CHAPTER 7

Employee Earnings and Deductions

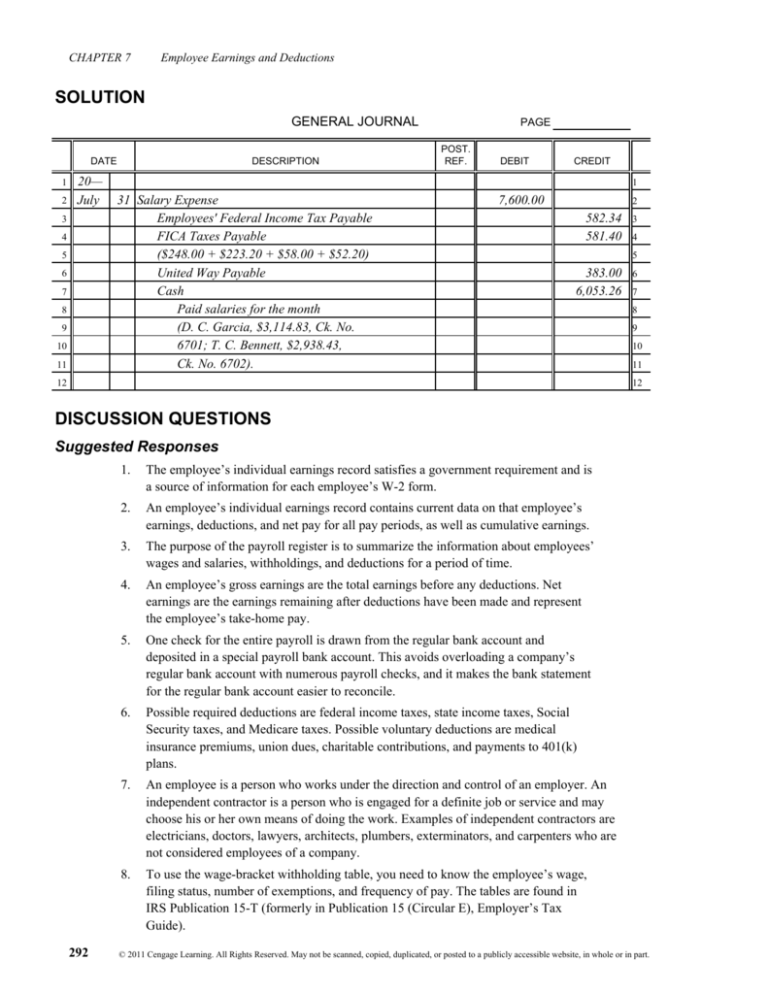

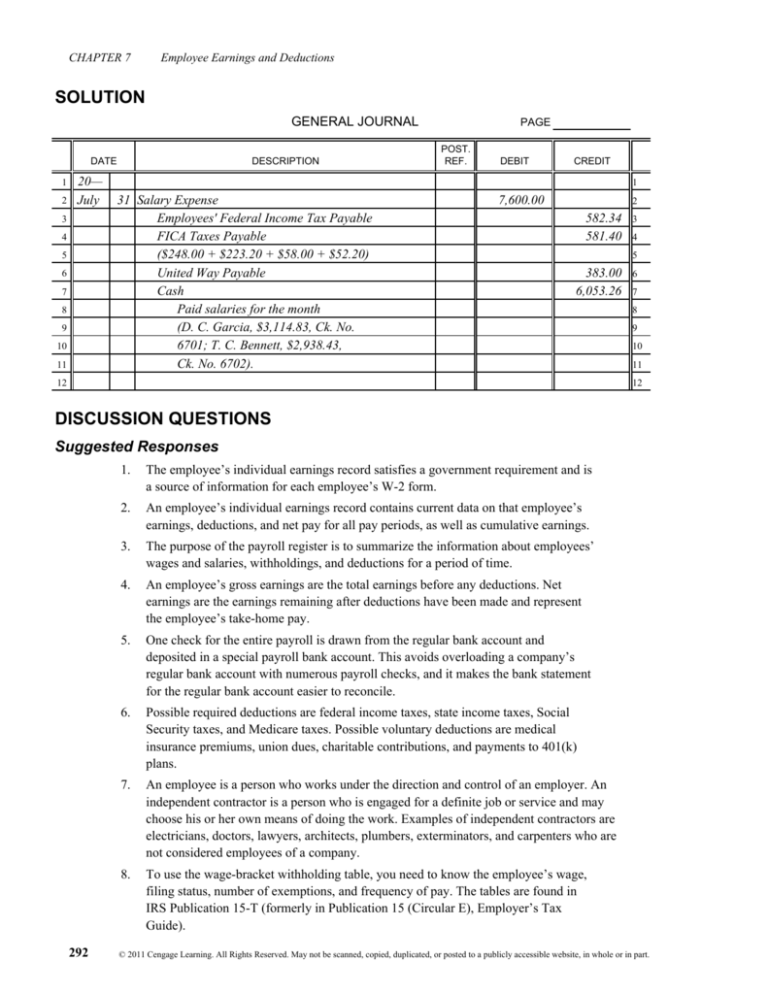

SOLUTION

GENERAL JOURNAL

DATE

1

2

20—

July

3

4

5

6

7

8

9

10

11

DESCRIPTION

PAGE

POST.

REF.

DEBIT

CREDIT

1

31 Salary Expense

Employees' Federal Income Tax Payable

FICA Taxes Payable

($248.00 + $223.20 + $58.00 + $52.20)

United Way Payable

Cash

Paid salaries for the month

(D. C. Garcia, $3,114.83, Ck. No.

6701; T. C. Bennett, $2,938.43,

Ck. No. 6702).

7,600.00

2

582.34

581.40

3

4

5

383.00

6,053.26

12

6

7

8

9

10

11

12

DISCUSSION QUESTIONS

Suggested Responses

292

1.

The employee’s individual earnings record satisfies a government requirement and is

a source of information for each employee’s W-2 form.

2.

An employee’s individual earnings record contains current data on that employee’s

earnings, deductions, and net pay for all pay periods, as well as cumulative earnings.

3.

The purpose of the payroll register is to summarize the information about employees’

wages and salaries, withholdings, and deductions for a period of time.

4.

An employee’s gross earnings are the total earnings before any deductions. Net

earnings are the earnings remaining after deductions have been made and represent

the employee’s take-home pay.

5.

One check for the entire payroll is drawn from the regular bank account and

deposited in a special payroll bank account. This avoids overloading a company’s

regular bank account with numerous payroll checks, and it makes the bank statement

for the regular bank account easier to reconcile.

6.

Possible required deductions are federal income taxes, state income taxes, Social

Security taxes, and Medicare taxes. Possible voluntary deductions are medical

insurance premiums, union dues, charitable contributions, and payments to 401(k)

plans.

7.

An employee is a person who works under the direction and control of an employer. An

independent contractor is a person who is engaged for a definite job or service and may

choose his or her own means of doing the work. Examples of independent contractors are

electricians, doctors, lawyers, architects, plumbers, exterminators, and carpenters who are

not considered employees of a company.

8.

To use the wage-bracket withholding table, you need to know the employee’s wage,

filing status, number of exemptions, and frequency of pay. The tables are found in

IRS Publication 15-T (formerly in Publication 15 (Circular E), Employer’s Tax

Guide).

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 7

Employee Earnings and Deductions

SOLUTIONS TO EXERCISES

Exercise 7-1

a.

b.

40 hours at straight time × $21.60 per hour

4 hours overtime × $32.40 per hour

$864.00

129.60

Total gross pay

$993.60

40 hours at straight time × $25.00 per hour

10 hours overtime × $37.50 per hour

$1,000.00

375.00

Total gross pay

$1,375.00

c.

$20,885 × 0.08

$1,670.80

d.

$81,600 ÷ 52 weeks = $1,569.23 per week

$1,569.23 per week ÷ 40 hours = $39.23 per regular hour

40 hours at straight time × $39.23 per hour

$1,569.20

176.55

3 hours overtime × $58.85 per hour

$1,745.75

Exercise 7-2

a.

40 hours at straight time × $37.00 per hour

b.

10 hours overtime × $55.50 per hour

$1,480.00

555.00

c.

Total gross pay

$2,035.00

d.

Federal income tax withholding

e.

Social Security tax withholding at 6.2 percent

f.

Medicare tax withholding at 1.45 percent

g.

Total withholding

h.

Net pay

$256.81

126.17

29.51

412.49

$1,622.51

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

293

Aston, F. B.

Dwyer, S. J.

Flynn, K. A.

Harden, J. L.

Nguyen, H.

Totals

294

Axton, C.

Edgar, E.

Gorman, L.

Jolson, R.

Nixel, P.

EMPLOYEE

Exercise 7-5

1.

2.

3.

4.

5.

6.

Exercise 7-4

a.

b.

c.

d.

e.

EMPLOYEE

$ 900.00

920.00

1,110.00

1,025.00

925.00

$4,880.00

$ 71.00

64.00

82.00

100.00

64.00

$381.00

FEDERAL

INCOME

TAX

WITHHELD

$ 55.80

57.04

68.82

63.55

57.35

$302.56

SOCIAL

SECURITY

TAX

WITHHELD

7,691.00

10,900.00

3,064.00

2,325.00

2,463.00

TOTAL

EARNINGS

113,691.00

156,365.00

39,943.00

26,959.00

9,313.00

ENDING

CUMULATIVE

EARNINGS

0.00

0.00

0.00

0.00

150.00

UNEMPLOYMENT

800.00

0.00

3,064.00

2,325.00

2,463.00

SOCIAL SECURITY

TAXABLE EARNINGS

$13.05

13.34

16.10

14.86

13.41

$70.76

MEDICARE

TAX

WITHHELD

7,691.00

10,900.00

3,064.00

2,325.00

2,463.00

MEDICARE

$ 25.00

25.00

25.00

25.00

25.00

$125.00

UNION

DUES

WITHHELD

$ 35.00

35.00

40.00

40.00

35.00

$185.00

UNITED

WAY

WITHHELD

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

106,000.00

145,465.00

36,879.00

24,634.00

6,850.00

BEGINNING

CUMULATIVE

EARNINGS

Total Earnings should be $7,944, not $7,494.

Ending Cumulative Earnings should be $253,698, not $253,248.

Social Security tax withheld should be $492.53, not $429.53.

Total deductions should be $2,041.72, not $2,083.00.

Net Amount should be $5,902.28, not $5,456.00.

Wages Expense should be $7,944, not $7,494.

1

2

3

0

2

ALLOWANCES

TOTAL

EARNINGS

Employee Earnings and Deductions

Exercise 7-3

CHAPTER 7

$ 700.15

725.62

878.08

781.59

730.24

$3,815.68

NET PAY

CHAPTER 7

Employee Earnings and Deductions

Exercise 7-6

GENERAL JOURNAL

DATE

1

2

3

4

5

6

7

8

9

10

20-Jan.

POST.

REF.

DESCRIPTION

PAGE

DEBIT

CREDIT

1

21 Sales Salary Expense

Driver Salary Expense

Office Salary Expense

Employees' Federal Income Tax

Payable

FICA Taxes Payable ($2,127.96 + $497.67)

Employees' Union Dues Payable

Salaries Payable

From payroll register.

14,960.00

10,692.00

8,670.00

2

3

4

5

3,975.00

2,625.63

560.00

27,161.37

6

7

8

9

10

11

11

12

12

Exercise 7-7

Regular earnings

Overtime earnings

Total earnings

Federal income tax withheld

State income tax withheld

Social Security tax withheld

Medicare tax withheld

Charity withheld

Total deductions

Net pay

BROWN

RINGNESS

TOTAL

$ 3,500.00

146.00

$ 3,646.00

$ 268.07

53.61

226.05

52.87

35.00

$ 635.60

$3,010.40

$2,618.00

120.00

$2,738.00

$ 131.87

26.37

169.76

39.70

97.00

$ 464.70

$ 2,273.30

$6,118.00

266.00

$6,384.00

$ 399.94

79.98

395.81

92.57

132.00

$1,100.30

$5,283.70

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

295

CHAPTER 7

Employee Earnings and Deductions

Exercise 7-8

GENERAL JOURNAL

DATE

1

2

20-Sept.

3

4

5

6

7

8

9

10

11

12

DESCRIPTION

PAGE

POST.

REF.

DEBIT

CREDIT

1

30 Salary Expense

Employees' Federal Income Tax

Payable

Employees' State Income Tax

Payable

FICA Taxes Payable ($395.81 + $92.57)

Charity Payable

Cash--Brown

Cash--Ringness

Issued checks 981 and 982

for the month of September.

6,384.00

2

3

399.94

4

5

79.98

488.38

132.00

3,010.40

2,273.30

6

7

8

9

10

11

12

13

13

14

14

296

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

×

$1,200.00

×

$180.00

$45.00 per hour

4 hours

OVERTIME PAY

Gross pay

Overtime pay

Regular pay

GROSS PAY

$1,380.00

180.00

$1,200.00

85.56

20.01

30.00

32.00

Social Security tax

Medicare tax

Union dues

Employee loan

Net pay

Total deductions

$133.00

Federal income tax

Less:

Gross pay

NET PAY

297

$1,079.43

300.57

$1,380.00

Employee Earnings and Deductions

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

$30.00 per hour

40 hours

REGULAR PAY

Problem 7-1A

CHAPTER 7

298

40

40

40

16

40

48

Bills, D.

Carney, W.

Dorn, J.

Edgar, L.

Fitzwilson, G.

TOTAL

HOURS

Arthur, P.

NAME

4,690.00

19,530.00

276.00

276.00

0.00

0.00

0.00

0.00

0.00

OVERTIME

EARNINGS

HIGHRIDGE HOMES

4,966.00

1,196.00

600.00

352.00

518.00

500.00

1,800.00

TOTAL

24,496.00

5,346.00

3,287.00

1,100.00

2,603.00

2,560.00

9,600.00

ENDING

CUMULATIVE

EARNINGS

3,166.00

1,196.00

600.00

352.00

518.00

500.00

0.00

UNEMPLOYMENT

4,966.00

1,196.00

600.00

352.00

518.00

500.00

1,800.00

SOCIAL

SECURITY

4,966.00

1,196.00

600.00

352.00

518.00

500.00

1,800.00

MEDICARE

February 21, 20--

TAXABLE EARNINGS

PAYROLL REGISTER FOR WEEK ENDED

401.15

115.00

26.00

0.00

14.00

13.00

233.15

FEDERAL

INCOME

TAX

307.89

74.15

37.20

21.82

32.12

31.00

111.60

72.00

17.34

8.70

5.10

7.51

7.25

26.10

MEDICARE

TAX

DEDUCTIONS

SOCIAL

SECURITY

TAX

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

920.00

600.00

352.00

518.00

500.00

1,800.00

REGULAR

4,150.00

2,687.00

748.00

2,085.00

2,060.00

7,800.00

BEGINNING

CUMULATIVE

EARNINGS

Employee Earnings and Deductions

Problem 7-2A

CHAPTER 7

781.04

206.49

71.90

26.92

53.63

51.25

370.85

TOTAL

4,184.96

989.51

528.10

325.08

464.37

448.75

1,429.15

NET

AMOUNT

CK.

NO.

2085

2084

2083

2082

2081

2080

PAYMENTS

CHAPTER 7

Employee Earnings and Deductions

Problem 7-2A (concluded)

GENERAL JOURNAL

DATE

1

2

3

4

5

6

7

8

20-Feb.

DESCRIPTION

PAGE

POST.

REF.

DEBIT

CREDIT

1

21 Wages Expense

Employees' Federal Income Tax

Payable

FICA Taxes Payable ($307.89 + $72.00)

Wages Payable

Payroll register for week ended

February 21.

4,966.00

2

3

401.15

379.89

4,184.96

11

12

13

5

6

7

8

9

10

4

9

21 Wages Payable

Cash--Payroll Bank Account

Paid wages for week ended

February 21.

4,184.96

10

4,184.96

11

12

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

299

44

40

45

40

44

43

Drew, W.

Garen, S.

North, O.

Ovid, N.

Ross, J.

Springer, O.

300

42

48

Caris, A.

TOTAL

HOURS

Bardin, J.

NAME

831.24

95.64

123.00

0.00

160.50

0.00

129.00

259.20

63.90

OVERTIME

EARNINGS

ALPINE COMPANY

8,753.24

945.64

943.00

860.00

1,016.50

1,960.00

989.00

1,123.20

915.90

TOTAL

381,095.24

45,120.64

7,373.00

41,010.00

44,891.50

107,860.00

44,834.00

45,463.20

44,542.90

ENDING

CUMULATIVE

EARNINGS

October 14, 20--

570.00

0.00

570.00

0.00

0.00

0.00

0.00

0.00

0.00

UNEMPLOYMENT

7,693.24

945.64

943.00

860.00

1,016.50

900.00

989.00

1,123.20

915.90

SOCIAL

SECURITY

8,753.24

945.64

943.00

860.00

1,016.50

1,960.00

989.00

1,123.20

915.90

MEDICARE

TAXABLE EARNINGS

PAYROLL REGISTER FOR WEEK ENDED

763.06

67.00

77.00

65.00

67.00

238.06

83.00

104.00

62.00

FEDERAL

INCOME

TAX

56.79

476.99

58.63

58.47

53.32

63.02

55.80

61.32

69.64

126.92

13.71

13.67

12.47

14.74

28.42

14.34

16.29

13.28

MEDICARE

TAX

DEDUCTIONS

SOCIAL

SECURITY

TAX

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

850.00

7,922.00

44,175.00

820.00

860.00

856.00

1,960.00

860.00

864.00

852.00

REGULAR

372,342.00

6,430.00

40,150.00

43,875.00

105,900.00

43,845.00

44,340.00

43,627.00

BEGINNING

CUMULATIVE

EARNINGS

Employee Earnings and Deductions

Problem 7-3A

CHAPTER 7

1,366.97

139.34

149.14

130.79

144.76

322.28

158.66

189.93

132.07

TOTAL

3945

CK.

NO.

7,386.27

806.30

793.86

729.21

871.74

1,637.72

830.34

3952

3951

3950

3949

3948

3947

#REF! 3946

783.83

NET

AMOUNT

PAYMENTS

CHAPTER 7

Employee Earnings and Deductions

Problem 7-3A (concluded)

GENERAL JOURNAL

DATE

1

2

3

4

5

6

7

8

20-Oct.

DESCRIPTION

PAGE

POST.

REF.

DEBIT

CREDIT

1

14 Wages Expense

Employees' Federal Income Tax

Payable

FICA Taxes Payable ($476.99 + $126.92)

Wages Payable

Payroll register for week ended

October 14.

8,753.24

2

3

763.06

603.91

7,386.27

11

12

13

5

6

7

8

9

10

4

9

14 Wages Payable

Cash--Payroll Bank Account

Paid wages for week ended

October 14.

7,386.27

10

7,386.27

11

12

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

301

47

Johnson, J.

40

Oscar, T.

Troy, B.

302

41

43

Nord, P.

43

46

Ginny, N.

42

40

Fine, J.

Maya, R.

40

Lund, D.

44

Don, V.

TOTAL

HOURS

Albee, C.

NAME

731,087.00

48,180.00

95,312.00

37,470.00

68,170.00

107,000.00

58,097.00

34,250.00

78,367.00

139,251.00

64,990.00

ENDING

CUMULATIVE

EARNINGS

TITAN COMPANY

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

UNEMPLOYMENT

11,626.00

930.00

1,832.00

720.00

1,310.00

1,900.00

1,117.00

660.00

1,507.00

0.00

1,650.00

SOCIAL

SECURITY

TAXABLE EARNINGS

14,667.00

930.00

1,832.00

720.00

1,310.00

2,100.00

1,117.00

660.00

1,507.00

2,841.00

1,650.00

MEDICARE

1,806.04

76.00

241.15

44.00

133.00

308.15

103.00

35.00

161.72

508.37

195.65

FEDERAL

INCOME

TAX

PAYROLL REGISTER FOR WEEK ENDED

720.80

57.66

113.58

44.64

81.22

117.80

69.25

40.92

93.43

0.00

102.30

SOCIAL

SECURITY

TAX

AR

AR

212.68

13.49 UW

26.56 UW

10.44 UW

19.00

30.45 UW

16.20 UW

9.57 UW

21.85 UW

41.19

360.00

20.00

25.00

20.00

70.00

20.00

25.00

35.00

25.00

95.00

25.00

AMOUNT

23.93 UW

MEDICARE

TAX

DEDUCTIONS

December 22, 20--

3,099.52

167.15

406.29

119.08

303.22

476.40

213.45

120.49

302.00

644.56

346.88

TOTAL

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

930.00

14,667.00

47,250.00

1,832.00

720.00

1,310.00

2,100.00

1,117.00

660.00

1,507.00

2,841.00

1,650.00

TOTAL

EARNINGS

716,420.00

93,480.00

36,750.00

66,860.00

104,900.00

56,980.00

33,590.00

76,860.00

136,410.00

63,340.00

BEGINNING

CUMULATIVE

EARNINGS

Employee Earnings and Deductions

Problem 7-4A

CHAPTER 7

CK.

NO.

11,567.48

762.85 2923

1,425.71 2922

600.92 2921

1,006.78 2920

1,623.60 2919

903.55 2918

539.51 2917

1,205.00 2916

2,196.44 2915

1,303.12 2914

NET

AMOUNT

PAYMENTS

12,890.00

930.00

1,832.00

720.00

1,310.00

2,100.00

1,507.00

2,841.00

1,650.00

SALES

SALARY

1,777.00

1,117.00

660.00

OFFICE

SALARY

EXPENSE ACCOUNT

DEBITED

CHAPTER 7

Employee Earnings and Deductions

Problem 7-4A (concluded)

GENERAL JOURNAL

DATE

1

2

3

4

5

6

7

8

9

10

11

20-Dec.

DESCRIPTION

PAGE

POST.

REF.

DEBIT

CREDIT

1

22 Sales Salary Expense

Office Salary Expense

Employees' Federal Income Tax

Payable

FICA Taxes Payable ($720.80 + $212.68)

Accounts Receivable

Employees' United Way Payable

Salaries Payable

Payroll register for week ended

December 22.

12,890.00

1,777.00

2

3

4

1,806.04

933.48

165.00

195.00

11,567.48

14

15

16

6

7

8

9

10

11

12

13

5

12

22 Salaries Payable

Cash--Payroll Bank Account

Paid wages for week ended

December 22.

11,567.48

13

11,567.48

14

15

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

303

304

×

$700.00

×

$210.00

$26.25 per hour

8 hours

Gross pay

Overtime pay

Regular pay

GROSS PAY

$910.00

210.00

$700.00

56.42

13.20

32.00

44.75

Social Security tax

Medicare tax

Union dues

Employee loan

Net pay

Total deductions

$62.00

Federal income tax

Less:

Gross pay

NET PAY

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

$17.50 per hour

40 hours

REGULAR PAY

OVERTIME PAY

Employee Earnings and Deductions

Problem 7-1B

CHAPTER 7

$701.63

208.37

$910.00

40

40

46

40

Lisk, J.

Myre, G.

Segel, T.

Torgel, I.

40

40

Hamn, R.

TOTAL

HOURS

Grant, L.

NAME

Problem 7-2B

4,392.00

44,505.00

161.58

0.00

161.58

0.00

0.00

0.00

0.00

OVERTIME

EARNINGS

4,553.58

748.00

879.58

770.00

712.00

724.00

720.00

TOTAL

49,058.58

8,249.00

7,464.58

10,359.00

7,510.00

7,220.00

8,256.00

ENDING

CUMULATIVE

EARNINGS

1,121.00

0.00

415.00

0.00

202.00

504.00

0.00

UNEMPLOYMENT

4,553.58

748.00

879.58

770.00

712.00

724.00

720.00

SOCIAL

SECURITY

4,553.58

748.00

879.58

770.00

712.00

724.00

720.00

MEDICARE

TAXABLE EARNINGS

April 14, 20--

297.00

47.00

67.00

52.00

43.00

44.00

44.00

FEDERAL

INCOME

TAX

DEDUCTIONS

44.64

282.32

46.38

54.53

47.74

44.14

44.89

10.44

66.03

10.85

12.75

11.17

10.32

10.50

645.35

104.23

134.28

110.91

97.46

99.39

99.08

TOTAL

3,908.23

643.77

745.30

659.09

614.54

624.61

620.92

NET

AMOUNT

CK.

NO.

305

2949

2948

2947

2946

2945

2944

PAYMENTS

Employee Earnings and Deductions

SOCIAL

SECURITY MEDICARE

TAX

TAX

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

748.00

718.00

770.00

712.00

724.00

720.00

REGULAR

7,501.00

6,585.00

9,589.00

6,798.00

6,496.00

7,536.00

BEGINNING

CUMULATIVE

EARNINGS

HARVEST COMPANY

PAYROLL REGISTER FOR WEEK ENDED

CHAPTER 7

CHAPTER 7

Employee Earnings and Deductions

Problem 7-2B (concluded)

GENERAL JOURNAL

DATE

1

2

20-Apr.

3

4

5

6

7

8

DESCRIPTION

POST.

REF.

PAGE

DEBIT

CREDIT

1

14 Wages Expense

Employees' Federal Income Tax

Payable

FICA Taxes Payable ($282.32 + $66.03)

Wages Payable

Payroll register for week

ended April 14.

4,553.58

2

3

297.00

348.35

3,908.23

4

5

6

7

8

9

9

14 Wages Payable

Cash--Payroll Bank Account

Paid wages for week ended

April 14.

10

11

12

13

3,908.23

10

3,908.23

11

12

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

306

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

42

40

42

44

40

41

46

42

Dore, C.

Gayle, A.

Hale, R.

Jilly, B.

Karn, S.

Ober, N.

Wong, J.

TOTAL

HOURS

Bolt, D.

NAME

Problem 7-3B

10,000.00

380,754.00

668.25

60.00

189.00

30.75

0.00

240.00

73.50

0.00

75.00

OVERTIME

EARNINGS

10,668.25

860.00

1,029.00

850.75

1,980.00

1,840.00

1,053.50

1,980.00

1,075.00

TOTAL

391,422.25

28,112.00

7,824.00

30,788.75

37,134.00

107,740.00

33,783.50

138,220.00

7,820.00

ENDING

CUMULATIVE

EARNINGS

460.00

0.00

205.00

0.00

0.00

0.00

0.00

0.00

255.00

UNEMPLOYMENT

7,748.25

860.00

1,029.00

850.75

1,980.00

900.00

1,053.50

0.00

1,075.00

SOCIAL

SECURITY

10,668.25

860.00

1,029.00

850.75

1,980.00

1,840.00

1,053.50

1,980.00

1,075.00

MEDICARE

TAXABLE EARNINGS

1,141.37

55.00

89.00

53.00

295.70

208.06

83.00

260.61

97.00

FEDERAL

INCOME

TAX

480.40

53.32

63.80

52.75

122.76

55.80

65.32

0.00

66.65

SOCIAL

SECURITY

TAX

154.70

12.47

14.92

12.34

28.71

26.68

15.28

28.71

15.59

MEDICARE

TAX

DEDUCTIONS

1,776.47

120.79

167.72

118.09

447.17

290.54

163.60

289.32

179.24

TOTAL

8,891.78

739.21

861.28

732.66

1,532.83

1,549.46

889.90

1,690.68

895.76

NET

AMOUNT

CK.

NO.

307

1870

1869

1868

1867

1866

1865

1864

1863

PAYMENTS

Employee Earnings and Deductions

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

800.00

840.00

820.00

1,980.00

1,600.00

980.00

1,980.00

1,000.00

REGULAR

27,252.00

6,795.00

29,938.00

35,154.00

105,900.00

32,730.00

136,240.00

6,745.00

BEGINNING

CUMULATIVE

EARNINGS

September 21, 20--

WILLIAMS COMPANY

PAYROLL REGISTER FOR WEEK ENDED

CHAPTER 7

CHAPTER 7

Employee Earnings and Deductions

Problem 7-3B (concluded)

GENERAL JOURNAL

DATE

1

2

20-Sept.

3

4

5

6

7

8

DESCRIPTION

PAGE

POST.

REF.

DEBIT

CREDIT

1

21 Wages Expense

Employees' Federal Income Tax

Payable

FICA Taxes Payable ($480.40 + $154.70)

Wages Payable

Payroll register for week

ended September 21.

10,668.25

2

3

1,141.37

635.10

8,891.78

4

5

6

7

8

9

9

21 Wages Payable

Cash--Payroll Bank Account

Paid wages for week ended

September 21.

10

11

12

13

8,891.78

10

8,891.78

11

12

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

308

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

TOTAL

HOURS

40

42

40

40

40

40

40

40

44

42

NAME

Chang, C.

Dugan, T.

Fancher, K.

Gannon, T.

Jones, L.

Lange, M.

Milton, D.

Naylor, B.

Orton, A.

Tiosha, J.

Problem 7-4B

517,356.00

49,185.00

96,118.00

38,219.00

38,994.00

108,300.00

38,539.00

33,905.00

38,405.00

41,111.00

34,580.00

ENDING

CUMULATIVE

EARNINGS

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

UNEMPLOYMENT

11,131.00

1,065.00

1,780.00

720.00

1,310.00

600.00

750.00

660.00

725.00

2,841.00

680.00

SOCIAL

SECURITY

TAXABLE EARNINGS

12,631.00

1,065.00

1,780.00

720.00

1,310.00

2,100.00

750.00

660.00

725.00

2,841.00

680.00

MEDICARE

1,482.67

95.00

228.15

44.00

133.00

308.15

49.00

35.00

44.00

508.37

38.00

FEDERAL

INCOME

TAX

690.12

66.03

110.36

44.64

81.22

37.20

46.50

40.92

44.95

176.14

42.16

SOCIAL

SECURITY

TAX

AR

AR

183.15

15.44 UW

25.81

10.44

19.00 UW

30.45 UW

10.88 UW

9.57

10.51 UW

300.00

25.00

70.00

—

20.00

35.00

25.00

—

25.00

20.00

80.00

AMOUNT

41.19 UW

9.86

MEDICARE

TAX

DEDUCTIONS

201.47

434.32

99.08

253.22

410.80

131.38

85.49

124.46

745.70

170.02

TOTAL

CK.

NO.

9,975.06

863.53 2923

1,345.68 2922

620.92 2921

1,056.78 2920

1,689.20 2919

618.62 2918

574.51 2917

600.54 2916

2,095.30 2915

509.98 2914

NET

AMOUNT

PAYMENTS

9,121.00

1,065.00

1,780.00

720.00

1,310.00

725.00

2,841.00

680.00

SALES

SALARY

309

3,510.00

2,100.00

750.00

660.00

OFFICE

SALARY

EXPENSE ACCOUNT

DEBITED

Employee Earnings and Deductions

2,655.94

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

1,065.00

12,631.00

48,120.00

1,780.00

720.00

1,310.00

2,100.00

750.00

660.00

725.00

2,841.00

680.00

TOTAL

EARNINGS

504,725.00

94,338.00

37,499.00

37,684.00

106,200.00

37,789.00

33,245.00

37,680.00

38,270.00

33,900.00

BEGINNING

CUMULATIVE

EARNINGS

December 29, 20--

BEST SPORTS COMPANY

PAYROLL REGISTER FOR WEEK ENDED

CHAPTER 7

CHAPTER 7

Employee Earnings and Deductions

Problem 7-4B (concluded)

GENERAL JOURNAL

DATE

1

2

20-Dec.

3

4

5

6

7

8

9

10

11

DESCRIPTION

PAGE

POST.

REF.

DEBIT

CREDIT

1

29 Sales Salary Expense

Office Salary Expense

Employees' Federal Income Tax

Payable

FICA Taxes Payable ($690.12 + $183.15)

Accounts Receivable

Employees' United Way Payable

Salaries Payable

Payroll register for week

ended December 29.

9,121.00

3,510.00

29 Salaries Payable

Cash--Payroll Bank Account

Paid wages for week ended

December 29.

9,975.06

2

3

4

1,482.67

873.27

150.00

150.00

9,975.06

5

6

7

8

9

10

11

12

12

13

14

15

16

13

9,975.06

14

15

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

310

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 7

Employee Earnings and Deductions

SOLUTIONS TO ACTIVITIES

CONSIDER AND COMMUNICATE

Suggested Response

It is true that a second bank reconciliation would be necessary if there were a payroll bank

account. There might also be additional service charges, depending on the bank and the

type of checking account. However, the primary advantage of using a second account

dedicated to payroll is that payroll funds are separated from the general checking account

funds. The reconciliation of both accounts is simplified because of the separation of

checking accounts and it limits the number of people who have access to the payroll

records.

A QUESTION OF ETHICS

Suggested Response

This action is neither unethical nor illegal. An employee may claim fewer allowances than

he or she is entitled to claim. Some people choose to have more taxes deducted because

they do not want to owe taxes on April 15 of the next year. However, this practice is not

encouraged unless one is extremely familiar with his or her tax position. Penalties may

occur if there is no legal basis for the number of allowances claimed.

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

311