Intel Corporation - NUS Investment Society

advertisement

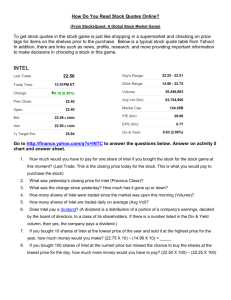

Intel Corporation Target Price: 29.52 USD (+2.95%) 22ndSeptember 2015 Last Closed Price: 12M Target: Upside Potential: GICS Sector: GICS Sub-­‐Industry: Bloomberg Ticker: 28.67 USD 29.52 USD 2.95% Information Technology Semiconductors INTC US Equity Summary of Investment Thesis Market Dominance in Microprocessors Intel has a staggering 99% market share on the server microprocessor market, with almost more than 95% of the world's servers are powered with Intel's Xeon Chips. Achieving an impressive average growth 13.2% of over the past 8 quarters on server microprocessor chips, we estimate a 10% per annum of growth will continue in the next two to four years. This figure is an estimate based on the current 15% CAGR growth of the server microprocessor market. Expected Rebound of Global PC Demand Intel's Skylake has received over 800 design wins from different manufacturers, who will be using Skylake in their sales of laptops, notebooks and hybrid 2-­‐in-­‐1s. With Intel’s estimates of around 500-­‐750 million consumers with PCs that are 4-­‐7 years old, the Company is poised to generate significant amounts of sales in the coming year from the market looking to replace their computer hardware. 3Y Price v. Relative Index 3Y Price v Relative Index 200% 150% 100% 50% 0% 2/1/13 2/1/14 2/1/15 Intel Relative Price NASDAQ Source: Yahoo! Finance Company Description Intel Corporation was founded in 1968 and is based in Santa Clara, California. It designs, manufactures, and sells integrated digital technology platforms worldwide. The company’s platforms are used in various computing applications, offers microprocessors that processes system data and controls other devices in the system, and wired network connectivity products. Key Financials 138,626 4,909 3.33% 99.8% 37.90 24.87 12.15 Market Capitalization (mil USD) Shares Outstanding (mil) Dividend yield Float 52-­‐Wk High 52-­‐Wk Low P/E (ttm) (USD mil) P/E (x) P/B (x) Current ratio Div Yield (%) D/E (%) EBITDA (mil) EPS (x) ROE (%) FY11A 13.77 2.21 2.36 3.47 57.47 20,887 1.89 18.89 FY12A 17.47 3.11 1.73 2.48 64.08 24,542 2.31 17.22 Key Executives Executive Chairman CEO, Director of Exec. Committee President CFO, VP Coporate Strategy Exec. VP, Gen. Manager of Tech and Manufacturing Group FY13A -­‐ -­‐ 2.83 -­‐ 50.32 24,711 -­‐ 19.70 FY14A -­‐ -­‐ 3.27 -­‐ 52.40 25,082 -­‐ 18.67 Andy D. Bryant Brian M. Krzanich Ren J. James Stacy J. Smith William M. Holt Huge Potential in Taking the Data Center Market As cloud computing continues to garner significant investment, Intel's server processor business will be an indirect beneficiary. Recently, tablets are the preferred choice to compute data through cloud servers that would require substantial server capacities, providing a platform for Intel's profitable server processor business. In the coming 5 years, we expect DCG to grow at 17.40%, with the DCG segment given a pro-­‐rated revenue weight at 29.18%. Competitive Positioning As Intel looks to shift its focus to establishing greater market dominance in its Data Centre Group business segment (where it has shown revenue growth from 21% in 2012 to 26% in 2014), it has acquired Altera Corporation. The Company plans to leverage on Altera's leading field-­‐ programmable gate array (FPGA) technology, an integrated circuit designed to be configured by a customer or a designer after manufacturing. This will allow Intel to defend and increase competitiveness in its profitable business by producing the server chips to be used in data centres. Future tech Intel is forward looking in researching nanoelectromechanical (NEM) relays over its competitors. This piece of emergent technology has widespread applications in next-­‐generation computing, and its main advantage is in that it can operate in very high temperatures. Compared to competitors using the easier-­‐to-­‐manufacture MEM and CMOS relays, Intel has a first mover advantage in producing for automotive, aerospace and geothermnal energy industries. Furthermore, in terms of presently known emerging technologies, only NEM relays can further improve FPGA. As IoT market expands and requires heavier duty data center storage needs, FPGA is used for these computationally intensive systems. Also, the most powerful supercomputer in the world today relies entirely on Intel processing power, utilising 80,000 units of Intel Xeon microprocessors, a 16 times increase in microprocessor use for 3 times the performance improvement on its predecessor. In terms of development, scientists estimate supercomputers will become 1,000 times more powerful by 2018 and 1,000,000 times more powerful by 2030. This is a market that Intel will continue to see dominance in, and with higher computational needs, Silicon and Manufacturing Technology Leadership Intel is the market leader in silicon process technology and combines this with the relentless pursuit of Moore’s Law. The Company drives a regular and predictable upgrade cycle by introducing a new microarchitecture every two to three years, and increases transistor density in the intervening periods (“Tick-­‐tock” development cadence). the Company will also profit from the exponentially higher data center use. Company Overview Figure 1:FY14 – Total Revenue Intel designs and manufactures advanced integrated digital technology platforms. A platform consists of a microprocessor and chipset, and may be enhanced by additional hardware, software, and services. These platforms are sold primarily to original equipment manufacturers (OEMs), original design 0.4% 4.0% 4.0% manufacturers (ODMs), and industrial and communications equipment 3.8% manufacturers in the computing and communications industries. The platforms are used to deliver a wide range of computing experiences in notebooks (including Ultrabook™ devices), 2 in 1 systems, desktops, servers, tablets, smartphones, and the Internet of Things (including wearables, 25.8% transportation systems, and retail devices). Intel also develops and sells software and services primarily focused on security and technology integration. The company was incorporated in California in 1968 and reincorporated in Delaware in 1989. PC Client Group Revenue Breakdown Data Center Group Revenue totalled USD$55.8 billion in FY14 while operating profit totalled Internet of Things Group USD$15.3 billion. Intel derives more than 87.9% of its revenue from the “PC Mobile and Communica;ons Group Client Group” and “Data Center Group” business segments, while the smallest So=ware and services opera;ng segments Others segment, “Mobile and Communications Group”, takes up 0.4% of total revenue. “Others” comprises ‘Netbook Group’, ‘New Devices Group’ and ‘Non-­‐volatile Source: Intel Annual Report 2014 Memory Solutions Group’. Intel’s most profitable business segments are the PC Client Group and Data Center Group, with profit margins of 42% and 50% Figure 2a: Geographical revenue respectively in FY14. breakdown The Company has significant presence in 5 main countries: Singapore, China, US, Taiwan and Japan. About 80% of revenue is generated from these countries while the remaining 20% is generated elsewhere. 5 Main Business Segments 20.7% 20.7% 5% 20% 16% 17.6% Singapore China (inc. HK) US Taiwan Japan Others Source: Intel Annual Report 2014 PC Client Group: Includes platforms designed for • Notebooks (e.g. Ultrabook devices) • 2-­‐in-­‐1 systems • desktops (all-­‐in-­‐ones and high-­‐end enthusiast PCs) • tablets • wireless and wired connectivity products • home gateway and set-­‐top box components Data Center Group: • server • network, and storage platforms designed for the enterprise • cloud computing • communications, infrastructure, and technical computing segments Internet of Things Group: Includes platforms designed for embedded market segments (retail, transportation, industrial and others). Mobile and Communications Group: Includes platforms designed for • tablet and smartphone market segments • mobile communications components such as baseband processors, radio frequency transceivers, Wi-­‐Fi, Bluetooth technology, global navigation satellite systems, and power management chips Software and services operating segments: • endpoints security • network and content security • consumer and mobile security from McAfee • software products and services that promote Intel architecture as the platform of choice for software development Industry Analysis & Competitive Positioning Figure 2b: Geographical revenue breakdown Cyclical PC Demand 15,000 10,000 5,000 0 11' 12' 13' 14' 15' Singapore China (&Hong Kong) United States Taiwan Japan Other countries Figure 3: Annual ROE 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% -­‐1.00% ROE Source: Capital IQ Figure 4: FPGA Market Share 12% 49% 39% Xilinx Altera Others The health of the semiconductor industry is highly dependent on the demand for PCs, which is cyclical. In the past 5 years, there has been a slowdown in PC sales, as shown in Figure 4. The recent slowdown in PC demand can be attributed to the increased demand in tablets, and also to the strong U.S. dollar against other currencies, thus weakening demand from other countries (e.g. Asia-­‐Pacific). Given the slowdown, Intel is expecting their fiscal 2015 revenue to fall as well. To offset the decline in the PC portion, Intel has been looking to shift its focus towards its Data Centre Group, where it has shown revenue growth from 21% in 2012 to 26% in 2014. However, we predict that the global demand for PC will rebound upon the launches of Intel's core processor micro-­‐architecture Skylake and Microsoft's Windows 10. Intel's Skylake has received over 800 design wins from different manufacturers, who will be using Skylake in their sales of laptops, notebooks and hybrid 2-­‐in-­‐1s. This could mark a reversal of the slow growth of PC demand to an uptrend as Intel estimates that around 500-­‐750 million PCs are 4-­‐7 years old; consumers will be looking to replace their computers in the next few years. Intel's acquisition of Altera — A Defensive Manoeuvre On 1 June 2015, Intel Corporation announced plans to acquire Altera Corporation for approximately $16.7 billion. The acquisition will couple Intel’s products and manufacturing process with Altera’s leading field-­‐ programmable gate array (or FPGA) technology, resulting in a configurable integrated circuit (Altera, 2014). The combination is expected to enable new classes of products that meet customer needs in the data center and Internet of Things market segments. 84% of Altera's revenue comes from the FPGA technology, taking up 37% of the market share. This can be seen as a defensive positioning by Intel to diversify its products in response to slowing PC sales revenue. The backward vertical integration indicates Intel’s attempt to control the supply of the FPGA, which complements the company’s plans of ramping up growth in the DCG and IoT segments. This will allow Intel to defend and increase competitiveness in the growing and profitable business segments— producing server chips to be used in data centres. Porter’s 5 Forces for Semi-­‐Conductor Industry Competitive Rivalry The semi-­‐conductor industry is categorized by intense rivalries between individual companies. There is constant pressure on chip makers to come up with better products and innovation. The result is an industry that continually produces cutting-­‐edge technology while riding volatile business conditions. Bargaining Power of Customers Most of the industry's key segments are dominated by a small number of large players. This results in consumers having relatively little bargaining power. Threat of New Entrants The semi-­‐conductor industry is one that has high barriers to entry due to high cost of entry and R&D. The cost of entry makes it extremely difficult for new companies to compete with established companies in technology innovation. Bargaining Power of Suppliers Large semiconductor companies have hundreds of suppliers for component parts and as such, suppliers have little bargaining power in the industry. This Figure 5: Porter’s 5 Forces Porter's 5 Forces Compe;;ve Rivalry Threat Of Subs;tute Products Bargaining Power Of Suppliers Bargaining Power Of Customers Threat Of New Entrants Strengths -­‐Integrated device manufacturer -­‐Emphasis on R&D -­‐ Brand equity and recognition Weaknesses -­‐ Declining PC sales -­‐ Excess capacity Opportunities -­‐ Acquisition of Altera Corporation -­‐ Emergence of IoT market Threats -­‐Intense competition Figure 6: SWOT Analysis diffusion of risk over many suppliers allows companies to keep the bargaining power of any one supplier to a minimum. Threat of Substitute Products There is high threat of substitutes in the semiconductors industry. The nature of the industry is such that companies spend huge amounts on R&D to constantly innovate and develop new products. As such. while intellectual property protection might stop the threat of new substitute chips for a period of time, within a short period of time companies start to produce similar products at lower prices. SWOT Analysis Strength One key strength Intel has is its position as an integrated device manufacturer (IDM) where it primarily manufactures its products in its own facilities. With technology becoming more advanced, semiconductor products are becoming increasingly complex. As such, it is important for researchers and manufacturers to be in the same physical location to ensure any complexities in design or manufacturing are addressed in real time. This gives Intel an edge over other semi-­‐conductor companies with the fabless-­‐foundry model, where the designers and manufacturers are separated which increases the product development cycle. Furthermore, Intel’s in-­‐house manufacturing capability has streamlined the process of production, shortened its time to market, and scaled new products more rapidly. Another strength of Intel is its emphasis on R&D. A high level of investment in R&D is especially important for companies in the semi-­‐conductor industry to stay ahead of the competition where technology is constantly evolving and consumer expectations rising. Lastly, Intel has strong brand equity and recognition. Once it develops a new product, it is relatively easy for the new product to be accepted and adopted by consumers. Weakness Intel's major weakness is the declining PC sales in recent years. To reduce the impact of the slowdown in the PC market, Intel needs to diversify into adjacent market segments, such as smartphones and tablets. However, the success into these new markets depend upon several factors, such as the innovation of new products, distribution and marketing strategies, and competition. Another weakness for Intel is its excess capacity. As a result of falling PC sales, Intel has not been manufacturing as much as in the past, and this has resulted in its manufacturing plants having excess capacity. This is a large amount of fixed cost that could be split up among more products if Intel had been manufacturing more products. Opportunities The emergence of Internet of Things (IoT) can also be seen as an opportunity for intel. International Data Corporation has estimated that the IoT market will be growing at a Compounded Annual Growth-­‐Rate (CAGR) of 7.9%, from 2013 to 2020. These devices are produced at an exponential rate, with the market for IoT solutions projected to grow from US$1.9 trillion to US$7.1 trillion in 2020 (Forbes, 2014). Threats Intel is facing strong competition to sustain its market share. For example, Samsung has overtook Intel in it’s R&D spending and is giving tough competition to The Company in technology innovation. Samsung has also gone ahead of Intel by developing the industry’s first 3D Vertical NAND flash memory. 3D Vertical NAND flash memory chips would double the capacity of existing solid-­‐state drive chips and are 50% more power efficient. Dupont analysis Figures Next Profit Asset Equity ROE (%) TTM largest margin competito (%) r in segment turnover (%) multiplier (%) Intel PC Client Group NVIDIA DEG Microchip Microprocessor Technology Data Center EMC 21.1 11.0 18.9 61.1 68.4 44.2 156.8 167.0 176.1 20.2 12.6 14.7 10.7 55.0 223.4 13.1 Symantec 12.1 49.0 216.9 12.9 Group Software Services Group (Anti-­‐virus) The above table lists Intel’s largest competitors by market share. We can observe that The Company has perfomed well in the last twelve months in ROE, exceedings its closest competitors in terms of profit margin by a considerable extent. Despite Intel’s overall favourable position, it may be able to improve on its efficiency in utilising its assets to generate sales. In that regard, NVIDIA is outperforming with a total asset turnover of 68.4% over Intel’s 61.1%. This is interesting to note as Intel’s depreciation over the years has outpaced its capital expenditure. Coupled with a projected increase in current ratio to around 3.27 in the next years, Intel’s management ought to better increase efficiency in asset use. The Company on the whole outperforms the rest of the industry in terms of its financial leverage. However, we can see here that this is not the case when compared to its closest competitors. All the other four companies rely less on equity financing than Intel, but the cost effectiveness of this strategy depends on a multitude of factors, the effects of which would only be evident in the long run. Financials On the whole, Intel has performed remarkably amidst market sentiment that the PC market has begun its slowdown. In 2014, earrnings per share (EPS) grew by 22.65% following two years of negative growth. It is important to note that Intel has over the years used stock buyback as a way of compensting its investors on top of issuing dividends. While it is uncertain how many new shares The Company will issue in the immediate future, projections for returns on capital are upward looking, growing to a new baseline of around 14% (14.15% in 2015), following returns of 10.8% and 12.79% in 2014 and 2013 respectively. According to our valuation, gross profit will continue to be strong and grow year on year. However due to increasingly high R&D costs associated with the relentless pursuit of Moore’s Law, net income will suffer, with little to negative growth in the immediate future (-­‐5.48% and 0.42% in 2015 and 2016 respectively). Figure 7: Assumptions Risk free rate Market risk premium Beta Cost of debt Corporate tax rate Terminal growth rate Source: Based on estimates 2.30% 13.82% 0.85 2.46% 35.00% 2.95% Investment Thesis Intel's near-­‐monopoly on server microprocessor market Intel has a staggering 99% market share on the server microprocessor market. Almost more than 95% of the world's servers are powered with Intel's Xeon Chips, based on the x86 chip architecture. With Intel’s acquisition of Altera, The Company plans to closely integrate FPGA onto its server processor chips, which is essential in cloud computing and data centres. Intel now boasts server microprocessor chip sales of $11.5 billion, which is 20.6% of its total revenue. Achieving an impressive average growth 13.2% of over the past 8 quarters on server microprocessor chips, we estimate about 10% per annum of growth will continue in the next two to four years. This figure is an estimate based on the current 15% CAGR growth of the server microprocessor market, but lowered expectations due to the depreciation of global currencies against the dollar, weakening demand. Nevertheless, strong growth in cloud and network infrastructure will be a key growth driver for the next 5 years, especially with the emergence of the Internet of Things. This will offset the weakening demand of the PC market in the imminent future. Skylake Processor expected to spur PC Demand Intel believes that there are between 500-­‐750 million PCs that are at least 4-­‐7 years old, and have made campaign plans to target these group of people to replace their PCs. Intel’s new Skylake processor would be the flagship product, boasting features such as higher performance, longer battery life, RealSense 3D cameras and enhanced form factors. Apart from improvements in performance and power efficiency, Intel’s Skylake processors will also offer new wireless charging and data transfer for a wire-­‐free computing environment. The new modifications offered by the Skylake Processor is likely to appeal to the IT-­‐savvy and the younger generation who seek to own the latest and most high-­‐tech device in the market. Hence, it will not be surprising if the Skylake Processor achieves significant market penetration, which ultimately boosts demand for PCs. Huge growth potential for Intel's Data Center Group As cloud computing continues to garner significant investment, Intel's server processor business will be an indirect beneficiary. Recently, tablets are the preferred choice to compute data through cloud servers that would require substantial server capacities, providing a platform for Intel's profitable server processor business. The rapid expansion of cloud computing and big data market will help Intel’s Data Center Group (DCG) in its long-­‐term growth. Data centers have gained increasing importance, especially with the exponential growth in the IoT market. Data centers and IoT will grow in tandem as IoTs would need to rely on huge amounts of data to be stored, with IoTs expected to multiply from about 5 billion to 30 billion in 2020. Intel’s 2014 Annual Report has already indicated that DCG’s percentage of revenue has increased from 21% to 26% from 2012-­‐2014. In the coming 5 years, we expect DCG to grow at 17.40%, with the DCG segment given a pro-­‐rated revenue weight at 29.18%. Furthermore, Intel’s new acquisition would play a major role in Intel’s plans to advance in its DCG. Altera's FPGA is being integrated with Intel's Xeon's chips for customisation and scalability for increasing loads of data, which is part of Intel's key features of its DCG segment. Huge growth potential in IoT segments Intel has the intention to capitalise on the rapid growth of Internet of Things (IoT), as IDC estimates that the IoT market will grow at a 7.9% CAGR from 2013 to 2020. In addition, the business segment is becoming more profitable, with profit margins improving from 17% in FY12 to 28% in FY14. As of today, Intel's addressable market within the overall IoT market adds up to an opportunity worth over $8.7 billion and is predicted to increase over time. While the $8.7 billion served addressable market is nowhere near as large as the opportunities that Intel has in the PC and server chip markets, it is still a substantial revenue opportunity. Nimbleness of Intel -­‐ Rapidly adapting to transformations Intel has been alert in adapting to demand changes in the technological landscape as consumer’s preference shift towards smaller, equally as powerful, mobile devices in place of PCs. The proliferation of mobile devices, at the expense of an ageing PC market, presents a significant risk towards Intel revenue, with more than 60% generated from the PC Client Group segment. Sticking to the strategy of expanding market share within the PC market, which is a main contributor of Intel’s success today, might no longer be viable. To mitigate this, Intel has been appreciably successful in shifting its focus of offering high-­‐performance, power-­‐hungry processors to low-­‐power consuming designs that inhabit most mobile devices such as smartphones and tablets. Their latest innovation, the Atom processor, which runs on Intel’s Silvermont architecture 22-­‐nanometer platform, has modifications that are comparable in power efficiency relative to competitors. This technology highlights Intel’s solid foundation in the new space, and positions the company well for competition as more winning designs emerge in future. We see Intel’s focus towards other product segments a huge plus point for the company, portraying their ability and willingness to leave their roots and adapt quickly to compete in new markets. Valuation Valuation methodology for next 10 years We employed the discounted cashflow (DCF) valuation method to arrive at the one year target price of USD$31.76. As Intel is a company with segments of vastly different natures, revenue projection was decomposed according to division. Over the past 5 years, Intel has reliably met its “tick-­‐tock” model of microarchitectural improvement with each cycle lasting 2 years. The revenue projection for 2015 (Skylake – “Tock”) averages the growth of the previous two “Tock” designations in 2013 and 2011. As Intel is set to continually shrink its process technology to 10nm in 2016 with the release of Kaby Lake (“Tick”), the revenue earnings projected averages the growth of the previous two “Tick” designations in 2014 and 2012. This method cannot reliably forecast the potential and limitations of improving transistor gate lengths forever, and the later years employ a division-­‐based projections weighted according to percent revenue in 2015. Intel has much potential to develop its presence in the System-­‐on-­‐Chip market, where no major player in the semi-­‐conductor industry has gained a certain foothold due to its requirements in complex engineering and technical knowhow. This roughly represents 5.41% of Intel’s current revenue and is poised to grow the fastest at 19.14%. Its other growth drivers come from IoT segments, which are augmented by its need for more data centers in DCG. Their combined growth average 14%, coupled with SoC, offsets the downturn in the traditional PC Client Group, which is responsible for 57.12% of Intel’s revenue today. Valuation considerations for terminal growth According to Redshift theory, it is difficult to tell if Moore’s Law-­‐backed innovation strategy will under-­‐ or overserve increasingly segmented information technology markets. In our valuation, we adopted an extremely conservative assumption that over the projection period of 10 years, all of Intel’s business segments have reached relative saturation (blueshifting) in its customer markets. Thereafter, any growth will closely follow GDP growth. Of particular interest is China, where it is assumed that the current slowdown in GDP growth will persist and maintain at an average of 3.9%. One significant weakness of our valuation method is that a comprehensive sum-­‐of-­‐the-­‐parts analysis was not used. Due to our reliance on division decomposition for revenue projection, a detailed SOTP valuation would better maintain analytic consistency and account for cash flows in riskier emerging markets, which should be discounted at a higher discount rate. However, a detailed SOTP valuation would also present some difficult challenges and take on a vastly greater number of assumptions that could result in errors. For example, given the dynamic and unpredictable nature of the IT market, it would be difficult to identify the main revenue drivers and growth segments, and subsequently value them independently. Furthermore, such a method of analysis requires accurate information on capital expenditure, investments and reinvestment rates by region, which is not forthcoming. Even revenue projection by business segment alone would be problematic, as future allocation judgments cannot be reliably estimated. Other notes on valuation In our valuation, we put increased weight on R&D costs, and assumed that administrative and general costs were centralized due to the economies of scale of Intel. We also distressed any growth in value of Intel’s goodwill. Given that Intel makes consistently significant yearly acquisitions (USD$934 million in 2014), goodwill and by extension total assets will continually be inflated, distorting the true value of the company since goodwill by itself does not generate cashflows. Finally, given that Intel is the market leader in the PC Client Group (69.06% of market share) and the second most dominant player in the Data Center Group (24.21%), we took the excess return period to be 10 years. Intel’s strong marketing channels and recognizable brand name also back this, even if it does happen to operate in a highly competitive industry. The terminal value of the firm is calculated one year past the projection period. The long-­‐term growth rate is calculated by the revenue-­‐weighted GDP growth rates of the countries Intel operated in in terms of 2016 projections by OECD. Sensitivity analysis We conducted a sensitivity analysis on our valuation to test for robustness. The two factors varied are long-­‐term growth rate and WACC, which includes zero percent growth and negative growth for the former. Over the range of extreme values, the share price obtained was between USD$26.89 (6.09% downside) and USD$33.46 (16.70% upside). Key Investment Risks Slowing Demand in Key Revenue Generating Operations and Increasing Competition Intel’s main source of revenue comes from its PC Client Group (62% of revenue). The PC is still Intel's most important market, despite the company's growing server chip business and its aggressive entry into the mobile market. Over the past few years, Intel has been largely able to weather any weakness in the PC market by winning market share from AMD, particularly at the low end of the market, where Intel traditionally has not focused on. However, market share has reached a point of saturation and Intel's performance is now more dependent on the ups and downs of the PC market. Also, International Data Corporation (IDC) expects PC shipments to decline by 6.2% in 2015, marking it the fourth year of volume declines. In addition, Intel's focus on its into low-­‐end PCs with its Atom processors could prove to be a bad decision. Low-­‐end PCs could cannibalize mid-­‐range PCs leading to a mix-­‐shift toward the low end, which could potentially hurt Intel's top line. Another issue could be a refocused Advanced Micro Devices (AMD). In 2016, AMD plans to launch its new Zen processors, which will focus mainly on the high-­‐end segment. With AMD mostly abandoning the low-­‐end segment, Intel could face stiff competition in the high end PC market. Also, Intel’s DCG faces significant competition from UK semiconductor designer ARM Holdings, whose business model in the recent years has focused on producing the most energy efficient chips in the industry. Since data centers face the problem of breaking through the energy efficiency ceiling, Intel will have to divert even more funds into R&D to keep up with the competition. Huge Spendings with Uncertain Future Intel's acquisition of Altera Corporation in an all -­‐cash deal for approximately $16.7 billion still leaves much to be considered. Intel bought Altera's shares at $54 per share, as opposed to the market price of $48.85 at the time of purchase. This is the most expensive acquisition Intel has made in its 47-­‐year history and many analysts have critiqued it as being excessively expensive. Moreover, Intel has been buying its way into the mobile market by subsidizing Original Equipment Manufacturers (OEMs) with steep discounts on chips, co-­‐ marketing agreements, and financial assistance in redesigning logic boards. This has caused its mobile unit to post an operating loss of $4.2 billion last year -­‐ down from a loss of $3.1 billion in 2013. As of now, it is still unclear if its billions spent on the acquisition of Altera Corporation and mobile subsidies will pay off eventually. This research material has been prepared by NUS Invest. NUS Invest specifically prohibits the redistribution of this material in whole or in part without the written permission of NUS Invest. The research officer(s) primarily responsible for the content of this research material, in whole or in part, certifies that their views are accurately expressed and they will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this research material. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. This report is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein. The research material should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this research material are subject to change without notice. ©2015 NUS Invest Research Analysts: Don Chng Ying Hao Kelvin Tan Wei Ming Liu Zhihao e0003985@u.nus.edu kelvin.tan@u.nus.edu A0124265@u.nus.edu Wilson Lim wilsonlim01@u.nus.edu