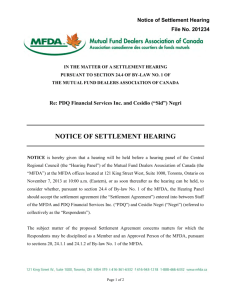

Notice of Application 201234 Re: PDQ Financial Services Inc.

advertisement

Notice of Application File No. 201234 IN THE MATTER OF AN APPLICATION PURSUANT TO SECTION 24.3 OF BY-LAW NO. 1 OF THE MUTUAL FUND DEALERS ASSOCIATION OF CANADA Re: PDQ Financial Services Inc. NOTICE OF APPLICATION (Section 24.3 of By-law No. 1) NOTICE is hereby given that an application pursuant to section 24.3 of By-law No. 1 of the Mutual Fund Dealers Association of Canada (the “MFDA”) will be brought by Staff of the MFDA (“Staff”), with notice to the Member, PDQ Financial Services Inc. (“PDQ”), before a hearing panel of the MFDA’s Central Regional Council (the “Hearing Panel”) in the MFDA hearing room located at 121 King Street West, Suite 1000, Toronto, Ontario on August 30, 2012 at 10:00 a.m. or as soon thereafter as the hearing can be held. DATED this 28th day of August, 2012. “Jason D. Bennett” Jason D. Bennett Corporate Secretary Mutual Fund Dealers Association of Canada 121 King Street West, Suite 1000 Toronto, Ontario M5H 3T9 Telephone: 416-943-7431 Facsimile: 416-361-9781 Email: CorporateSecretary@mfda.ca Page 1 of 5 THE APPLICATION IS FOR AN ORDER issued in accordance with s. 24.3.3(b) of MFDA By-law No. 1, to impose the following terms and conditions on the authority of PDQ to conduct securities related business: 1. PDQ shall appoint an individual satisfactory to the MFDA Compliance Department, other than Cesidio Negri (“Mr. Negri”), to manage the financial affairs of PDQ who shall: (a) be required to provide approval of any expense, payment or withdrawal made for PDQ or taken from any of its bank accounts or investments before any expense is incurred or any payment or withdrawal is made; and (b) be responsible for all financial filings with the MFDA including PDQ’s monthly filings of Form 1; 2. PDQ shall comply with all early warning requirements and restrictions set out in MFDA Rules 3.4.2 and 3.4.3 that are imposed on PDQ by Staff from time to time, including without limitation, the restrictions prohibiting PDQ from undertaking any of the following activities without the prior written consent of Staff: (a) making payments directly or indirectly by way of loan, advance, bonus, dividend, repayment of capital or other distribution of assets to any director, officer, partner, shareholder, related company, affiliate or associate of PDQ (regardless of whether the recipient of the payment presently has or previously had any role in the direction or control of PDQ); (b) reducing the capital of PDQ in any manner including redemption, repurchase or cancellation of any of its shares; (c) reducing or repaying any indebtedness which has been subordinated with the approval of Staff; or (d) increasing non-allowable assets, unless a prior binding commitment to do so exists, or entering into any new commitments which would have the effect of materially increasing the non-allowable assets of PDQ; 3. Except with the prior written consent of Staff, PDQ shall not solicit or accept any further Page 2 of 5 investment of money directly or indirectly in PDQ by any means including, without limitation: (a) the acquisition of shares or any other securities or other interest in the Member or a party related to the Member including any right to convert or exchange a currently held interest (for example an interest in a related party) into an equity interest in the Member in the future; or (b) the provision of a loan or any other kind of advance directly or indirectly for the benefit of PDQ; 4. PDQ shall produce to MFDA Financial Compliance Staff any records within the possession, power or control of shareholders or companies related to PDQ that bear on the finances of PDQ or concern payments to or from PDQ; 5. PDQ shall respond to all requests for information directed to it by MFDA Financial Compliance Staff within the time periods specified in the request; 6. PDQ shall preserve all books and records, including all hard copy and electronic records in PDQ’s possession and control including, without limitation, any computer servers, hard drives and other electronic records stored in any form (the “Records”) for a period of 7 years, or for such other time period as a Hearing Panel may order, which records shall be made available to Staff on demand within a reasonable timeframe; and 7. If it has not done so prior to the hearing of the application, PDQ shall, within 14 days of the hearing of the application, provide Staff with a written plan explaining how PDQ will immediately restore the minimum capital requirements applicable to it pursuant to MFDA Rules and ensure that it maintains minimum capital on an on-going basis. THE GROUNDS FOR THE APPLICATION ARE: 1. PDQ has frequently failed to maintain the minimum capital required pursuant to MFDA Rule 3.1.1(a) and is presently capital deficient; Page 3 of 5 2. PDQ has been designated in early warning pursuant to MFDA Rule 3.4.2(a) since September 2, 2009 and has failed to rectify the circumstances causing it to be designated in early warning; 3. PDQ has incurred financial losses of more than $40,000 in every calendar year since 2008 (except for 2009 when PDQ reported a profit of $16,208); 4. PDQ has frequently failed to comply with terms and conditions imposed on it after it was designated in early warning by, for example, continuing to make payments to officers and shareholders of PDQ (such as Mr. Negri who is a shareholder, a director, the Chief Compliance Officer and Ultimate Designated Person of PDQ), while designated in early warning without the prior written consent of the MFDA, contrary to MFDA Rule 3.4.2(b)(iv); 5. PDQ has failed to maintain adequate records reflecting its financial position and performance by, for example, classifying expenses made for the personal benefit of Mr. Negri, as corporate expenses; 6. Recently, PDQ has only been able to temporarily rectify capital deficiencies from time to time by soliciting new investors to purchase shares in PDQ or lend or by other means advance money to PDQ; and, 7. Sections 24.3.2(a)(iv), (viii), (xi), and 24.3.3(b) of MFDA By-law No. 1; and 8. Such further and other grounds as Staff may advise and the Hearing Panel may permit. THE FOLLOWING EVIDENCE will be relied upon at the hearing of the application: 1. The Affidavit of Andy Ng sworn August 24, 2012; 2. The Affidavit of John Gallimore sworn August 24, 2012; and Page 4 of 5 3. Such further and other evidence as Staff may submit and the Hearing Panel may permit. Shelly Feld Senior Enforcement Counsel Mutual Fund Dealers Association of Canada Direct Line: 416-943-7406 Email: sfeld@mfda.ca Rohit Kumar Enforcement Counsel Mutual Fund Dealers Association of Canada Direct Line: 416-945-5136 Email: rkumar@mfda.ca STAFF OF THE MFDA 121 King Street West, Suite 1000 Toronto, Ontario M5H 3T9 Fax: 416-361-9073 TO: PDQ Financial Services Inc. C/O Cesidio Negri and Paul Stadnik 5000 Yonge Street, Suite 1901 Toronto, Ontario M2N 7E9 Doc 307736 Page 5 of 5