deposit scheme

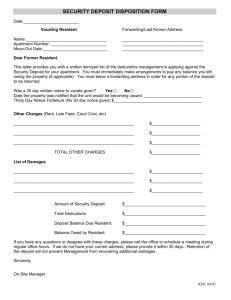

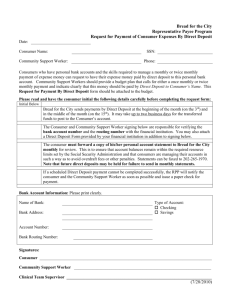

advertisement

LIABILITY PRODUCTS RESOURCE MOBILISATION DIVISION RESOURCE MOBILISATION DIVISION HEAD OFFICE HEAD OFFICE FIRST FLOOR, RAJENDRA BHAWAN, RAJENDRA PLACE, NEW DELHI – 110008. rrmd@pnb.co.in 1 DEPOSIT SCHEMES SAVINGS SAVING DEPOSITS CURRENT DEPOSITS TERM DEPOSITS TERM DEPOSITS • PNB PRUDENT SWEEP • PNB TOTAL FREEDOM SALARY ACCOUNT • PNB VIDYARTHI •PNB RAKSHAK SCHEME •PNB SHIKSHAK SWEEP SCHEME •PNB PNB SHIKSHAK O/D SCHEME SHIKSHAK O/D SCHEME • PNB MITRA (FINANCIAL INCLUSION) TERM DEPOSITS CURRENT DEPOSITS PNB SMART ROAMER SCHEME • MBFD, Spl. TD, Ord. TD, Anupam, Sugam & VAY TD Schemes •PNB COMBO •TAX SAVER FD • FD SCH. FOR ROAD ACCIDENT VICTIMS • RECURRING DEPOSIT • FLEXI RECURRING DEPOSIT/FLEXI JAMA YOJNA / • PNB DUGANA SCHEME • PNB LAKHPATI SCHEME • PNB 555& 1111 DAYS •CAPITAL GAIN SCHEME • PNB GROWTH FD SCHEME • PNB BULK FD SCHEME •PROSPECTIVE SENIOR CITIZEN SCHEME 2 Prudent Sweep (S/F) Scheme Savingg Account Scheme p providingg facilityy of automatic transfer of balance from Savings Accounts to Fixed Deposit. • Opening of account with Rs. 500/‐ only. • Minimum Quarterly Average Balance: Rs. 5,000/ 5,000/‐ in Rural/Semi Urban & Rs. 10,000/‐ in Urban/Metro • Cut off level for Sweep: Rs. 15000/‐ in Rural/Semi Urban & Rs. 40000/‐ in Urban/Metro. • Multiples of minimum Sweep Out/In: Rs. 10,000/‐ • Tenor of FDR: 7 days to 179 days. • Various V i F Free F iliti Facilities: 100 cheque h l leaves i a financial in fi i l year, Internet I t t Banking Services, 50% concessions on annual maintenance charges for Demat Services for the first year only, ATM Card facility etc. (R f RBD/DEP/Cir. (Ref: RBD/DEP/Ci No. N 33 dated d t d 20.10.2009 20 10 2009 & 41 dated d t d 31.12.2009) 31 12 2009) 3 Smart Banking Current Account Scheme Existing CA – Smart Roamer Account scheme replaced with the introduction of 4 variants under the present scheme namely PNB SILVER, SILVER PNB GOLD, GOLD PNB DIAMOD & PNB PLATINUM. Various features are as under: Sl. No. 1 2 3 4 5 6 Particulars VARIANTS PNB SILVER VARIANTS PNB GOLD VARIANTS PNB DIAMOND VARIANTS PNB PLATINUM Scheme code CSMR1 CSMR2 CSMR3 CSMR4 Minimum Quarterly Average Balance (QAB) Initial Deposit (R/SU/U & M) Non Maintenance of QAB Charges (per quarter) 50,000 2,00,000 5,00,000 10,00,000 5 000 5,000 5 000 5,000 5 000 5,000 5 000 5,000 150 600 1500 3,000 Minimum Balance for Sweep‐in and Sweep‐out facility Sweep‐in and Sweep‐out in multiples of Tenor of Term Deposit (At applicable card rate) 50 000 50,000 2 00 000 2,00,000 5 00 000 5,00,000 10 00 000 10,00,000 10,000 10,000 25,000 25,000 15 to 91 days 4 Smart Banking Current Account Scheme (Contd..) Sl. No. 7 8 9 Particulars Free Cheque Leaves (per quarter) RTGS/NEFT charges Concession in Cash Deposit Charges‐ Base Branch Local/ Outstation Non base Branch 10 11 Concession in Inter‐sol transfer transactions i) Local (same city/same clearing centre) ii)Outstation Concession in Cash withdrawal Charges: i)Base Branch ii)Local / Outstation non base branch VARIANTS PNB SILVER S VARIANTS PNB GOLD GO VARIANTS PNB DIAMOND O VARIANTS PNB PLATINUM 100 200 300 500 Free Free Free Free 25 % of applicable charges 50 % of applicable charges 75 % of applicable charges Free 25 % of applicable charges 50 % of applicable charges 75 % of applicable charges Free Free Free Free Free 25 % of applicable charges 50 % of applicable charges 75 % of applicable charges Free Free Free Free Free 25 % of applicable g charges 50 % of applicable charges g 75 % of applicable charges g Free 5 Smart Banking Current Account Scheme (Contd..) Sl. No. Particulars 12 Instant credit of outstation cheques Maximum outstanding Amount at any point of time irrespective of the number of cheques ‐ after ensuring six months of satisfactory operation in the account. Free Collection of outstation Ch Cheque per quarter t maximum i upto Rs. (Issued in favour of customer) Annual Custody Charges for Demat Services (except NSDL/ CDSL charges) 13 14 VARIANTS PNB SILVER S VARIANTS PNB GOLD GO VARIANTS PNB DIAMOND O VARIANTS PNB PLATINUM 15,000 20,000 50,000 1,00,000 0.50 lac per quarter t 2.00 lac per quarter t 5.00 lac per quarter t 10.00 lac per quarter t Waived Waived Waived Waived 30 nos (Max. Amt. upto Rs.10.00 lacs) Free 15 Issue of Free Demand Drafts per quarter 5 nos (Max. Amt. upto Rs.0.50 lacs) 10 nos (Max. Amt. upto Rs.2.00 lacs) 16 Stop Payment instruction charges Free Free 15 nos (Max. Amt. upto Rs.5.00 lacs) Free 17 Account Statements Free Free Free Free 6 Smart Banking Current Account Scheme (Contd..) Sl. No. Particulars 18 POS Machine‐ Installation Charges Transaction Processing Charges Merchant Service Fee 19 20 21 22 Credit Card (Corporate/ Individuals, i.e, Proprietor, Partners, Promoters & Directors etc.)‐ Joining Fee/Renewal Fee/ Annual Fee on Primary & Add on Card PNB Fee Portal & Payfee Fund Collection Module Door Step Banking Services i.i T Transaction ti Charges Ch i. Cash Handling Charges iii. Agency Charges (The charges are finalized by Circle Offices) VARIANTS PNB SILVER PNB SILVER VARIANTS PNB GOLD PNB GOLD VARIANTS PNB DIAMOND PNB DIAMOND Applicable Charges VARIANTS PNB PLATINUM PNB PLATINUM 50% concession on Free Applicable Charges Applicable Charges 50% concession on Free Applicable Charges Charges will be decided at HO Level on the basis of merit of each client. Free Free Free Free Free Free Free Free Free Free Free Free Free Free Free 25% concession on applicable charges 25% concession on CIT Charges decided by Circle Office by Circle Office Free 50% concession on applicable charges 50% concession on CIT Charges decided by Circle decided by Circle Office Free 75% concession on applicable charges 75% concession on CIT Charges decided by Circle decided by Circle Office Free Free (Ref: RMD/Cir. No. 67 dated 10.12.2011) Free (No CIT Charges) 7 PNB Vidyarthi SF Scheme • • • • Account can be opened/maintained with Zero balance. O/D Facility: To meet the contingent/day to day needs of students who are staying away from their parents for education and having secured admission in recognized/reputed educational institutions, an Overdraft facility Initially upto Rs. 5000/‐ which may be enhanced upto Rs. 10,000/‐ is provided. Various Free Facilities like: Cheque book, Internet Banking, Free issuance of draft for all type of fees/examination fees, Intersol transactions, ATM Cum Debit card. The account to be transferred to General category, after the Vidyatrhi attains an age of 21 years. (Ref: RBD/DEP/Cir. No. 26 dated 26.08.2005 & 8/2012 dated 28/01/2012) 8 Total Freedom Salary Account (TFSA ‐ SF A/c) Scheme • • • • • • Account under the scheme can be opened/maintained with Zero balance. Eligibility: Employee whose salary account is being opened should be a permanent employee. Minimum number of accounts to be opened should be 10 or 75% of the strength of the permanent employees of the corporate ((in that location), ), whichever is lower. Zero balance account with O/D facility (maximum Rs. 50,000/‐ or last salary credited in the account, whichever is less). The overdraft is adjustable any time duringg the next six months salary(ies) y( ) or in bullet repayment, p y if desired by the account holder. 50% discount in one locker at the branch convenient to customer for 1st year only. y Various Free facilities: Statement of Accounts, Issuance of interest certificate and balance certificate, Issuance of ATM Cum Debit card, RTGS/NEFT p Rs. 50,000/‐ Transaction upto TFSA has been assigned the wrong code and due to this the scheme have not been properly classified under TFSA in CBS leading to aberration in MIS. 9 (Ref: RBD/DEP/Cir. No. 50 dtd. 23.12.08, 4 dtd. 23.01.10 & 47 dtd. 29.08.11) PNB Combo Scheme (Term Deposit) PNB COMBO Deposit Scheme provides a deposit product with special features f t off Recurring R i Deposit D it & Fixed Fi d Deposit D it (Maturity (M t it basis). b i) Maturity value of Recurring Deposit shall be automatically crystallized into Fixed Deposit (Multi‐Benefit Option) and earn interest for remaining tenure of the contract. contract Monthly Installment with a minimum of Rs. 1,000/‐ or multiples thereof, with a maximum of Rs 1 Lac. Agreement Agreement for deposit shall be for a period of 36 months, 48 months, 60 months, 72 months and 84 months (including RD period of 12, 24 & 36 months). Penalty for late payment of installments shall be @ Rs. 2.00 per Rs. 1,000/‐ per month. Premature payment facility is available under the scheme. Demand Loan/Overdraft facility is available under the scheme. (Ref: RRMD/DEP/Cir. / / No. 30 dated 01.09.2010) 10 PNB Growth Term Deposit Scheme • • • • • • • • Eligibility: Individual singly or jointly, minor, proprietorship, partnership, commercial organizations, company, corporate body etc. Option regarding interest: Income Option ‐( Outflow of interest), Maturity Option ‐ (Interest re‐invested). Amount: Minimum Rs. 1.00 Crore, and thereafter in multiples of Rs. 1 and Maximum Rs. 10.00 Crore only Period of Deposit: Maturity Option‐ 7 days to 120 months, Income Option‐ 180 days to 120 months Auto renewal: Permitted under the scheme Premature withdrawal: Permitted with applicable penalty Part withdrawal: Permitted under the scheme Advances/Overdraft facility: Permitted under the scheme (Ref: RBD/DEP/Cir. No. 37 dated 14.10.2008 & 21 dated 07.05.2010) (Ref: RBD/DEP/Cir. No. 37 dated 14.10.2008 & 21 dated 07.05.2010) 11 PNB Bulk Term Deposit Scheme • • • • • • • • • Objective: For single deposits of above Rs. 10 Crores Eligibility: Individual singly or jointly, minor, proprietorship, partnership, commercial organizations, company, corporate body etc. Option regarding interest: Income Option: (Outflow of interest) and Maturity Option: (Interest re‐invested) Amount: Minimum Above Rs. 10 Crore, and thereafter in multiples of Rs. 1 Period of Deposit: Maturity Option Option‐ 7 days to 120 months, Income Option Option‐ 180 days to 120 months Auto renewal: Auto renewed for period of 14 days. Premature withdrawal: permitted with penalty clause Premature withdrawal: permitted with penalty clause. Part withdrawal: Not permitted under the scheme Advances/Overdraft facility: Permitted under the scheme (Ref: RBD/DEP/Cir. No. 38 dated 14.10.2008 & 21 dated 07.05.2010) 12 PNB Tax Saver Scheme • • • • • Initial Deposit of Rs. 100/‐ only or in multiples thereof subject to maximum deposit of Rs 1.00 Lac per year. Minimum deposit period 5 year and maximum 10 year. Lock in period of 5 year. Loan/OD is not permitted during the lock in period. REBATE ON INCOME TAX under Sec 80 C REBATE ON INCOME TAX under Sec. 80 C (Ref: RBD/DEP/Cir. No. 29 dated 11.08.2006) 13 Scheme for Road Accident Victims • • • • • • • Period of Deposit: For any period 12 months to 120 months. In case, the Honorable Court directs fixed deposit tenor of more than 120 months, same shall be auto renewed if the period exceeds 120 months. Automatic Renewal: Auto renewal will be done for period prescribed by the Court. Interest: 1% above CARD rate of interest as applicable for normal Fixed Deposit scheme for various tenors. No premature cancellation permitted. No loan/OD is permitted. It is mandatory to open a Saving Fund account wherein monthly interest of the Fixed Deposit shall be credited. No cheque book is to be issued under the Saving Fund account without the permission of the Court. (Ref: RBD/DEP/Cir. No. 19 dated 01.05.2010) 14 PNB Bal Vikas Term Deposit Scheme • • • • • • A child who has attained the age of 10 years and not beyond 18 years in his/her own name on giving proof of age. Accounts in the name of minor, below the age g of 10 yyears will be opened p under natural/legal g gguardian. Minimum monthly deposit of Rs. 1000/‐ or multiples of Rs. 500/‐ for first 5 years under RD component. Thereafter, for another 5 years under TD ((income option– p Monthly/Quarterly y y as p per mandate of depositor). p ) Total period of the scheme shall be 10 years. Nomination, Auto renewal, Loan facility is available. Payable at par on maturity at all branches Payable at par on maturity at all branches. Premature withdrawal facility is available. (Ref: RMD/DEP/Cir. No. 45 dated 08.11.2010) 15 PNB Capital Gains Scheme • • • • The deposits may be made under the provisions of Sections 54, 54B, 54D, 54F or 54G of the I.T. Act by any depositor intending to avail benefit under the said section or sections of the Act. There will be two types of deposit accounts: – Deposit Account‐A: This account will be in the form of our existing Saving Funds Account. – Deposit Account‐B: This account will be in the form of our existing Term Deposit Account (cumulative as well as non cumulative). Transfer of the Account: – Both the accounts, i.e., Account Account‐A A and Account Account‐B B can be transferred from one deposit office to another deposit office of the same Bank. Premature withdrawal is permitted before expiry of the period for which deposit was made; rate of interest on such deposits shall be as applicable to period for which deposit remained with deposit office, as a penalty for pre‐ mature withdrawal. 16 Cont. Withdrawal from the account: – Depositor having Account‐A, at any time after making initial deposit, can apply on Form ‘C’ with Pass Book for withdrawal of amount. – Depositor intending to make withdrawal from his Account‐B shall fit get his account transferred in his account‐A. – Withdrawal for more than Rs. 25,000/‐, will be allowed through crossed demand draft. Utilization of amount of withdrawal: At the time of any withdrawal from Account‐ A other then the initial withdrawal, depositor shall furnish in Form ‘D’, in duplicate, the h details d il regarding di manner and d extent off utilization ili i off amount off immediately i di l preceding withdrawal. • Closure of Account: If a depositor desires to close his account, he shall have to apply to deposit office on Form ‘G’ G along with the approval of the Assessing Officer with the Pass Book/Deposit Receipt. Deposit office shall pay the amount of balance including interest accrued to depositor. • Change or alienation: Amount standing to the credit of the depositor in any account under the Scheme shall not be offered as security for any loan or guarantee and shall not be charged or alienated in any manner, whatsoever. 17 (RBD:DEP:CIR:No. 43 dated 08.12.2005) Recurring Deposit Scheme • • • • • • RD schemes provides an opportunity to build up savings through regular monthly deposits over a fixed period of time with twin advantages of affordabilityy and higher g returns. Low minimum monthly deposit amount of Rs. 100/‐ only. Encourages savings without stress on finances. High rates of interest (identical to the fixed deposit rates) High rates of interest (identical to the fixed deposit rates). Period of deposit ranging from 6 months to 120 months in multiples of 3 months. L Loans against deposits available. i td it il bl (MC No. 13/93 dated 24.06.1993 and MC No. 137/98‐22.12.98) 18 Flexi Recurring Deposit Scheme • • • • • • • Flexi RD scheme has been designed to cater to the needs of persons with fluctuating income. Person having fixed income but variable surplus can also take advantage of this. The depositor can choose a core monthly instalment with a minimum of Rs. 100/‐ or above in its multiples. The depositor can deposit 10 times of core amount in a month. Encourages savings without stress on finances. Non‐applicability of Tax Deduction at Source (TDS). High rates of interest (identical to the fixed deposit rates). Flexibility in period of deposit with maturity ranging from 6 months to 120 months. Loans against deposits available. (MC No. 80/1996 Dt. 15.01.1996 7 MC No. 158/2000 dated 22.01.2000) 19 PNB Dugna Scheme Minimum Rs. 5000/= (Maximum Rs. 1 Crore per day), in multiples of Rs. 1/=. Period of deposit: 94 months Rate of Interest: 9.00% (General); 9.50% (Senior Citizen) Maturity value with principal of Rs. Rs 100/ 100/‐ for general customer Rs. Rs 201.00 201 00 & for senior citizens Rs. 209.00 Interest is re‐invested on the deposit amount (quarterly compounded) without Income option. Auto renewal of fixed deposit is permitted under the scheme for one year under regular scheme. Premature payment facility is available under the scheme. Demand Loan/Overdraft facility is available under the scheme. (RRMD:CIR:No. 31 dated 03.09.2010 & RMD:CIR:No. 51 dated 09.12.2010 and 07/2011 dated 03.02.2011 ) 20 PNB Lakhpati RD (A) Scheme This scheme would enable the depositor to become a “Lakhpati”. Maturity proceeds will be reinvested under FD Spectrum Scheme (under maturity option) for one year only at applicable card rate of interest at the time of maturity, y, if not withdrawn byy the account holder. Auto renewal of fixed deposit is permitted under the scheme for one year. Premature payment facility is available under the scheme. Existing Variants under the scheme: Amount of Instalment Period in months ROI Rs. 1000 Rs. 1000 Rs. 1500 Rs. 1340 Rs. 1300 78 78 57 60 63 9.00% 9.25% 9.00% 9.00% Cont. 21 New Variants introduced w.e.f. 10.12.2010: Amount of Instalment Rs. 1070 Rs. 880 R 730 Rs. Rs . 620 Rs. 530 • • Period in months Period in months 72 84 96 108 120 ROI 9.00% 9.00% 9 00% 9.00% 9.00% 9.00% Nomination, Loan, Auto renewal, Premature withdrawal facility available. Payable at par on maturity at all branches. (Ref: RRMD/DEP/Cir. No. 32 dated 06.09.2010, 38 dated 01.10.2010, 39 dated 04.10.2010, 42 dated 20.10.2010 and 52 dated 10.12.2010 and 07/2011 dated 03.02.2011 ) RMD‐H.O. 22 PNB Lakhpati RD (B) Scheme PNB Lakhpati Scheme provides a deposit product with special features of Recurring Deposit & Fixed d Deposit (Maturity ( b ) basis). Maturity value of Recurring Deposit shall be automatically crystallized into Fixed Deposit (Multi‐Benefit Option) and earn interest for remaining tenure of the contract. Amount A t off Recurring R i Deposit D it installment i t ll t & period i d off deposit d it (RD & FD): FD) Amount of installment may be deposited in multiples of Rs. 100/‐ and total period of deposit 120 months. RD period may be 24, 36, 48 & 60 months whereas FD period may be 96, 84, 72 & 60 months as per choice of customer. customer Period of Scheme: Upto 31.03.2011 (if not withdrawn by the Bank earlier). Maturity: Deposit shall mature on due date which shall be linked to date of opening of the RD account. Premature payment facility is available under the scheme. scheme Demand Loan/Overdraft facility is available under the scheme. (Ref: RRMD/DEP/Cir. No. 32 dated 06.09.2010, 38 dated 01.10.2010, 39 dated 04.10.2010, 42 dated 20.10.2010 and 08/2011 dated 04.02.2011) 23 PNB 555 Days Scheme y • • • • • Minimum amount of deposit is Rs. 10,000/‐ and thereafter in multiples of Rs. 1,000/‐. However, maximum deposit accepted under the scheme shall be Rs. 10 Crore p per day. y Tenor of deposit is 555 days with applicable interest rate of 9.30%. Premature payment facility is available under the scheme. Demand Loan/Overdraft facility is available under the scheme. scheme Scheme of 777 days discontinued w.e.f. 01/02/2012 (RMD:DEP:CIR: No. 44 dated 30.10.2010 & 36 dated 15.06.2011) 24 PNB 1111 Days Scheme • • • • • • Minimum amount of deposit is Rs. 100/‐ and thereafter in multiples of Rs. 1/‐ However, maximum deposit accepted under the scheme shall be Rs. 10 Crore per day Tenor of deposit is 1111 days only with applicable interest rate of 9.50% Period of Scheme: Scheme shall remain operative w.e.f. 01.02.2011 till the time it is withdrawn by the Bank Premature payment facility is available under the scheme Demand Loan/Overdraft facility is available under the scheme Scheme of 1000 days discontinued w.e.f. w e f 01/02/2012 (RMD:DEP:CIR: No. 06 dated 02.02.2011 & 36 dated 15.06.2011) 25 PNB SUVIDHA WITH PULL SWEEP FACILITY Product is most suitable for customers, who maintain multiple accounts of multiple lti l scheme h t types, f better for b tt fund f d managementt across the th branches. b h The customer accounts under scheme types like SBA (Saving Fund), CAA (Current Account), CCA (Cash Credit Account), ODA (Overdraft Account), TDA (Fle i Fixed (Flexi Fi ed Deposits) can be marked for pulling. p lling the order of sweep s eep has been set like SBA, CAA, ODA, CCA, TDA (flexi fixed deposits). Contribution to the Pool: ¾ For Debit bi balance b l account, Effective ff i available il bl amount = (Sanction ( i limit/Drawing li i / i Power which ever is less+ Adhoc limit, if any) – (Clear bal amount+ Lien, if any+ System Reserved amount, if any) ¾ For Credit balance account, account Effective available amount = (Clear bal amount+ Sanction limit/Drawing Power which ever is less, if any) – (Lien, if any+ System Reserved amount, if any) ¾ System will first identify all the positive balance accounts and then the negative balance accounts for contribution. RMD‐H.O. 26 Minimum Quarterly Average Balance/ Sanctioned Limit Requirement Service Charges: Particulars Min. Bal./QAB (in last quarter) Service Charges Upto 4 Accounts Qtrly Rs.4 Lac in any of SF/CA OR Rs. 4 Lac limit in CC/OD Free of Charge. 4 Qtrly Rs.4 Lac in any two of SF/CA AND/OR Rs. 4 Lac limit in any two CC/OD Free of Charge. More than Accounts & (RMD:DEP:CIR: No. 55 dated 24.12.2010) 27 MULTI BENEFIT TERM DEPOSIT SCHEME • • • • • • • Initial Deposit of Rs.100/‐ only, and thereafter in convenient multiples of any amount of Rupees with a maximum amount of Rs.99,99,999/‐ At PAR Collection of Term Deposit Receipt At PAR Collection of Term Deposit Receipt Payable at all Branches (Only on Maturity) Loan/Overdraft facility available Automatic Renewal: The provision of automatic Renewal is available provided the customer has given the mandate while opening the account Availability of Premature Cancellation Extension of Term Deposit (RMD:DEP:CIR: No. 26 dated 07.04..2011) (RMD:DEP:CIR: No. 26 dated 07.04..2011) RMD‐H.O. 28 SPECIAL TERM DEPOSIT SCHEME SPECIAL TERM DEPOSIT SCHEME • • • • • • • • IInitial i i l Deposit D i off Rs.100/‐ R 100/ only, l and d thereafter h f i convenient in i multiples l i l off any amount of Rupees with a maximum amount of Rs.99,99,999/‐. Monthly/Quarterly Interest payment option. At PAR Collection of Term Deposit Receipt; Payable at all Branches (Only on Maturity) Loan/Overdraft facility available. y Automatic Renewal: The provision of automatic Renewal is available provided the customer has given the mandate while opening the account. Availability of premature cancellation Availability of premature cancellation Extension of term deposit (RMD DEP CIR N 23 d t d 07 04 2011) (RMD:DEP:CIR: No. 23 dated 07.04..2011) 29 PNB ORDINARY TERM DEPOSIT SCHEME • • • • • • • • • • • The Term Deposit Ordinary (TDO) account can be opened with a minimum deposit of Rs.100/‐ as initial deposit and thereafter in multiples of Re.1/‐ with maximum amount of Rs.99,99,999/‐ For the period ranging from 7 days to 179 days At PAR Collection of Term Deposit Receipt Payable at all Branches (Only on Maturity) Loan/Overdraft facility available Automatic Renewal Permitted Availability of Premature Cancellation E t i off Fixed Extension Fi d Deposit D it The rate of interest shall be payable in accordance with the circulars issued by the Bank from time to time. Interest shall be paid at simple rate. Conversion to any other Term Deposit scheme is allowed (Ref : RMD Cir No. 14/2011 dated 16.03.2011) 30 ANUPAM TERM DEPOSIT SCHEME • Initial Deposit of Rs.10000/ Initial Deposit of Rs.10000/‐ only, and thereafter in multiples of Rs.1000/ only, and thereafter in multiples of Rs.1000/‐ with a maximum amount of Rs.99,99,000/‐ • In built Overdraft Facility In built Overdraft Facility. • Facility of further deposits in the same account and automatic enhancement of overdraft limit. limit • Payable at all Branches (Only on Maturity) • For period ranging from 6 months to 120 months. ( (RMD:DEP:CIR: No. 27 dated 26.04..2011) ) RMD‐H.O. 31 SUGAM TERM DEPOSIT SCHEME • • • • • • • Initial Deposit of Rs.10000/‐ only, and thereafter in multiples of Rs.1000/‐ with a maximum amount of Rs.10 Crore/. For period ranging from 46 Days to 120 months. Facilityy to withdraw anyy amount before maturityy in multiples p of Rs.1000 any time without breaking the entire deposit and without losing interest on the remaining deposit under the scheme. Facilityy of Auto Renewal available. Payable at all Branches (Only on Maturity) Premature renewal: Extension in the period of deposit before maturity is permitted. permitted No penalty to be levied and the interest payable to be contractual rate or the rate under the scheme on the contractual date applicable for the tenor for which the deposit has run, run whichever is lower. lower (RMD:DEP:CIR: No. 26 dated 13.04..2011 and 50 dated 03.10.2011) 32 PNB VARSHIK AAY YOJANA (VAY) DEPOSIT SCHEME • • • • • • • • • • Rs.10,000/ Rs 10 000/‐ and in multiples of Rs.1000/ Rs 1000/‐ thereof. thereof The maximum amount permitted under the scheme is Rs.99, 99,000/‐ The deposit will be accepted for 24, 36, 48, 60, 72, 84, 96, 108 & 120 months onlyy At PAR Collection of Fixed Deposit Receipt Payable at all Branches (Only on Maturity) Loan/Overdraft facility available Automatic Renewal is permitted Availability of premature cancellation Extension of fixed deposit is permitted Th rate The t off interest i t t shall h ll be b CARD rates t and d payable bl in i accordance d with ith the th circulars issued by the Bank from time to time Conversion to any other Term Deposit scheme is allowed (RMD DEP CIR No. (RMD:DEP:CIR: N 13 dated d t d 16.03..2011) 16 03 2011) 33 PROSPECTIVE SENIOR CITIZEN DEPOSIT SCHEME • • • • • • • • • • • The Scheme shall be applicable for the age of 55 years and above and up to 60 years. Rs.100/‐ and in multiples of Rs.1/‐ thereof. The maximum amount permitted under the scheme is Rs.99, 99,999/‐ Under Income Option, Option the deposit will be accepted from 1 year to 10 year in complete months/quarter as opted by depositor. Under Maturity Option any period between 1 year to 10 year At PAR Collection of Fixed Deposit Receipt Payable at all Branches (Only on Maturity) Loan/Overdraft facility available Automatic Renewal is permitted Availability of premature cancellation Extension of fixed deposit is permitted The rate of interest shall be CARD rates and payable in accordance with the circulars issued by the Bank from time to time Conversion to any other Term Deposit scheme is allowed 34 (RMD:DEP:CIR: No. 45 dated 01.08.2011) Premium Customer/HNIs • • • • The criteria for Premium Customer/High Networth Individual (Savings): “Total Relationship Value (TRV) of Rs 5.00 Lakh with minimum SB balance of Rs 0.50 Lakh OR Quarterly Average Balance of Rs 1.00 Lakh or above in the SB account in the preceding quarter” SB account in the preceding quarter Once a customer is identified as HNI/Premium Customer, he/she continues to be classified as Premium Customer for always/forever, even if TRV or Quarterly average balance goes down the benchmark High Value customer shall have only One Touch Point/single window dealing in the branch A separate t area for f Relationship R l ti hi Manager M and d HNI clients li t is i created t d and d named “Privilege Lounge” (RMD DEP CIR No. (RMD:DEP:CIR: N 49 dated d t d 06.12.2010) 06 12 2010) 35 ASBA Facility • • • • • • • • • The facility may be used for applying in public issue of companies. companies PNB is registered with SEBI as Self Certified Syndicate Bank (SCSB). SCSB is the bank offering facility of applying through ASBA process. The investor is required to have an account with any of our Branch. The money remains in the account and earns interest. Lien is marked and the moneyy is appropriated pp p on allotment without involvement of physical refund. No cheque is issued. There is no clearing of instrument. ASBA facility is also available to investor directly through a link on www.pnbindia.com or www.pnbindia.in 36 37