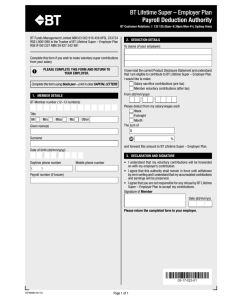

BT Lifetime Super – Employer Plan

advertisement