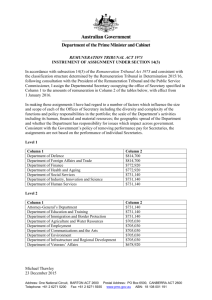

Guidelines for the discount rate for remuneration

advertisement