View Amicus Brief - Sidley Austin LLP

advertisement

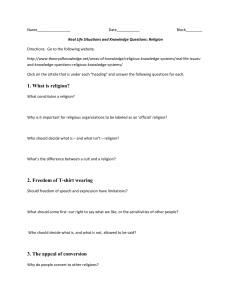

No. 02-3102 IN THE UNITED STATES COURT OF APPEALS FOR THE SEVENTH CIRCUIT Freedom From Religion Foundation, Incorporated, et al., Plaintiffs-Appellants, v. Scott McCallum, et al., Defendants-Appellees, and Faith Works Milwaukee, Incorporated, Intervening Defendant-Appellee. Appeal from the United States District Court for the Western District of Wisconsin Judge Barbara B. Crabb (Case No. 00-C-617-C) Brief Amicus Curiae of Evangelicals for Faith-Based Initiatives, Prison Fellowship Ministries, and Christian Community Health Fellowship Gene C. Schaerr Michael L. Post Richard H. Menard Jr. SIDLEY AUSTIN BROWN & WOOD LLP 1501 K Street, N.W. Washington, D.C. 20005 (202) 736-8000 Attorneys for Amici Curiae RULE 26.1 DISCLOSURE STATEMENT Amici curiae Prison Fellowship Ministries and Christian Community Health Fellowship are section 501(c)(3) non-profit corporations, neither of which has a parent corporation. No publicly held corporation holds ten percent or more of the stock of Prison Fellowship Ministries or of Christian Community Health Fellowship. Amicus curiae Evangelicals for Faith-Based Initiatives is not incorporated. Amici curiae are represented before this Court by the law firm of Sidley Austin Brown & Wood LLP. Amici curiae did not appear, through counsel or otherwise, before the district court in this case. December 23, 2002 __________________________ Gene C. Schaerr Michael L. Post Richard H. Menard Jr. SIDLEY AUSTIN BROWN & WOOD LLP 1501 K Street, N.W. Washington, D.C. 20005 Attorneys for Amici Curiae i CONTENTS RULE 26.1 DISCLOSURE STATEMENT ................................................................................... i TABLE OF AUTHORITIES........................................................................................................ iii IDENTITIES AND INTERESTS OF AMICI CURIAE.............................................................. v SOURCE OF AUTHORITY TO FILE....................................................................................... vii INTRODUCTION .........................................................................................................................1 ARGUMENT..................................................................................................................................2 I. THE FAITH WORKS PROGRAM CANNOT BE INVALIDATED ON THE GROUND THAT IT INVOLVES GOVERNMENTAL INDOCTRINATION ..........3 A. State Funds Reach Faith Works Only as a Result of Individual Choices............4 B. The Route by Which Funds Reach Faith Works Is Constitutionally Immaterial ....................................................................................................................7 II. THE FAITH WORKS PROGRAM INVOLVES ONLY PERMISSIBLE COGNIZANCE OF RELIGION, NOT IMPERMISSIBLE ENDORSEMENT OF RELIGION ...................................................................................................................9 CONCLUSION............................................................................................................................12 ii TABLE OF AUTHORITIES CASES Agostini v. Felton, 521 U.S. 203 (1997) .................................................................................2, 6, 8 Board of Education of Kiryas Joel Village v. Grumet, 512 U.S. 687 (1994).................................12 City of Boerne v. Flores, 521 U.S. 507 (1997) ..............................................................................11 Corporation of the Presiding Bishop of the Church of Jesus Christ of Latter-Day Saints v. Amos, 483 U.S. 327 (1987) .....................................................................................................11 County of Allegheny v. ACLU, Greater Pittsburgh Chapter, 492 U.S. 573 (1989) ......................1 Doe v. Village of Crestwood, Illinois, 917 F.2d 1476 (7th Cir. 1990) ...........................................1 Freedom from Religion Foundation, Inc. v. Bugher, 249 F.3d 606 (7th Cir. 2001) ......................2 Freedom from Religion Foundation, Inc. v. McCallum, 214 F. Supp. 2d 905 (W.D. Wis. 2002) ......................................................................................................................................4, 9 Freedom from Religion Foundation, Inc. v. McCallum, 179 F. Supp. 2d 950 (W.D. Wis. 2002) ......................................................................................................................................4, 9 Gillette v. United States, 401 U.S. 437 (1971) .............................................................................11 In re Young, 141 F.3d 854 (8th Cir. 1998) ..................................................................................11 Indiana Civil Liberties Union v. O’Bannon, 259 F.3d 766 (7th Cir. 2001) ..................................1 Lemon v. Kurtzman, 403 U.S. 602 (1971)......................................................................................1 Lynch v. Donnelly, 465 U.S. 668 (1984) ........................................................................................7 Marks v. United States, 430 U.S. 188 (1977).................................................................................9 Mitchell v. Helms, 530 U.S. 793 (2000) .................................................................................5, 7, 9 Mueller v. Allen, 463 U.S. 388 (1983)........................................................................................4, 8 Rosenberger v. Rector and Visitors of the University of Virginia, 515 U.S. 819 (1995) ...............7 Santa Fe Independent School District v. Doe, 530 U.S. 290 (2000)...............................................1 Sullivan v. Sasnett, 91 F.3d 1018 (7th Cir. 1997) ........................................................................... iii Walz v. Tax Commission, 397 U.S. 664 (1970)............................................................................10 Witters v. Washington Department of Services for the Blind, 474 U.S. 481 (1986)..........4, 6, 7, 8 Zelman v. Simmons-Harris, 122 S. Ct. 2460 (2002)..........................................................3, 6, 8, 9 Zobrest v. Catalina Foothills School District, 509 U.S. 1 (1993) ...............................................4, 6 Zorach v. Clauson, 343 U.S. 306 (1952).......................................................................................10 STATUTES 26 U.S.C. § 170 .............................................................................................................................11 42 U.S.C. § 2000e-1 ......................................................................................................................11 42 U.S.C. §§ 2000bb – 2000bb-4 .................................................................................................11 42 U.S.C. §§ 2000cc – 2000cc-5 ...................................................................................................11 50 App. U.S.C. § 456....................................................................................................................11 iv IDENTITIES AND INTERESTS OF AMICI CURIAE Amici curiae are private, faith-based, non-profit organizations dedicated to serving persons in need, in part in cooperation with government agencies. Amici1 operate and support faith-based services that respond to bodily, mental, and emotional needs, as well as providing spiritual assistance, in a context of respect for the religious liberties of their clients. By working in cooperation with government agencies, Amici are able to contribute to the amelioration of societal ills in circumstances in which those agencies and secular private groups may be unable or unwilling to do so. Amici submit this brief for the Court’s consideration because the resolution of this case could help to determine whether such avenues for cooperation remain open or, instead, are closed in service of a flawed legal theory that does not accommodate the religious autonomy and character of faith-based organizations. Evangelicals for Faith-Based Initiatives (EFBI) is a national network of evangelical intermediary organizations formed to encourage cooperative relationships between faith-based service providers and federal, state, and local governments, while preserving the religious liberties of the providers and of their clients. EFBI’s members, each of which represents or serves multiple faith-based service organizations, include the Salvation Army, World Vision, World Relief, We Care America, the Center for Public Justice, Operation Blessing, Evangelicals for Social Action, the National In this brief, the term Amici refers to amici curiae in support of affirmance; amici curiae in support of Appellants will be expressly identified as such. 1 v Association of Evangelicals, Nazarene Compassionate Ministries, and the National Network of Youth Ministries. EFBI seeks to help eliminate discrimination in government funding programs against faith-based organizations by furthering policies that ensure a level playing field at the national, state, and local levels. Prison Fellowship Ministries is a tax-exempt, charitable religious organization, founded in 1976 and currently operating in every state and in 95 countries, that ministers to prisoners, ex-prisoners, crime victims, and their families. It offers seminars in the tenets of Christianity and such practical skills as how to be a good father and an honest employee, organizes local churches to provide gifts to prisoners’ children, and matches inmates with Christian pen pals on the outside. Among Prison Fellowship’s many programs is Justice Fellowship, an effort to find practical applications of restorative justice, such as sentencing low-risk offenders to restitution and community service, enabling them to remain with their families while atoning for their crimes, and promoting reconciliation between offenders and their victims. The Christian Community Health Fellowship (CCHF) is a national network of more than 1,500 health professionals and students concerned about the health care needs of the poor. Its mission, guided by the biblical mandate to serve the poor, is to provide quality health care throughout the United States by recruiting and coordinating Christians to serve underprivileged communities. CCHF members practice a holistic approach to health, integrating health care with community development and attending to the physical, mental, emotional, and spiritual needs of those they serve. CCHF currently administers a federal grant from the Compassion Capital Fund of the vi Department of Health and Human Services to provide monetary awards and technical training to faith-based organizations. CCHF also advises its members on how and whether to seek government funding and status as government-recognized health care community facilities. SOURCE OF AUTHORITY TO FILE All parties have consented in writing to the filing of this brief. vii INTRODUCTION Contrary to the arguments advanced by Appellants and their amici, the district court’s decision was plainly correct under Lemon v. Kurtzman, 403 U.S. 602 (1971), and its more recent progeny. In Lemon, the Supreme Court set forth what remains the basic framework for resolving Establishment Clause questions: the challenged law or policy must have a secular purpose, must neither advance nor inhibit religion, and must not foster excessive entanglement between church and state. In the time since Lemon, however, it has become clear that the varying factual settings in which such questions typically arise demand commensurate adjustments to the Lemon test and its application. As a result, two lines of jurisprudence pertinent here have emerged. The first chiefly consists of cases involving state-sponsored religious activities and public displays of religious symbols. In such cases, the first two prongs of the Lemon test are collapsed (practically if not always technically) into what this Court has called an “endorsement test,” under which the inquiry is whether the challenged law or policy has the purpose or effect of endorsing religion. See, e.g., Santa Fe Indep. Sch. Dist. v. Doe, 530 U.S. 290, 307 (2000) (public school’s providing forum for students’ religious invocation resulted in “perceived or actual endorsement of the message” by the state); County of Allegheny v. ACLU, Greater Pittsburgh Chapter, 492 U.S. 573, 600 (1989) (creche in county courthouse conveyed governmental endorsement of Christian message).2 See also Indiana Civil Liberties Union v. O’Bannon, 259 F.3d 766, 773 (7th Cir. 2001) (public display of Ten Commandments “amounts to the endorsement of religion by the state”), cert. denied, 534 U.S. 1162 (2002); Doe v. Village of Crestwood, 917 F.2d 1476, 1478 2 1 The second line of cases involves transfers of public aid to religious entities (usually sectarian schools). In those cases, the emphasis on endorsement is subordinated to an emphasis on whether it is appropriate to attribute to the government a religious entity’s mission and work, and the Lemon test is adjusted accordingly. In determining whether an aid program has constitutionally permissible effects (assuming it has a secular purpose), courts ask whether any religious indoctrination linked to the aid is attributable to the government, whether beneficiaries are selected according to religious criteria, and whether the aid program results in excessive entanglement. See, e.g., Agostini v. Felton, 521 U.S. 203, 222-32 (1997); Freedom From Religion Found., Inc. v. Bugher, 249 F.3d 606, 611-12 (7th Cir. 2001). The case at bar belongs to this second line of jurisprudence, and therefore the considerations of perceived “endorsement” on which Appellants dwell are not directly pertinent. Rather, as the district court recognized, the relevant inquiry is whether the arrangement between Faith Works and the state of Wisconsin effects “religious indoctrination” attributable to the state. The district court correctly held that it does not, and Amici urge this Court to affirm that holding. ARGUMENT The Supreme Court has made clear that the Establishment Clause permits “private choice” programs, under which government aid (in-kind or cash) is directed to religious (7th Cir. 1990) (Catholic mass at municipal festival “conveys the message of approval or endorsement” of Catholic faith). 2 entities “only as a result of the genuine and independent choices of private individuals.” Zelman v. Simmons-Harris, 122 S. Ct. 2460, 2465 (2002). The key requisite of such a program (implicit in the predicate of private choice) is that any religious indoctrination correlatable with the aid is not attributable to the government. If the decision to transfer the aid is wholly private, indoctrination cannot be ascribed to the government and the Establishment Clause is not implicated.3 The district court correctly concluded that the arrangement between Faith Works and the Department of Corrections constitutes a private choice program, marked by no governmental indoctrination. Likewise, the district court correctly rejected the argument that state agents’ role in relation to the Faith Works program effects an unconstitutional endorsement of religion. The Establishment Clause forbids the state to sponsor or interfere with religion but does not mandate cold indifference to religion. The posture assumed by DOC and its officers with regard to Faith Works is well within the bounds of recognition of religion and spirituality that the governing law has long sanctioned. I. THE FAITH WORKS PROGRAM CANNOT BE INVALIDATED ON THE GROUND THAT IT INVOLVES GOVERNMENTAL INDOCTRINATION The interposition of private choice between the state and an institutional recipient of state funds is the principal determinant of whether religious activity by the institution is attributable to the state. See Zelman, 122 S. Ct. at 2467-68 (upholding program providing Appellants and their amici do not dispute that rehabilitation of penal offenders is a legitimate secular purpose, nor do they argue that the contract defines beneficiaries by reference to religion or results in excessive church-state entanglement. Accordingly, this brief will not address those components of the Lemon-Agostini test. 3 3 vouchers redeemable at religious schools); Zobrest v. Catalina Foothills Sch. Dist., 509 U.S. 1, 10 (1993) (upholding state’s provision of interpreter for deaf students in sectarian schools); Witters v. Washington Dep’t of Servs. for the Blind, 474 U.S. 481, 487 (1986) (holding that Establishment Clause permits use of state aid for studies at Christian college); Mueller v. Allen, 463 U.S. 388, 399-400 (1983) (upholding state tax deduction for parochial school expenses). As long as there is genuine private choice, it makes no difference whether the funds actually pass through the individual’s hands or are transferred by the state at the individual’s direction. The relevant criterion is the control exercised by the private beneficiary. The district court correctly found that criterion satisfied here. A. State Funds Reach Faith Works Only as a Result of Individual Choices Appellants contend that the differences between Faith Works and non-faith-based alternatives preclude a genuine choice between treatment programs. They insist, in essence, that the Faith Works program is too effective, or too attractive, to be considered comparable to secular alternatives.4 This reasoning is flawed for several reasons. First, as Appellees have noted, the relevant ground of comparison is whether the program satisfies the conditions of parole or allows the offender to avoid parole The chief differences, besides the spiritual component of the Faith Works program, are its length (nine to twelve months rather than one to three) and its holistic approach (including responsible parenting, employment skills, and community reintegration). See Freedom From Religion Found., Inc. v. McCallum (July opinion), 214 F. Supp. 2d 905, 908-09 (W.D. Wis. 2002); McCallum (January opinion), 179 F. Supp. 2d 950, 955 (W.D. Wis. 2002). 4 4 revocation. In that respect Faith Works is identical to the alternatives. See Brief of Appellees Scott McCallum et al. (“State Appellees’ Brief”) at 36-37; Brief of Intervening Appellee (“Faith Works Brief”) at 8, 24-25. Second, as a matter of simple logic, it is an odd conception of “genuine choice” that demands indistinguishable alternatives. The features of Faith Works that are absent from other programs create a genuine choice that was absent before Faith Works was an option. Third, as a matter of policy, the absence of a secular program with the same set of characteristics is hardly ground for an indictment of Faith Works. According to Appellants’ argument, the inclusion of Faith Works in the list of service providers would be unobjectionable (or less objectionable) if others on the list offered better services than they do. Faith Works is suspect, in Appellants’ view, only because it responds to a concededly legitimate need. Finally, Appellants’ analysis is untenable as a matter of constitutional law. The purpose for the rule that religious and secular alternatives be reasonably comparable is to ensure that the government, while making both of them available, does not create incentives tilting the field in favor of the religious. As a plurality of the Supreme Court recently put it, “to say that a program does not create an incentive to choose religious [institutions] is to say that the private choice is truly ‘independent.’” Mitchell v. Helms, 530 U.S. 793, 813 (2000) (plurality opinion). In other words, the government’s involvement must not create an artificial preference for the religious over the nonreligious. This is why the governing cases speak in terms of financial incentives: since 5 the government’s main contribution is financial, that is where a potential often exists for the government to place a thumb on the scale. See Zelman, 122 S. Ct. at 2468 (noting the absence of “financial incentives that skew the [voucher] program toward religious schools”) (internal quotation marks omitted); Agostini, 521 U.S. at 231 (state aid program must not “creat[e] a financial incentive to undertake religious indoctrination”); Zobrest, 509 U.S. at 10 (challenged statute “creates no financial incentive for parents to choose a sectarian school”); Witters, 474 U.S. at 488 (challenged state aid program “creates no financial incentive for students to undertake sectarian education”). In this case, the “incentives” to which Appellants object were not created by the government, but are simply aspects of the Faith Works program that some prospective participants can be expected to prefer. See Appellants’ Brief at 46-47 (Faith Works offers nine- to twelve-month residential treatment, which “is advantageous for some offenders”); see also Brief Amicus Curiae in Support of Reversal at 16-17 (noting the nineto twelve-month feature and the fact that Faith Works “contains employment readiness and family reintegration components”). Under Appellants’ approach, a more effective faith-based program, before it could be offered as an option, would have to be dragged to the level of the least effective secular alternative. But the availability of Faith Works as an option to offenders no more creates an incentive in favor of Faith Works than the voucher program in Zelman, the tax deduction in Mueller, or the vocational assistance program in Witters created an incentive in favor of religious schools. In each case, the only “skewing” was in the individual beneficiaries’ preference for the religious alterna- 6 tives. If that were a disqualifying factor, then “private choice” would be meaningless and no program with a faith-based alternative could pass constitutional muster. B. The Route by Which Funds Reach Faith Works is Constitutionally Immaterial Appellants and their amici also emphasize two related aspects of the arrangement between Faith Works and DOC that they contend make it a “per capita aid” program and not a “true private choice” program: the amount of funding transferred in a given payment period corresponds to the number of offenders enrolled, and the funds are transferred from DOC to Faith Works without first passing through the hands of individual beneficiaries. Neither of these points has any bearing on the constitutional inquiry before the Court. 1. Under a per capita aid program, aid is distributed based on the number of persons served or encompassed by the recipient institution, with no antecedent discretionary role for the individual beneficiaries.5 By contrast, an individual’s decision to enroll in Faith Works is an express precondition of the allotment of that individual’s share of DOC funds. It is therefore entirely up to the participant whether his share of the funds is directed to Faith Works or to one of a half dozen other service providers. Amici note, parenthetically, that Appellants’ proffered categorical distinction between “per capita aid” programs and “true private choice” programs is nowhere to be found in the controlling jurisprudence. The distinction is drawn from Justice O’Connor’s concurring opinion in Mitchell, which in turn draws heavily on Justice O’Connor’s concurring opinions in Lynch v. Donnelly, 465 U.S. 668 (1984), Witters, and Rosenberger v. Rector & Visitors of Univ. of Va., 515 U.S. 819 (1995). See Mitchell, 530 U.S. at 842-44 (O’Connor, J., concurring in the judgment), and citations therein. Amici are aware of no decision of the Supreme Court or this Court, before or since Mitchell, adopting the reasoning in the Mitchell concurrence. 5 7 That the calculation of payments is based on a headcount, moreover, is a mere administrative convenience of no constitutional moment. Nor is there any significance in the fact that the state exerts a measure of control over the dedication of the disbursed funds—a consideration that characterizes all “private choice” cases.6 For example, the tax deduction at issue in Mueller was available only for certain enumerated expenses, see 463 U.S. at 391 & n.2; the vocational assistance in Witters was similarly circumscribed, see 474 U.S. at 483; and the vouchers in Zelman could be redeemed only at accredited schools in a limited geographic area, see 122 S. Ct. at 2463-64. In each of these cases, as here, the individual beneficiaries had some discretion but were required to transfer the allotted funds to one of an officially predetermined set of institutions. 2. With respect to the mechanism by which DOC funds reach Faith Works, the relevant instruction of the governing jurisprudence has nothing to do with accounting. It is that government aid, before reaching or benefiting any religious [entity, must] first pass[] through the hands (literally or figuratively) of numerous private citizens who are free to direct the aid elsewhere . . . . Although the presence of private choice is easier to see when aid literally passes through the hands of individuals . . . there is no reason why the Establishment Clause requires such a form. The oft-invoked paycheck analogy (see Agostini, 521 U.S. at 226; Witters, 474 U.S. at 486-87) may be of some heuristic value, in that it highlights the dispositive role of the private individual. But it is misleading if taken too literally. Unless the beneficiary is free to spend the allotted funds on groceries, the funds are not like a paycheck in any real sense. 6 8 Mitchell, 530 U.S. at 816 (plurality opinion) (internal citations omitted).7 The fact, for example, that the beneficiary parents in Zelman physically laid their hands on stateissued checks is inconsequential. The point is that the parents decided where the disbursed funds would be spent. Thus, the difference between Zelman and this case can be likened to the difference between a check written to party A on the express condition he sign it over to party B and a check written to B at A’s behest. As a practical matter, there is no difference between the two. As a constitutional matter, therefore, there should be no difference either. II. THE FAITH WORKS PROGRAM INVOLVES ONLY PERMISSIBLE COGNIZANCE OF RELIGION, NOT IMPERMISSIBLE ENDORSEMENT OF RELIGION Appellants argue that the role of parole officers in the Faith Works program— referring offenders to Faith Works and in some cases affirmatively recommending it— effects a state endorsement of religion. Appellees have ably demonstrated the many flaws in this argument, and Amici will not restate that analysis here. See State Appellees’ Brief at 35-36 & n.3, 39 & n.6; Faith Works Brief at 18-23. See also McCallum (July opinion), 214 F. Supp. 2d at 916-17 and McCallum (January opinion), 179 F. Supp. Appellants’ amici assert that the passage just quoted is not controlling precedent—as indeed it is not. Neither, of course, is the concurrence, notwithstanding the amici’s jurisprudential alchemy (2 parts concurrence + 3 parts dissent = holding), except to the extent of its consonance with the plurality. See Marks v. United States, 430 U.S. 188, 194 (1977). The relevant point is that the plurality’s reasoning on this score, not yet endorsed or rejected by a controlling decision of the Court, is persuasive and in keeping with longstanding precedent. 7 9 2d at 966-67 (noting that an analysis focused on endorsement is not appropriate in the context of this case). It bears emphasis, though, that a central part of a parole officer’s job is to assist with an offender’s transition to becoming a productive member of the community, which naturally requires a certain awareness of the attributes, needs, and proclivities of the individual offender. Appellants’ arguments ignore this fundamental reality. According to their analysis, if the parole officer knows or believes that a treatment program with a religious component would be more helpful to an offender’s transition than a purely secular one, the officer is constitutionally proscribed from expressing that judgment. With regard to that (and only that) set of personal attributes and needs, the offender must fend for himself. That approach not only lacks jurisprudential support but distorts an animating principle of the Establishment Clause. That provision recognizes that, for many citizens, religion and spirituality are parts of life which, although they are beyond the power of the government to interfere, at the same time, need not and should not be subjected to a constitutionally mandated quarantine. See Corporation of the Presiding Bishop of Church of Jesus Christ of Latter-Day Saints v. Amos, 483 U.S. 327, 336-38 (1987); Walz v. Tax Comm’n, 397 U.S. 664, 672-73 (1970); Zorach v. Clauson, 343 U.S. 306, 313-14 (1952). Appellants would have this Court decree the spiritual aspects of a person’s life untouchable. But that position, far from manifesting a salutary neutrality respecting religion, would convey an affirmative hostility. Cf. Zorach, 343 U.S. at 314 (“we find no constitutional requirement which makes it necessary for government to be hostile to 10 religion and to throw its weight against efforts to widen the effective scope of religious influence”); see also State Appellees’ Brief at 39 n.6. This the law does not require. It is settled that the government may, without running afoul of the Establishment Clause, not only take cognizance of the religious but set it apart for special protection. Such statutes have been enacted, and upheld, time and again. See, e.g., 42 U.S.C. § 2000e-1 (exemption from Title VII proscription of religious discrimination in employment)8; 26 U.S.C. § 170(a), (c)(2)(B) (federal tax deduction for contributions to religious organizations); 50 App. U.S.C. § 456(g) (exemption from military training and service for ministers and seminary students)9; 42 U.S.C. §§ 2000bb – 2000bb-4 (Religious Freedom Restoration Act, prohibiting undue interference with religious practice)10; see also 42 U.S.C. §§ 2000cc – 2000cc-5 (Religious Land Use and Institutionalized Persons Act, affording same protection to religious uses of land and to individuals in state custody). All of these enactments represent permissible “accommodation, acknowledgment, and support for religion[, which are] an accepted part of our political and cultural See Amos, 483 U.S. 327 (rejecting Establishment Clause challenge to Title VII exemption. 8 Cf. Gillette v. United States, 401 U.S. 437 (1971) (rejecting Establishment Clause challenge to religious exemption from military draft). 9 See In re Young, 141 F.3d 854, 861-62 (8th Cir.) (rejecting Establishment Clause challenge to RFRA), cert. denied sub nom. Christians v. Crystal Evangelical Free Church, 525 U.S. 811 (1998); Sullivan v. Sasnett, 91 F.3d 1018, 1022 (7th Cir.) (same), vacated on other grounds, 521 U.S. 1114 (1997). RFRA was held invalid as applied to the states, see City of Boerne v. Flores, 521 U.S. 507 (1997), on Fourteenth Amendment grounds. Eight Justices rejected the petitioners’ Establishment Clause challenge, and the statute remains in 10 11 heritage” and are fully sanctioned by the Establishment Clause. Board of Educ. of Kiryas Joel Village v. Grumet, 512 U.S. 687, 723 (1994) (Kennedy, J., concurring). The policy under consideration does no more. In fact, it is more modest in scope, in that it gives religion no special status. It should be upheld. CONCLUSION The district court’s holding that the arrangement between the Wisconsin Department of Corrections and Faith Works is constitutionally valid should not be disturbed. Respectfully submitted, December 23, 2002 __________________________ Gene C. Schaerr Michael L. Post Richard H. Menard Jr. SIDLEY AUSTIN BROWN & WOOD LLP 1501 K Street, N.W. Washington, D.C. 20005 Counsel for Amici Curiae Prison Fellowship Ministries, Evangelicals for Faith-Based Initiatives, and Christian Community Health Fellowship force as applied to the federal government. 12 CERTIFICATE OF SERVICE I certify that on this 23rd day of December, 2002, I caused a copy of the foregoing Brief Amicus Curiae of Evangelicals for Faith-Based Initiatives, Prison Fellowship Ministries, and Christian Community Health Fellowship to be sent by first-class mail, postage prepaid, to the following persons: Richard L. Bolton Boardman, Suhr, Curry & Field LLP One South Pinckney Street, Suite 410 Post Office Box 927 Madison, Wisconsin 53701-0927 Bruce A. Olsen, Assistant Attorney General Wisconsin Department of Justice 17 West Main Street, Room 605 Post Office Box 7857 Madison, Wisconsin 53707-7857 Daniel Kelly Reinhart, Boerner, Van Deuren, S.C. 100 North Water Street, Suite 2100 Post Office Box 514000 Milwaukee, Wisconsin 53203-3400 Jordan Lorence Alliance Defense Fund Law Center 14333 North Pima Road, Suite 165 Scottsdale, Arizona 85260 December 23, 2002 DC1 611382v1 __________________________ Richard H. Menard Jr.