A HEURISTIC METHOD FOR THE FACILITIES IN SERIES

advertisement

Onderzoeksrapport

Nr ~

7817

A HEURISTIC METHOD FOR THE FACILITIES IN SERIES

DYNAMIC LOT SIZE PROBLEM

by

H. R.

LA1'1BRECHT

J. VANDER EECKEN

H. VANDERVEKEN

Katholieke Universiteit Leuven, Department of Applie.d Economies

De 1.:.i~nstraat

B···JOOO

2

I~EUVEN

BELGIUH

IIJe::telijk Depot

D/1978/2376/26.

A HEURISTIC NETHOD FOR THE FACILITIES IN SERIES

DYNAMIC LOT SIZE PROBLEM

H.R. LM1BRECHT~

J. VANDER EECKEN

H. VANDERVEKEN

This paper focuses on heuristic procedures for the uncapacitated

facilities in series dynamic lot size problem. Several multilevel and level-by-level procedures are compared with the optimal rrndels

of \.J. ZANGWILL and S. LOVE. The best heuristic differs only marginally - on the average by no more than 1 .84 % - from the optimal solutiono Our computational expe.rience is based on a large

set of simulation experiments.

Io INTRODUCTION.

There has been a widespread interest in the deterministic dynamic production

and inventory models since the publication of the classic paper of Wagner

and Whitin [ 12] ,

Their model deals with the search for optimal produc-

tion (ordering) and inventory schedules for a single stage, single product

system given a fluctuating deterministic demand pattern over a finite horizon

o

Presumed computational difficulties with Wagner-w'hitin's model have

led to a number of heuristic approaches such as Part Period Balancing,

Least Unit Cost, Least Total Costt Silver-Neal Heuristic, etc ••••

In recent years various papers have appeared on production-inventory planning in multi-echelon or multistage systems.

The

seria~

arborescent and as-

sembly structures are the best known production configurations.

In this paper we will concentrate on the facilities in series dynamic lot

ze problem.

Because of the computational difficulties of the optimal so-

lution algorithms we propose an efficient near-optimal heuristic procedure.

::1'1

Katholieke Universiteit Leuven, Department of Applied Economics.

This work was supported by the Fonds Derde Cyclus under grant ,OT/V /19.

The serial dynamic economic Jot size production model has been studied

~~he

amoug others by

d~fferent

:o:ev,;::ral

processes.

Eaeh process is assumed to take place in a

processing industries

Serial <>ystctns ::.::::::::

facility.

f:i.no..t product requires

e.g. steel and chemical industry,

A concave cost structure is assumed so

that costs: may eTnbody a fixed charge.

No bacl<logging is per·mitted so that

requirements are to be met as they occur.

It is also assumed that one

of production at any facility requires as input one unit of production

from the preceeding facility.

t,et

~

:::::

r.'

l

l '

be the market demand for the finished product in period i,

0

lb

<\)"

•

:II

= 1,

Define x. • as the production of faci H ty j, j

n.

in period i.

Production is instantaneous.

hl.

••• , m

Let I . . he the inventory stored at facility j at the end of

],1

Let PJ,l

. . (x) he the cost of producing x units and H. . (I) be the

],l.

cost of holding I units

stock. F . . (x) is a fixed charge function and

period

i.

.

J,l.

we assume H. . (I) to be

J ':!.

The obj

1s to determine the production schedule in each facility that

r:u.m.n:uzes total costs.

HinimL"'

The appropriate programming problem is as follows

t

(l)

I.;

j ""l

Subject to

(2)

i=l, .••• ~ n

i:=:1~

0

I.J,U"

{ i L!- :1

= I.],n = 0

••• , n

(3)

¥(i,j)

(4)

¥.

(5)

J

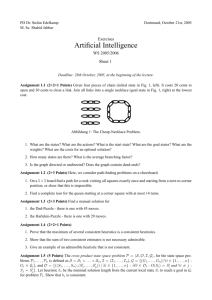

has cleverly represented the constraints as floiV constraints

in a single-source network (see figure 1).

Equations (2) and (3) demonstrate

2.

nodal conservation of flow in the network.

The determination of the opti-

to

mal production schedule is

the

network

optimal flow.

n

L: r.

i=l l.

-----~--~

I

I

I

fac t

I

------~-~)

fac j

~---- "">Q-- -t

fac m

!

r

J

r.

1

FIGURE 1.

r

n

3.

II. THE OPTD:1AL SOLUTION ALGORITHHS •

Constraint (2) ·- (5) define a closed bounded convex set, and since the objective function is concave, it will attain its minimum at an extreme point

of the convex set.

An extreme flow is defined as the network flow equiva-

lent of an extreme point of the convex set of feasible solutions.

Zangwill

demonstrates that) in the absence of capacity constraints) an extreme flow

has the property that any node in the network can have at most one positive

input, or :

x J,~

•.• I ],~.. l

=0

for all i and j

As a consequence, the input into node (j,i) must satisfy demand over an in-,

tegral number of periods.

algorithm

tions.

Zangwill [ 14] developed a dynamic programming

the above characteristic of. optimal solu-

ting

t-Ie refer to

[ 14]

for a detailed description of the algorithm.

Love I 7 J considered the facilities in series model with the following cost

assumptions :

Production costs are non-increasing in t

Inventory holding costs are non-decreasing in j :

H.

(I)~H._Ll t(I)~ j=l, •• .,m-1

],t

J .... '

As a consequence of the above assumptions, L.ove proves that if in a given

period production starts in a

duce~

facility~

then its successors must also pro-

that is to say once production starts in a given period i, facility

then production continues in i at all facilities j+l, ••• , m.

tion schedules are called nested.

tic reduction

Such produc-

The nested schedule case causes a dras-

the number of computations required to find the optimal

production schedule.

We refer to

[ 7]

j~

for a detailed descripti'on of the

4.

resulting

The al

thms of Zang><Till and Love \;rere programmed in FORTRAN IV. (on IBM

ThE!

370/358 :Hodel 3)

tr

facilities and

planning horizon.

th the number of

1

tho::. 1Tu1nber o.f

included in the

Figures 2 and 3 illustrate these results graphically.

III. HEURISTIC PROCEDURES.

The heuristic procedures explained

this section hold under the following

cost assumptions :

• The

cost func

o(x . • )

J~1

'"" 1 if X!~

the

m~it

~"

P . . (x . . )

],1

],1

S. o(x . . ) + b .• x . . with

J

],1

J

],1

>0 and O(X,],1.) ""'0 if X.],1• ""0, is the same for

J,~

each time per

~

but may differ from facility to facility.

Since

production <:ost is constant, it has no influence on the op-

timal

and may therefore be

• The inventory holding cost fuaction h .• I", i

J

st::1n1 throngh

but

As a result of these two as

non·~dr ~reasing

linear and h. is conJ

from star~ to successor staf?e.

J

~.

the production schedules

w

~..rill

be nested.

A. THE }fOLTI-LEVEL HEURISTIC.

The proposed heuris

quantities are ass

is of the multi-level type which means that production

to

Hn approach enhances the p·rac

ties on a period by period basis.

Such

value of the method mainly because the

current decisions can be bafed on near

and thus accurate data.

5.

Z3ec

7

Zangwill

Love

6

4

3

2

-4

5

FIGURE 2.

6

7

9

6.

n=:JO

6

U"'10

n -7

- - - - - - - - - - - - - - - - - - - - - - - n•)

4

5

FIGURE 3.

6

1() faciE tic

7o

Define reorder period k as a period with positive production at all facili-

> 0). For each

1

facility and each time period a coefficient will be calculated indicating

ties (period one is always the

reorder period if r

rs

whether a cost reduction 1s poss

le by incorporating dem<1nds

m, reorder period k.

into t:he lot of facility j, j=l,

cients turn out to be negative for a certain period i, i

If all coeffi-

>k

then period i

is considered as the new reorder period and the loading meachanism is repeated.

The following coefficients will be used

J

2.:

Sa - C.

-

1.-11

;<,

Q,=l

h .• r. ( i -k)

J 1

i "" k+1' k+2, •••

¥.

J

( i -p . ) r . ( h . - h .

J

!.

J

)

J- 1 .

<

jo

i

¥.

J

with

= k+2,

k+3

(7)

> jo

C.1-1, as the cumulative inventory holding costs incurred from reorder

period k up to period i-i.

as the last period with positive production at facility j.

p.

J

For each time period i, the fac:i.li ty

which

(6)

Max {U . .

j

],~

~

is selected as the facility for

O}

Define the set A as follows

A = {j \U • . is computed by (6)} •

J,l

h

•

•

'1

• turns out tat

I-f 1t

J.KEA. we set J.o • J.K , e 1se J,Q k·eeps 1ts

prev1ous.y

determined value.

8.

At the beginning of the loading process, i.e. at the start of each new

. 1 we set J"

reor d er per1oc

We

j

t

= 1,

For

ch<'~ck whether

••• m(=j

0

0

equa 1 to m.

advantageous to

it

rk+l

xj ,k'

For this first step only formula (6) is evaluated.

).

j"" l

we have

u1 ~k+l- "" s l -

hl .rl·+'

'I

j:=2

we have

<::!

u2,k+l "" ""1 +

sz

-

s9.,

- h m··rk+l

j=m we have

1.11

um~k+l .,

The first component of

in

k,

m

L:~

9,=1

Uj~k+l

(Ck "" 0)

h2.rk+1

represents the cost savings for not producing

ties l , 2 ~ • • • j.

The other terms represent inven-

tory holding costs as the consequence of producing more than·the current

requirements.

Note also that for a specific facility j we treat the faciliJ

ties 1, •.• ~ j as a single facili

and h. as cost parameters.

2:

with

J

£""1

• '!... t0e

1

Th e f ac1'1"1ty J.~ W1t•a

last faci

t

coeffic

pmn t

.._p

ty producing rk+l in period k, or,

-~

J "" 1 ~ ••• J

I

.:l(

J ,k

= rk+l

and

xj~k+l "" rk+l

Since for fhe

t

:JL

J

.~

1 ""

s (

j "" J.x+'• '

rk

.o

step J cA, we set J

~

.~

J •

•

E:!

"" '

m

selected to be tL.a

k+2.

rements of

We next turn to the

Both c effie

(6)

.

.

and (7 \J may no1.v be used (.dependJ.ng

on the posJ.. t1on

o f J. 0) • 1'.

.n.gures 4 and

5 illustrate

evaluated respectively by for-

t:he a.l

.o

trary J •

mula (6) and 0) for an

1

.o

-~

J '"J

--

~1

----

:eo

l

-> •

L

I

v

I

.o .ox

J ""J

I

;

l

-·-----~>···

'

~.!.

I II

~~--J

•'IIi

I

I

1

'lio

i

if

l

r

--,1

,.•

k

Ill

!

~

I -

If

"'

!

'k+l

FIGURE il ~ alternatives

evaluated by (6)

FIGURE 5 : alternatives

evaluated by (7)

After the :;;;election of the highest positive coefficient the procedure is re-

peated for the requirements of period k+3.

The procedure ends if all

coefficients turn out to be negative, indicating that a new reorder period

is found.

Notice that formula (6) computes the possible savings :resulting from not

scheduling production

facility

j~

period

i~

but adding r. to. the produc1

J ~ period ·:.

li

t; of

tion

Formula (7) or: the other hand

lot of

evaluates the possible Servings by adding r!, to ...lh: prod

fc.-~

J.-

ty

j~

the last period tv-ith positive production for

peeiod pj \vhich

facility j .,

Remember also that the production schedules must be nested,

. se 1 ec:teo' proauct:ton

'

.

.

that means that once

::;.s

cont1.nues

at j.'}t. + 1 , .... , m..

It is clear that the production quantitites must be adjusted after each

step of the procedure.

Because the production program is constructed on a period-by..;.period basis,

it 1nay turn out that demand of the last

all facil:i ties

period n.

period~ rn~

has to be produced at

In this case a backtracking procedure examines

v..rhether it is not better to incorporate rn into an earlier lot.

We there-

fore compare the saved set-up costs with the additi.onal inventory holding

costs cau:.>ed

production (

in inventory from the last period with positive

n

each facility) to period n.

r

A 7 facility, 7

problem will be used to illustrate the above proce-

dure.

Fad

4

80

l

3

100

100

4

2GO

5

300

200

!00

2

6

7

Reorder period

70

2

3

~

"

-~

l,

,.

:J

k~l.

A'*'{l, 2~ ••• 7}

60

~00

5

6

7

120 80

40

Formula (6) u12 "'

400 - 2

X

70 ""

260

500 - 2

X

70 ""

360

u32

=

=

600 - 3

X

70""

390

ut,2

=

800 - 3

X

70 ""

590

U,.,L2

u52 ""' llOO - 3 x 70 "" 890

u62 "" 1300 - l~ X 70 "" 1020

u72 = 1400 - 5

M~X {u j,2 } "' U72

= 1050

J

c2 = s x

10

•o

J

X

+ J.~

70 "" 1050

"'

7

= 350 •

=7

A

= {1 ,

2, ••• , 7}

=

400- 350- 2

X

X

60

= -190

U23 "'

U

=

33

500 - 350 - 2

X 2 X

60

= - 90

= -110

u43

800 - 350 - 2x3x60=

Formula (6) U13

2

600- 350- 2 X 3 X 60

90

u53 "' 1100 - 3.50 - 2 X 3 X 60 "" 390

u63 ""' 1300 - 350 - 2 x 4 x· 60 = l+70

u73 "" 1400 - 350 - 2

= 350

C3

• cnec.

• k r

4

,

+ 2 X 4 X 60

3'

0

=6

Formula (6) u l

t ~

~ A

X 5 X

60 '"'

450

= 830.

= !J ,

2 ~ ••• , 6 }

u34 "'

400 - 830 - 3 X 2 X 100 "" -1030

500 - 830 - 3 X 2 X 100 "" - 930

600 - 830 - 3 X 3 X 100 = -1130

u44 ""

800 - 830 - 3 X 3 X 100

""

u24 "'

=-

930

U

54

U

64

Formula (7) u

74

~

1100- 830- 3 X 3 X 100

= 1300

.., u

64

- 830 - 3 X 4 X 100

+ s

7

-630

~

-730

- (4-3) - 100 (5-4)

"" -730 + ] 00 - 1.00 ... -7 30 •

Since all coefficients are negative we turn to the next reorder

period k=4.

Reorder period k=4.

Max {U. }

j

J, 5

• check r

6

, j

0

= 6,

], 6

'5

= 820

+

j~ ~ 6, j~cA, j

0

=6

A~ {1, 2, ••• , 6}

j""

U.

= u6

1~2,

•••• 6 is computed via (6) and U.

J, 7

Max {U. } = U.

.

.h 6

J, 7

J

= 200

+ j:l'( ""'

7, j~A, j

0

""

via (7).

6

C "' 480 + 80 X 4 + 80 X 5 .,. 1200

6

• check r

7

, j

0

= 6,

A

= {1 ~

2,

••• , 6}

U. . , j"" 1, 2, ••• , 6 is computed by formula (6) and

J, 7

uj,7 via formula (1)

Since all U.

J, 7

are negative we turn to the next reorder point k=7=n.

13.,

The production program for periods 4, 5,and 6 is repr.es0nted on figure 6.

FIGURE 6.

The demand r 7 has to be produced on all facilities.. We therefore examine

whether it is not advantageous to incorporate r 7 into an earlier lot ..

This is done by comparing the saved set-up cost with the additional in-

ventory holding cost incurred by carrying r 7 in inventory from the last

period with positive production to period 7.

14.

= 160

X

2

X

2 "" 260

j "" 3

J "" 4

400 - 3 X 40

500 - 3 X 40

600 - 3 X 40

X

800 - 3

X

40

X

j ... 5

1100- 3

X

40

X

3 "" 240

3 "" 440

3 "" 740

j "" 6

i300- 3

X

40

X

...

1400 - 2

X

40

X

j

l

""

j ""' 2

J

7

4 "" 820

5 - l X 40 X 4

The greatest saving is obtained for j

=

840

= 7.

The resulting solution using the multi-level he,uristic is as follotvs

x . . (I. . )

J.~

],~

i

2

j

4

3

5

·6

7

1

210(0)

0(0)

0(0)

340(0)

0(0)

0(0)

0(0)

2

210(0)

0(0)

0(0)

340(0)

0(0)

0(0)

0(0)

3

210(0)

0(0)

0(0)

340(0)

,0(0)

0(0)

0(0)

4

210(0)

0(0)

0(0)

340(0)

0(0)

0(0)

0(0)

5

210(0)

0(0)

0(0)

340(0)

0(0)

0(0)

0(0)

6

210(60)

0(60)

0(0)

.340(240)

0(0)

0(0)

0(0)

7

150(70)

0(0)

60(0)

240(120)

0(40)

0(0)

Total cost

set-up costs

3000

Inventory costs

2590

100(0)

5590

The optimal solution found by Love • s algorithm is as follows

15.

~i

3

2

4

5

6

7

J

1

210(0)

0(0)

0(0)

340(0)

0(0)

0(0)

0(0)

2

210(0)

0(0)

0(0)

340{0)

0(0)

0(0)

0(0)

3

210(0)

0(0)

0(0)

340(0)

0(0)

0(0)

0(0)

4

210(0)

0(0)

0(0)

340(0)

0(0)

0(0)

0(0)

5

210(0)

0(0)

0(0)

340(120)

0(120)

0(0)

0(0)

6

210(130)

0(0)

0(0)

220( 120)

0(0}

120(0)

0(0)

80(0)

130(60)

0(0)

100(0)

120(40)

0(0)

7

120(0)

Total costs of the optimal solution : 5520. The heuristic differs for this

specific example by 1.27% from the optimal solutiono

B. LEVEL-BY-LEVEL HEURISTICS

A level-by-level heuristic assigns production quantities to

a specific

fa-

cility over all periods and uses the resulting production program as demands for the preceeding facility.

The level-by-level heuristics start

with the last facility.

Let rij) be the requirements for facility j, periods i, i

=

l, •.• ,n.

These

requirements are the production qua~~tities of facility j+l for all periodcq

io For j=m we have that r~m) = r., i = 1, ••• , n.

l.

1.

Any single stage dynamic lot-size algorithm can be used such as

Wagner-lifui tin

Part Period Balancing

Least Unit Cost

Silver and Meal [ 9]

Order

~foment

[8 1

The cost parameters for each faci

t

4

are given by

and h .•

J

The level-by-level heuristics consist. in fact in nothing else than using

m times one of the abovementioned sh1gle stage lot sizing procedures with

the appropriate cost parameters.

The recently developped Order ~Homent heuristic

I 8 J needs

more explanation ..

Let Gk,p ""

and

W~

~;rith

J

=

ITBO.

E(r).(t-1) + ITBO .• E(r). (TBO.- ITBO.]

"L> J

t=l

E(r) = n

J

n

r,

i=l

J

J

r.)_

2 .. A.

TBOj =

J

h, .E(r)

J

ITBOj

= f TBOj 1~ ,

i.e. the greatest integer less than or equal

TBO ..

J

The Order-Homent heuristic states to order for periods k through p-1) the

first th11e thl< following inequality holds :

G

''k

"">

,p ...

w•

J

The other lot sizing algorithms are so well known that no further exy:lanation is needed.

IV. COMPUTATIONAL

l~XPERIENCE.

The multi-level and level-by-level heuristics have been tested on a large

sample of problems.

Costs are expressed as percentages of the cost of

the optimal solution which is set equal to 100.

The average percent above

the optimal solution for the heuristics is given in Table I.

Procedure

Cost Performance

l1ulti-Level Heuristic

101.84

Level-by-Level

Older Moment

1\lagner-lifni tin

Part Period Balancing

Silver-Meal

·,[,east Unit Cost

106.25

109.01

11 L 15

112.47

H7.92

TABLE 1.

As can be seen from Table l. the mu ti-level heuristt

is superior to the

other procedures.

In order to exp1it1y characterizing the sample (72 problems wit,h 4

and 4

~ m ~ 10) 'l:ve

~

n ~ 10

introduce the follm.ring measures of problem complexity.

I. The coefficient. of demand vari.'3don

vD ""'

where D is the average demand and crD is the standard deviation

of demands

The sample contains

variable demand patterns as well as

problems with inc1:easing, de..:reasing and const nt demand patterns

2. The coefficient of cost variation

,.

"1-l

--"'--)/m-1

s.

J

The change in inventory holding costs and set-up costs from facility to facility seems to be an important element for the effectiveness of the proposed heuristics.

A large value of VC is an indi-

cation that eosts are highly variable and as a consequence difficult to solve by means of a heuristic.

Table 2 compares the multi-level heuristic (M..L.) and the level-by-level order

moment (O.M.) procedure in function of VC and VD.

"

~

0 -

'J

>

1.5- 3

r;_

• -'

D

H.L.

O.M.

M.L.

O.M.

M.L.

100.7.5

101.28

100. 7<:1,

105.91

101.27

H.L.

o.M.

I 08.25

H.L.

101.78

101 .52

OoM.

102.78

H.L.

O.M.

102.87

103.33

0 - 0.15

o. 15

- 0.30

102.2

> 0.30

M.L.

101.14,

.,

O.M.

M.L~

102.5

I

}f.L.

103.23

3

0.!1.

111 • 99

O.M.

108.33

O."M.

112.96

TABLE 2.

The 72 problems were evenly spread over the 9 cells of Table 2.

As can be seen from Table 2, the Multi-Level heuristic is superior to

Order Moment for all values of VC and VD.

The proposed Hulti-Level approach

19 ..

is far more better than Order

~ioment

for

values of VC.

The same

conclusion holds by con1pa.ring the multi-level heuristic with the other

level-by-level procedures.

The Multi-Level heuristic resulted in the optimal solution for 34 out of

the 72 problems.

'11m 5 Level-by-Level

heuristics were also tested using the following cost

parameters.

A.

J

= s.

and

J

h.

J

The costs deviate from the optimal solution by 12 .. 2% to 17.9% depending

on the heuristic used.

Table 3 summarizes the CPU-times for a number of selected cases.

The

co~

puter times are considerately lower than the ones required for the optimal

algorithm of S. Loveo

Moreover, the computer time is approximately linear

both with respect to the number of facilities and the number of periods, which

is not the case for the optimal al.g<Yri thms.

CPU-times in msec~; n""' 10, m = 4t 5, 6, 7, 8

4

5

6

7

8

164

195

239

263

299

938

1209

1471

1738

2028

m

Multi-level Heuristic

s.

l,ove

X

CPU-times in msec ; m= 5, n "" 4, 5, 6.

m

Mul ti-Leve 1 Heuristic

S. Love

~

On llU-1 370/358 Hodel 3

... ,.

10

4

5

6

7

8

9

10

102

126

!37

149

174

H35

195

214

304

411

562

733

892

1209

20.,

Th~: CPU tim.: for the level-by~level procedures does not di.ffer significant-

ly from. the computer time of the multi -level heur:l.stiiit.,

REFERENCES

t 1J

W.B. CRO\.JSTON & 1'1. \:i!AGNER : aDynamic Lot-Size Hodels for Multi-Stage

Assembly Systems", Hanagement Science~ Vol. 20, No. 1 ~ September 1973 1 pp. 14-21.

[ 2]

W.B. CRO\.JSTON ,. :tvl. WAG"fffiR, J. HILLIA1'1 : "Ee.onom.ic Lot-Size Dett:rmination in Hulti-Stage Assembly Systemsut Hanagement Science$

Vol. 19~ No. 5~ January 1973~ pp. 517-527.

[31

.1. J. DE MATTHEIS : HAn Economic IJot-Si.zing Techniqu~~.

Algorithm11 , IBM Systems~ Vol. 7~ No~ i, 1968.

[ l~ ]

A.B. KALYMON :

11

Systems~t,

The Part-Period

A l)ecomposi tion. Algorithm for Arborescence Inventory

Operations Resea-rch~ Vol. 20~ No. 4, .July-August 1972~

pp. 860·-8 i'

[ 5}

H. KONNO : 11Minimum Concave Cost Sedes Production Systems with Deterministie Demands - A bacldogging Case" Journal of Operations

Re.st:::arch Society of .Japan) Vol. 16, No. 4, December 1973,

pp. 246-253 ~

[ 6]

M.R. LAMBRECHT & J. VANDER EECKEN ~ "A Facilities in Series Capacity

Constrained Dynamic Lot-Size H:Odel" ~ Europi;;an Journal of Operational Research, Vol. 2 ~ 1978, pp. 42-ll9.

[ 7)

S.F. l.OVE : nA

Schedulesn~

1:Lt s

Inventory Modt;d with Nested

Nanagement Science, Vol. 18, No. 5, January 1972,

pp. 327-338.

[81

B.J. NcLAlmN & D.C. i'vYflYBARK: "Multi-Level Lot Sizing Procedures in a

Material Requirements Planning Environment", Discussion Paper

No. 64, Indiana Univc:rsity, November 1976,. 26 pp. ·

{ 9]

E. SIL\'"ER & H~ HEAL : "A Heuristic for selectiltg Lot-Sizing Quanti ties

for the Case

a DetE!X111inistic Tim.e~varying Demand Rate and

Discrete Opportunities for Replenishment"~ Production and Inventory Hanagen1;;mt, 2nd quarter 1973, pp. 64-74.

{10]

J. VANDER EECIG.~N~ H.4 LAHBRECHT & J.P. LINDEBRINGS: "Selection of Lot

Sizing Procedures for the Case of a Deterministic Time Varying

Demand Rate over a Finite Horizonn~ Bedrijfseconomische Verhandeling, DTEW, No. 7501, KUL~ 1975, 39 pp.

[ i1J

A.F. VEINOTT : 11~1inimum Concave Cost Solution of Leontief Substitution

Models of Multi··Facili ty Inve·ntory Systemsn ~ Operations Researchs

VoL 17, No. 2, Harch-April 1969, pp. 262-291.

t 12]

H.:H. WAGNER & '.t .11 .. tiiHITIN : "Dynamic Version of the Economic I..ot-

Siu::! Hodel, Management Science, VoL

pp. 212-219"

{E J

W.I. ZANGWILL :

W. I. ZANGHILl, :

No. l, October 1958,

11

Hanagemer~t

£ i 4]

5~

Minimum Concave Cost Flows in Certain Networks'\

Science, Vol. 14, No. 7) Jvlarch 1968, pp. 429-450.

11

A Backlogging and a Nulti-Ec.helon 'Hodel of a Dynamic

Economic Lot-Size Production System - A Networ'k. Approach",

l:1.anagement Science, Vol. 15, No.9, Nay !969~ pp. 506-527.