business strategy formulation modeling

advertisement

BUSINESS STRATEGY FORMULATION MODELING

VIA HIERARCHICAL DYNAMIC GAME

Celso Pascoli Bottura; Eliezer Arantes da Costa

Laboratório de Controle e Sistemas Inteligentes – LCSI

Faculdade de Engenharia Elétrica e de Computação – FEEC

Universidade Estadual de Campinas – UNICAMP

<bottura@dmcsi.fee.unicamp.br>; <eliezer@futuretrends.com.br>

Campinas, São Paulo, Brazil

Abstract – Stochastic infinite dynamic games can be used as a conceptual basis for the development of strategic business

game models for cooperative and competitive environments and under turbulent conditions. This study presents an

analytical framework to develop a challenging and motivating tool for the improvement of executive strategic

management capability, using discrete time stochastic strategic hierarchical dynamic games. The dynamic game is

organized in three hierarchical levels: at the upper one lies the coordinating module, representing the market actions, at

the intermediate level are the competing companies, and at the lower level those responsible for each company’s

management units. Each company’s team has a computational model to simulate the company’s dynamic behavior. Some

classic game theory equilibrium strategies are presented and applied to the proposed strategic game. Stackelberg, Nash

and Pareto equilibrium strategies, duly combined in the proposed hierarchical structure, allow the attainment of

theoretical lower-bound solutions for didactic games.

Keywords – Business strategic games – hierarchical dynamic games – strategic management training

Introduction

Several efforts have been made to model and to solve problems of optimization for large-scale systems with hierarchical

structures, as much for tactical as for strategic use, in productive systems [1, 2] and in decision support systems [3]. The

formalization of non-cooperative dynamic game theory in [4] serves as the basis for a series of interesting applications,

among them the treatment of an optimization problem utilizing distributed and parallel processing in hierarchical

structures [5]. Non-cooperative dynamic game theory is a field that can be explored in educational applications for

development and training of executives, which is the purpose of this study. Concepts about company strategy have been

consolidated in [6], reviewed and expanded in [7], and applied to manufacturing for instance, in [8]. A tutorial

consolidation of the concepts of strategic management is presented in [9].

More recently, an effort toward strategic planning was developed in [10], in which a strategic business game is

employed to generate turbulent scenarios. Such research creates a business game using dynamic simulation resources,

applying principles originally proposed in [11], revised and expanded to apply in the business arena in [12]. The work

presented here, expanding the application of [10], employs competitive and turbulent scenarios, in which companies are

simulated vying for markets and clients and, at the same time, disputing limited resources and supplies. A stochastic

strategic hierarchical dynamic game for application in executive training programs is proposed here as a model for a

competitive and turbulent business environment

1. Executive capability development

Experiments in the development of human resources

and specialized studies about adult education – also

called ‘andragogy’, by some authors – show that

traditional teaching methods, based on presentations,

lectures, readings and seminars, lack something as they

do not motivate, nor involve participants on their real

day-to-day problems. In contrast, playful activities such

as business games and firm simulations in cooperative

or competitive conditions and under turbulent

environments are methods that, if well applied, can

stimulate emulation, enthusiasm, and motivation –

essential elements for efficient learning.

Some modern pedagogical applications for the

development and improvement of companies’ future

managers and decision-makers have used business

games, mainly implemented as computer models for

companies’ operational programming in short-term time

frames, usually based on spreadsheets concepts.

It is a fact that a vast amount of literature on this

subject [6, 8] – even some of the most recent – [7, 9],

treat the concepts of strategic management from a more

qualitative than quantitative point of view.

Nevertheless, some efforts have been made to quantify

strategic actions and their long-term consequences

through mathematical models [10, 12].

Company modeling using optimization and

simulation concepts and methods may reasonably

represent these business environments, at least for

educational purposes. Concepts and resources for

modeling and simulation of continuous systems can be

found in [11, 12]. For the present work, important

contributions are in [4, 5, 13, 14, 15, 16, 17].

y

Business games were greatly developed mainly from the

1950s on as an adaptation, for the company’s

environment, of war games concepts, methodology and

results that had long been used in the military field.

Experiments have shown that participants of business

games end up enthusiastically motivated to increase their

capabilities, including abilities to use more quantitative

tools. Well-elaborated games are able to integrate

segmented knowledge and concepts from various fields

or disciplines, thus enabling participants to form a global

vision of a company and its market as a whole.

The team decision-making interactive process fosters

interpersonal relationships; it provides incentive for the

search for objective data, for the ability to seek out

consensus and for solutions by negotiation. Leadership,

clear and assertive communication, and giving and

receiving feedback capabilities are also highlighted.

Otherwise, competition among distinct teams encourages

the ability to make decisions under pressure, uncertainty,

conflicting situation and tension, seeking consensual

solutions internally, while under intense external

competition.

3. Non-cooperative deterministic game

In order to implement a conceptual platform for business

games, we begin at the concepts and formulations of

dynamic games theory. With a sufficiently broad

meaning for this purpose, we can define a noncooperative deterministic dynamic game [NDDG] with

several participants and multiple stages as a systems

optimization problem with multiple decentralized and

autonomous decisions.

Thus, from the point of view of systems control

theory, a [NDDG] can be associated with a particular

problem of optimal control with multiple controllers. In

this type of game, each of the N participants – or players

– receiving information progressively disclosed by the

structure of the game, makes a sequence of decisions,

stage by stage, attempting to optimize one’s objective

function (1) – while obeying the game constraints.

For a formal presentation of the optimization problem

introduced above, we adopt the following notation,

derived from the terminology of systems theory [4].

For the basic model, we call:

x

k

the vector that represents the state of the game at

stage k;

(1 )

We always make use of the concept that the players must minimize

their objective function.

k

an observation of the state

x

k

for the player Pi at

stage k;

η ki the information available to the player Pi at stage k;

u

2. Educational uses of business games

i

i

k

the action decided by the player Pi at stage k.

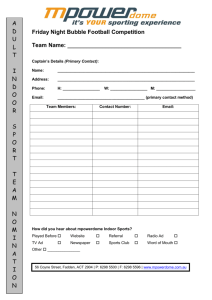

So, we can define an infinite non-cooperative

deterministic dynamic game [NDDG] as a structured

set of logical-mathematical conceptual elements, whose

relationships are graphically represented in Figure 1.

In fact, the above-referred definition assumes some

simplification hypotheses: (a) the duration of the game

is fixed; (b) time is assumed to be discrete, by stages;

and (c) all equations, functions and variables are

admitted to be deterministic. Restrictions (a) and (b) of

the [NDDG] do not limit its applicability to strategic

business games for educational purposes, but the item

(c) will be relaxed in Section 4 below.

4. Non-cooperative stochastic game

The [NDDG] described above does not adequately

represents a business environment due to the failure to

encompass random possibilities in the process, which

are common in the business world, full of surprises

brought about by both external and internal factors.

An extension of the [NDDG] concept to deal with

these stochastic aspects can be accomplished with small

changes in some of the formal elements described

above. A simple way to understand and to treat the

randomness of the game is to add into the model a new

‘player’, the (N+1)th, called nature, S, whose decisions

and actions influence the state of the game evolution

and the objective function value calculation.

Nature’s actions can be assumed to obey a

probabilities law established a priori and thus, the state

transition equation in [NDDG] is replaced by a function

of a conditional state probability distribution, given the

previous actions of the players and the previous values

of the state [4].

Keeping these considerations in mind, we can

define an infinite non-cooperative stochastic dynamic

game [NSDG] discrete in time, with N players, with a

pre-defined fixed duration, as a structured set of

logical-mathematical conceptual elements, whose

relationships can also be illustrated graphically in

Figure 1, by merely introducing one more player, S,

the nature, and replacing the deterministic character by

a stochastic one for some variables and functions.

From the point of view of systems control theory,

a [NSDG] non-cooperative stochastic game can be

associated with a particular problem of optimal

stochastic control with multiple controllers [1, 4].

Considering the sufficient generality of the

[NSDG] game, it is adopted as the conceptual reference

platform for the strategic business games treated in this

work.

U

i

k

: u k ∈U k

i

U

Γ

Γ :γ

i

i

k

k

∈ Γk

i

u

i

k

η

Informat ion Space

Ν :η

i

i

k

k

Ν

i

=

γ (η

i

i

k

k

u

η

∈ Νk

i

k

u

⊂ { y ,...,

1

k

u

i

i

i

1

y ,u

k

(z

zi* = imin

∈N

f

1

x

1

k

k +1

k

..., u k ,..., u k )

x

k

,...,

y

N

i

y

k

=

i

h (x

k

k

x

⇐

k

x

Observat ion Funct ion

,..., u1 ,..., u k −1}

yes

K +1 ?

no

k −1

i

=

x

N

i

)=

i

z

( xk , u k ,

i

k

u

:

N

k −1

xk +1 =

Delay

i

i

X

St ate Transit ion

i

)

k

k

∈

X

i

η

k

k

Informat ion i St ruct ure

k

x

i

Decision / Control

k

:

X

i

St rat egy Space

End of Game: *

The Winner is i

for which

*

St ate Space

Control Space

K +1

k +1

k +1

x

k

Object ive Funct ion

z :

J ( x ,..., x

u ,..., u ,..., u )

i

z

i

=

K +1

1

i

1

i

N

1

k

K

,

Init ializat ion:

Init ial st at e is given

k

)

x

k

Y

z

i

k

⇐

x

1

i

k

Observat ion Set

Y

i

k

:

y

i

k

∈Y k

i

Figure 1 – Sche mat ic representation of a non-cooperative dynamic ga me – [NDDG] / [NSDG]

5. Strategic reference game

Applying the concepts and formulation of [NSDG] to

model business games for educational purposes

requires several simplifications and specifications

without loss of the generality and applicability intended

for the given purpose. We will work with a special

class of games, which we call strategic reference game

[SRG], defined as a particular case of [NSDG], which

is, simultaneously, strategic, stationary, equitable, and

closed-loop, encompassing the following concepts:

(a) A strategic game can be defined as a [NSDG] for

which the objective function to be minimized is an

exclusive function of the final state of the game, x K +1 ,

that is,

z

i

=

J (x

i

(i )

K +1

) ; i ∈ N ; ( 2)

(b) A stationary game can

be defined

as a i[NSDG] for

(i )

i

which the functions f k (...) , hk (...) and γ k (...) and the

space Ν k can be rewritten as

i

and

f

(i )

(...) ,

i

h (...)

and

γ

i

(...)

Ν , respectively, discarding, thus, the subscript k ;

i

(c) An equitable game can be defined as a [NSDG] for

which the superscript i, which differentiate the

characteristics of (ithe

players,

cani be discarded. Thus,

)

i

the functions f k (...) , hk (...) , γ k (...) , J i (...) and the

space

J

(...)

Ν

can be rewritten as

and

Ν , respectively;

i

k

f

k

(...) ,

h (...) , γ

k

k

(...) ,

k

(d) A closed-loop

game can be defined as a [NSDG]

i

for which η k = { x1 ,..., xk} , for every k ∈ K , that is, the

players have access to all information about the past

states of the game.

6. Games with hierarchical structure

Proceeding the work with [SRG], we further specify its

structure, in order to obtain a more useful formal model

for the intended purpose.

6.1. Hierarchical game in two levels

A non-cooperative hierarchical game in two levels is

modeled through a process of forming a group of

subsystems, each one representing a competing

company, with its own operative rules for state

transition, information, decision, and objective

function. Each company, here represented by a

subsystem [CS]i , vies in the market for raw materials,

specialized production man power, managerial

resources, financial resources, technology, and other

supplies. On the other hand, they also compete in the

market for clients’ preferences.

The market, in the broader sense, also interferes on

the game, acting on prices and quantities transacted by

the N competitors, their clients and providers. A

method of representing the market actions is to

introduce into the game a new player, the (N+2) th,

which we will call ‘the market’, symbolized by Q,

which has the duty of seeking out the balance between

the aggregate demand and the aggregate offer for both

supplies and products.

The [SRG], organized as described above, is

defined as a hierarchical game in two levels, [HG2].

The formulation of this concept can be obtained

through a convenient partition and segmentation

process of the [SRG] game, resulting in two types of

subsystems described below:

I. Company subsystems [CS]i – The mathematical

formulation of a company subsystem [CS]i, for

k ∈ K and i ∈ N can be written as follows:

(a)

i

x

k +1

The problem of optimal stochastic control with a strategic

objective function such as defined here can be seen as a specific

application of predictive control [19]. The goal is to optimize the

desired ‘final result’. That is, the ‘closer’ the players are able to place

their companies to the target final state, the better their game

performance is graded.

f ( x ,u , λ ) ,

i

i

i

i

k

k

k

k

x

given the initial state

i

1

, for

each subsystem [CS]i , and

(b)

(2 )

=

z =J

i

y = h ( x ) , η k ⊂ { yk , uk −1} ,

i

i

i

k

k

k

i

K +1

i

i

i

u = γ (η )

i

i

i

k

k

k

and

i

( xK +1) .

II. Market Coordinator Subsystem [MCS] – The

mathematical formulation of the market coordinator

subsystem [MCS], k ∈ K and i ∈ N , similarly to the

those prices.

[CS]i subsystem (3) can be written, respectively, as:

Coordination by prices is what mostly resembles

the situation prevalent in a free competitive market,

with multiple suppliers and multiple buyers, without

any of them regulating or controlling the market prices

and/or quantities.

(a)

m

=

k +1

g (m , λ ,..., λ

1

k

k

k

v = ρ (m ) , µ

δ = R (m ) .

(b)

k

k

k

k

k

k

,..., λ k , u k ,..., u k ,..., u k ) , and

k

i

N

1

= {vk , λ k −1} ,

i

N

λ = β (µ )

i

i

i

k

k

k

and

k

The [CS]i modules communicate only with the

market coordinator subsystem, [MCS], which informs

to each one of them, at the beginning of each new

i

stage, its decision parameter, λ k . The [CS]i, in turn,

i

informs the [MCS] about their decisions uk .

6.2. Hierarchical game in three levels

By analogy with the treatment given to the [SRG]

game, we can additionally expand the dynamic

hierarchical game [HG2], applying a further

segmentation process to each company subsystem

[CS]i: each of the competing i companies is assumed to

consist of G Managerial Units, [MU]ij, where

j ∈ {1,2,..., G} , introducing G new players for each

company.

These managerial units, [MU]ij, represent the main

functional or managerial areas of the company. In this

sense, each [MU]ij has its own state transition equation,

information structure, strategies, and decisions, and a

specific objective function to be minimized. However,

leaders of managerial units should seek out consensus

with their peers to reach the optimal objective function

for their company as a whole.

Therefore, by analogy with the segmentation

presented at Section 6.1, the model for [HG2] can be

expanded to obtain [HG3] wherein the coordination of

a second level is achieved by a new module called

[CSC]i, representing the coordination of all the [MU]ij,

by the company’s chief executives.

7. Coordination of hierarchical game

Resuming the problem of multi-level coordination, we

choose, for simplicity sake, the [HG2] as a basic

reference. Two classic ways to treat the matter of multilevel coordination have been proposed: coordination by

quotas and coordination by prices.

We will only describe the latter, which is the one

utilized in this study. (4) Within this option, player Q

i

establishes market prices, λ k , as much for supplies as

8.

Equilibrium strategies

To formulate a dynamic hierarchical game, such as the

game [HG2], or even better, as [HG3], the best

strategies for the player ‘market’, Q, for the company

directors, Pi, for the company coordination the [CSC]i

and for those in charge of the Managerial Units [MU]ij

should be those ones that optimize their respective

objective functions.

In strategic hierarchical dynamic games, the

purpose is to find a sequence of decisions that brings

the system to the final desired state– or as close as

possible to it. The classic ways of solving this problem

would be to treat it as an optimal control problem,

solvable, in theory, by Pontryagin’s Minimum

Principle, by the Calculus of Variations or by

Dynamic Programming [4, 13, 18, 19, 20], depending

on the case. These theoretical methods, however, are

not adopted in this study, as they do not make use of

the specific knowledge of the problem and its topology,

on the way we are implementing and exploring, with

multiple heuristic human decision-makers.

From a careful analysis of possible alternative

strategies for each configuration of the relationship

between players in [HG3] results the following

conclusions:

(i) The competitive relationship among players Pi can

be treated as a typical Nash equilibrium strategy, (5)

since they act independently from each other and are

prevented from sharing information and from

cooperating among each other for making coordinated

decisions in order to optimize together their objective

functions;

(ii) The relationship among those responsible for the

Managerial Units [MU]ij of the same company i can be

characterized as a game to which the Pareto

equilibrium strategy (6) applies, since it is a game of

(5 )

A Nash equilibrium point,

The symbols

m, g , λ , v, ρ , µ , β , δ , R

used for the [MCS]

subsystem are defined accordingly by analogy to [CS]i.

(4 )

In coordination by quotas, the market establishes quantities of

supplies and of products for each player. The players offer prices for

supplies and products they wish to buy and to sell.

1

i

N

for a non-

cooperative game (K=1) of variable sum, with N players, may be

i

i

defined if, for every u ∈U , i ∈N , the following N inequalities are

simultaneously true:

1

i

J (u ,..., u ,..., u

N

1

1

fori final products, and players Pi make their decisions

uk about the quantities they want to buy and sell at

(3 )

*

u = (u ,...,u ,...,u ) ∈U

i

J (u ,..., u ,..., u

N

i

1

i

J (u ,..., u ,..., u

N

)≤

1

i

J (u ,..., u ,..., u

N

1

1

) , ...,

) ≤ J i (u ,..., u ,..., u ) , ...,

N

)≤

i

1

N

i

J (u ,..., u ,..., u

N

N

).

(6 )

A Pareto optimum in a variable sum cooperative game (K=1),

with N players, if it exists, can be defined as the point

*

1

i

N

for which there does not exist any other point

= ( ,..., ,..., ) ∈

u u u u U

u = ( u ,..., u ,..., u

1

i

J (u ) ≤ J (u ) ,

i

i

i

i

N

) ∈U

∀i ∈ N ,

that

meaning

satisfies

that

the

J (u

i

inequalities

i

)≤

J (u

i

i

),

variable sum, in which there should be cooperation

among the managers in charge in order to optimize the

objective function for their company as a whole;

(iii) The relationship between the player Q,

coordinator, representing the market, and each player Pi

can be interpreted as a typical Stackelberg equilibrium

strategy (7), in which the market is the leader and each

player Pi acts as a follower;

(iv) The relationship between the internal coordinator

of each company, called the [CSC]i, and each [MU]ij

can also be considered as a typical Stackelberg

equilibrium strategy, since the strategic decisions of

the coordinator are assumed to be known a priori by

each unit manager.

Despite these considerations, the direct application

of the conditions mentioned above – the Stackelberg,

Nash and Pareto equilibrium strategies – to the game

in question ends up handicapped for practical reasons

because, with the exception of Q, the other players are

human beings making heuristic decisions.

Nonetheless, these conclusions are certainly useful

to the conceptual organization of the games,

considering that: (a) they enable the creation of formal

models for business games, which expand our

understanding of alternative strategies available to the

players; (b) they enable the creation of a correct

taxonomy for business games within the concepts of

classic game strategies; and (c) they enable, under some

specific conditions, the generation of algorithms for the

calculation of a lower-bound theoretical solution, (8)

which could serve as the lower limit to the heuristic

solutions human players can produce.

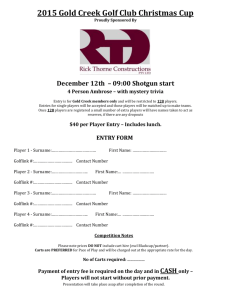

Figure 2 illustrates the application of the concepts

presented here, for a hierarchical game in three levels,

indicating applicable classic equilibrium strategies for

each case.

1st Level

Market

Coordinator

Stackelberg

Strategy

2nd Level

Co mpany 1

...

Co mpany i

...

Co mpany N

Stackelberg

Strategy

Nash Strategy

3rd Level

Managerial

Unit i,1

...

Managerial

Unit i,j

...

Managerial

Unit i,G

Pareto Strategy

Figure 2 – Classic strategies applicable to a

hierarch ical ga me on three leve ls - [HG3]

9. Implementing business games

A business game in three hierarchical levels, such as

[HG3], can be computationally implemented through

the interconnection of the following modules. (9)

9.1. Implementing subsystems [CS]i

The computational implementation of a subsystem

[CS]i is achieved in such a way that the player Pi can

‘simulate’ as many times as he/she deems necessary,

within the allowed time limit, within each stage, the

dynamic behavior of its company, within the planning

horizon span.

Among the computational environments that

generate dynamic simulation tools available on the

market, the software Vensim® DSS32 5.1 (10) can be

adopted, utilizing the concepts of level variables (11) and

of flow variables, (12) duly inter-related. The software

Simulink® (13) can also be used.

9.2. Implementing subsystems [MU]ij

∀i ∈ N , only if

J (u ) = J (u

i

i

i

inequality written for at least one

i∈N

i

),

∀i ∈ N , with the

.

(7)

Let a hierarchical game between player M, called the leader, and a

player P, called the follower, be with strategic decisions λ and u ,

J (λ , u ) , respectively,

in which, the player M, opts first for his decision λ and, following

and objective function

R (λ , u )

that, P opts for his decision

u

and

, knowing

λ

beforehand. A

Stackelberg’s equilibrium point, if it exists, is defined as equal to

( , u ) ∈ ( L ,U ) for which:

λ

T : L →U such that, for any

J (λ , T λ ) ≤ J (λ , u ) for every

The computational implementation of the [MU]ij

modules uses the same methodology described above,

with dynamic models in Vensim or Simulink. In order

to implement a strategic cooperation among those in

charge of the [MUs]ij, they are encouraged to share

information and heuristically seek the optimization of

the objective function of the company as a whole.

The players – the executives of each company –

make their decisions in a cooperative way, with the

purpose of minimizing a multi-criteria global function,

which should take into account the ‘strategic health of

the company’, (14) assuring the state trajectory of their

a) There is a transformational relation

fixed

λ ∈L

,

u ∈U

b) There is

for every

(8 )

λ ∈L

λ ∈L

such that

, where

R (λ ,T λ ) ≤ R (λ ,T λ )

u =T λ

.

We call the lower-bound solution that set of decisions for a

strategic game, which optimizes all the objective function for all the

players at all levels.

(9 )

The [HG2] game can be treated as a particular case of the [HG3].

Ventana® Simulation Environment, of Ventana Systems, Inc.

(11)

The level variables represent the quantities that can be modeled as

results of an accumulation process. For example: raw materials in

stock, orders backlog, employees level, etc.

(12)

The flow variables represent quantities that can vary over time as

functions of decisions made by managers, clients, providers,

competitors, etc.

(13)

Simulink® is a module of MATLAB 6.0, of MathWorks, Inc.

(14)

A successful implementation of a solution for this problem [5] is

the one that adopts a linear quadratic objective function, associated

(10)

companies is maintained within a hyper-tube feasibility

region. (15)

9.3. Implementing modules [CSM]

and [CSC]i

The algorithm for the subsystem coordination [CSM]

module generates the prices for supplies and products

that are informed to the players – executives of

competing companies. For the aggregate supply, the

algorithm forces the prices to rise whenever the

aggregate demand has a tendency to overtake its supply

availability; and it forces prices to fall, in the opposite

situation. For the aggregate supply of products to the

market, the behavior of the coordinator is the reverse.

The [CSM] module also generates randomly,

according to specific probability distributions,

the

i

numeric sample values for the variables θ k ∈ Θ and

ϕ ∈Ψ

i

k

influencing

the

game,

thus

creating

probabilistic scenarios with graded rigor levels, both

externally and internally.

The module that coordinates all the [MU]ij, called

[CSC]i , implemented at the level of the [SSE]i, follows

the same principles and mechanisms of the [CSM]

module, with appropriate adaptations.

10. Conclusions

Some comment and conclusions can be summarized as

follows:

• The classic equilibrium strategies from game theory

are applicable to adequately represent the optimal

cooperative and/or competitive players’ strategic

decisions in hierarchical business games;

• Game theory concepts and models can be used for

computation of a solution to be used as a lower-bound

for the heuristic solution human beings can produce;

• Complex competitive and turbulent business

environments can be adequately modeled as stochastic

hierarchical strategic games;

• Dynamic non-cooperative game theory can be used as

a conceptual and formal platform for the development

of strategic business games for educational purposes;

• Business games constitute a support decision tool for

good strategic decision formulation via heuristic

teamwork and game theory equilibrium strategies

concepts utilization.

• The educational experiment under implementation

using the model here presented is sufficient to show that

the framework and modeling proposed can be

efficiently used as a didactic tool for the education and

of decision makers and for fostering their capability for

planning and strategic management, as intended.

to the ‘distance’ – within a given metric – between the values

obtained by the players and the established target-value.

(15)

We call feasibility hyper-tube that region of the space X consisting

of all the possible state trajectories of the system, x ik ∈ X , obeying

the rules of the game.

Bibliografical References

[1] A.E. Bryson, Jr. & Y.C. Ho, Applied optimal

control (Washington, DC: Hemisphere, 1975).

[2] E.A. Costa, Otimização de operação de redes de

escoamento (Campinas, SP: Universidade Estadual

de Campinas, Faculdade de Engenharia Elétrica,

Dissertação de Mestrado, 1979).

[3] A.P. Sage, Decision support systems engineering

(New York, NY: Wiley, 1991)

[4] T. Başar & G.J. Olsder, Dynamic non-cooperative

game theory (Philadelphia, PA: SIAM, Series in

Classics in Applied Mathematics, Philadelphia,

1999).

[5] J.T. Costa Filho, Proposta para computação

assíncrona paralela e distribuída de estruturas

especiais de jogos dinâmicos (Campinas, SP:

Universidade Estadual de Campinas, Faculdade de

Engenharia Elétrica, Dissertação de Doutorado,

1992).

[6] H.I. Ansoff, Implanting strategic management

(Englewood ClifCS, NJ: Prentice-Hall, 1984).

[7] S.B. Zaccarelli, Estratégia e sucesso nas empresas

(São Paulo,SP: Saraiva, 2000).

[8] M. Porter, Competitive strategy (New York, NY:

Free Press, 1980).

[9] E.A. Costa, Gestão estratégica (São Paulo, SP:

Saraiva, 2002).

[10] R. Colombo, Aplicação de jogo de empresas: Um

experimento com geração randômica de cenários

em sistemas dinâmicos (São Paulo, SP: Fundação

Getulio Vargas, Dissertação de Doutorado, 2003).

[11] J.W. Forrester, Industrial dynamics. (Cambridge,

MA: The MIT Press, 1961).

[12] J.D. Sterman, Business dynamics: Systems thinking

and modeling for a complex world (New York,

NY: McGraw-Hill, 2000).

[13] R.E. Bellman, Dynamic programming (Princeton,

NJ: Princeton University Press, 1957).

[14] C.P. Bottura, H.M.F. Tavares & E.A. Costa,

Hierarchical control of a production-transportation

network with buffer storage, Proc. International

Conference on Cybernetics and Society - IEEE,

Denver, 1979, 280-285.

[15] J.T. Costa Filho & C.P. Bottura, Hierarchical

multidecision making on a computer network with

distributed coordination and control. Proc. 39th

Annual Allerton Conference on Communication

Control and Computing, 10/1991, Urbana, 1991,

703-704.

[16] Y.Y. Haimes & D. Li, Hierarchical multiobjective

analysis for large-scale systems: review and

current status, Automatica, v. 24 (1) 1988, 53-69.

[17] J.B. Cruz, Jr, Leader-follower strategies for

multilevel systems, IEEE Transactions on

Automatic Control, v. AC-23.(2) 1978, 244-255.

[18] M. Athans & P.L. Falb, Optimal control: An

introduction to the theory and its application (New

York, NY: McGraw-Hill, 1966).

[19] R.R. Bitmead, M. Guevers & V. Wertz, Adaptive

optimal control (New York, NY: Prentice Hall,

1990).

[20] A.P. Sage & C.C. White, Optimal system control

(Englewood Cliff, NJ: Prentice-Hall, 1977).