please review the following information before

advertisement

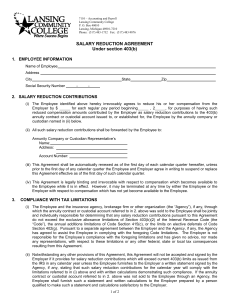

PLEASE REVIEW THE FOLLOWING INFORMATION BEFORE SUBMITTING PAPERWORK TO FIRST FINANCIAL: FORMS NEEDED TO ESTABLISH A NEW 403(b)/403(b)(7) ACCOUNT • First Financial Administrators’ Salary Reduction Agreement. • The APPLICATION and other paperwork required by the investment company. If an employer signature is required, please forward it to FFA. • TRS’ Uniform Disclosure Notice should be completed by the sales representative and forwarded to the investment company. (fixed and variable annuities only) Website: www.trs.state.tx.us TO INCREASE, DECREASE, OR STOP A CURRENT 403(b)/403(b)(7) REDUCTION • Complete First Financial Administrators’ Salary Reduction Agreement only. AGENTS INFORMATION • All agents must enroll on www.ffga.com (click on “Retirement Services” button then “403(b) Online Agent Enrollment”. When you enroll you are accepting the “School District Rules for Solicitation” form for the current school year. Agents must be enrolled in order for business to get processed. You can obtain forms by visiting our web page at www.ffga.com/403b/403b_main.htm EMPLOYEES & AGENTS – Once you have completed all necessary forms, please send them to First Financial to the attention of the Retirement Services Department: Regular mail: First Financial Administrators, Inc. P.O. Box 670329 Houston, Texas 77267 or Overnight mail: First Financial Administrators, Inc. 515 N. Sam Houston Pkwy E., 5thFloor Houston, Texas 77060 *CONTACT US BY: PHONE: 1-800-523-8422 / 281-847-8422 FAX: 281-847-8427 E-MAIL: Betty.James@ffga.com Carolyn.Torres@ffga.com Christy.Williams@ffga.com Elizabeth.Gomez@ffga.com Felix.Zuniga@ffga.com TDA - A SMART APPROACH FOR MEETING YOUR FINANCIAL GOALS! A Tax Deferred Annuity gives you the opportunity to supplement other retirement savings plans and enjoy favorable tax advantages along the way. Q. WHAT IS AN ANNUITY? A. An annuity is a contractual agreement between you and a life insurance company. In return for the deposits you make during your working years, the company promises to pay you monthly payments for a designated period of time. Only a life insurance company can offer an annuity that guarantees payments for life. Q. WHAT IS A 403(b)(7)? A. In 1974, along with other code changes, paragraph (7) was added to Code Section 403(b). While previously 403(b) participants were limited to choosing between fixed and variable annuities, Section 403(b)(7) added a third investment option - mutual funds having custodial arrangements with a recognized financial institution. For the first time, participants were able to take advantage of the financial opportunities of mutual fund accounts, including the popular “no load” funds. Q. ARE THERE ANY LIMITS TO HOW MUCH I CAN DEFER EACH YEAR? A. YES Provision 2006 2007 2008 402(g) limit on elective deferrals to 403(b) plans $15,000 $15,500 Expected to be $16,000 with incremental increase of $500 403(b) deferrals for participants 50 or older $5,000 $5,000 Expected $5,000 **Employees of qualified employers may contribute up to an additional $3,000/year after 15 years of service. (An averaging calculation must be done to ensure that the option is available) Q. WHO SHOULD CONSIDER A TDA? A. You should investigate a TDA if: * You pay substantial amounts of federal income taxes. * You are in a dual income family. * You are single, with no dependents. * You are investing money on an after-tax basis for long-term goals. * You have sufficient emergency funds. Q. WHY IS A TDA AN IMPORTANT SAVINGS PLAN? A. Contributions to a TDA are deposited into the plan on a pre-tax basis. In addition, interest earnings accumulate on a tax-deferred basis. Q. HOW ARE CONTRIBUTIONS MADE? A. To establish a TDA plan, you must complete an application and a salary reduction agreement form; which, in effect, reduces your taxable salary. Your employer will automatically reduce your paycheck by the amount you designate and will contribute that portion to the plan. Q. IF I BEGIN THE CONTRACT DURING THE MIDDLE OF THE YEAR, IS IT TOO LATE FOR ME TO PUT IN THE MAXIMUM ALLOWED AMOUNT FOR THE YEAR? A. No. With your employer’s permission, you can establish your salary reduction agreement to make up for the months you missed so far. For example, if you wish to deposit $100 a month but did not sign up until June; you could make your agreement for $200 a month until the end of the year and $100 a month thereafter. Q. MAY I STOP CONTRIBUTING AT ANY TIME? A. YES. You may terminate your salary reduction agreement at any time. Q. WHAT HAPPENS IF I CHANGE JOBS? A. If you remain eligible for a TDA, you have several options: 1. Continue your present contract with your existing carrier with your new employer. 2. Leave your present contract on paid-up status, if the account value is at least $600; and begin a new contract with an insurance company offered by your new employer. 3. Transfer the value of your present account to a new contract with an insurance company offered by your new employer. No taxes will be due if the transfer is executed properly. 4. Take a lump sum distribution. The distribution amount is includeable as income for the year and taxed accordingly. 5. Choose an annuity option. Annuity payments are taxable as received. If you do not remain eligible for a TDA, you may choose either option 4 or 5, or: 1. You may transfer your account value to an IRA (IRA Rollover). No taxes will be due if the transfer is executed properly. However, your account will then be subject to IRA tax rules. 2. You may leave your account on paid up status if the account value is at least $600. No taxes will be due. Q. CAN I HAVE A TDA PLAN IN ADDITION TO OTHER SAVINGS OR RETIREMENT PLANS? A. YES. You may have a TDA in addition to your IRA. Because federal and state rules and regulations differ between IRA’s and TDA’s, it is generally agreed that it is best to maximize your TDA contributions before starting an IRA. You may also be a participant in other savings or retirement plans your employer provides. Q. IF I PLAN TO RETIRE IN JUST A FEW YEARS, SHOULD I PARTICIPATE IN A TDA PLAN? A. If you are nearing retirement age, you may be able to make larger salary reductions due to your years of accumulated past service and thus take maximum advantage of the program until retirement. Q. CAN I WITHDRAW MONEY FROM MY TDA PLAN? A. The IRS prohibits withdrawal of elective contributions and earnings on those contributions except for: * attainment of age 59 ½ * death * disability * separation from services * financial hardship (contributions only). If money is withdrawn for one of the above reasons, ordinary income tax must be paid. In addition, the contract itself may impose withdrawal or surrender charges. Also, a 10% tax penalty may be imposed by the IRS in certain circumstances. A financial hardship withdrawal will affect you in two additional ways: 1. Your contributions must be suspended for 6 months following the withdrawal; and 2. Your contributions for the year following this 6 month period will be subject to certain limitations. Q. MAY I TAKE OUT A LOAN WITHOUT HAVING TO PAY TAXES ON IT? A. Policy loans are permitted by law. The maximum loan amount is generally 50% of account value, not to exceed $50,000, and must be repaid in five years or it will be considered a taxable distribution. Insurance companies are not obligated to offer a loan provision. Q. WHEN MUST I BEGIN RECEIVING A DISTRIBUTION FROM MY TDA PLAN? A. Generally, the IRS requires that a participant must begin receiving retirement benefits no later than April 1 following the year in which the participant reaches age 70 1/2. However, if still employed by an eligible employer, the participant may defer making withdrawals until retirement/separation from service. Q. WHAT CHOICES DO I HAVE REGARDING PAYOUT OPTIONS WHEN I BECOME ELIGIBLE? A. You can select from the following retirement distribution options: 1. Lump sum 2. Annuity option: a. Life income b. Life income for two payees c. Cash refund life annuity d. Payments of a stated dollar amount e. Payments of a stated period of time Q. WHAT HAPPENS TO MY ACCOUNT IF I DIE? A. If you die before taking an annuity and your named beneficiary is your spouse, your contract may stay in force on a paid-up status with your spouse as the contract holder. Your spouse may choose any form of distribution that was available to you, such as lump sum distribution or annuitization. Your spouse would also have the option of a rollover to an IRA. List of 403(b) Certified Companies as of July 11, 2008 Name of Certified Company AIG Annuity Insurance Company Annuity NonAnnuity x AIG SunAmerica Asset Management Corp. AIG VALIC x AXA Equitable Life Insurance Company x TRS # Website Address Phone Number Company's Annual Filing Shows Representatives Properly Licensed and Qualified in 2008? 07 - 044 - 01 www.aigannuity.com 800-424-4990 Yes x 03 - 076 - 02 www.sunamericafunds.com 800-858-8850 No x 07 - 006 - 03 www.aigvalic.com 800-448-2542 Yes 07 - 047 - 01 www.axaonline.com 800-628-6673 Yes AllianceBerstein Investments, Inc. x 07 - 059 - 02 www.alliancebernstein.com 800-221-5672 No American Century Investments x 05 - 080 - 02 www.americancentury.com 800-345-3533 Yes American Funds Distributors, Inc. x 07 - 011 - 02 www.americanfunds.com 800-421-9900 Yes x 04 - 077 - 03 www.anico.com 800-835-5320 No American National Insurance Company x American United Life Insurance Company Americo Financial Life and Annuity Insurance Co. x 07 - 062 - 01 www.oneamerica.com 800-249-6269 No x 07 - 053 - 01 www.americo.com 800-634-1181 Yes Annuity Investors Life Insurance (AILIC) x 07 - 003 - 01 www.gafri.com 800-789-6771 Yes Aviva Life Insurance Company x 07 - 016 - 01 www.avivausa.com 800-225-8073 No 07 - 073 - 02 www.blackrock.com 800-882-0052 No BlackRock Funds x CM Life x 07 - 025 - 01 www.massmutual.com 800-366-8226 No Commonwealth Annuity x 08 - 090 - 01 http://insuranceservices.se2.com 800-457-9047 Yes DWS Scudder Distributors, Inc. x 08 - 066 - 02 www.dws-scudder.com 800-621-1048 Yes Diversified Investment Advisors, Inc. x 07 - 086 - 02 www.divinvest.com 800-755-5803 No Federated Funds x 06 - 083 - 02 www.federatedinvestors.com 412-358-2226 No Fidelity Investments x 07 - 012 - 02 www.403b.com 800-343-0860 Yes 07 - 051 - 01 www.fslins.com 800-648-8624 Yes Fidelity Security Life Insurance Company x First Investors Corporation x 07 - 008 - 02 www.firstinvestors.com 800-423-4026 Yes Franklin Templeton Investments x 08 - 054 - 02 www.franklintempleton.com 800-527-2020 No * X indicates company has certified that it meets the conditions established by statute (Article 6228a-5, §§ 4-13, Vernon’s Texas Civil Statutes) and rule (34 Texas Administrative Code, Chapter 53) to offer this product type to Texas school district and open-enrollment charter school employees through salary reduction agreements. List of 403(b) Certified Companies as of July 11, 2008 Name of Certified Company Annuity NonAnnuity TRS # Website Address Phone Number Company's Annual Filing Shows Representatives Properly Licensed and Qualified in 2008? 08 - 089 - 01 www.gafri.com 800-789-6771 Yes 07 - 071 - 03 www.gwrs.com 888-404-4032 No x 07 - 056 - 01 www.retire.hartfordlife.com 800-528-9009 Yes Horace Mann x 07 - 027 - 01 www.horacemann.com 800-999-1030 Yes ING Life Insurance and Annuity Company x 07 - 032 - 01 www.ingretirementplans.com 800-262-3862 Yes ING Retirement Plans x 07 - 046 - 01 www.ing.com/us/tsa 877-884-5050 Yes ING USA Annuity and Life Insurance Company Industrial Alliance Pacific Insurance and Financial Services, Inc. x 06 - 082 - 01 www.ingannuities.com 800-369-5303 Yes x 07 - 072 - 01 www.iaplife.com 888-681-9201 Yes 07 - 049 - 02 www.invescoaim.com 800-959-4246 Yes Great American Financial Resources x Great-West Life & Annuity Insurance Company x Hartford Life Insurance Company Invesco Aim Distributors, Inc. x x Jefferson National Life Insurance Company x 07 - 052 - 01 www.jeffnat.com 866-667-0561 Yes Kansas City Life Insurance Company x 05 - 079 - 01 www.kclife.com 800-821-6164 No Kemper Investors Life Insurance Company x 08 - 004 - 01 http://insuranceservices.se2.com 800-457-9047 Yes 07 - 063 - 02 http://investorservices.leggmason.com 800-451-2010 Yes Legg Mason Partners Fund Advisor, LLC x Life Insurance Company of the Southwest x 07 - 005 - 01 www.lifeofsouthwest.com 800-543-3794 Yes Lincoln Financial Group x 07 - 019 - 01 www.lfg.com 800-454-6265 Yes Lord Abbett Distributor, LLC x 07 - 055 - 02 www.lordabbett.com 888-445-0031 Yes MFS Fund Distributors, Inc. x 07 - 065 - 02 www.mfs.com 800-637-1255 Yes 07 - 024 - 01 www.massmutual.com 800-366-8226 No 07 - 010 - 02 www.membersfunds.com 800-877-6089 Yes MassMutual Life x MEMBERS Mutual Funds x Metropolitan Life Insurance Company x 07 - 031 - 01 www.metlife.com/mlr 800-236-8489 Yes Metropolitan Life Insurance Co. of Connecticut x 07 - 039 - 01 www.metlife.com/mlr 800-236-8489 Yes Midland National Life Insurance Company x 07 - 035 - 01 www.midlandannuity.com 877-586-0240 Yes * X indicates company has certified that it meets the conditions established by statute (Article 6228a-5, §§ 4-13, Vernon’s Texas Civil Statutes) and rule (34 Texas Administrative Code, Chapter 53) to offer this product type to Texas school district and open-enrollment charter school employees through salary reduction agreements. List of 403(b) Certified Companies as of July 11, 2008 Website Address Phone Number Company's Annual Filing Shows Representatives Properly Licensed and Qualified in 2008? 01 www.modern-woodmen.org 800-447-9811 Yes - 01 www.nationwide.com 614-249-7111 Yes 023 - 01 www.newyorklife.com 800-710-7945 No - 034 - 01 www.nacolah.com 866-322-7065 Yes NonAnnuity Name of Certified Company Annuity TRS # Modern Woodmen of America x 07 - 069 - Nationwide Life Insurance Company New York Life Insurance and Annuity Corporation North American Co. for Life and Health Insurance x 07 - 037 x 07 - x 07 OppenheimerFunds Distributor, Inc. x 07 - 045 - 02 www.oppenheimerfunds.com 800-525-7048 Yes Pacific Life Insurance Company x 07 - 085 - 02 www.pacificlife.com 800-722-2333 No Pioneer Funds Distributor, Inc. x 07 - 014 - 02 www.pioneerinvestments.com 800-622-0176 No Principal Funds x 07 - 057 - 02 www.principalfunds.com 800-222-5852 No 08 - 091 - 01 http://insuranceservices.se2.com 800-457-9047 Yes Protective Life Insurance Company x Putnam Investments x 07 - 042 - 02 www.putnam.com 800-662-0019 Yes RiverSource Investments, LLC x 07 - 048 - 02 www.ameriprise.com 800-862-7919 Yes 07 - 067 - 01 www.ameriprise.com 800-862-7919 Yes 07 - 009 - 02 www.securitybenefit.com 800-888-2461 Yes 07 - 020 - 01 www.securitybenefit.com 800-888-2461 Yes 07 - 015 - 02 www.sentinelfunds.com 800-282-3863 No RiverSource Life Insurance Company x Security Benefit Security Benefit x x Sentinel Group Funds, Inc. Southern Farm Bureau Life Insurance Company x x 07 - 021 - 01 www.sfbli.com 601-981-7422 Yes State Farm Life Insurance Company x 07 - 088 - 01 www.statefarm.com 800-447-4930 Yes 03 - 075 - 02 www.statefarm.com 800-447-4930 No State Farm VP Management Corp. x Symetra Life Insurance Company x 07 - 013 - 01 www.symetra.com 877-796-3872 Yes Thrivent Financial for Lutherans x 07 - 050 - 01 www.thrivent.com 800-847-4836 Yes x 07 - 040 - 02 www.thrivent.com 800-847-4836 No x 08 - 043 - 03 www.tiaa-cref.org 800-842-2776 No Thrivent Investment Management Incorporated TIAA-CREF x * X indicates company has certified that it meets the conditions established by statute (Article 6228a-5, §§ 4-13, Vernon’s Texas Civil Statutes) and rule (34 Texas Administrative Code, Chapter 53) to offer this product type to Texas school district and open-enrollment charter school employees through salary reduction agreements. List of 403(b) Certified Companies as of July 11, 2008 Name of Certified Company T. Rowe Price Transamerica Financial Life Insurance Company Transamerica Life Insurance Company Annuity NonAnnuity TRS # Website Address Phone Number Company's Annual Filing Shows Representatives Properly Licensed and Qualified in 2008? 07 - 061 - 02 www.troweprice.com 800-492-7670 Yes x 07 - 087 - 01 www.divinvest.com 800-755-5803 No x 07 - 018 - 01 www.durham.transamerica.com 800-237-8872 No 07 - 028 - 02 www.usaa.com 800-531-8292 Yes x USAA Investment Management Company x USAA Life Insurance Company x 07 - 033 - 01 www.usaa.com 800-531-8292 Yes United of Omaha x 06 - 084 - 01 www.mutualofomaha.com 800-775-6000 No United Teacher Associates Insurance (UTA) x 08 - 001 - 01 www.gafri.com 800-438-3398 Yes The Vanguard Group, Inc. x 07 - 029 - 02 smallbiz.vanguard.com 610-662-2003 Yes Van Kampen Funds, Inc. x 07 - 030 - 02 www.vankampen.com 800-341-2911 No Waddell & Reed, Inc. x 07 - 007 - 02 www.waddell.com 888-923-3355 Yes Washington National Insurance Company x 06 - 081 - 01 www.conseco.com 800-940-1843 Yes Western Reserve Life Assurance Co. of Ohio x 07 - 026 - 01 www.westernreserve.com 800-851-9777 Yes Woodmen of the World Life Insurance Society x 07 - 060 - 01 www.woodmen.org 800-225-3108 No * X indicates company has certified that it meets the conditions established by statute (Article 6228a-5, §§ 4-13, Vernon’s Texas Civil Statutes) and rule (34 Texas Administrative Code, Chapter 53) to offer this product type to Texas school district and open-enrollment charter school employees through salary reduction agreements. 403(b) Salary Reduction Agreement P.O.BOX 670329 Houston, Texas 77267-0329 Phone Number: (800)523-8422 Fax Number: (281)847-8427 First Name FFASRA -12/05 Middle Initial Last Name Home Address City Date of Birth Date Hired State Zip Code __ Home Phone# ( ) Annual Salary $ Employer / School District # of Pay Periods 9 10 11 12 Social Security # __ Campus Code (Ector Co. Only) Work Phone# ( ) Completed by: 20 EFFECTIVE DATE: 24 26 Other _______________ (CIRCLE ONE) □ As soon as possible □ Later: (Pay date) / / READ IMPORTANT: THIS FORM REPLACES AND CANCELS ALL PREVIOUS AGREEMENTS ON FILE. VENDOR CODES REQUIRED FOR CALIFORNIA SCHOOLS ONLY. ACTION TAKEN Amount Per Pay Period Amount Per Pay Period N-New I- Increase D- Decrease R–Resume LIST ALL NEW AND EXISTING COMPANIES BELOW: 403(b) Pre-Tax Roth 403(b) After-Tax E– Existing S- Stop Company Name/ Vendor Code (CA only) $ $ Circle One - N I D R E S Company Name/ Vendor Code (CA only) Company Name/ Vendor Code (CA only) $ $ $ $ Circle One - N I D R E S Circle One - N I D R E S $ $ TOTAL PER PAY PERIOD NEW COMPANY REMITTANCE ADDRESS: ADDRESS REQUIRED FOR NEW ACCOUNTS ONLY HAVE YOU TAKEN A HARDSHIP WITHDRAWAL IN THE LAST 6 MONTHS? Y OR N (CIRCLE) IF YES, INDICATE DATE TAKEN? Eligible and participating in the “Age 50 + Catch-Up” provision. Eligible and would like to participate in the “15 Year Catch-Up” provision. Complete the following: Total past contributions with current Employer through the end of the last calendar year, (include both, Employer and Employee contributions) 403(b) $ (Employee) 401(K) $ (Employee) 403(b) $ (Employer) 401(K) $ (Employer) Please provide the total amount of excess funds contributed under the “15 Year Catch-Up” provision if being utilized currently or if utilized in the past. $_______________ 1. I authorize the Employer and the Employer agrees to reduce the Employee’s salary by the amount stated above and remit to the Provider Company of choice for the purchase of an annuity eligible under Section 403(b) and/or Section 403(b)(7) of the Internal Revenue Code as amended, providing retirement benefits for the Employee. The Employee’s rights to such annuity are nonforfeitable. 2. This agreement shall be legally binding and irrevocable while employment continues, provided however, that either party may change or terminate this agreement by giving notice in writing at least 30 days prior to the effective date of such change or termination. 3. The Employee is responsible for the accuracy of the excludable amounts stated in this Agreement. Any overstatement of the amounts excludable as a salary reduction in this agreement, or any other violation of the requirement of Section 403(b) could result in additional taxes, interests, and penalties to the Employee. Employee Signature Date Agent/Broker Name (Print) Date Agent/Broker Signature Phone Number: Texas 403(b) & 403(b)(7) Grandfathered Accounts Form In accordance with 34 TAC Section 53.2(c) which states: “A company that entered into a contract with an employee before June 1, 2002, is not subject to the certification requirements established by this chapter with respect to that contract, but the company is subject to the certification requirements established by this chapter with respect to any contracts or qualified investment products offered to, or entered into with, an employee on or after June 1, 2002”; and Section 53.2 (d) which states “If a company has entered into a contract with an employee before June 1, 2002, the company or employee may demonstrate in a manner acceptable to an educational institution that the provisions of this chapter do not apply to the contract in order for the company to receive contributions to, or payments for purchase of, the qualified investment product described in the contract through a salary reduction agreement between the educational institution and the employee.” By signing below, I testify that the company named on the attached Salary Reduction Agreement was established prior to June 1, 2002. ______________________________ School District ______________________________ Grandfathered Company Name ______________________________ Participant’s Name (Print) ______________________________ Representative’s Name (Print) ______________________________ Participant’s Signature ______________________________ Representative’s Signature ______________________________ Social Security Number ______________________________ Date Please note: If the company requires a new application, the company is not considered grandfathered. P O Box 670329 Houston, Texas 77267-0329 (281) 847-8422 (800) 523-8422 Fax: (281) 847-8427