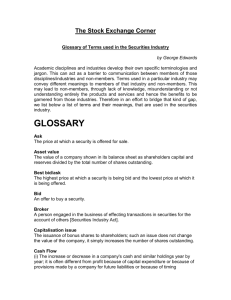

short investment glossary - Autorité des marchés financiers

advertisement