2011 Annual Report - Minor International Public Company Limited

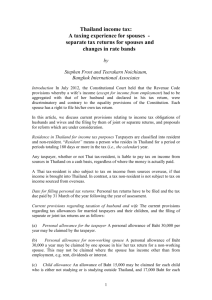

advertisement