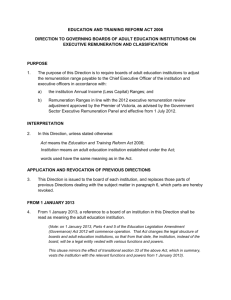

Guidelines for the discount rate for remuneration

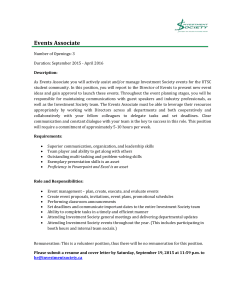

advertisement