The Wealthy Hand-to

advertisement

The Wealthy Hand-to-Mouth

Greg Kaplan

Princeton University

Gianluca Violante

New York University

Justin Weidner

Princeton University

In preparation for the next BPEA volume

Yale, April 8th 2014

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 1 /46

Understanding the joint dynamics of (c, y)

• PIH and buffer-stock model: organizing frameworks

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 2 /46

Understanding the joint dynamics of (c, y)

• PIH and buffer-stock model: organizing frameworks

• Several anomalies unexplained by standard theory:

1. Micro: c overreacts to predictable y growth

Johnson, Parker, and Souleles (2006)

2. Macro I: C overreacts to predictable Y growth

3. Macro II: ∆C uncorrelated with r

Campbell and Mankiw (1989, 1990, 1991)

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 2 /46

Understanding the joint dynamics of (c, y)

• PIH and buffer-stock model: organizing frameworks

• Several anomalies unexplained by standard theory:

1. Micro: c overreacts to predictable y growth

Johnson, Parker, and Souleles (2006)

2. Macro I: C overreacts to predictable Y growth

3. Macro II: ∆C uncorrelated with r

Campbell and Mankiw (1989, 1990, 1991)

• Solution: sizable share of hand-to-mouth (HtM) households

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 2 /46

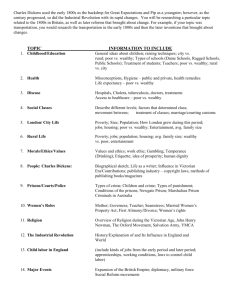

Measurement of HtM households

• Traditional: “one-asset” (net worth) view of the data

◮ Two groups:

1. Non-HtM: substantial net worth

2. HtM: zero net worth

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 3 /46

Measurement of HtM households

• Traditional: “one-asset” (net worth) view of the data

◮ Two groups:

1. Non-HtM: substantial net worth

2. HtM: zero net worth

• Alternative: “two-asset” (liquid-illiquid) view of the data

◮ Three groups:

1. Non-HtM: substantial liquid wealth

2. Poor-HtM: no liquid wealth and no illiquid wealth

3. Wealthy-HtM: no liquid wealth, but substantial illiquid wealth

• Traditional view misses the Wealthy HtM

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 3 /46

The W-HtM: questions

1. When is W-HtM behavior optimal?

2. How do we identify W-HtM households in survey data?

3. What is the share of W-HtM across countries?

US, CA, AU, UK, DE, FR, IT, ES

4. Portfolio? Demographics? Persistence of their status?

5. High MPC out of transitory y shocks? Evidence from PSID

6. What are the implications of W-HtM for fiscal policy?

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 4 /46

TOY

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

MODEL

p. 5 /46

Environment

• At t = 0: portfolio choice between liquid and illiquid asset (m1 , a)

◮ Illiquid asset: gross return R at t = 2, and consumption

commitment κa at t = 1

• At t = 1: receive income y1 , consume c1 , save m2 (no credit)

• At t = 2: receive income y2 , consume c2

• Preferences: u(c1 ) + u(c2 ) (no discounting)

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 6 /46

Environment

• At t = 0: portfolio choice between liquid and illiquid asset (m1 , a)

◮ Illiquid asset: gross return R at t = 2, and consumption

commitment κa at t = 1

• At t = 1: receive income y1 , consume c1 , save m2 (no credit)

• At t = 2: receive income y2 , consume c2

• Preferences: u(c1 ) + u(c2 ) (no discounting)

• Definition of HtM status:

◮ N-HtM: m2 > 0 &

a>0

→

c1 = c2

◮ P-HtM: m2 = 0 &

a=0

→

c1 < c2

◮ W-HtM: m2 = 0

a>0

→

c1 << c2

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

&

p. 6 /46

Portfolio allocation

max u(c1 )

+

u(c2 )

s.t.

m1 + a

c1 + m2

c2

=

=

=

1, a ≥ 0, m1 ≥ 0

y1 + m1 − κa

y2 + m2 + Ra

{m1 ,a}

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 7 /46

Portfolio allocation

max u(c1 )

+

u(c2 )

s.t.

m1 + a

c1 + m2

c2

=

=

=

1, a ≥ 0, m1 ≥ 0

y1 + m1 − κa

y2 + m2 + Ra

{m1 ,a}

• Long-run Euler equation

∂m2

∂m2

′

≥ u (c2 ) R +

u (c1 ) 1 + κ +

∂a

∂a

′

• Determines endowment points at t = 1, 2:

{y1 + (1 − a) − κa, y2 + Ra}

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 7 /46

Consumption/saving at t

=1

max u (c1 )

+

u (c2 )

s.t.

c1 + m2

c2

m2

=

=

≥

y1 + 1 − (1 + κ) a

y2 + Ra + m2

0

{c1 ,m2 }

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 8 /46

Consumption/saving at t

=1

max u (c1 )

+

u (c2 )

s.t.

c1 + m2

c2

m2

=

=

≥

y1 + 1 − (1 + κ) a

y2 + Ra + m2

0

{c1 ,m2 }

• Short-run Euler equation (t = 1):

u′ (c1 ) ≥ u′ (c2 )

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 8 /46

Consumption/saving at t

=1

max u (c1 )

+

u (c2 )

s.t.

c1 + m2

c2

m2

=

=

≥

y1 + 1 − (1 + κ) a

y2 + Ra + m2

0

{c1 ,m2 }

• Short-run Euler equation (t = 1):

u′ (c1 ) ≥ u′ (c2 )

• Long-run Euler equation (t = 0):

u′ (c1 ) ≥

R

· u′ (c2 )

1+κ

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 8 /46

Hand-to-mouth behavior

• Short-run EE ⇒ HtM if:

y2 > y1 + 1

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

⇒

m2 = 0

p. 9 /46

Hand-to-mouth behavior

• Short-run EE ⇒ HtM if:

y2 > y1 + 1

⇒

m2 = 0

• Long-run EE + u CES ⇒ W-HtM iff:

R

>

1+κ

y2

y1 + 1

ε1

,

IES = ε

• Trade-off: higher c2 for lower consumption smoothing btw periods

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 9 /46

Hand-to-mouth behavior

• Short-run EE ⇒ HtM if:

y2 > y1 + 1

⇒

m2 = 0

• Long-run EE + u CES ⇒ W-HtM iff:

R

>

1+κ

y2

y1 + 1

ε1

,

IES = ε

• Trade-off: higher c2 for lower consumption smoothing btw periods

• W-HtM has high MPC out of unexpected (small) transfer at t = 1

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 9 /46

M EASUREMENT S TRATEGY

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 10 /46

From theory to measurement

• Two kinks in the household budget constraint:

1. Zero liquid wealth

(mt+1 = 0)

2. Unsecured credit limit

(mt+1 = −m)

• HtM households end the pay-period t at a kink

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 11 /46

From theory to measurement

• Two kinks in the household budget constraint:

1. Zero liquid wealth

(mt+1 = 0)

2. Unsecured credit limit

(mt+1 = −m)

• HtM households end the pay-period t at a kink

• Mismatch in timing of y receipt and c expenditures

• y receipt at the start of the pay-period, c throughout the pay-period

1. HtM at zero kink have positive avg. liquid wealth

2. HtM at credit limit have avg. liquid wealth above limit

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 11 /46

Identification of HtM in survey data

• A household is P-HtM at the zero kink if:

ait = 0,

and

0 ≤ mit ≤ m∗it

• A household is W-HtM at the zero kink if:

ait > 0,

and

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

0 ≤ mit ≤ m∗it

p. 12 /46

Identification of HtM in survey data

• A household is P-HtM at the zero kink if:

ait = 0,

and

0 ≤ mit ≤ m∗it

• A household is W-HtM at the zero kink if:

ait > 0,

and

0 ≤ mit ≤ m∗it

• A household is P-HtM at the credit limit if:

ait = 0,

mit ≤ 0 and

mit ≤ m∗it − mit ,

• A household is W-HtM at the credit limit if:

ait > 0,

mit ≤ 0 and

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

mit ≤ m∗it − mit

p. 12 /46

Graphical illustration of HtM behavior

Cash in hand

Cash in hand

−m + yt

yt

t

m̄t =

m̄t =

yt

2

t

t

t+1

(a) HtM at the zero kink

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

yt

2

−m

−m

t

t+1

(b) HtM at the credit limit

p. 13 /46

Graphical illustration of HtM behavior

Cash in hand

Cash in hand

−m + yt

yt

t

m̄t =

m̄t =

yt

2

t

t

t+1

(c) HtM at the zero kink

• Suggests: m∗it =

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

yt

2

−m

−m

t

t+1

(d) HtM at the credit limit

yit

2

p. 13 /46

Bias in estimator of HtM share with m∗it

= yit /2

1. Average balances: downward bias

• It misses some HtM households

• It never mistakes a N-HtM for HtM

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 14 /46

Bias in estimator of HtM share with m∗it

= yit /2

1. Average balances: downward bias

• It misses some HtM households

• It never mistakes a N-HtM for HtM

2. Balances at a random point during the pay-period:

• It misses some cases of HtM households

• It mistakes a N-HtM for HtM only if the household has liquid

balances, at the end of the pay-period, less that yit /2 away

from the threshold

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 14 /46

DATA

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 15 /46

Surveys on household portfolios

• United States: Survey of Consumer Finances 1989-2010

• Canada: Survey of Financial Security 2005

• Australia: Household, Income, and Labour Dynamics 2010

• United Kingdom: Wealth and Assets Survey 2010

• Germany, France, Italy, and Spain: Household Finance and

Consumption Survey 2008-10

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 16 /46

Surveys on household portfolios

• United States: Survey of Consumer Finances 1989-2010

• Canada: Survey of Financial Security 2005

• Australia: Household, Income, and Labour Dynamics 2010

• United Kingdom: Wealth and Assets Survey 2010

• Germany, France, Italy, and Spain: Household Finance and

Consumption Survey 2008-10

Sample selection: head 22-79 year-old, positive income,

Sample size per survey: ∼ 5, 000 households

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

(oversampling rich)

p. 16 /46

Empirical details

• Pay-period: Bi-weekly (supported by CEX)

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 17 /46

Empirical details

• Pay-period: Bi-weekly (supported by CEX)

• Income: All labor income plus government transfers that are

regular inflows of liquid wealth, before taxes

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 17 /46

Empirical details

• Pay-period: Bi-weekly (supported by CEX)

• Income: All labor income plus government transfers that are

regular inflows of liquid wealth, before taxes

• Liquid wealth: Checking, savings, money market and call

accounts plus directly held mutual funds, stocks and corporate

bonds, plus imputed cash holdings, net of credit card debt

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 17 /46

Empirical details

• Pay-period: Bi-weekly (supported by CEX)

• Income: All labor income plus government transfers that are

regular inflows of liquid wealth, before taxes

• Liquid wealth: Checking, savings, money market and call

accounts plus directly held mutual funds, stocks and corporate

bonds, plus imputed cash holdings, net of credit card debt

• Illiquid wealth: Value of housing and real estate net of mortgages

and HELOC, private retirement accounts, cash value of life

insurance, certificates of deposit, and saving bonds

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 17 /46

Empirical details

• Pay-period: Bi-weekly (supported by CEX)

• Income: All labor income plus government transfers that are

regular inflows of liquid wealth, before taxes

• Liquid wealth: Checking, savings, money market and call

accounts plus directly held mutual funds, stocks and corporate

bonds, plus imputed cash holdings, net of credit card debt

• Illiquid wealth: Value of housing and real estate net of mortgages

and HELOC, private retirement accounts, cash value of life

insurance, certificates of deposit, and saving bonds

• Borrowing limit: One month of income (for comparability)

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 17 /46

R ESULTS : U NITED S TATES

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 18 /46

.5

How large is the share of HtM in the US?

P−HtM

0

.1

.2

.3

.4

W−HtM

1989 1992 1995 1998 2001 2004 2007 2010

• 30% of U.S. households are HtM, and 2/3 of them are W-HtM

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 19 /46

.5

What is the portfolio composition for W-HtM?

0

.1

.2

.3

.4

Both other and housing wealth

Only housing wealth

Other illiquid but no housing wealth

1989 1992 1995 1998 2001 2004 2007 2010

• Mostly homeowners, but 1/5 of W-HtM are without any real estate

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 20 /46

0

.1

Share of HtM among Homeowners

.2

.3

.4

.5

.6

.7

W-HtM among homeowners, by leverage ratio

=0

0−.3

.3−.6

.6−.9

.9−1.2 1.2−1.5 1.5−1.8 1.8−2.1 2.1−2.4 2.4−2.7 2.7−3

Leverage Ratio

• Misra-Surico (2013): homeowners with big mortgages had strong

c response to 2001 and 2008 fiscal stimulus payments

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 21 /46

P−HtM

P−HtM

.3

.4

.2

.3

1992

1995

1998

2001

2004

2007

2010

0

.1

.2

.1

0

1989

1992

1995

1998

2001

2004

2007

2010

(b) Pay-period of 1 month

W−HtM

P−HtM

.3

.2

.1

1989

1992

1995

1998

2001

2004

2007

2010

(c) Reported credit limit

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

0

.1

.2

.3

.4

P−HtM

.4

W−HtM

1989

.5

.5

(a) y-weighted share of HtM

0

W−HtM

.4

W−HtM

.5

.5

Robustness

1989

1992

1995

1998

2001

2004

2007

2010

(d) Vehicles in illiquid wealth

p. 22 /46

More robustness

Baseline

Higher illiquid wealth cutoff

Businesses as illiquid assets

Direct as illiquid assets

Other valuables as illiquid assets

Excludes cc-puzzle households

HELOCs as liquid debt

Disp. income (via TAXSIM)

Comm. cons. - beg. of period

Comm. cons. - end of period

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

P-HtM

0.121

0.121

0.114

0.120

0.117

0.163

0.120

0.121

0.102

0.149

W-HtM

0.192

0.192

0.193

0.217

0.196

0.183

0.181

0.188

0.166

0.272

HtM

0.312

0.312

0.307

0.337

0.312

0.346

0.301

0.309

0.268

0.421

HtM-NW

0.137

0.137

0.129

0.137

0.132

0.177

0.135

0.137

0.116

0.174

p. 23 /46

More robustness

Baseline

Higher illiquid wealth cutoff

Businesses as illiquid assets

Direct as illiquid assets

Other valuables as illiquid assets

Excludes cc-puzzle households

HELOCs as liquid debt

Disp. income (via TAXSIM)

Comm. cons. - beg. of period

Comm. cons. - end of period

P-HtM

0.121

0.121

0.114

0.120

0.117

0.163

0.120

0.121

0.102

0.149

W-HtM

0.192

0.192

0.193

0.217

0.196

0.183

0.181

0.188

0.166

0.272

HtM

0.312

0.312

0.307

0.337

0.312

0.346

0.301

0.309

0.268

0.421

HtM-NW

0.137

0.137

0.129

0.137

0.132

0.177

0.135

0.137

0.116

0.174

• Estimates based on net worth miss at least half of HtM

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 23 /46

.4

Age profile of HtM households

P−HtM

0

.1

.2

.3

W−HtM

20

40

60

80

Age

• P-HtM: young, whereas W-HtM: middle-age

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 24 /46

2

.8

Do W-HtM look more like P-HtM or N-HtM?

1.5

.5

P−HtM

0

0

W−HtM

N−HtM

20

40

60

80

20

40

Age

60

80

Age

(a) Fraction married

.3

80

(b) Number of children

P−HtM

.1

40

Fraction

.2

60

W−HtM

N−HtM

20

20

P−HtM

0

W−HtM

N−HtM

0

Thousands of 2010 USD

P−HtM

1

Number

.6

.4

.2

Fraction

W−HtM

N−HtM

40

60

Age

(c) Median income

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

80

20

40

60

80

Age

(d) Frac. w/ unemp. member

p. 25 /46

300

N−HtM

200

Thousands of 2010 USD

10

5

W−HtM

100

P−HtM

15

W−HtM

N−HtM

0

0

Thousands of 2010 USD

20

Do W-HtM look more like P-HtM or N-HtM?

20

40

60

80

20

40

60

80

(a) Median net liquid wealth

(b) Median net illiquid wealth

1

Age

1

Age

W−HtM

N−HtM

.6

.4

.2

0

0

.2

.4

.6

.8

N−HtM

.8

W−HtM

20

40

60

Age

(c) Fraction in housing

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

80

20

40

60

80

Age

(d) Fraction in ret. accounts

p. 26 /46

Persistence of HtM status

07 → 09

P

W

N

Ergodic

P

0.548

0.101

0.055

0.126

W

0.127

0.455

0.129

0.191

N

0.326

0.444

0.816

0.683

• Expected durations:

◮ P-HtM status: 4.5 years

◮ W-HtM status: 3.5 years

◮ N-HtM status: 11 years

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 27 /46

Summary on P-HtM vs W-HtM

P-HtM

1/10 of population

young

low income

no wealth

–

persistent state

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

W-HtM

1/5 of population

middle-age

middle/high income

high illiquid wealth

portfolio like N-HtM

more transient

p. 28 /46

Summary on P-HtM vs W-HtM

P-HtM

1/10 of population

young

low income

no wealth

–

persistent state

W-HtM

1/5 of population

middle-age

middle/high income

high illiquid wealth

portfolio like N-HtM

more transient

• Conclusion: they should be modelled as two different groups!

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 28 /46

C ROSS -C OUNTRY C OMPARISON

∼ 2010

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 29 /46

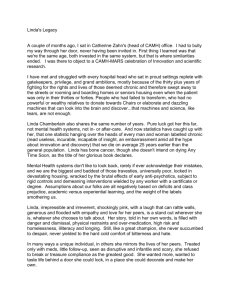

.5

Cross-country comparison: share of HtM

P−HtM

0

.1

.2

.3

.4

W−HtM

US

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

CA

AU

UK

DE

FR

IT

ES

p. 30 /46

.5

Cross-country comparison: share of HtM

P−HtM

0

.1

.2

.3

.4

W−HtM

US

CA

AU

UK

DE

FR

IT

ES

• Sizable variation in share of HtM

• In all countries, W-HtM twice as many as P-HtM

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 30 /46

.5

Cross-country comparison: portfolio of W-HtM

0

.1

.2

.3

.4

Other illiquid but no housing wealth

Only housing wealth

Both other and housing wealth

US

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

CA

AU

UK

DE

FR

IT

ES

p. 31 /46

.5

Cross-country comparison: portfolio of W-HtM

0

.1

.2

.3

.4

Other illiquid but no housing wealth

Only housing wealth

Both other and housing wealth

US

CA

AU

UK

DE

FR

IT

ES

• Big variation in portfolio composition

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 31 /46

.3

Fraction of households

.05

.1

.15

.2

.25

0

0

Fraction of households

.05

.1

.15

.2

.25

.3

Cross-country comparison: distribution of m/y

−10

−5

0

5

10

Net liquid wealth to monthly labor income ratio

−10

Fraction of households

.05

.1

.15

.2

.25

.3

(b) United Kingdom

0

0

Fraction of households

.05

.1

.15

.2

.25

.3

(a) United States

−5

0

5

10

Net liquid wealth to monthly labor income ratio

−10

−5

0

5

10

Net liquid wealth to monthly labor income ratio

(c) Italy

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

−10

−5

0

5

10

Net liquid wealth to monthly labor income ratio

(d) Spain

p. 32 /46

.4

P−HtM

P−HtM

.2

0

.1

.2

.1

0

22−24 25−29 30−34 35−39 40−44 45−49 50−54 55−59 60−64 65−69 70−74 75−79

20−24 25−29 30−34 35−39 40−44 45−49 50−54 55−59 60−64 65−69 70−74 75−79

Age

Age

W−HtM

P−HtM

.2

.1

0

0

.1

.2

.3

P−HtM

.3

W−HtM

(b) United Kingdom

.4

(a) United States

.4

W−HtM

.3

W−HtM

.3

.4

Cross-country comparison: age profile of HtM

22−24 25−29 30−34 35−39 40−44 45−49 50−54 55−59 60−64 65−69 70−74 75−79

22−24 25−29 30−34 35−39 40−44 45−49 50−54 55−59 60−64 65−69 70−74 75−79

Age

Age

(c) Italy

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

(d) Spain

p. 33 /46

MPC

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

OF THE

W-H T M

p. 34 /46

MPC out of transitory income shocks

• Do W-HtM (and P-HtM) respond strongly to transitory y shocks?

• Challenges:

1. Need panel data on income, consumption, and wealth

2. Individual income shocks are not directly observed

• Solutions:

1. Bi-annual data from 1999-2011 waves of the PSID

2. Identification strategy from Blundell-Pistaferri-Preston (2008)

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 35 /46

BPP identification strategy

• Residual log income is a sum of permanent + i.i.d. components:

∆ log yit = ηit + ∆εit

• Transmission coefficient of shock ε into c:

cov (∆cit , εit )

M P Cε ≡

var (εit )

• Assume households have no foresight about future shocks:

cov (∆cit , ηi,t+1 ) = cov (∆cit , εi,t+1 ) = 0

• Then M P Cε can be estimated as:

cov (∆cit , ∆yi,t+1 )

\

M

P Cε =

cov (∆yit , ∆yi,t+1 )

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 36 /46

Results

\

M

P Cε

Baseline

P-HtM

W-HtM

N-HtM

HtM-NW

N-HtM-NW

0.243

0.301

0.127

0.229

0.201

(0.065)

(0.048)

(0.036)

(0.054)

(0.030)

Note: Boostrapped SE based on 250 repetitions

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 37 /46

Results

\

M

P Cε

Baseline

P-HtM

W-HtM

N-HtM

HtM-NW

N-HtM-NW

0.243

0.301

0.127

0.229

0.201

(0.065)

(0.048)

(0.036)

(0.054)

(0.030)

Note: Boostrapped SE based on 250 repetitions

• W-HtM are the group with the largest point estimate for the MPC

• Gap with the MPC of the N-HtM statistically significant

• Split based on net worth uninformative

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 37 /46

I MPLICATIONS

OF

W-H T M

BEHAVIOR

FOR FISCAL POLICY

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 38 /46

Implications of W-HtM for fiscal policy

• Ignoring that W-HtM are a separate group leads to a distorted

view of effects of fiscal policy

• Examples:

1. Consumption response to lump-sum transfer (e.g., FSP)

2. Size asymmetry in response to FSP

3. Optimal design (income targeting) of the FSP

4. Cross-country differences in aggregate C response to FSP

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 39 /46

Three alternative models (U.S. SCF 2010)

SIM-2: Standard Incomplete Markets model with 2 assets

• Kaplan and Violante (2014): transaction cost of $1,000

• Three types: P-HtM, W-HtM, and N-HtM

SIM-1: Standard Incomplete Markets model with one asset

• One asset version of KV, calibrated to net worth

• Fewer HtM: it misses all W-HtM

SP-S: SPender-Saver model

• Spenders (c = y) and Savers (forward looking as in SIM-1)

• Right number of HtM, but exaggerates their MPC (=1)

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 40 /46

MPCs out of $500 in the three alternative models

SIM-2

SIM-1

SP-S

P-HtM

W-HtM

N-HtM

HtM

N-HtM

HtM

N-HtM

Average

0.35

0.44

0.06

0.14

0.02

1.00

0.02

Low Income

0.34

0.37

0.16

0.15

0.04

1.00

0.04

Middle Income

0.38

0.44

0.09

0.11

0.02

1.00

0.02

High Income

0.31

0.52

-0.02

0.12

0.01

1.00

0.01

Age <=40

0.38

0.42

0.08

0.16

0.02

1.00

0.02

Age 40-60

0.30

0.42

0.01

0.11

0.01

1.00

0.01

Age >60

0.39

0.51

0.13

0.04

0.04

1.00

0.04

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 41 /46

Aggregate quarterly MPC

Transfer size

Model

SIM-2

SIM-1

SP-S

0.18

0.04

0.35

$50

0.29

0.05

0.35

$2,000

0.05

0.03

0.35

$500 – bottom tercile

0.26

0.07

0.50

$500 – top tercile

0.20

0.03

0.34

$500

Size asymmetry

Income targeting

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 42 /46

Aggregate quarterly MPC

Transfer size

Model

SIM-2

SIM-1

SP-S

0.18

0.04

0.35

$50

0.29

0.05

0.35

$2,000

0.05

0.03

0.35

$500 – bottom tercile

0.26

0.07

0.50

$500 – top tercile

0.20

0.03

0.34

$500

Size asymmetry

Income targeting

• SIM-1 (SP-S) under- (over-) estimates C response to FSP

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 42 /46

Aggregate quarterly MPC

Transfer size

Model

SIM-2

SIM-1

SP-S

0.18

0.04

0.35

$50

0.29

0.05

0.35

$2,000

0.05

0.03

0.35

$500 – bottom tercile

0.26

0.07

0.50

$500 – top tercile

0.20

0.03

0.34

$500

Size asymmetry

Income targeting

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 43 /46

Aggregate quarterly MPC

Transfer size

Model

SIM-2

SIM-1

SP-S

0.18

0.04

0.35

$50

0.29

0.05

0.35

$2,000

0.05

0.03

0.35

$500 – bottom tercile

0.26

0.07

0.50

$500 – top tercile

0.20

0.03

0.34

$500

Size asymmetry

Income targeting

• Large FSP have smaller bang-for-the-buck

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 43 /46

Aggregate quarterly MPC

Transfer size

Model

SIM-2

SIM-1

SP-S

0.18

0.04

0.35

$50

0.29

0.05

0.35

$2,000

0.05

0.03

0.35

$500 – bottom tercile

0.26

0.07

0.50

$500 – top tercile

0.20

0.03

0.34

$500

Size asymmetry

Income targeting

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 44 /46

Aggregate quarterly MPC

Transfer size

Model

SIM-2

SIM-1

SP-S

0.18

0.04

0.35

$50

0.29

0.05

0.35

$2,000

0.05

0.03

0.35

$500 – bottom tercile

0.26

0.07

0.50

$500 – top tercile

0.20

0.03

0.34

$500

Size asymmetry

Income targeting

• High-income (W-HtM) households consume their FSP as well

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 44 /46

.4

us

.05 .1 .15 .2 .25 .3 .35

Estimated MPC under SPS model

Estimated MPC under SIM−1 model

.05 .1 .15 .2 .25 .3 .35

.4

Cross-country differences in aggregate MPC out of $500

uk

ca

de

it

fr

au

it

de

ca

us uk

0

es

0

aufr

es

.1

.125

.15

.175

Estimated MPC under SIM−2 model

SIM−1 model

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

SPS model

.2

45 degree line

p. 45 /46

Conclusions

• Not all hand-to-mouth households are created equal...

• ...and it matters

Kaplan-Violante-Weidner, ”The Wealthy Hand-to-Mouth”

p. 46 /46