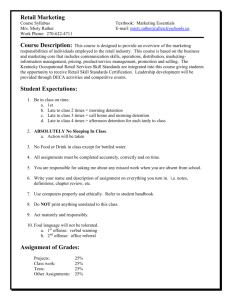

Retail Fuel Pricing and Margins

advertisement

Retail Fuel Pricing and Margins Oil Price Information Service • www.opisnet.com • 888.301.2645 Price Competitively Monitor Market Share Evaluate Pricing Strategies Analyze Markets for Growth Benchmark Operating Profits OPIS retail fuel prices are incorporated into a variety of devices, such as websites, mobile phones, personal and onboard navigation systems, and customized widgets. Because OPIS can offer real-time pricing through these applications, its clients are some of the largest, well-known companies in their respective fields. What is OPIS Retail Fuel Data? OPIS is the leading North American provider of real-time and historical retail fuel prices and operating margins. In 1999, OPIS launched the first retail fuel pricing database in North America. With its unique ability to map retail fuel prices back to wholesale markets, it quickly followed up with a rack-to-retail margin service. OPIS now receives approximately 2 million gasoline and diesel prices daily for nearly 140,000 retail outlets across North America. Fuel players including traditional major brands, regional independents, aggressive convenience store chains, supermarkets, and big box stores provide OPIS with pricing. Real-time and historical pricing and margins can be delivered through a variety of ways, making it easy to incorporate into the simplest or most complex business systems. Inside ... Who Uses OPIS Retail Fuel Data and Why?...........................................................1 How Are OPIS Retail Fuel Prices Collected?..........................................................2 How Are OPIS Operating Fuel Margins Calculated?...............................................2 OPIS Retail Fuel Products and Services............................................................. 3-4 Meet the OPIS Retail Fuel Team..............................................................................5 OPIS Retail Fuel Methodology............................................................................ 6-7 Who Uses OPIS Retail Fuel Data and Why? OPIS retail fuel prices are used by a variety of industries and institutions. Oil Companies Navigation Companies Oil companies rely on OPIS retail data to benchmark themselves against industry pricing and operating profits. The information helps to determine locations ripe for acquisition or divestiture. Popular personal navigation devices such as Magellan and TomTom utilize OPIS retail prices to help drivers determine the best gas price on their route. Petroleum Retailers Financial analysts utilize OPIS retail data for tracking operating margins at publicly traded companies to know the profit conditions before quarterly calls. In addition, they set benchmarks for hedging and analyzing how price increases/ decreases at the pump affect other industry sales. Retailers need to have a solid grasp of the activity in their market. That’s why they use the OPIS pricing and margin information to help them set prices at their stations, research what competitors are moving the market in their area, and determine if they are under- or over-performing in terms of rack-to-retail operating profits. Fleets Fleets leverage OPIS retail pricing information by benchmarking drivers’ fuel buying habits versus an established industry index. By having this data at their disposal, fleets can also identify the most economical stations for fueling their tanks and can evaluate whether their cost-plus programs are successful. Websites Popular websites like MapQuest and AAA display OPIS gas prices that help drive repeat traffic and advertising opportunities. Mobile Apps OPIS retail data is an essential element in many mobile applications. When combined with traffic, weather and other dynamic content, it gives the user everything they need to know in the palm of their hand. Auto Manufacturers Some leading auto manufacturers install onboard navigation systems into their vehicles. Many of these navigation systems incorporate OPIS retail fuel data which allow consumers to get real-time fuel prices with a push of a button or voice-activated command. 1 Financial Analysts Consultants Consulting companies use the OPIS retail fuel database for oil company clients and end-users which are affected by price volatility in the oil industry. They also rely on pricing and margin data to help clients identify the best location opportunities and make good branding decisions. Educational Institutions Educators integrate OPIS’s retail pricing and operating margin data in their economic models as well as dissertation research. Some universities use this data to produce studies on how fuel prices impact other industry segments. Government Agencies State and federal government agencies rely on OPIS retail data to monitor prices as fuel costs have a huge impact on tax revenue and the economy. In addition, this data is used to track whether any below-cost laws are being violated. Media Outlets OPIS retail fuel prices are accessed every day by thousands of media outlets thanks to its relationship with AAA and its popular website, www.fuelgaugereport.com. By distributing OPIS data, news organizations are better positioned to provide guidance on where gas prices are headed. How Are OPIS Retail Fuel Prices Collected? OPIS has multiple pricing sources and uses various methods to ensure the most reliable fuel price data. Sources of Retail Fuel Prices Include: GasBuddy Updates From Individual Station Owners GasBuddy users are passionate about fuel prices! The awardwinning mobile app has been downloaded over 30 million times and core users update prices regularly to the tune of 80,000 unique stations each day and growing. Quality is topnotch as noted by GasBuddy’s 5-star mobile app rating. Individual station owners update their station information and prices through the OPIS Store Manager website — guaranteeing that their prices are seen by consumers in navigation and web applications. Direct Feeds From Leading Chains OPIS receives credit card transactions through exclusive relationships with the leading fleet card companies. OPIS captures most prices in real-time. Throughout the day many leading chains send OPIS their current fuel prices to ensure their information is seen as accurate and up-to-date by consumers. Transaction Data How Are OPIS Operating Fuel Margins Calculated? Retail Price Less All Taxes Less Wholesale Price Less Freight Gross Profit Margin 5 Key Points About OPIS Retail Operating Margins: 1. Every OPIS retail station is assigned to an OPIS rack based on proximity. 3. The rack price used is from the same day the retail transaction occurs. 2. When an OPIS retail station sees a transaction, a net rack price is subtracted and a margin is then calculated at the station level. If the retail station is branded, such as Shell, OPIS uses the Shell branded rack price. If no Shell branded price exists at the closest rack, then OPIS uses a branded average. 4. If the station is unbranded, such as Wawa or Sheetz, OPIS will use an unbranded average. 5. OPIS includes all local, state and federal taxes and calculates any ethanol credits if applicable, to deliver the most accurate operating margins available. 2 OPIS Retail Fuel Products and Services OPIS is the leading U.S. provider of real-time and historical retail fuel prices and margins. OPIS Retail Radius Report Get updated retail gas prices and diesel fuel prices for competitors within a 2-mile, 5-mile and 10-mile radius of each of your locations. This service allows you to survey your competitors’ retail gasoline and diesel prices without ever leaving your office. Frequency: Real-Time OPIS Retail Fuel Average Prices and Margins 3 April 25, 201 OPIS has retail gasoline and diesel fuel prices and gross margins for nearly 140,000 stations. This data can be customized for any geographic region. Frequency: Daily, Weekly, Monthly OPIS Retail DataHouse This self-serve web query tool allows you to get historical gasoline and diesel prices and margins from as far back as January 2007 to as current as 8 days prior to your request. Queries can be run any time of day and results are delivered in a downloadable format. Frequency: On Demand OPIS Retail Fuel Watch Newsletter This newsletter provides the intelligence you need to accurately and efficiently grade rack-to-retail profit performance against key competitors in more than 300 markets. Easy-to-read charts, graphs and tables put vital, concise, and accurate downstream market intelligence at your fingertips. * Issue 18 Volume 12 ustry The Oil Ind ’s Benchm ark For Retai l Gasoline An d Diesel Pr ices & Profi ts 8cts/gal. e Midwest at 36. West Coast ble Gasolinspreads in the Great Lakesareand 47.1cts/gal and gins Douolin ar rgins M diesel is l ma and sel e se die t ie D h gas Southeas Clear, Concise Scorecar of the Entire ation for bot A s/gal. ek to whered bulk prices is The pricing equ ent decline in margins 46.8ct lined on the we pace of the rec ss margins dec couple of , particularly Gasoline gro average by a changing as the wever, the drop in prices retail 30-day rolling y were a n. Ho eks, has pushed now trail the y we than where the slowing dow the two t las slightly higher sel in the the year. e 33cts/gal ain die of som rem ch on d re per but t we use ts, foc cen p prices otheir highes pum to gas ns rall ble rgi ove ma dou en more than diesel gross year ago wh are now. margins are etail profit ive than they tail Fuel Watch Current diesel more expens y saw rack-to-r data from Re of the countr . Back in the most recent Coast where Every region last few weeks line, based on ept the West the exc in h ek bot nge we al, rk cha on the re equ (RFW), a sta margins drop ne margins we tempo sel and gasoli sed slightly. a shift in the February, die spreads increa ter levels. rgins reflects retails have redepressed win e change in ma lthier now for Th hea at relatively ch crude number mu is ture ts/gal, to over West Texas . de ces cru nt pri k Bre The margin pic diesel margins are near 45c of bul /bbl and ide gross weeks. April k to over $91 sale gasoline ers. Nationw bounded bac up 48% in two line in whole than they last week and esting the dec times better up 24% from $102/bbl, arr bers higher. re than three num mo g are din sen fits Page 12 gross pro prices and Continued on theast at ry. Regional & National Breakdowns: are in the nor taiill were in Februa eta Re o--R -To ck-T o-retail t diesel profits Ra ies k-t e lth rac tat st hea e y-S Th -B the smalle State rgins 9 Easy-to-Read Charts Power Rankings ts/gal, with 9 Brand Gasoline Ma more than 50c Trren d Price T 9 Regional Breakdowns 9 Market Share Estimates tional Fuel 12 -Week Na DIESEL Revealing Heat Maps in %Profit Frequency: Weekly Retail Year in & Profit O 31.4 26.7 25.9 GASOLINE Retail in %Profit Rack Marg 395.6 Net 339.2 346.6 354.4 Rack Marg 323.1 334.0 339.1 16.1 12.6 15.3 28.6 4.1% 3.1% 3.7% 18.5 27.8 12.7 35.1 15.3 19.1 26.8 24.7 Net 2.4% 8.4 289.7 403.1 3.4% 348.1 298.1 12.2 2/4 5.9% 411.0 24.3 307.6 295.3 2.8% 333.6 10.2 2/11 357.6 8.9% 414.5 357.9 36.6 318.2 308.0 4.3% 320.0 16.4 2/18 368.4 8.8% 413.2 356.6 317.4 35.9 327.7 311.4 6.9% 26.1 2/25 378.0 9.1% 409.8 353.2 300.0 37.2 326.1 5.9% 313.1 376.3 21.8 3/4 9.6% 406.8 350.3 38.9 320.8 299.0 5.3% 308.3 370.9 19.5 3/11 7.4% 403.7 347.2 315.1 29.5 319.4 299.9 6.0% 344.6 22.0 3/18 369.5 7.6% 401.0 30.5 317.8 295.8 4.8% 17.5 343.5 312.9 3/25 368.0 9.1% 296.6 399.9 36.2 314.1 7.4% 304.3 364.2 26.8 4/1 11.4% 284.5 396.8 340.5 291.3 44.9 311.4 6.6% 361.4 23.4 4/8 392.6 336.2 304.6 281.2 5.6% 19.7 4/15 354.5 301.6 281.9 taxes and 1.5 4/22 351.6 al and local feder , and rack price less state ; Net = retail between net = difference ge retail price cost; Margin Retail = avera = wholesale freight; Rack cts per gal for l Date Retai 40.2 18.3 21.1 9 Margin Rankings By Brand 9 The Best & Worst Markets 15.3 11.6 15 19.7 28.8 22.2 18.7 8.6 10.2 16.6 19.7 18.5 16.5 21.1 19.5 20.6 25.3 12.1 18.6 17.5 13.5 19.7 17.3 24.8 25.4 21.4 29.6 20.2 13.2 28.3 9 9 Expert Commentary 22.1 13.8 16.4 16.3 Gasoline Avg 21.8 (16) 22.2 to 40.2 (17) 18.3 to 22.2 (17) 8.6 to 18.3 in cts per gal Trren d Margin T k National ek ee We 52 W ot rgin Snapsh Gasoline Ma ins Diese l Marg 50 40 OPIS Retail Year in Review and Profit Outlook Report 23.4 20 Current 3 Week Ago Month Ago il products and ut OPIS reta rmation abo For more info 3 il 25, 201 9/3 Marg ins 1/7 1/2 8 2/1 8 3/1 1 9/2 4 10 /1 5 11 /5 11 /2 6 12 /1 7 y 0 5/2 1 6/1 1 Year-Ago 30-Da Rolling 4/3 y Current 30-Da Rolling Gaso line 4/1 4/2 2 10 in cts per gal Apr Frequency: Monthly, Quarterly 18.2 0 Frequency: Annual This report allows you to see which retail fuel brands are successfully selling the most gasoline or diesel gallons in any given geographic area. It also includes the average retail fuel price differential for a particular brand against its competitors. 19.5 19.7 7/2 7/2 3 8/1 3 Packed with pages of intriguing brand details plus market snapshots, heat maps, national and regional breakdowns, and more, this report delivers a 360-degree look at the previous year’s retail landscape. OPIS Retail Market Share Report 30 21.9 in cts per gal .aspx el-prices tail-fuUEL W ATCH et.com/re AIL F ETAIL IS R ET ww.op1isn z OP t http://w services, visi Brought to you by a 200 Two Washingtonian Center • 9737 Washingtonian Blvd., Suite OPIS Retail Fuel Products and Services OPIS is the leading U.S. provider of real-time and historical retail fuel prices and margins. OPIS Retail Chain Scorecard Receive weekly average retail fuel prices, rack/wholesale prices and retail fuel gross margins for each store you operate. BONUS: This report compares your retail fuel station’s pricing and operating margins against the average, median and mode retail fuel prices and margins within a 2- or 5-mile radius of your station’s location. Frequency: Weekly OPIS Retail Fuel Prices by Station Retail Landscape! n Review Outlook 9 Annual DOE Statistics 9 Market Comparisons 9 Grade Ratios 9 Plus, Much More a publication of 0 • Gaithersburg, MD • 20878 Get updated retail fuel prices by station every 25 minutes. This report is perfect for companies looking for up-to-the-minute retail gasoline and diesel fuel pricing for large geographic areas such as multiple states or the entire U.S. Frequency: Real-Time OPIS Retail Fuel Stations List No other source offers a better retail fuel station list than OPIS. Unlike companies that periodically update station information through phonebook records, OPIS captures brand changes quickly because it tracks station changes by its unique price coding system. Frequency: Daily OPIS Retail Fuel Prices Widget Drive traffic to your site with this dynamic widget. It is simple to use and easy to install with minimal programming on your part. Customize the size of the frame, colors to match your scheme, even add your logo. Frequency: Real-Time OPIS Truckstop Spread Report This truckstop fuel price report provides all available on-road diesel products retail prices for 6,000 truckstops. Also includes available DEF prices. Reports are by state, interstate or truckstop network. Frequency: Daily 4 Meet The OPIS Retail Fuel Team Fred Rozell, Director, Retail Division Over the past 17 years Fred has developed the OPIS retail database into the most timely and accurate source of retail prices and margins in the United States and Canada. He has won multiple awards for product development and has built strategic relationships with some of the largest consumer companies in the country. Fred also created the OPIS margin index which provides retailers a much needed benchmark to track profit performance against an industry standard. He earned a B.S in Business Administration from Monmouth University. Tom Kloza, Chief Oil Analyst Tom has analyzed crude oil, refined products, and gas liquids for nearly four decades. He has written commentary for Marketwatch and is a regular guest commentator for Bloomberg Financial Markets and NPR Marketplace. He has also appeared on CNBC, Nightline, the CBS Morning Show, and Good Morning America. Tom has commented specifically on OPEC matters and U.S. gasoline and diesel prices for BBC, CBS, NBC, CNN, MSNBC, CBS News, and ABC. Tom is one of the founders of OPIS. Ben Brockwell, Director of Data, Pricing & Information Services Ben is considered one of the foremost experts on petroleum prices and benchmarking. His editorial prowess covers all markets from how TVAs impact jobber purchasing strategies to jet fuel prices and supply. Many of OPIS’s most innovative products and services were created and developed under his leadership. He’s often called upon to explain market conditions at top industry meetings. Ben is one of the founders of OPIS. Brian Norris, Associate Director, Retail Pricing/Business Development Brian joined OPIS in 2005 and has worked in a variety of sales and marketing roles throughout his tenure. As Associate Director of Retail Pricing and Business Development, he works to ensure the integrity and accuracy for OPIS’s real-time prices and margins. He also works on developing new products and expanding the current product offering within the OPIS retail group. Brian graduated from Washington College in 2005 with a Bachelor of Arts in Business Management. Jeff James, Operations Manager Jeff is responsible for the day-to-day support of all OPIS customers and internal processes and also consults major clients, business partners and software vendors in the development and support of the custom data feeds necessary to meet their industry intelligence requirements. 5 Carolyn Brown, Retail Program Manager Carolyn is responsible for IT project management across the OPIS Retail suite of products. She came to OPIS in 2013 with an extensive background in business information architecture and analysis. As Director of Data Management with premier online banking and student loan service providers, she led her teams to deliver accurate, representative and timely data solutions to customers. Carolyn graduated from Towson State University with a Bachelor of Science degree in Business Administration and Marketing. Scott Brandon, Retail Information Specialist Scott began working with OPIS as a quality control analyst. From there he moved into a dual role for IT and Quality Control departments where he now serves as an information specialist for the Retail team. In 2007 Scott earned his Bachelors of Science degree in Business Administration with a focus in management from Coastal Carolina University. John McGuire, Retail Quality Control Manager John joined OPIS in 2006, where he created and now manages the Retail Quality Control team. John is responsible for ensuring the accuracy of the OPIS retail database, providing operational support and customer service for all OPIS retail related products and communicating with our clients to assess their needs. Paul Switzer, Retail Data Analyst Paul joined OPIS in 2011. Prior to that, he was an Account/ Project Manager for a leading provider of information technology solutions for the hospitality and retail industries. As a Retail Data Analyst, he works to ensure the accuracy and integrity of retail data throughout North America. He also works with clients to help facilitate the use of OPIS’s products. Paul graduated from Towson University in 1997 with a Bachelor of Science in Health Care Management. Kevin Hummer, Retail Data Analyst Kevin joined OPIS in 2007. As a Retail Data Analyst, he works to ensure the accuracy and integrity of data for nearly 140,000 unique stations in the United States and Canada. He also works with clients to help facilitate the use of OPIS’s products. Kevin graduated from Appalachian State University with a Bachelor of Science in Criminal Justice. OPIS Retail Fuel Methodology OPIS Retail Gasoline Pricing Price Discovery – Every day OPIS captures station-specific retail gasoline and diesel prices for nearly 140,000 service stations throughout the United States and Canada. Through exclusive relationships with credit card companies, direct feeds, and other survey methods, OPIS is able to provide the most comprehensive and accurate pump prices in the industry. Data Integrity – To ensure accuracy of the retail prices, OPIS scrubs the data through a number of computer programs to make sure the prices are current and are for pump gasoline purchases only – not for in-store purchases that may include non-gasoline products. OPIS gets prices for all major retailers regardless of whether the station is company-operated, jobber-owned or dealeroperated. Included in the feed are many of the more aggressive c-stores, such as WAWA, QuikTrip, Maverik and Sheetz and most of the discount chains and supermarkets, such as Wal-Mart, HEB and Kroger. In addition, we collect prices from warehouse clubs such as Costco and Sam’s. Time Stamp – OPIS is able to capture prices in near real-time – as soon as the swipe or observation occurs. By the end of the day, nearly 100,000 sites in the U.S. and 6,000 outlets in Canada have seen at least one price delivered during the day. Data Integrity – OPIS combines this retail price data with current rack and tax rate information to calculate the estimated laid-in costs and operating margins of fuel at each of the fueling sites included in the OPIS survey. The OPIS estimated cost figures are recognized as the industry standard for benchmarking “cost-plus” fuel purchases by large trucking fleets. Cost-plus is a method of purchasing fuel at the retail level where the fleet (buyer) and truckstop (seller) agree to a fixed margin above the cost of the fuel to the truckstop. This fixed margin protects both the fleet and the truckstop by ensuring the cost of fuel to the fleet and the profit to the truckstop is tied to a legitimate market index. The following is a list of the diesel fuel products OPIS tracks and some typical uses for those products: • No. 2 ultra-low-sulfur – No. 2 ultra-low-sulfur has a sulfur content of less than 15 ppm and must be used to supply at least 80% of the nation’s on-road diesel fuel sold at the retail level as of October 15, 2006. In addition to clear No. 2 low-sulfur, OPIS also provides pricing for red-dye, premium, low emissions and winter grades of ultra-low-sulfur diesel fuels. All of the OPIS ultra-lowsulfur diesel products are understood to include lubricity. • No. 2 low-sulfur – Clear low-sulfur No. 2 diesel has a sulfur content up to 500 ppm and can be used for up to 20% of the nation’s on-road diesel fuel sold at the retail level. In addition to clear No. 2 low-sulfur, OPIS also provides pricing for red-dye, premium, winter, low emissions diesel and lubricity grades of low-sulfur diesel fuels. • No. 2 high-sulfur – Clear high-sulfur No. 2 diesel is used as an off-road fuel for equipment such as farm machinery or as home heating oil. • No. 1 low-sulfur – Clear low-sulfur fuel is commonly used for “blending” on-road fuels. Diesel is blended during winter months to create a diesel fuel that will not solidify or gel in colder temperatures. OPIS Retail Diesel Pricing Price Discovery – OPIS surveys the current retail prices of No. 2 low-sulfur and ultra-low-sulfur diesel fuel from more than 8,000 active truckstops and travel plazas in the U.S. and Canada. Retail prices are gathered by major fuel card companies including Comdata and EFS as well as through direct feeds from major truckstop chains. OPIS reports wholesale fuel prices by products as defined by EPA standards more so than by any type of product use. For example, the EPA defines low-sulfur fuels as having a sulfur content of less than 500 ppm and ultra-low-sulfur diesel as less than 15 ppm. 6 OPIS’s Retail Fuel Methodology • No. 1 high-sulfur – Clear high-sulfur is used for various off-road agricultural and industrial purposes. Crop drying ovens is one example. • Kerosene – Kerosene has a lower freeze point, lower flash point and lower pour point. • Red-dye – Diesel fuel is dyed red to denote it is being used for tax-exempt purposes. Entities that are taxexempt (school boards, etc.) use red-dyed fuel. There is no difference in red-dyed product specifications. Reddyed prices typically are 0.25 to 0.35 cts higher than clear prices to recoup the charge for the dye and dying process. • Premium diesel – The higher cetane rating is what makes a regular diesel a premium diesel, along with some type of detergent package that serves to clean the engine as the fuel is burned. Cetane is to diesel what octane is to gasoline. Premium diesel typically has a minimum 45 cetane rating, whereas regular diesel is closer to a 38 to 40 cetane rating. • Winter diesel – During the winter months, on-road diesel fuels may be blended with other diesel fuels or chemical additives to produce a winter diesel that will not begin to solidify or gel due to cold temperatures. OPIS also provides pricing for red-dye, premium, and lubricity grades of winter diesel fuels. • 7 Lubricity – Several states have mandated the use of a lubricity additive in several on-road low-sulfur diesel fuels. OPIS provides separate pricing displays for low-sulfur and low-sulfur with lubricity products. Diesel postings which may include lubricity are low-sulfur, red-dye, winter and premium diesel products. Since all ultra-lowsulfur products must have a lubricity component, it is not necessary to maintain a separate lubricity product grouping within ultra-low-sulfur products. • CARB diesel – As of June 1, 2006, all diesel fuel sold for vehicular use in California must meet a 15 ppm maximum sulfur limit (ultra-low), in addition to meeting all of the current low aromatics CARB diesel specifications. The definition of “vehicular use” in California includes on-highway vehicles and non-road vehicles such as agriculture and construction equipment. • Low emissions diesel (LED) – Beginning in October 2005, 110 counties East/Central Texas required the use of LED in both on-road vehicles and in non-road agricultural and construction equipment. LED diesel must contain less than 10 percent by volume of aromatic hydrocarbons and must have a cetane number of 48 or greater. • Non-road locomotive marine diesel (NRLM) – Effective June 1, 2007 for refiners and October 1, 2007 for marketers, U.S. supply points required lower sulfur diesel for off-road transportation use in locomotives and for marine use in boats, etc. in various states. NRLM diesel contains more than 15 ppm sulfur but less than 500 ppm sulfur and replaced the high-sulfur diesel fuel that exceeds 500 ppm and is still used for home-heating oil purposes Where it exists, OPIS racks display NRLM diesel simply as “NRLM.” By 2010, all off-road locomotive and marine transportation fuel must meet NRLM specs. Time Stamp 7:30 a.m. 10:00 a.m. Retail diesel price files available Cost-plus prices are available The retail diesel prices and the OPIS Gross Contract Average are used to create these numbers. The data is delivered Monday through Friday by email, the Internet, FTP and many third-party vendors. Time stamps for retail pricing are local to where the station operates. “We rely on OPIS to give us quick access to retail pricing information for our competitors across the country. It provides us a benchmark to establish our daily pump prices at our cardlocks. It’s considered a valuable tool to ensure our pricing remains competitive. ” - Paul Missurelli, Financial Analyst, Jacobus Energy www.opisnet.com • 888.301.2645