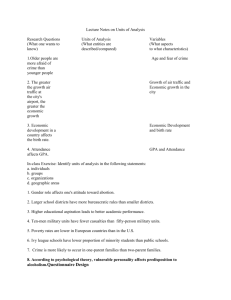

IT9 One-Parent Family Tax Credit

advertisement

ver 14.01 12.02 RPC004180_EN_WB_L_2 ITIT99 One-Parent One Parent Family Tax Tax Credit Family Credit What is a One-Parent Family Tax Credit? A One-Parent Family Tax Credit is a tax credit that is available to a single parent, or a person who has custody of and maintains a child who is living with him or her. This can include someone who is single, widowed, a surviving civil partner, deserted, separated (from spouse or civil partner), divorced or whose civil partnership has been dissolved. This tax credit has been abolished with effect from 31 December 2013. However, it can still be claimed for years up to and including 2013, subject to Revenue’s 4-year time limit on submitting claims. For years 2014 onwards, a new tax credit ‘Single Person Child Carer Tax Credit’ may be claimed by a single parent with a qualifying child(ren). For more information on this tax credit see www.revenue.ie. How can I claim entitlement to the One-Parent Family Tax Credit? A One-Parent Family Tax Credit is a credit that can be claimed if a child resides with you for the whole or part of the tax year and: uyou are not jointly assessed to tax as a married person or a civil partner u you are not living with your spouse or civil partner u you are not cohabiting u you have not been widowed or become a surviving civil partner in the year for which you are making the claim and are not in receipt of the basic personal tax credit to which you are entitled as a result of your bereavement for that year. 2 With regard to whom can I claim the One-Parent Family Tax Credit? A claimant with a qualifying child can claim this credit. A qualifying child means a child: during the tax year, or who is under 18 years of age at the beginning of the tax year u who, if over 18 years of age: is receiving full-time education or undergoing a fulltime training course for a trade or profession for a minimum of two years, or is permanently incapacitated either physically or mentally from maintaining himself or herself and has become so before reaching 21 years of age, or has become permanently incapacitated after reaching the age of 21 years but while in receipt of full-time education, or undergoing a full-time training course for a trade or profession and a child u born u of whom you are the parent (including a step-parent or an adoptive parent) or, if not a parent, of whom you have custody and who you maintain at your own expense for the whole or part of a tax year. Note: A post-graduate course is not considered as full-time education for the purpose of this tax credit. What relief am I due? One tax credit will be given for any year of assessment up to and including 2013, irrespective of the number of dependent children that resided with you in that year. The credit, where due, is given in addition to your normal Personal Tax Credit. It is not apportioned between claimants. Each qualifying claimant can claim the full tax credit for a dependent child provided the qualifying conditions are met and the child resides with each claimant for at least part of the relevant year. 3 Claims for years up to and including 2013, will be processed by reviewing your income tax liability and any refund due will be sent directly to you by Revenue. Tax refunds can be paid by cheque or to your bank account. It is not possible to make a refund directly to a foreign bank account that is not a member of the Single Euro Payments Area (SEPA). Further information on SEPA can be found on www.revenue.ie. If I am in receipt of the One-Parent Family Payment, does this affect my entitlement? No, whether or not you are in receipt of the One-Parent Family Payment from the Department of Social Protection does not affect your entitlement to this tax credit. However, the One-Parent Family Payment is a taxable source of income which must be declared to Revenue. How do I claim? Complete Form OP1 which is attached to this guide, or is available from: u www.revenue.ie u Revenue’s Forms and Leaflets Service at LoCall 1890 30 67 06 (or if calling from outside the Republic of Ireland phone +353 1 702 3050) u any Revenue office. If you pay tax under the self-assessment system, the tax credit is claimed by completing the ‘One-Parent Family Tax Credit’ section on your annual tax return. 4 Further information PAYE customers can get further information by visiting www.revenue.ie or by phoning your Revenue office whose LoCall number is listed below. u Border Midlands West Region 1890 777 425 Cavan, Donegal, Galway, Leitrim, Longford, Louth, Mayo, Monaghan, Offaly, Roscommon, Sligo, Westmeath u Dublin Region Dublin (City and County) u East & South East Region 1890 444 425 Carlow, Kildare, Kilkenny, Laois, Meath, Tipperary, Waterford, Wexford, Wicklow u South West Region Clare, Cork, Kerry, Limerick 1890 333 425 1890 222 425 Please note that the rates charged for the use of 1890 (LoCall) numbers may vary among different service providers. If calling from outside the Republic of Ireland phone +353 1 702 3011. 4-year time limit: A claim for tax relief must be made within four years after the end of the tax year to which the claim relates. Accessibility: If you are a person with a disability and require this leaflet in an alternative format the Revenue Access Officer can be contacted at accessofficer@revenue.ie This leaflet is intended to describe the subject in general terms. As such, it does not attempt to cover every issue which may arise in relation to the subject. It does not purport to be a legal interpretation of the statutory provisions and consequently, responsibility cannot be accepted for any liability incurred or loss suffered as a result of relying on any matter published herein. Revenue Commissioners January 2014 5