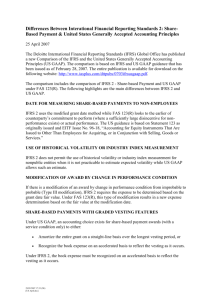

Research on IFRS 2 update_NSS sept 2010

advertisement