A Spatial Hedonic Analysis of the Effects of Wind Energy Facilities

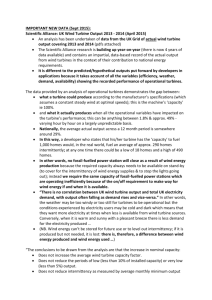

advertisement