Accounting Case

Accounting Case

Written by K. H’Ondi, under the supervision of Professor W. Ben-Amar

Telfer School of Management

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Tandem Technology Limited (TTL)

Tandem Technology Limited (TTL) is a federally-incorporated private company. All of its shares, i.e., 8,000 common shares, are held by the CEO and founder, George Martin. TTL is located in the National Capital Region and specializes in the development and commercialization of hearing aids for the deaf and hearing impaired. The nature of its activities makes the company subject to a number of Canadian laws and regulations, such as the Medical Devices Regulations and the Food and Drugs Act .

TTL was founded in February 1990 by George Martin, an engineer by training. Originally its main activities were research and development of new technologies for amplifying and improving sound transmission. Once a new technology was developed and patented, TTL would sell or lease the production rights to a manufacturer in return for a royalty on the sales of the product. Its inventions were used in the manufacture of a number of instruments, such as sound systems and loudspeakers.

The sound technology industry is extremely competitive and largely dominated by big companies. These have a monopoly on industry investment and an unlimited access to human and technological resources, which allows them to exercise a significant influence on market trends. For this reason it is difficult for a small company to be profitable, because the nature of the activities involved demands substantial funding. Nevertheless, the ingenuity of its engineers and Mr. Martin’s excellent management has enabled TTL to make a profit year after year.

A turning point for TTL came in 1995, when the company developed and patented a miniaturized amplifier, which it leased to a hearing aid manufacturer for a five-year period in return for a royalty on the sales of the product. The amplifier was extremely effective in amplifying only useful sounds. As a result, the hearing device manufactured by the leasing company was so successful that TTL’s royalties from sales of the product between 1996 and 1998 constituted more than 50% of its profits.

For this reason, George Martin made a strategic decision in 1998 to orient TTL’s new research activities towards the development of microphones, amplifiers, loudspeakers and microprocessors, all components of hearing devices. In fact, he decided to completely abandon his previous operating activities and specialize in the development and commercialization of various types of hearing aids.

Today, TTL’s activities are conducted by the same unit, and are subdivided into three departments. The first is Research and Development (R&D), which conducts research aimed at developing new technologies. The second is Manufacturing (MAN), which manufactures new

1 This case describes a fictional company made up by the author.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 1

Accounting Case

H’Ondi, K. and Ben-Amar, W. products from technology developed by R&D as well as from technologies acquired from outside in the form of patents. The third department is Distribution (DIST), which sells the products manufactured by MAN as well as products manufactured by external companies that have given

TTL exclusive commercialization rights.

Although the hearing aid industry is much less competitive that the sound technology industry in which TTL previously operated, they are similar in that most of the companies in the field are public (open) companies. This is primarily due to the sector’s capital-intensive nature, which requires a level of investment that often can only be obtained from access to public markets. Thus, a number of companies that tried to remain in this market did not succeed either because they were under-capitalized (the average debt-to-equity ratio being around 70%), or their technologies did not perform, or they had not developed products that were innovative enough to stay ahead of the competition.

George Martin has a highly centralized management style. To maintain control, he keeps abreast of all aspects of his company’s management. Since he founded TTL, he has put his heart and soul into carving out a place in the industry and remaining profitable and viable. Recent years’ results seem to indicate that he has achieved his goal; not only can he show an excellent financial position, but the MAN department is operating at full capacity, requiring TTL to sell the results of some of its research rather than making the products in-house. As a result, to increase manufacturing capacity, George is considering acquiring one of TTL’s competitors.

It is the beginning of January 2011. You, a young accountant with the firm of Laflamme

Bentley L.L.P are responsible for the TTL account. You and your colleague Albert Sansouci have gone to TTL this morning to meet George Martin and Janice Terry, company comptroller, to discuss several urgent issues.

Mr. Martin: Thanks for coming, Albert; it’s always a pleasure to see you.

Mr. Sansouci: The pleasure’s all mine, George. How can we help you today?

Mr. Martin: You’ve already met Janice, our new comptroller. She’s come on board at a critical moment for the company and is finding herself really stretched by the workload.

Ms. Terry: I’m still getting to know TTL’s accounting system. Now, with the changes announced by the Chartered Accountants of Canada (CAC), TTL will have to make a choice as soon as possible between the application of the new standards for closed capital companies or the

International Financial Reporting Standards (IFRS) for the business year beginning on January 1,

2011. I would like your view on which of the two—the IFRS standards or the closed-capital company standards—would be better for TTL. To assist your analysis, I’ve prepared a document

(Appendix I) that includes our current accounting policies, as well as TTL’s income statement as of December 31 (Appendix II). Since our major creditor hasn’t asked for a cash flow statement we haven’t prepared one. We’d like the new financial reporting framework to be as close as possible to the policies presently in place.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 2

Accounting Case

H’Ondi, K. and Ben-Amar, W.

You: Do you also want to know the main differences between the existing conventions and those in the framework we recommend?

Ms. Terry : No thanks, that won’t be necessary. I think the reading I’ve been doing and the training I’ve received will allow me to sort out any questions as they arise.

Mr. Martin: Before I forget, I met with my advisor at the National Investment Bank and we agreed that the best way to expand TTL would be by acquiring a company in this sector, which we would then merge into our manufacturing department. I’ve already got a company in mind, and if all goes according to plan the acquisition talks should start before the end of the month. I’ll probably need to discuss the accounting issues involved with your team further down the road, when the transaction has been completed.

Mr. Sansouci: George, this is a major financial transaction. As your advisor, I’d like to take a look before it’s finalized.

Mr. Martin: Thanks, Albert, but I don’t think that will be necessary. I’m planning on buying

Audio Solutions Ltd. (ASL). The company has had several run-ins with government agencies over the current industry regulations and its owners are almost compelled to sell it. It’s a bargain!

However, because you insist, I’ll send along the files containing ASL’s financial statements

(Appendix III), the description of its operations (Appendix IV) and the acquisition’s conditions of purchase, which are non-negotiable (Appendix V). I’d like you to go ahead with a study of the acquisition and my potential financing sources (Appendix VI), and come up with a recommendation that will help me make the best decision.

On your return to the office, your colleague says, “I’d like you to start working on the questions of the transition to new accounting standards and of the acquisition as soon as possible.

You’ll go with me to the next meeting with the client to give him our recommendations. Prepare a presentation for him that addresses all his questions. Be sure to include all the accounting issues related to the accounting and evaluation of the acquisition, whether we recommend it or not, according to the framework suggested. But don’t get into the tax implications. Our tax team will deal with them when the time comes.”

Work to be done

Prepare the presentation that will be made at the next meeting with George Martin and Janice

Terry of TTL.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 3

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Summary of Appendices

Appendices

I Tandem Technology Limited: Accounting Policies

II Tandem Technology Limited: Summary of Financial Statements

III

IV

V

VI

Audio Solutions Limited: About the Company

Audio Solutions Limited: Summary of Financial Statements

Audio Solutions Limited: Conditions of Purchase

Tandem Technology Limited: Potential Sources of Financing

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 4

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Appendix I

Tandem Technology Limited: Accounting Policies

Inventory

Raw materials, finished products and work in progress are evaluated at the lowest price, established according to weighted average cost method, and the net realizable value.

Fixed assets

Fixed assets are shown at cost. Depreciation is calculated according to the straight line method.

Research and development costs

Research costs are debited in the financial year in which they are incurred.

Development costs are debited in the financial year in which they are incurred unless they meet the capitalization and depreciation criteria according to generally accepted accounting principles. Depreciation is calculated by the straight line method over a 3-year period, starting from the year that the development of the new product ends and where the commercial production begins.

Taxes on earnings

The company uses the asset-liability method when accounting for income taxes. Under this method, assets and liabilities of future income taxes are recognized for the future income tax consequences attributable to temporary differences between the book values of the assets and liabilities shown in the financial statements and their respective values for tax purposes.

Fair value of financial instruments

The book values of cash on hand, accounts receivable, notes receivable, accounts payable and expenses due and accrued, as well as bank indebtedness, approximate their fair value given the short-term due date of these instruments.

Contingencies

According to Generally Accepted Accounting Principles, the company’s financial statements account for the amount of an eventual loss as a debit when the amount of the loss in question can reasonably be estimated and when it is likely that a future event will confirm that an asset has depreciated or a liability has been created before the balance sheet date.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 5

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Impairment of Financial Assets

Management regularly reviews the evaluation and depreciation of assets, factoring in events and circumstances that could indicate that their book values might not be recoverable. In such cases, the book value is adjusted to the recoverable value.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 6

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Appendix II

Tandem Technology Limited, Summary of Financial Statements

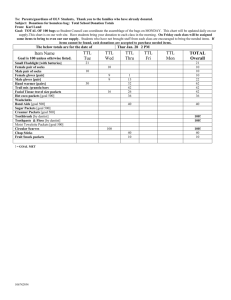

Tandem Technology Limited (TTL)

Summary of Financial Statements for the financial year ending December 31, 2010

($ thousands)

2010

Sales

Cost of goods sold

Gross profit

Sales and administration costs

Research costs

Depreciation

Interest on debt

Other charges

Net income before tax

Tax on revenue

Net income

14,556

9,020

5,536

446

2,450

1,300

345

187

4,728

808

157

$ 651

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 7

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Tandem Technology Limited, Summary of Financial Statements (cont.)

ASSETS

Cash

Accounts receivable

Notes receivable

Inventory

Other short-term assets

Land

Net fixed assets

Satellite participation

Capitalized development costs

Patents

Other long-term assets

Tandem Technology Limited (TTL)

Balance Sheet as at December 31, 2010

($ thousands)

Total assets

LIABILITIES AND EQUITY CAPITAL

Expenses due and accrued

Bank loan

Accounts payable

Short-term portion of long term debt

Long-term debt

Obligations arising from leasing contracts-financing

Equity capital

Share capital

Retained earnings

Total liabilities and equity capital

2010

12,173

15,816

5

160

67

740

972

3,890

2,600

1,300

7,054

15,816

22

66

10

45

3,500

3,643

956

7,264

830

1,245

678

1,200

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 8

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Appendix III

Audio Solutions Limited: About the Company

Audio Solutions Limited (ASL) is a federally-incorporated private company. Its founder and board chairman, Carl Beauchamp, owns 62% of its common shares while the remaining shares are held by other individuals who also sit on its board of directors.

Since 2003, ASL has specialized in the manufacture of hearing devices and prostheses, which it sells to a number of Canadian distributors. The company does no research and development and it acquires manufacturing rights by purchasing patents. Some analysts believe the company’s strength is its use of cutting-edge technology in production, which considerably reduces costs and improves the products manufactured.

Nevertheless, at the beginning of 2007, ASL and several of its clients were found guilty under both the Food and Drugs Act and the Competition Act of having manufactured and commercialized instruments potentially harmful to consumers’ health and of misleading advertising about the benefits of the product. The accusations pertained to the Audio 364hearing aid, a new product that ASL had begun to make near the end of 2005 and which it discontinued the moment the charges were laid. ASL had to recall all the devices in question and reimburse the full purchase price to all purchasers who requested this refund.

The results of the official inquiries showed that the problems of quality were mainly due to some poor management decisions on the part of ASL relating to the purchase of the patent and the manufacture of the Audio 364 hearing aid. In any event, it seems that another Health Canada investigation, this time into the product HAS200, is currently underway.

As a result, several ASL clients stopped doing business with the company and it was obliged to borrow major amounts at high cost to try to cover all the expenses resulting from the guilty verdict. Since that time (2007) the company has continued to accumulate losses. Despite these poor results, no ASL creditor has threatened to recall its loan, because the unit recorded excellent results in the past and all observers agree that the company should eventually be able to get back on the road to profitability.

Lastly, since ASL’s directors announced their intention of selling the company, a number of its competitors have shown interest in buying it.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 9

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Appendix IV

Audio Solutions Limited: Summary of Financial Statements

Audio Solutions Limited (ASL)

Summary of Financial Statements for the financial year ending November 30, 2010

($ thousands)

2010

Sales

Cost of goods sold

Gross profit

Sales and administration costs

Interest on short-term debt

Interest on long-term debt

Expenses from recall of Audio

Depreciation

Other expenses

Net income

3,510

2,544

966

297

74

134

364

124

75

1,083

(117)

2009

2,646

1,734

912

266

66

120

378

123

63

1,033

(121)

A business evaluation specialist has assessed the liquidation value of ASL’s assets at

$3.511 million at the moment of drafting the offer and that their fair market value at $5.577 million.

ASL’s financial statement of November 30, 2010, shows liabilities of $4.645 million. According to the data obtained from ASL’s executive, no refund of debt has been made and no other debt has been incurred since the closing date.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 10

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Audio Solutions Limited (ASL)

Summary of assets for the financial year ending November 30, 2010

($ thousands)

Cash on hand

Land

Building

Materials

Other long-term assets

Total assets

FMV Net liquidation value

134

953

1,270

2,380

840

$5,577

120

715

953

1,190

1534

$3,511

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 11

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Appendix IV

ASL Conditions of Purchase

Once ASL’s board of directors has given unanimous approval, TTL can purchase the company by buying either its assets or its shares. After the acquisition, ASL’s activities will be completely merged into TTL’s manufacturing department, at which time ASL will cease to exist.

Purchase of shares:

Purchase of assets:

If TTL acquires ASL by purchasing all of its outstanding shares, TTL must pay ASL’s shareholders a monetary consideration of $932,000.

If TTL acquires ASL by purchasing the entirety of its assets, TTL must pay

ASL a monetary consideration of $6 million.

The consideration to be paid was established by assessing the fair market value of ASL’s assets and liabilities as well as other factors likely to affect the transaction.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 12

Accounting Case

H’Ondi, K. and Ben-Amar, W.

Appendix V

Tandem Technology Limited: Potential Sources of Financing

National Investment Bank (NIB)

NIB will support TTL’s expansion by financing the cost of acquisition including transaction costs at a fixed interest rate of 12%, not exceeding the fair market value of its shares at the time of purchase. The conditions of the loan are that TTL assign to the bank all shares in ASL and all future financing decisions (incurring debt) with other creditors must be approved by the bank.

Amelin Trust Inc.

Amelin Trust Inc. has offered to invest in TTL in return for a large number of preferred shares. TTL will have to issue 10,000 non-voting preferred shares with a cumulative dividend of

15%, in return for which the trust company will give TTL up to a maximum of $6 million. In the event that TTL does not want the full amount, the number of preferred shares to be issued will be determined proportionately to this offer.

Should TTL be unable to pay the dividends on the preferred shares, all of them will be converted to common shares with voting rights.

Watson Investment Company (WI)

Watson will invest up to $6 million in return for 6,000 newly issued common shares with voting rights. The WI offer is also conditional on the creation of a new five-member board of directors, three of whom will be named by Watson. Should TTL want a smaller amount than the maximum available, the number of common shares to be issued will be determined on a basis proportionate to this offer. However, the condition regarding the creation of the board of directors would remain the same.

Jeux du commerce TD Assurance Meloche Monnex 2011 Page 13