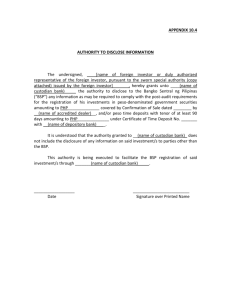

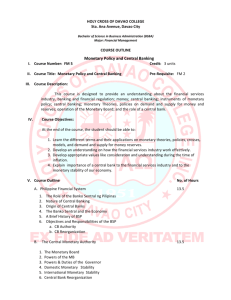

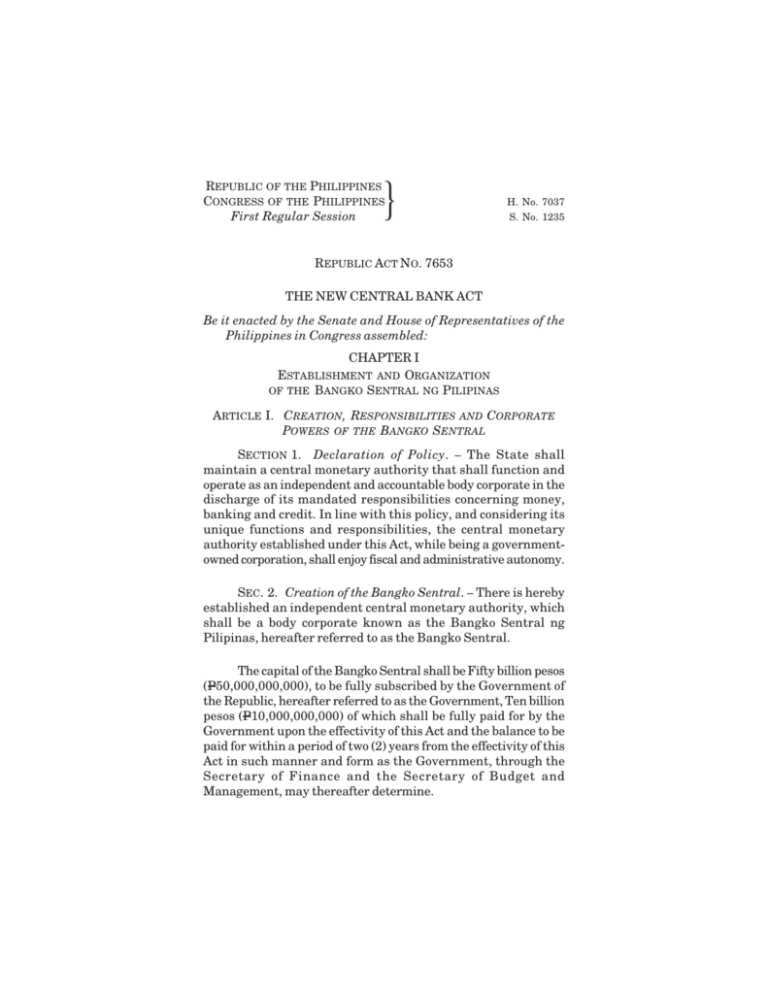

New Central Bank Act - Bangko Sentral ng Pilipinas

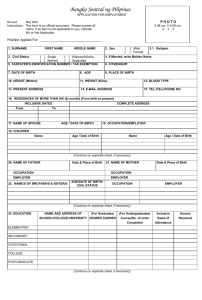

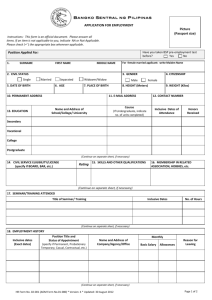

advertisement