September 1 October – 31 December 1 January – 31 March 1 April – 30 June Due date for payment 28 October 28 January 28 April 28 July Due date for lodgment of SGC statement 14 November 14 February 14 May 14 August Funds to pay tax at 15% on earnings and deductible contributions. Funds to be subject to capital gains tax on all assets from 01.07.1988 regardless of acquisition date. All non-cash assets should be revalued each year at 30 June. B AGE BASE LIMITS GP Concessional Contributions Cap Non-Concessional Contributions Cap (3 times above) Lump Sum Low Rate Cap (Lifetime limit no tax) Capital Gains Tax Cap Untaxed Plan Cap Over 50 Concessional Cap (See Below) 2009 $50,000 $150,000 $145,000 $1,045,000 $1,045,000 $100,000 2010 $25,000 $150,000 $150,000 $1,100,000 $1,100,000 $50,000 Concessional contributions made to super will be indexed inline with Average Weekly Ordinary Times Earnings (AWOTE) but only increased in $5000 increments. Concessional contributions include employer contributions and personal contributions claimed as a tax deduction by a nonsupported person. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 12 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d You will be taxed on concessional contributions over the cap at a rate of 31.5% in addition to the 15% tax paid by the fund. Between 1 July 2007 and 30 June 2012, a transitional concessional contributions cap will apply. During this time, the annual cap will be $100,000 for people aged 50 or over. ty From 1 July 2007 there is no distinction between concessional (deductible) contributions made by self-employed persons, employers or employees as personal contributions. SELF-EMPLOYED sP Self employed persons are eligible to claim a tax deduction for personal superannuation contributions. From 1 July 2007 self employed persons are eligible for the government co–contribution as specified below. er GOVERNMENT SUPERANNUATION CO-CONTRIBUTION From 1 July 2007, a taxpayer is eligible for the co-contribution in a year of income if: • • rtn • • they make a personal superannuation contribution by 30 June each year into a complying superannuation fund or retirement savings account their total income is less than $ (this is indexed annually to reflect changing average wages) 10% or more of their total income is from eligible employment, running a business or a combination of both they are less than 71 years old at the end of the year of income they do not hold an eligible temporary resident visa at any time during the year Pa • Year B 01.07.08 – 30.06.09 GP 01/07/2009 to 30/06/2012 01/07/2012 to 30/06/2014 From 01/07/2014 Assessable Income $30,342 $60,342 Maximum Co-Contribution (limited to 150% contribution) $1,500 $1,500 reduced by 5 cents per dollar where assessable income is over $30,342 Formula: $1,500 - [(AI-) x 0.05] Nil Not yet known 100% Not yet known 125% Not yet known 150% This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 13 GPB Partners Pty Limited General Tax Figures & Details – 2009 PAYROLL <$1M 7% 7% 8% 8% 9% MAXIMUM EARNINGS BASE (Maximum salary on which SGC is required to be paid) er sP 1999/00 $100,960 ($25,240 per quarter) 2000/01 $105,200 ($26,300 per quarter) 2001/02 $110,040 ($27,510 per quarter) 2002/03 $116,880 ($29,220 per quarter) 2003/04 $122,240 ($30,560 per quarter) 2004/05 $128,720 ($32,180 per quarter) 2005/06 $134,880 ($33,720 per quarter) 2006/07 $140,960 ($35,240 per quarter) 2007/08 $145,880 ($36,470 per quarter) 2008/09 $152,720 ($38,180 per quarter) PAYROLL >$1M 7% 7% 8% 8% 9% ty EMPLOYEE 1998-99 1999-2000 2000-2001 2001-2002 2002-2003+ Lt d SUPERANNUATION GUARANTEE CHARGE rtn EMPLOYMENT TERMINATION PAYMENTS The tax treatment of employment termination payments is now covered by ITAA97 – Part 2-40. B Pa Life Benefit Termination Payment ETP Cap 2007/08 - $140,000 2008/09 - $145,000 2009/10 - $150,000 GP BONA FIDE REDUNDANCY Tax Free Amounts - 2001 2002 2003 2004 2005 2006 2007 2008 2009 $5,062 + $2,531 per year $5,295 + $2,648 per year $5,623 + $2,812 per year $5,882 + $2,941 per year $6,194 + $3,097 per year $6,491 + $3,246 per year $6,783 + $3,392 per year $7,020 + $3,511 per year $7,350 + $3,676 per year This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 14 PRIVATE COMPANY LOANS TO SHAREHOLDERS 7.8% 6.8% 6.3% 6.55% 7.05% 7.30% 7.55% 8.05% 9.45% ty 2001 2002 2003 2004 2005 2006 2007 2008 2009 sP Div 7 Interest Rates Lt d GPB Partners Pty Limited General Tax Figures & Details – 2009 NSW STAMP DUTY – SHARE TRANSFERS IN UNLISTED COMPANIES Min $10 60 cents per $100 rtn er NSW STATE TAXES/DUTIES Duties amendment (abolition of state taxes) is due to abolish the following state taxes. 1 July 2007 1 January 2008 1 January 2009 1 July 2009 1 January 2011 1 January 2009 GP B Pa Hire of goods Leases Unlisted marketable securities Mortgages Business assets other than land Transfer of shares in share management fisheries This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 15 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d TAX VALUE OF GOODS TAKEN FOR PRIVATE USE FROM BUSINESS (to be included as taxable income) ty Taxation Determination TD 2008/32 This determination updates the schedule of amounts that the Tax Office will accept as estimates of the value of goods taken from stock for private use for certain industries for the 2007/08 income year. The basis for determining values of goods taken from stock was derived from the latest Household Expenditure Survey (HES) results issued by the Australian Bureau of Statistics adjusted for Consumer Price Index (CPI) movements for each category of items. This method can NOT be used for companies as actual sale values of goods used is required in this situation. sP The Tax Office says it intends to adjust the values annually to reflect the most recent HES data or the HES data uplifted for CPI movements, and reissue the schedule at the commencement of each income year. The Schedule for the value of goods taken from trading stock for private use is: er Amount (excluding GST) for child 4-16 years $ 535 360 1,470 1,470 1,595 1,470 385 1,390 1,760 GP B Pa Bakery Butcher Restaurant/cafe (licensed) Restaurant/cafe (unlicensed) Caterer Delicatessen Fruiterer/greengrocer Takeaway food shop Mixed business (includes milk bar, general store, and convenience store) Amount (excluding GST) for adult/child over 16 years $ 1,070 720 3,680 2,940 3,190 2,940 770 2,780 3,520 rtn Type of business This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 16 GPB Partners Pty Limited General Tax Figures & Details – 2009 Annual turnover Less than $20m $20m to less than $100m $100m to less than $500m $500m to less than $1bn $1bn and over Dollar Value Correction limits Less than $5,000 Less than $10,000 Less than $25,000 Less than $50,000 Less than $300,000 sP ty $20m to less than $100m $100m to less than $500m $500m to less than $1bn $1bn and over Time limit in which you can correct errors Up to 18 months (18 monthly BASs, 6 quarterly BASs or 1 annual GST return) Up to 3 months (3 monthly BASs) Up to 3 months (3 monthly BASs) Up to 3 months (3 monthly BASs) Up to 3 months (3 monthly BASs) er Annual turnover Less than $20m Lt d CORRECTING GST MISTAKES (ATO Publication: NAT4700-07.2004) The Tax Office notes that while the normal way to correct mistakes is to revise the previous BAS, in some cases taxpayers can make corrections on a later BAS. The table below sets out when businesses can use a later BAS to correct mistakes made on an earlier BAS. Corrections may be made to decrease or increase GST payable or to decrease input tax credits. Summary of Rate of Penalty Base Base penalty increased/decreased to: penalty If If disclosure made hindrance During audit Before audit 75 90 60 15 50 60 40 10 50 (25)* 60(30)* 40(20)* 10(5)* 25(10)* 30(12)* 20(8)* 5(2)* Pa Culpable behaviour rtn TAX SHORTFALL PENALTIES GP B Intentional Disregard (s 284-90) Recklessness (s 284-90) Tax avoidance (s 284-160) Profit shifting (no dominant tax avoidance purpose) (s 284-160) No reasonable care (s 284-90) No reasonable arguable position (s 284-90) Failure to make statement Profit shifting (tax avoidance purpose) 25 25 30 30 20 20 5 5 75 50(25)* 90 60(30)* N/A 40(20)* N/A 10(5)* * The rates of penalty in brackets apply if the position adopted by the taxpayer is reasonably arguable. This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 17 GPB Partners Pty Limited General Tax Figures & Details – 2009 Lt d LATE LODGEMENT PENALTIES Base penalty for a Medium Large small entity withholder/entity withholder/entity Twice the base penalty Maximum penalty 1 penalty unit (currently $110) per 28 i.e. $220 per 28 day being 5 times the base day period or part period or part thereof penalty FBT returns thereof i.e. $550 per 28 day Business Activity Statements period or part thereof Other tax returns ty Culpable behaviour for failure to lodge Income tax returns rtn Non-commercial losses Personal services income measures STS Uniform capital allowance regime Debt & equity Thin capitalisation General value shifting regime Demergers Simplified imputation regime Consolidations Legislative reference (refers to the ITAA 1997 unless otherwise stated) Div 35 Divs 84, 85, 86 and 87 Div 328 Div 40 Div 974 Div 820 Divs 723, 725 & 727 Div 125 Part 3-6 Part 3-90 er Issue sP SUMMARY OF KEY DATES Pa Div 7A & trust distributions Taxation of financial arrangements Quarterly remission of SGC B Co-contribution mechanism GP STS Entrepreneurs’ Tax Offset Replacement of s 109UB ITAA 1936 (Subdiv EA ITAA 1936) NBTS (Taxation of Financial Arrangements) Bill (No1) 2003 Commencement Date 1 July 2000 1 July 2000 1 July 2001 1 July 2001 1 July 2001 1 July 2001 1 July 2002 1 July 2002 1 July 2002 1 July 2002 (concessions extended to 2004 income year) 12 December 2002 & 19 February 2004 14 May 2002 & 1 July 2003 Superannuation Guarantee Charge Act 1992 Government Co-contribution for Low Income Earners Act 2003 Income Tax Assessment Act 1997, Subdivision 61-J Small Business Entity Regime introduced This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 1 July 2003 1 July 2003 1 July 2005 1 July 2007 18 SUMMARY OF KEY DATES – SUPERANNUATION Legislative reference Commencement Date Family Law Legislation 28 December 2002 Amendment (Superannuation) Act 2001 Quarterly remittance of SGC Superannuation Guarantee 1 July 2003 Charge Act 1992 Co-contribution mechanism Superannuation (Government Co1 July 2003 contribution for Low Income Earners) Act 2003 30% Child Care Tax Rebate Tax Laws Amendment 1 July 2004 (2005 Measures No. 4) Act 2005 However first claim will not Royal Assent; 19/12/05 be available to be made until 2005/2006 income tax return Abolishment of Super Surcharge Superannuation laws amendment 1 July 2005 (abolishment of surcharge) Act 2005 New simplified Superannuation Tax laws Amendment (Simplified 1 July 2007 Superannuation) Act 2007 Lost + unclaimed super Superannuation Legislation 1 July 2007 Amendment (simplification) Act 2007 Use Ordinary Times Earnings 1 July 2008 (OTE) as defined by superannuation guarantee legislation to calculate superannuation guarantee New definitions of income for tax Various 1 July 2009 offsets and thresholds GP B Pa rtn er sP ty Issue Super splitting on marriage breakdown Lt d GPB Partners Pty Limited General Tax Figures & Details – 2009 This Schedule is to be read in conjunction with the disclaimer. Liability is limited by a scheme approved under Professional Standards Legislation 19