Stock Valuation: A Second Look

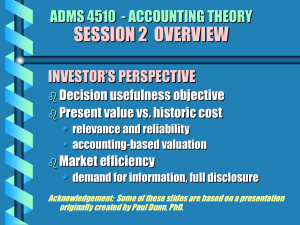

advertisement