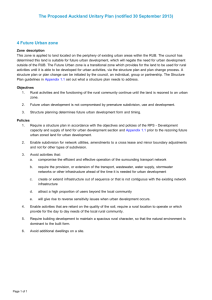

Rural America in Transition

advertisement