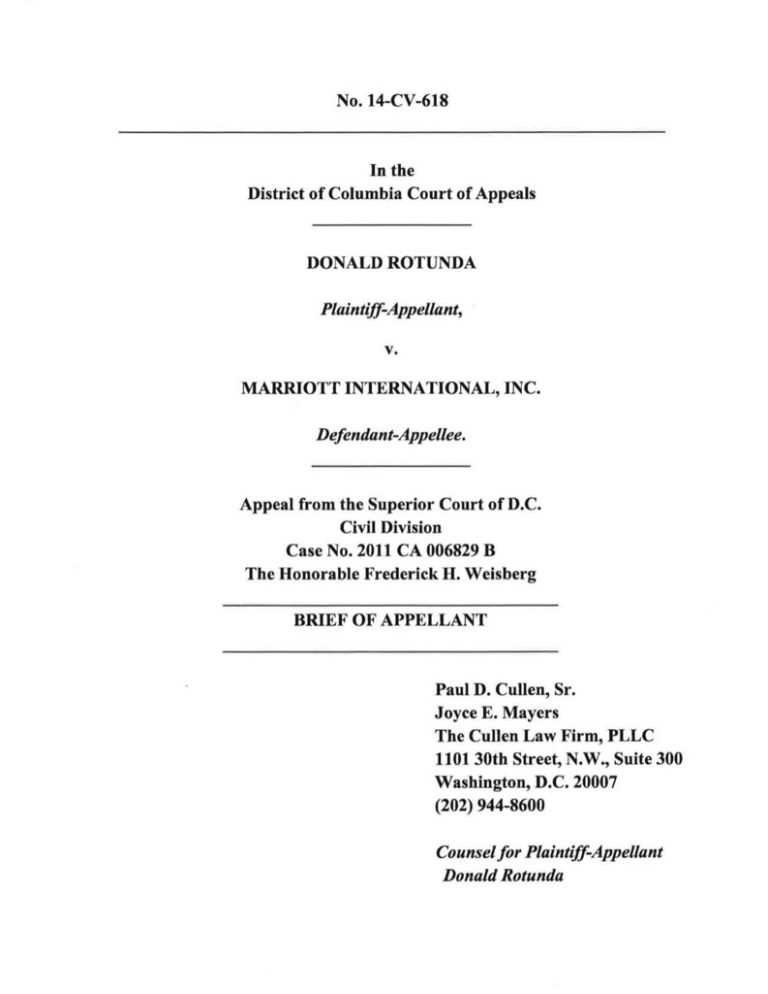

No. 14-CV-618

In the

District of Columbia Court of Appeals

DONALD ROTUNDA

Plaintiff-Appellant,

v.

MARRIOTT INTERNATIONAL, INC.

Defendant-Appellee.

Appeal from the Superior Court of D.C.

Civil Division

Case No. 2011CA006829 B

The Honorable Frederick H. Weisberg

BRIEF OF APPELLANT

Paul D. Cullen, Sr.

Joyce E. Mayers

The Cullen Law Firm, PLLC

1101 30th Street, N.W., Suite 300

Washington, D.C. 20007

(202) 944-8600

Counsel for Plaintiff-Appellant

Donald Rotunda

TABLE OF CONTENTS

STATEMENT OF THE CASE ........................................... .......................................................... ... 1

I.

Nature of the Proceedings ...... .... .............................................................................. l

II.

Procedural History .............................................................................................. .... .2

III.

Orders of the Superior Court for Which Review is Sought ........................ ..... ....... .4

STATEMENT OF FACTS ......... ........ ...................................... ...... .. .. ............. ... ... .......................... 6

ISSUES PRESENTED ..... .............................. ................... ........... .................................................. 12

STANDARD OF REVIEW .............................................................. ... ............................ .............. 13

SUMMARY OF THE ARGUMENT ..................................................... ....................................... 13

ARGUMENT ............................................ ..................... ................................. ...... ............ ............. 17

I.

THE CPPA AUTHORIZES SUITS FOR DAMAGES PAYABLE TO

MEMBERS OF THE GENERAL PUBLIC INDEPENDENT OF

PROCEDURES REQUIRED UNDER RULE 23 ................................................. 17

A.

Individual Members of the General Public Are Entitled

to Monetary Damages in a Representative Action .................................... 17

B.

The Superior Court Erred in Endorsing Margolis .................................... .24

C.

The Court Is Empowered to Ensure Due Process Rights

Outside of Rule 23 Procedural Requirements ........................................... .28

II.

BUSINESS TRAVELERS MAY ENGAGE IN CONSUMER

TRANSACTIONS PROTECTED BY THE CPPA ............................................... 31

III.

THE DISTRICT OF COLUMBIA HAS A COMPELLING

INTEREST IN APPLYING ITS LAWS TO MARRIOT'S CONDUCT .............. 37

A.

Marriott's Representations that it is Headquartered in

Washington D. C. provide the District of Columbia with

a Compelling Interest in applying Its Laws to Marriott's Conduct ........... 37

B.

Controlling Case Law Supports Application ofD.C. Law

to Marriott's Conduct. ................... ........................................................... ..38

I

C.

IV.

Application ofD.C. Law is Neither Arbitrary nor

Fundamentally Unfair ................................................................................ 41

MEMBERS OF THE GENERAL PUBLIC ARE ENTITLED

TO SUMMARY JUDGMENT AS A MATTER OF LAW

ON THE MERITS OF THE CLAIMS RAISED BY ROTUNDA ....................... .43

A.

Marriott's Price Representations to Rotunda and Others

Were Objectively False and Omitted Material Facts ................................ .44

B.

Neither the Intent of the Merchant Nor Reliance By the

Consumer Are Elements of Proof Under the CPP A ................................. .45

C.

Price is Material as a Matter of Law .................. ... ... .... .. ..... ... .... ... ..... ... .. .. .4 7

CONCLUSION ............... ....... ...... ...... ................... ... .. ... .... .......... .. ..... .. ...... .... .. .... ... ..... .. .. ......... ...... 48

ADDENDUM

II

TABLE OF AUTHORITIES

Cases

Act Now to Stop War & End Racism Coalition v. District of Columbia,

905 F. Supp. 2d 317 (D.D.C. 2012) ........................ ...... ..... ......................... ..................... ....... .. 25

All State Insurance Co. v. Hague,

449 U.S. 302 (1981) ......................................... .. ........................... ............... ....... ................ 41, 42

Alicke v. MCI Communications,

111F.3d909 (D.C. Cir. 1997) .... .......................... ................ ............................. ....................... 48

Aspinall v. Phillip Morris Companies,

813 N.E.2d 476 (Mass. 2004) ................................................................................................... 46

Bledsoe v. Crowley,

849 F.2d 639 (D.C. Cir. 1988) .................................................................................... .. ............ 38

Blodgett v. Univ. Club,

930 A.2d 210 (D.C. 2007) ........................... .. ...... ..... ....................... ........ ....... ........................... 25

Boyle v. Gira!,

820 A.2d 561 (D.D. 2003) .......................................................................... ......... .. .. .......... .. 28, 29

Breakman v. AOL LLC,

545 F.Supp.2d 96 (D.D.C. 2008) .................................................................................. 14, 22, 26

Calvetti v. Antclifl,

346 F. Supp. 2d 92 (D.D.C. 2004) .......... ....................... ........................................................... 45

Choharis v. State Farm Fire and Cas. Co.,

961 A.2d 1080 (D.C. 2008) ................ ....................................................................................... 13

Clifton Terrace Assoc. v. United Techs Corp.,

728 F.Supp. 24 (D.D.C. 1990) ................................................................................. :................ 36

Davis v. Powertel, Inc.,

776 So. 2d 971 (Fla. App. 2001) ......................................................................................... 46, 48

111

District Cablevision Limited Partnership v. Bassin,

828 A.2d 714 (D.C. 2003) .. ................. ...... ..... ........... ..... ............... ....... .. .. ......... ... .. ... ... ......... .. .. 46

District of Columbia v. Coleman,

667 A.2d 811 (D.C. 1995) ........... .. ... ........ .. .......... ................. .. .......... ..... ...... .......... ........ .. .. ... .... 38

Dorn v. McTigue,

157 F. Supp. 2d 37 (D.D.C. 2001) ..................... .... ... ...... .. .... .... ......... ... ....... ... ................ ..... .. ... 40

Eli Lilly & Co. v. Home Ins. Co.,

764 F.2d 876 (D.C. Cir. 1985) .... ...... .. ............. ............... ........... ..... .... ........... ...... .. .. ... ........... ... 41

F. TC. v. Crescent Pub. Group, Inc.,

129 F. Supp. 2d 31l(S.D.N.Y.2000) ..... ... ... .. .. ... ... ...... ...... ....... ..... .. ....... .. ..... ....... .. .... .. ...... 47, 48

F. TC. v. Five Star Auto Club, Inc.,

97 F. Supp. 2d 502 (S.D.N.Y. 2000) ............. ... ... .. .. ..... ........... ...... .. ...... .. ... ......... .. ... .......... ....... 47

F. TC. v. Wilcox,

926 F. Supp. 1091 (S.D. Fla. 1995) ........ .. ..... .............. ... .... ...... ... ............... ...... .... .... ............ ... .. 47

Flemming v. United States,

546 A.2d 1001 (D.C. 1988) ........ ............ .... .. .... .. .... ... ... ... .... ... ... ... ....... ..... ... ..... ... .... ...... ..... ....... 25

Ford v. ChartOne,

908 A.2d 72 (D.C. 2006) ...... ... ..... .................... .... ........ ... ... .. ... .......... ... .... ..... .... 31, 32, 33, 34, 35

Fort Lincoln Civic Ass 'n, Inc. v. Fort Lincoln New Town Corp.,

944 A.2d 1055 (D.C. 2008) ..................... ....... ..... ........ .. .. .. .. .... .................. .. ... ... .......... ........ ... ... 46

Gillis v. Clark Equip. Co.,

579 S.W.2d 869 (Tenn. Ct. App. 1978) ..... ....... ..... ... ... .................... ....... .... ................... ...... ..... 26

Gomez v. Indep. Mgmt. ofDelaware, Inc.,

967 A.2d 1276 (D.C. 2009) ............................ .. .... ....... .. .... ................. ... ............... ......... ...... .. ... . 19

Grayson v. AT&T Corp.,

15 A.3d 219 (D.C. 2011) ............ ....... .... ... ..... ....... .... .......... .. ..... ...... ...... 19, 20, 22, 26, 29, 46, 47

lV

Green v. H&R Block,

355 Md. 488 (Md. 1999) ........................................................................................................... 48

Haynes v. District of Columbia,

503 A.2d 1219 (D.C. 1986) ............................................. ........................ ......... .............. ........... 26

Howard v. Riggs Nat'l Bank,

432A.2d 701 (D.C.1981) ......................... :..................... .......................................................... 31

In re C.A.P.,

356 A.2d 335 (D.C. 1976) ............................................................ ............................................. 26

In re Cliffdale Assoc.,

103 F.T.C. 110, 165 (1984) ....................................................... .................................. ... 46, 47, 48

In re Thompson Medical Company, Inc.,

104 F.T.C. 648 (1984) ............................................................................................................... 47

Independent Communications Network v. MCI Telecommunications Corp.,

657 F. Supp. 785 (D.D.C. 1987) .................................. .... ........... .............................................. 36

Jackson v. Culinary School of Washington,

788 F. Supp. 1233 (D.D.C. 1992) ...... ....................................................................................... 40

Kaiser Georgetown Community Health Plan,

491 A.2d 502 (D.C. 1985) ............................ .............................. .. ............................................. 42

Kopf! v. World Research Group LLC,

298 F. Supp. 2d 50 (D.D.C. 2003) ........................... ....... ................. ..... ................ .................... 40

Kraus v. Trinity Management Services, Inc.,

999 P.2d 718 (Cal. 2000) .................................................................................................... 28, 30

Kraft v. FTC,

970 F.2d 311 (7th Cir. 1992) ................................................. ................................ .......... .......... 47

Logan v. Providence Hospital, Inc.,

778 A.2d 275 (D.C. 2001) .......................... ..... ............................................................ ... ............ 39

Malone v. Saxony Co-op Apartments, Inc.,

763 A.2d 725 (D.C. 2000) ......................................................................................................... 13

v

Margolis v. U-HA UL International, Inc.,

2007 CA 5245, 2009 D.C. Super. Lexis 8 (Dec. 17, 2009) ..... ... ........................... .. ....... ..... . 4, 13

Margolis v. U-Haul,

2009 WL 5788369 (D.C. Super. Ct. December 17, 2009) .............. ........................ 24, 25, 26, 27

Mazanderan v. Independent Taxi Owners Association,

700 F. Supp. 588 (D.D.C. 1988) ................................ ... ............ ... .. ... ........................................ 36

National Consumer League v. Bimbo Bakeries USA,

_ F. Supp. 2d _ , 2014 WL 2536795 (D.D.C. June 4, 2014) .. .................. ......... ........... 23, 27

National Consumer League v. General Mills, Inc.,

680 F. Supp.2d 132 (D.D.C. 2010) .................................... .... ........ ..... .. ...... 14, 19, 22, 26, 27, 28

National Consumers League v. Doctor's Assoc., Inc.,

2013 CA 006549 B (D.C. Super. Ct. September 12, 2014) ......... .......... ... .............. 14, 19, 24, 27

National Consumers League v. Flowers,

_F. Supp. 2d__, 2014 WL 1391246 (D.D.C. April 8, 2014) ............................................... 23

National Consumers League v. Kellogg Co.,

No. 2009 CA005211 B (D.C. Super. Ct.) ....... ...... ............ ............... ........... ............. ..... ...... ...... 29

Novartis v. Federal Trade Commission,

223 F.3d 783 (D.C. Cir. 2000) ..................................... .... ... ........ .......... .. .... .... ... .... ............. 47, 48

Odems v. District of Columbia,

930 A.2d 137 (D.C. 2007) ........ ......... ..... .... ...... .......... ..... ........................ ...... ....................... .... . 13

Pearson v. Chung,

961A.2d1067 (D.C. 2008) .......................... .............. .. ................... .. ..... ... ................................ 47

Phillips Petroleum v. Shutts,

472 U.S. 797 (1985) .......................... ..... ..... ........................................ ............. ......... ................ 41

Saucier v. Counrywide Home Loans,

64 A.3d 428 (D.C. 2013) ................................................................................ .... ..... 13, 46, 47, 48

vi

Shaw v. Hyatt Int'! Corp.,

461 F.3d 899 (7th Cir. 2006) ...... ...... ... ....... ....... ............ .... .... ........... ........ ..... ......... ...... ..... .... ...... 5

Shaw v. Marriott Int'!,

570 F. Supp. 2d 78 (D.D.C. 2008) .... .. ........ ..... ....... .. ..... .. .... ............. .. ..... ...... ......... .. ...... ...... ...... 2

Shaw v. Marriott Int'!,

605 F.3d 1039 (D.C. Cir. 2010) .. ........................ .......... ..... ..... ....... .......... ........... 2, 12, 15, 31, 44

Shaw v. Marriott Int'!, Inc.,

62 A.3d 1283 (D.C. 2013) ............... ... .. .. .... ... .......... .......... .. .... ... ........ ........ ... ............ .. .......... 3, 15

Thompson Medical Co. v. FTC,

791 F.2d 189 (D.C. Cir. 1986) ... ... ..... ........ ... .......... .... ... .... ........ .......... ............. ...... ... ... .. .... ...... 47

Tyco Industries Inc. v. Lego Systems, Inc.,

1987 WL 44363 (D.N.J.1987) ............................. ....... ......... ..... ... ...... ... ..... .. .... ........ .................. 47

Washkoviak v. Student Loan Marketing Ass 'n,

900 A.2d 168 (D.C. 2006) .................... ........ .................................... .... .... .............. . 16, 38, 39, 41

Wells v. Allstate Insurance,

210 F.R.D. 1(D.D.C.2002) ................ ....... ..... ... .. .. ............ .. ... .............. ........... ... .. .............. 46, 48

Wesch/er v. Klank,

561A.2d1003 (D.C. 1989) .. .... .... .. .. ............. ...... ....... ... ........ .. ... .... ... .... 15, 16, 31, 32, 33, 34, 35

Wiggins v. Avco Financial Services,

62 F.Supp. 2d 90 (D.D.C. 1999) ... ... ......................... ........ ....... ............ .. ............ .. .... ..... ............ 38

Williams v. Cent. Money Co.,

974 F.Supp. 22 (D.D.C. 1997) ........................ ........ .. .. .. .... ............. .... .. .. .................. .......... ....... 39

Williams v. First Government Mortgage and Investors Corp.,

176 F.3d 497 (D.C. Cir. 1999) .................................... .. ..... ... ....... ................... .... .... .................. 38

Zuckman v. Monster Beverage Corp.,

958 F. Supp. 2d 293 (D.D.C. 2013) ............................ .................................. ......... ................ .. ......... 23

Vll

Statutes

28 U .. C. § 1332 (d) ... ............................ ...... ... ............... .. .......... .... ... ................... .. ..... ............... .. ... 2

28 u.s.c. § 2072 ............................ .. .. .... .... ..... ........ .............................. ......................... ............ ... 25

D.C. Code § 28-3901 et seq. (2000) .. .. .. ..... .... ... ........ .. ...... ...... .. .. ..................................................... 1

D.C. Code § 28-390l(a)(l) (2000) ............. ..... .. ...... ..................... .... .................... ............. .... ... .. ... 21

D.C. Code § 28-3901(a)(2) (2000) ........... ... ..... .................... ... ............. ........ ........ ... .... .......... ..32, 34

D.C. Code § 28-3901(a)(3) (2000) .... ... .............. .................... ....................................................... 32

D .C. Code § 28-390l(b)(l) (2000) ..... ... ...... .. .......................................................................... 16, 21

D.C. Code§ 28-3901(c) (2000) ..................... .. .. .... ................ ........................................................ 20

D.C. Code§ 28-3904(e) (2000) .. .......... ........................ ... ..... ........ ............... ..... ...................... .45, 46

D .C. Code § 28-3904(f) (2000) ................... ..... ... ... ...................... ............ .... ........ .......... .. .. .... .45, 46

D.C. Code§ 28-3905(k) (2000) ..... ... ........... ..... ... .... ............. ... ..... .. ... ... .......... .......... ..... .... 14, 22 25

D.C. Code§ 28-3905(k)(l) (2000) ........ ...................... .. ........................ 2 12, 13, 17, 18 21, 28 48

D.C. Code , 28-3905(k)(l)(A) (2000) .................................................................. 13, 18 19, 21, 26

D.C. Code§ 28-3905(k)(l )(E) (2000) ....................... ...... ... .... ... .. .. ...... ... ... ....... ...... .... ..... ........ 18, 21

D.C. Code§ 28-3905(k)(l)(F) (2000) ..... .......... ............. .... ............. ....... ....... .................. .. ....... ..... 14

D.C. Code § 28-3909 ........... ....... .......... ... ....... ........................ ......................... ......... ................. .... 20

D.C. Code§ 28-3909 (a) ....................... ....... ...... ....... .... ......................................... ....... ................ 29

viii

STATEMENT OF THE CASE

I. Nature of the Proceeding

Marriott International, Inc. operates a worldwide network of hotels linked through a central

reservation system used by all of its affiliated properties. Plaintiff Donald Rotunda claims that

Marriott violated the D.C. Consumer Procedure and Protection Act (CPP A) by making false

representations and by omitting material facts as to the price to be charged to guests making

reservations through its worldwide system for rooms in hotels owned, managed or franchised by

it in Russia. D.C. Code§ 28-3901 et seq. (2000). Marriott quoted rates for these rooms in U.S.

Dollars (USDs). Room charges were only payable in Russian Rubles (RUR) calculated at an

internal hotel rate. As a result, the actual cost of the room was always more in USD than the

amount originally quoted when the room was booked.

This appeal involves three fundamental questions. First, is Marriott accountable for its

improper trade practices under the laws of the District of Columbia? Marriott is incorporated in

Delaware, and, many years ago, moved its headquarters over the District line into Bethesda.

Nevertheless, it is undisputed that Marriott engaged in a longstanding, widespread and persistent

practice of publishing to the whole world (including to its potential guests) the fact that it is

headquartered in the District of Columbia. These representations have given Marriott significant

commercial advantages. Do Marriott's representations that it is headquartered in the District of

Columbia create circumstances where it may be held accountable under the laws of this

jurisdiction?

Second, the CPP A authorizes an individual to file claims for damages for himself as well

as on behalf of the general public. Statutory damages are payable to individual consumers. The

statute imposes no requirement on the person seeking to represent the general public to file such

1

claims under the class action provisions of SCR Civil Rule 23. This Court is being asked to decide

the fundamental nature of representative actions under the CPP A. Its decision will have profound

impact on the role of the courts of the District of Columbia in consumer protection proceedings.

If, as the court below found, all representative actions for damages are "essentially class actions,"

the courts of the District of Columbia will likely surrender jurisdiction over such cases to federal

courts under the removal provisions of the Class Action Fairness Act, 28 U.S.C. § 1332 (d).

Third, which members of the general public should be included within Rotunda's claims.

If Marriott may be held accountable for its unfair trade practices under the laws of the District of

Columbia, do the protections of DC law extend to both residents and non-residents?

Are

individuals who stayed in Marriott hotel rooms to satisfy their personal needs to bathe and rest

while traveling on business protected by the CPPA?

II. Procedural History

Plaintiff, Donald Rotunda, brings claims on behalf of himself and the general public

pursuant to D.C. Code § 28-3905(k)(l).

This case grows out of Britt A. Shaw v. Marriott

International, Case No. 2005 CA 3679 B. The Shaw case was originally filed in the Superior

Court as a class action and was removed to the U.S. District Court for the District of Columbia

pursuant to the Class Action Fairness Act, 28 U.S.C. § 1332(d). The U.S. District Court, without

citing to the controlling case law by this Court, found that because Shaw had travelled to Russia

for business, he was not a "consumer" entitled to protection under the CPPA. Shaw v. Marriott

lnt'l, 570 F. Supp. 2d 78, 89 (D.D.C. 2008). The D.C. Circuit reversed the district court's merits

holding finding that, because in its view Shaw did not have rights under the CPP A, he lacked

standing to bring a claim in the federal courts. Shaw v. Marriott lnt'l, 605 F.3d 1039, 1046 (D.C.

Cir. 2010).

2

Because Shaw lacked Article III standing, the federal courts had no subject matter

jurisdiction. Shaw's claims were remanded to the Superior Court. Id. On remand, the Superior

Court found, under the doctrine of collateral estoppel, that the D.C. Circuit's ruling that Shaw

lacked standing to bring his claims in federal court was binding on the Superior Court with respect

to its jurisdiction over Shaw's claims. The Superior Court dismissed Shaw's claims for lack of

standing. (Order dated July 13, 2011). The Superior Court refused to consider the D.C. Circuit's

reasoning on Shaw's qualification as a "consumer" under the CPPA, stating that it made no

difference whether the D.C. Circuit was right or wrong in its analysis. (Shaw v. Marriott, Case No.

2005 CA 3679, Hearing 7/13/2011). This Court affirmed that ruling in an unpublished opinion.

Shaw v. Marriott International, Inc., 62 A.3d 1283 (D.C. 2013) without venturing beyond the

Superior Court's ruling.

Rotunda, an absent member of the putative class in the Shaw case, sought to join as a party

plaintiff in the Shaw case in January 2011. Before ruling on the motion to amend, the Superior

Court dismissed Shaw's claim. Rotunda then filed his CPP A claims as a separate case in August

2011. Recognizing that the facts proving Marriott' s violation of the CPP A introduced in the Shaw

case were identical to those applicable to Rotunda's claim, the Superior Court allowed all

discovery completed in the Shaw case to be available in the Rotunda matter. Order, December 21,

2011. The parties filed cross motions for summary judgment in September 2011.

For reasons not pertinent here, the parties resubmitted their cross motions for summary

judgment in March 2013. On May 1, 2013, the Superior Court denied Marriott's motion for legal

insufficiency.

Joint Public Appendix ("JPA") 1.

It denied Rotunda's motion for summary

judgment on the grounds that there were genuine issues of fact to resolve. Id. Prior to setting this

matter for trial, the Court determined that there were threshold issues related to Rotunda's claim

3

on behalf of the general public that required resolution before trial. It set a briefing schedule to

address those issues.

On October 31, 2013, the Superior Court entered an order dismissing Rotunda's claim on

behalf of the general public, leaving only his individual claim against Marriott for violation of the

CPPA. On May 9, 2014, a Consent Judgment was entered in favor of Rotunda on his individual

claim. JPA 15. The Judgment specifically preserved Rotunda's right to appeal the issues decided

in the October 31 Order. On May 29, 2014, Rotunda timely filed his Notice of Appeal.

III. Orders of the Superior Court For Which Review is Sought

The Superior Court's order dated October 31, 2013 dismissed Rotunda's claim for money

damages on behalf of the general public. JP A 5. That order addressed three principal issues. First,

the Court held that a case filed by an individual under the CPP A seeking money damages for

himself and members of the general public "is in essence a class action, whether pled as such or

not and must satisfy the requirements of Rule 23." Id. The Court, citing Margolis v. U-Haul

International, Inc., 2007 CA 5245, 2009 D.C. Super. Lexis 8 (Dec. 17, 2009), held that because

Rotunda "is attempting to maintain his CPP A claim for money damages on behalf of the "general

public" without even attempting to satisfy the requirements of Rule 23, his representative claim

must be dismissed as a matter oflaw." Id.

Second, the Court held that, even if Rotunda could represent members of the general public

for money damages under the CPP A, individuals procuring hotel services to meet their personal

needs to sleep and bathe while traveling on business were not consumers protected under the CPP A

and are not members of the general public that could recover in such a representative action. Id.

Third, the Court held that, because Marriott was incorporated in Delaware and maintained

its headquarters in Maryland, non-residents of the District of Columbia could not seek redress

4

against Marriott under the CPP A. The specific holding stated that "it makes no difference that as

a matter of constitutional law the District could apply its law to Marriott's conduct, the question is

whether it would; and under the District's well established choice oflaw principles, it would not."

Id.

The Superior Court's Consent Order and Final Judgment dated May 9, 2014 constituted a

final judgment in favor of Plaintiff Rotunda on his individual claim against Marriott. Rotunda was

awarded statutory damages of $1,500. The right to appeal the Court's October 31, 2013 order

respecting Rotunda's right to sue for damages on behalf of the general public was preserved and

the question of Rotunda's entitlement to attorney's fees was deferred until after disposition of this

appeal. JP A 15. The terms of the consent order do not constitute an admission of liability or

wrongdoing by Marriott (JP A 15 at if 1) or a finding of such liability by the Court. Id.

The question of Marriott's liability to both Rotunda individually and members of the

general public was presented to the Superior Court in Rotunda's Resubmitted Motion for Partial

Summary Judgment on the Issue of Liability. (March 19, 2013). Marriott did not move for

summary judgment on the merits. Its pre-trial motion for summary judgment was limited to: a)

the defense of judicial estoppel; b) whether claims against Marriott were barred by decision of the

Seventh Circuit in Shaw v. Hyatt Int'! Corp., 461 F.3d 899 (7th Cir. 2006), a case brought under

the Illinois consumer protection statute; and c) plaintiffs right to recover damages on behalf of

the general public. Except for questions related to Rotunda's ability to bring claims for damages

on behalf of the general public (which the Court addressed in its October 31, 2013 order), the

Superior Court denied the issues raised by Marriott's summary judgment motion as legally

insufficient. JPA 5.

5

The Superior Court denied Rotunda's Resubmitted Motion for Summary Judgment on the

ground that there were genuine issues of material fact in dispute. JP A 5. Prior to the entry of the

Consent Order and Judgment, Rotunda was preparing to go to trial on the so-called genuine issues

of fact related to the merits of his claims, the only issues unresolved by prior orders of the Court.

The October 31, 2013 order of the Superior Court denying Rotunda's partial motion for summary

judgment on the issue ofliability is properly before this Court on appeal.

STATEMENT OF FACTS

Marriott's Trade Practices

Marriott International, Inc. controls a system of hotel properties throughout the world

which operate under various Marriott Propriety Marks. (PSMF

~if

1,2,3; JP A 110, Joint Seal

Appendix ("JSA") 1-89; MSUF ~ 1; JPA 206). 1 Marriott misrepresented the price for rooms at

its Russian Hotels. (PSMF ifif 4-8; IPA 111-112, 374, 321; JSA 251, 273). Marriott offered rooms

for specific amounts of U.S. Dollars ("USD") knowing that guests at its Russian Hotels would

never pay the represented price. (PSMF

~~

170-179; JPA 141-143, 702, 599; JSA 273, 140, 136,

233). Guests were charged at checkout in Russian Rubles ("RUR") calculated at an internal hotel

exchange rate that always resulted in an actual cost to the guest in USD in excess of the price

originally represented by Marriott. (PSMFifif 4-8; JPA 111-112; MSUF

ifil

11-15; JPA 208,

Marriott Memorandum in Opposition to Motion for Class Certification (U.S. D. Ct. ECF # 75-2)

at 5-6 (emphasis added).

Marriott operates and controls a centralized, worldwide Reservation System in which all

of the Marriott Russian Hotels, including the franchised hotels, participate. (PSMF

1

~if

9-1 O; JPA

Rotunda refers to his Statement of Material Facts in Support of Motion for Partial Summary

Judgment as "PSMF." Reference to Marriott's Statement of Undisputed Facts Filed in Support

of its Amended Motion for Summary Judgment is identified as "MSUF."

6

113, 517-518, 541-558; JSA 14, 22, 33; MSUF i! 9; JPA207). The Reservation System employs a

database of current and stored information regarding accommodations for its Marriott branded

hotels known by the acronym "MARSHA." (PSMF

ifil 11-20; JPA 113-115, 544, 517-518, 541-

558 583; JSP 287, 90, 112, 137, 193, 321, 726; MSUF

i! 9; JPA 207). MARSHA maintains

information related to daily room prices and the currency governing the transaction. Id. The

management of each Marriott branded hotel is required to notify the Marriott Reservation System

of the most recent room rates applicable in that hotel property, and of any changes in the room

rates. (PSMF i! 20; JPA 115; JSA 28, 32; MSUF

i! 9; JPA 207). Marriott franchised hotels may

be free to establish their own room rates, but, once those rates are established, franchised hotels

are forbidden by their license agreements to charge a "rate higher than the rate specified to the

guest by the Reservations System office at the time the guest's reservation was made." (PSMF i!

20; JPA 115; JSA 28). The D.C. Circuit found that Marriott was responsible for the charges to

guests at the franchised hotels in Russia "because it exercises some control over the franchised

hotels, including capping the rates they charge for rooms." Shaw, 605 F.3d at 1042, citing PSMF

irir 9-11, 20, 28-32.

It is Marriott's practice to provide room reservation confirmations to hotel guests reserving

rooms through its Reservation System. (PSMF

iril 28-29; JPA 116, 329, 289, 286, 283). A

confirmation is generated by the MARSHA database, assigned a confirmation number, and issued

to the hotel guest. (PSMF iii! 30-31; JP A 117, 517-518, 553-559, 329, 289, 286, 283, 618; MSUF

if 22; JPA 209). Each reservation confirmation states the per night room price only in USD.

Marriott's USD denominated price confirmations are objectively false. (PSMF

Id.

ifil 33-36;

JPA 117-118, 329, 289, 286, 283; JSP 273). The hotel bill is payable at check-out only in RUR,

never USD. Marriott Memorandum in Opposition to Motion for Class Certification (U.S. D. Ct.

7

ECF # 75-2) at 5-6 (emphasis added). At check-out, guests are presented with a hotel bill showing

a charge for the room in "Units." Id. The quantity of Units has the same numeric value as the

quantity of USD quoted as the price for the room on Marriott's reservation confirmation. Id. Hotel

charges are converted from Units to RUR at a rate of Units to RUR that is always less favorable

to the guest than the rate set by the Central Bank of Russia for conversion of USD to RUR. Id.

Marriott does not dispute the mechanics used to implement its business practice:

Marriott Russia Hotels would convert the quoted U.S. dollar amount into rubles

using a hotel exchange rate and a pre-arranged monetary unit called a "currency

unit" or simply "unit" when a guest checked out and paid for his or her room. The

currency unit always equaled the amount quoted in U.S. dollars .... In Russia, this

practice was followed not just by Marriott Russia Hotels, but by most other

hotels and businesses that quoted prices for goods or services in U.S. dollars to

protect against the ruble's fluctuations in value.... Internal or "house" exchange

rates were used by businesses in Russia for similar reasons. By setting an internal

exchange rate above the Central Bank Rate, businesses could better protect

themselves from fluctuations in the value of the ruble. ...

Marriott Memorandum in Opposition to Motion for Class Certification (U.S. D. Ct. ECF # 75-2)

at 5-6 (emphasis added). Marriott understood that its pricing practices created discrepancies

between quoted and paid rates. (PSMF iii! 170-172; JPA 141, 702, 599; JSA 273, 140, 136, 233).

Marriott documented that mark-ups of the hotel exchange rates over the Central Bank rates ranged

from 2.6 to 15.5 percent during the period covered by this litigation. (PSMF if 172; JPA 141; JSA

130, 133 (Bates 9M-00821 and 9M-00816)).

At the time the room was booked, Marriott provided no information to its guests at its

Russian Hotels that would have enabled the guest to understand the actual per night charge for the

hotel room. (PSMF

iii! 37-50; JPA

119-123; MSUF 22; JPA 209, 274). Marriott did not disclose

to hotel guests reserving rooms at Marriott Russian Hotels that their hotel bill at checkout could

be paid only in RUR, not USD, or that the amount of RUR would be calculated using a conversion

8

of "Units" to RUR at the "hotel exchange rate." Id. Marriott did not disclose to hotel guests

reserving rooms at Marriott Russian Hotels that the "hotel exchange rate" is different from the

Central Bank rate for the conversion ofUSD to RUR. Id. Nor did Marriott disclose that translation

of Units to RUR at the hotel rate would result in a charge in USD for the room greater than the

amount in USD stated in the hotel guest's reservation confirmation. Id. Marriott's standard room

confirmation is secured by the guests credit card and locks the guest into its terms unless the guest

cancels the reservation at least 24 hours prior to the schedule check-in time. (MSUF 22; JP A 209,

274). Representations of further price disclosures purportedly made to guests upon arrival at the

hotel in Russia would have been made only after the guest was locked in to Marriott's original rate

confirmation.

The D.C. Circuit described the "scheme by Marriott International to overcharge guests at

its Russia hotels" this way:

Plaintiff Britt Shaw's experience shows how Marriott's system worked. In April

2005, Shaw made a one-night reservation at the Marriott Renaissance Moscow

during a business trip for his law firm. He was quoted a price of $425. When Shaw

checked out of the hotel, he learned that he could only pay in rubles, not in dollars.

Marriott used its own exchange rate of $1 to 32 rubles and charged Shaw 13,600

rubles for what he had been told would be a $425 room. At that day's official

exchange rate of $1to27.7543 rubles, 13,600 rubles equaled $490. Shaw paid $65

more than the price quoted to him when he reserved his room. The remaining

plaintiffs were treated similarly.

Shaw, 605 F.3d at 1041. Mr. Rotunda's experience precisely mirrors the D.C. Circuit's description

of Marriott's deceptive scheme. At all times material to this action, Mr. Rotunda was a resident

of the District of Columbia. (Marriott Answer Rotunda case,

if 17, JPA

89). In February 2003,

Mr. Rotunda made a reservation for a room at the Marriott Moscow Grand Hotel by calling the

Marriott central reservation phone number and was issued a written reservation confirmation from

Marriott's reservation system. (PSMF ifif 206-208, JPA 150, 691-699, 725, 274; MSUF if 22; JPA

9

209). Mr. Rotunda's reservation confirmation quoted a room rate of $299.00 USD per night.

(PSMF~

208; JPA 150, 274; MSUF

was quoted in USD. (MSUF

~

~

22; JPA 209). The confirmation specifically stated the rate

22; JPA 209, 274). Mr. Rotunda's reservation confirmation does

not disclose that payment would be required to be made in RUR at the time of check-out, nor

makes any reference to "Units," "UNT," "Currency Units" or "exchange rate." (PSMF

~~

209-

210; JPA 151; MSUF ~ 22; JPA 209, 274). Mr. Rotunda, who traveled as a tourist checked out of

the Marriott Moscow Grand Hotel on March 31, 2003 at which time he received a hotel bill listing

the charges for his guest stay which exceeded what he had been quoted when he made his

reservation. (MSUF

~~

23-24; JPA 209-210). In March 2003, the Marriott Moscow Grand Hotel

utilized a translation rate of 33.5 or 33 RUR per unit of charge in preparing its bills. (PSMF ~ 215;

JPA 151, JSA 129-133). On March 29, 2003, the Central Bank currency exchange rate was

31.3805 RUR/USD. The translation rate utilized by Marriott in preparing Mr. Rotunda's final

hotel bill was thus at least 5.2% greater than the Central Bank RUR/USD exchange rate

(33/31.3805 = 1.0516). (PSMF

~~

216-217; JPA 152, 308). Mr. Rotunda was charged at least

$313 .95 for his room; or $15 more than the $299 per night Marriott originally represented as the

per night price of the room.

Marriott's Relationship to the District of Columbia

Marriott International, Inc. is a Delaware corporation with corporate offices located in

Bethesda, Maryland. (MSUF

~~

2-3; JPA 206). At all times material to this action, Marriott had

engaged in longstanding, widespread and persistent representations to the public that it was

headquartered in the District of Columbia, and had other substantial contacts with the District of

Columbia. Marriott regularly conducts business in the District of Columbia. (Marriott's Answer

to First Amended Class Action Complaint in Shaw ("Answer") ~ 17, JP A 50). Marriott's website

10

contained numerous representations that its corporate headquarters was at One Marriott Drive in

Washington, D.C. 20058. (Answer if if 23-26, JPA 51-52). The "Corporate Information" section

of Marriott's website states the corporation's "Contact Information" is "Corporate Headquarters,

Marriott International, One Marriott Drive, Washington, D.C. 20058". (Answer if 23, JPA 51).

The "Careers" and "Investor Relations" sections of Marriott's website state, "The company is

headquartered in Washington, D.C." and provides the address: Marriott International, Marriott

Drive, Washington, D.C. 20058. (Answer

if if 24,

25, JPA 51). The "Our Brands" section of

Marriott's website contains a "Marriott International Factoid," which states, "Did you know

Marriott International: Is headquartered in Washington DC." (Answerif 26, JPA 51-52). Marriott's

annual report to its shareholders for the years 2000 - 2006 all contain similar representations.

(Answer if 27, JPA 52; Declaration of Kelly Taylor {"Taylor Dec.") at 2, JPA 702). From 2002 to

2007, Marriott's annual meeting of shareholders was held at the J.W. Marriott Hotel, 1331

Pennsylvania Ave., N.W., Washington, D.C. 20008. (Id) Marriott's Form 8-K Report dated

February 8, 2005, filed with the Securities and Exchange Commission, shows Corporate

Headquarters address as Marriott Drive, Washington, D.C., 20058. (Answer if 28, JP A 52). All of

Marriott's formal press releases prior to August 8, 2007 (found on its website) recite that it is

headquartered in Washington, D.C. {Taylor Dec. at if 7, JPA 703). Marriott's General Counsel is

identified in Martindale Hubbell as being located at One Marriott Way, Washington, D.C. 20058.

(Answer if 29, JPA 52).

Marriott has admitted that it promotes the identification of its brand with the District of

Columbia for its own commercial advantage. Marriott states:

Marriott admits that it has stated on its website that "the perpetuation of the

company's culture has proven a positive financial impact." Marriott states that its

historic roots to the District of Columbia date back to 1927 when the Company's

11

founders began their business operations in the District of Columbia. (Answer if 22.

JPA51).

Marriott explains its claim of residence in Washington, D.C.: "to honor Marriott's historical roots

and connections to Washington, D.C., the company at times represents that it is headquartered

there". (Answer

if if 32,

33, IPA 52-53). Marriott acknowledges that it purposefully identifies

itself with Washington, D.C., stating:

When Marriott moved its headquarters location to Bethesda, Maryland in 1979, it

was decided that a Washington, D.C. address would be easier for guests, investors,

and other interested parties to identify and recognize than a Bethesda, Maryland

address. (Marriott International Inc. 's Response to Plaintiffs' First Set of

Interrogatories and Requests for the Production of Documents, Nos. 8 and 9, JP A

317).

Marriott's Russia Hotels are both company-owned and franchised. (MSUF

ifif 9,

10, IPA

207). Marriott is responsible for its deceptive conduct for both its company-owned and franchised

properties. Shaw v. Marriott International, 605 F.3d 1039 at 1042.

ISSUES PRESENTED

1. Does the representative action authorized under D.C. Code § 28-3905(k)(l) provide

recovery of damages payable to individual consumers independent of the class action

procedures of Rule 23?

2. Do individuals traveling on business qualify as consumers when they purchase goods or

services to serve their personal needs?

3. Marriott has made widespread representations to members of the general public that it is

headquartered in the District of Columbia. Do such representations give the District an

interest in applying its laws to Marriott's conduct that is at least as great as the interest of

any other jurisdiction?

4. Did the Superior Court err in denying Rotunda's motion for summary judgment:

a. By erroneously injecting a requirement that a plaintiff prove intent to deceive?

12

b. By questioning the materiality of Marriott's false price representations and holding

that there is a factual issue as to whether the combination of false price

representations and the failure to disclose material facts has a tendency to deceive an

ordinary consumer?

c. By finding that there were material issues of fact respecting the nature of Marriott's

price representations and its failure to disclose material facts.

STAND ARD OF REVIEW

The question of statutory interpretation regarding the application of the D.C. Consumer

Protection and Procedures Act is subject to de nova review. Odems v. District of Columbia, 930

A.2d 137, 140 (D.C. 2007).

This Court reviews the grant or denial of a motion for summary

judgment de nova. Saucier v. Counrywide Home Loans, 64 A.3d 428, 437 (D.C. 2013); Choharis

v. State Farm Fire and Cas. Co., 961 A.2d 1080, 1088 (D.C. 2008); Malone v. Saxony Co-op

Apartments, Inc., 763 A.2d 725, 728 (D.C. 2000).

SUMMARY OF THE ARGUMENT

Compliance With Rule 23 -The Superior Court's October 31, 2013 order (relying exclusively on

Margolis v. U-Haul Int 'l Inc., 2007 CA 5245, 2009 D.C. Super Lexis 8 (Dec. 17, 2009)), held that

an individual may not bring an action for money damages on behalf of himself and the general

public without meeting all of the "procedural and constitutionally-based" requirements of Rule 23.

APP AT 2. The clear weight of authority holds otherwise. The remedial terms of the CPPA

unambiguously provide for any person acting for himself or "for the interests of the general

public ... to recover or obtain ... treble damages or $1,500 per violation."

D.C. Code 28-

3905(k)(l )(A). Nothing in the statute conditions recovery of monetary relief on behalf of the

general public on satisfaction of the procedural requirements for certification of a class action.

The Council's intent reflected in the plain language of section 28-3905(k)(l) has now been

expressly affirmed in the legislative reports accompanying the 2012 amendments to the CPPA.

13

The Alexander Report notes that the amendments clarify what the law has provided since the year

2000. The amendments clarify the definition of "consumer" protected by the CPPA to include

separate and distinct representative capacities -- both "a private attorney general on behalf of the

general public" and "the representative of a class of consumers." The amendments emphasize that

"any claim" including a private attorney general suit "may recover or obtain" enumerated remedies

including "treble damages or $1,500 per violation." Judge Nash in National Consumer's League

v. Doctor's Associates, Inc., Case No. 2013 CA 0065498, 2014 D.C. Super. Lexis 15 (D.C.

Superior Court Sept. 12, 2014), recently held, in direct contravention of Margolis, that "[t]he

phrase 'any claim . . . may recover or obtain the following remedies' at the beginning of §

3905(k)(2) indicates that the remedies listed are available to all litigants." Slip Op. at 16 (emphasis

added). Further, the due process fears expressed by the Superior Court were found baseless in

Doctor's Associates. Damages are expressly "payable to the consumer"; not the representative.

Slip Op. at 16. Addendum ("Add.") 12. Section 28-3905(k)(l)(F) additionally "grants courts

broad discretion to impose remedial measures as they deem fit." Id.

Every private attorney general action for money damages filed on behalf of the general

public under CPPA section 28-3905(k), that had been remoyed to the U.S. District Court for the

District of Columbia under the Class Action Fairness Act, has been remanded back to Superior

Court. In each case the federal court, citing Breakman v. AOL, LLC, 545 F.Supp.2d 96, 101 (D.D.

C. 2008) found that such representative actions are procedural vehicles distinct from class actions

removable under the Class Action Fairness Act. In Nat'! Consumer's League v. Gen. Mills, Inc.,

680 F.Supp.2d 132, 139 (D.D.C. 2010), the court found that requiring compliance with Rule 23

would not be a construction that would lead to a liberal construction of the CPP A.

14

Business Travelers - The use of a hotel room to meet the personal needs of a guest for a place to

sleep and bathe does not lose its status as a consumer transaction merely because the guest travels

on business. The controlling case on this issue, Weschler v. Klank, 561A.2d1003 (D.C. 1989),

holds that "it is the ultimate retail transaction between the final distributor and the individual

member of the general public that the act covers." 561 A.2d at 1005. Where the purchaser is not

in the regular business of reselling goods or services, the purchaser is not a merchant and the sale

to him is a consumer transaction.

The U.S. District Court in Shaw ignored Weschler. On appeal the D.C. Circuit misread it,

believing incorrectly that this Court found Klank was not a consumer. Shaw, 605 F.3d at 1043.

When the issue came before the Superior Court on remand of the Shaw case from federal court,

Judge Burgess believed that his hands were tied under the principles of collateral estoppel. He

concluded that it did not make any difference whether the D.C. Circuit got this issue right or wrong.

When Rotunda placed the issue before the Superior Court in this case, Judge Weisberg concluded

that this Court must have agreed with the federal courts views in Shaw because if it didn't "one

would have expected our Court of Appeals to have said something about it." JPA 10 at note 6.

But the history of the Shaw case in the courts of the District of Columbia shows a completeI y hands

off position on the merits of the business traveler issue. This Court affirmed Judge Burgess'

holding that Shaw was precluded from relitigating his status as a consumer and that it didn't matter

whether the D.C. Circuit was right or wrong on that issue. Shaw v. Marriott Int'l, Inc., 62 A.3d

1283 (D.C. 2013) (Unpublished). The business traveler issue is now squarely before this Court.

Rotunda is not collaterally estopped by the Shaw decision. Here, it does make a difference whether

the D.C. Circuit got it right or wrong. The use of the hotel room for the personal needs of a guest

who is not in the business of reselling hotel accommodations is a consumer transaction falling

15

squarely within the holding of this court in Weschler. In Wesch/er the article sold had a mixed

purpose - the use of an antique chest in either the purchaser's home or office. 561 F.2d at 1004.

That fact made no difference to this Court's analysis. So too, here, where there is also a potential

mixed use, the incidental business purpose does not take away from the essentially personal use

of the hotel room. A decision attempting to narrow the holding in Wesch fer would run counter to

the statute's directive that the CPPA be liberally construed to remedy unfair trade practices. D.C.

Code§ 28-3901 (b)(l) and (c)(3).

Choice of Law - The Superior Court did not contest the proposition that a non-resident defendant

may be held accountable to District residents under the CPP A. JPA 5. The question remains as

to whether Marriott's representations that it is headquartered in the District of Columbia justifies

regulation of its conduct under D.C. law. JPA 12-13 at 8-9. The controlling principle on this

choice of law issue is whether the interest of the District of Columbia in enforcing its law is at

least as great as the interest of any other jurisdiction. Washkoviak v. Student Loan Mktg. Ass 'n,

900 A.2d 168, 180 (D.C. 2006).

The record is clear that Marriott engaged in a longstanding, widespread and persistent

effort to represent to the whole world (including potential guests) that it was headquartered in the

District of Columbia. These representations were false and were intended to secure commercial

benefits for Marriott. In effect, Marriott was informing all potential guests that it could be found

in, and, by implication, could be held accountable in the District of Columbia.

These

representations give the District of Columbia an interest in holding Marriott accountable under the

CPPA that is at least as great as the interest of Maryland, Delaware or any other state to apply their

laws. Judge Weisberg's statement that Marriott was merely pretending that its business was

located in the District (JP A 13 at 9) turns a blind eye to the reality of what was going on with

16

respect to the District of Columbia. Marriott's representations were part of a systematic, highly

focused effort to promote its commercial interests. The opinion offers no reasons why Maryland

or any other state would have a greater interest under these circumstances than the District of

Columbia.

Summary Judgment - The Superior Court erred in denying Rotunda's Motion for Partial

Summary Judgment on the issue of liability. There can be no factual issue on the question of

intent. Proof of intent is not required under the CPP A. Further, price is always material and a

false representation as to price necessarily has a tendency to mislead an ordinary consumer as to a

material fact. Likewise the failure to disclose material facts has a tendency to mislead. Finally,

there is no dispute that Marriott's price representations in USD were objectively false and that the

prices actually charged in RUR were calculated at undisclosed "units to RUR" exchange rates.

Summary Judgment on the issue ofliability should have been granted to Rotunda on behalf of the

general public.

ARGUMENT

I. THE CPPA AUTHORIZES SUITS FOR DAMAGES PAYABLE TO MEMBERS OF

THE GENERAL PUBLIC INDEPENDENT OF PROCEDURES REQUIRED UNDER

RULE23

A. Individual Members of the General Public Are

Entitled to Monetary Damages In a Representative Action

Rotunda seeks statutory damages under D.C. Code § 28-3905(k)(l) (2000) for himself and

individual members of the general public. As discussed below, the Superior Court has ample

authority to fashion a remedy that protects the due process rights of all interested parties without

making this a Rule 23 class action. The legislature was well aware of Rule 23 but chose to create

a remedy independent of class action procedures. The Superior Court erred in holding that

damages are not available to members of the general public in a representative suit absent

17

compliance with the requirements for certification of a class under Superior Court Rule 23. The

Superior Court relied on one case, and ignored broader authority which demonstrates the clear

intention of the D.C. Council to allow for monetary recovery to all consumers injured by unlawful

trade practices proscribed by the CPP A. Most significantly, the Superior Court wholly ignored

the actual words of the statute.

The starting point for the interpretation of any statute is the language of the statute itself

Section 28-3905(k)(l) (2000) could not be more clear.

The statute provides expressly for

representative actions on behalf of the general public and for specific monetary relief payable to

each consumer injured by an unlawful trade practice. The statute states:

A person, whether acting for the interests of itself, its members, or the general

public, may bring an action under this chapter in the Superior Court of the District

of Columbia seeking relief from the use by any person of a trade practice in

violation of a law of the District of Columbia and may recover or obtain the

following remedies:

(A) treble damages, or $1,500 per violation, whichever is greater, payable to the

consumer; * * * *

(E) in representative actions, additional relief as may be necessary to restore to

the consumer money or property, real or personal, which may have been

acquired by means of the unlawful trade practice; or

(F) any other relief which the court deems proper.

D.C. Code § 28-3905(k)(l) (2000) (emphasis added). These plain words can only be read to grant

a right of action to a person acting on behalf of the general public to recover money to be paid to

consumer victims of an unlawful trade practice. Section 28-3905(k)(l )(A) provides for treble

damages or statutory damages expressly for any claim, including a claim by a person on behalf of

the general public, to remedy a violation of the Act. Section 28-3 905(k)(l )(E) underscores the

availability of such damages in representative suits by authorizing "additional relief' in the form

of restitution in representative actions. For that term to have meaning, section (k)(l)(E) must

18

provide relief in addition to something else -- in addition to the treble damages and statutory

damages authorized in section (k)(l)(A). See, National Consumers League v. Doctor's Assoc.,

Inc., 2013 CA 006549 B (D.C. Superior Court Sept. 12, 2014) Slip Op. at 16. Add. 12.

Nothing in these sections limits recovery by consumers on compliance with any additional

conditions precedent or procedure of any kind. Nothing in these sections limits recovery of

monetary relief on behalf of the general public to satisfaction of the procedural requirements

associated with certification of a class action. National Consumer League v. General Mills, Inc.,

680 F. Supp. 2d 132, 137 (D.D.C. 2010).

The legislative history of these provisions supports this conclusion. In 2000, the Council

amended the CPP A to provide for representative suits and the particularized remedies related to

representative actions.

In 1995, due to severe financial problems, the Council suspended

enforcement of the CPPA by the Department of Consumer and Regulatory Affairs ("DCRA") for

budgetary reasons. Grayson v. AT&T, 15 A.3d 219, 239-241(D.C.2011); Gomez v. Indep. Mgmt.

of Delaware, Inc., 967 A.2d 1276, 1287 & n.13 (D.C. 2009) (citing history of suspensions of

DCRA enforcement authority). In the 2000 amendments, the Council extended that suspension

until October 1, 2002, again for budgetary reasons. Grayson, 15 A.3d at 242.

Interested parties reacted to the suspension of DCRA's enforcement authority by

recommending changes to the pre-2000 version of the CPPA to enable public interest organizations

and individuals to halt and seek remedies for illegal trade practices. See D.C. Bar, Section on

Antitrust, Trade Regulation & Consumer Affairs, Consumer Protection in the District ofColumbia

Following the Suspension ofDCRA Enforcement ofthe Consumer Protection Procedures Act (Apr.

1999), appended to Letter from Mara Verheyden-Hilliard, Section Co-Chair, to the Council (Mar.

29, 2000). JP A 217. Among the new means of enforcement afforded consumers, the 2000

19

amendments "allow representative organizations as well as individuals to maintain actions to

redress unfair trade practices." Id. at 10. The rationale for the expansion of the private right of

action was to "provide public interest organizations and individuals additional abilities to take

consumer protection actions in the public interest to stop fraudulent conduct when an unlawful

trade practice comes to their attention" because, prior to the amendment, it was "not possible to

bring a consumer action to stop illegal conduct until after a victim suffers injury." D.C. Council,

Comm. on Consumer & Regulatory Affairs, Report on Bill 13-679, Fiscal Year 2001 Budget

Support Act of 2000 (Apr. 26, 2000) (Section 3: Consumer Protection, Rationale). JPA 230. The

committee recognized that expansion of the private right of action will "also allow the government

to coordinate with the non-profit and private sectors more efficiently, allowing the government to

leverage the impact of existing public resources and target its activities in areas where enforcement

by private parties will not be sufficient. As a consequence, consumer protection can be increased

without any additional, or substantial, cost to the government." Id.; Grayson, 15 A.3d at 240-41.

The "key CPP A amendments" in the 2000 legislation included a strong statement of

legislative intent: "D.C. Code§ 28-390l(c): 'This chapter shall be construed and applied liberally

to promote its purpose."' Grayson, 15 A.3d at 242.

The amended legislation left in place the

existing legal remedy of statutory damages, now made applicable to representative suits, and

enhanced the remedies available in representative suits by providing for the equitable remedy of

disgorgement. Id. Amendments to D.C. Code § 28-3909 authorizing the consumer protection

enforcement authority of the Corporation Counsel retained the power to seek restitution and

damages suffered by consumers and added the authority to cooperate with private interests and

various government agencies to protect the interests of consumers. Id. and n. 68.

20

In sum, in amending the CPPA in 2000, the Council intended the liberal application of the

statute to "assure that a just mechanism exists to remedy all improper trade practices." D.C. Code

§ 28-3901(b)(l). The Council compensated for budget constraints on DCRA by supplementing

the enforcement capability of the government and by empowering representative suits to protect

the interests of the general public. The Council specifically included individuals and other private

interests in its definition of the "persons" authorized to bring representative suits under the CPP A.

D.C. Code § 28-3901(a)(l) and 3905 (k)(l). The Council left in place the statutory damages

remedy of $1,500 per violation payable to the consumer; and added expressly for representative

suits - "additional relief' - in the form of the restoration of money to the consumer (restitution).

D.C. Code§ 28-3905(k)(l)(A) and (E). Nothing in the language of the statute or in the legislative

history suggests any procedural burden on the reach or remedy of representative actions. To the

contrary, the statute mandates its "liberal" application.

Recent amendments to the CPP A reinforce the legislative intent established above. The

Council explained the background for the amendments:

In 2000, the Council amended the Consumer Protection and Procedures Act

(CPPA) to allow non-profit public interest organizations and the private bar to bring

litigation in the public interest. In an effort to provide a more robust consumer

protection enforcement structure, the 2000 amendments permitted persons

(including non-profit organizations and other entities) to sue "on behalf of

themselves or the general public" when the act had been violated. See D.C. Code §

28-3905 et seq.

Report on the Consumer Protection Amendment Act of 2012, Councilmember Yvette M.

Alexander, Chairperson, Committee on Public Services and Consumer Affairs, November 28,

2012 ("Alexander Report") at JPA 759-760 (emphasis added).

The Alexander Report emphasizes the intent of the Council to clarify the private right of

action authorized by section 28-3905 "in the wake of the D.C. Court of Appeals' decision in

21

Grayson." Alexander Report at JP A 762. The amendments are intended to reinforce an expansive

reach of the CPP A "by being more explicit about what kind of suits the Council intends to

authorize." Id. The amendments authorize "four separate, independent standing provisions." Id.

"Each illuminates the differing situations in which consumers or organizations acting on behalf of

consumer interests might have standing to sue under the act." Id. With respect to consumers, the

Report explains:

New subsection (k)(l )(A) provides a right of action for consumers. It is not

intended to alter a right a consumer currently has to bring an action, whether

individually, jointly with other consumers, as a private attorney general on behalf

of the general public, as the representative of a class of consumers, or otherwise.

Alexander Report at JP A 7 62 (emphasis added). The legislative history affirms the right existing

from the enactment of the 2000 amendments for an individual to act as a private attorney general

on behalf of the general public.

Moreover, the Alexander Report clarifies what the law has authorized since 2000 -- that

representative suits and class action suits are distinct. The Report defines a consumer's rights of

action under the CPP A, including his right to sue not only as an individual, but in two separate and

distinct capacities -- "as a private attorney general on behalf of the general public,[or] as the

representative of a class of consumers .... "

Courts addressing this issue have uniformly found that representative suits and class

actions are separate and distinct procedural vehicles under the CPP A. National Consumer League

v. General Mills, Inc., 680 F. Supp.2d 132, 137 ("the plain language of the CPPA expressly

authorizes suits like NCL's that are brought on behalf of the general public without imposing any

requirement that the suit meet the strictures of Rule 23"); Breakman v. AOL LLC, 545 F. Supp.2d

96, 101 (D.D.C. 2008)("The CPPA specifically authorizes a private attorney general suit without

any reference to class action requirements. See D.C.Code § 28-3905(k). Breakman has not

22

attempted to comply with Rule 23 of the D.C. Superior Court Rules of Civil Procedure, and he has

not sought class certification .... Hence, this representative action is authorized by District of

Columbia statute and is a separate and distinct procedural vehicle from a class action."); Zuckman

v. Monster Beverage Corp., 958 F. Supp. 2d 293, 304-05 (D.D.C. 2013)("Because the plaintiff in

[Breakman] did not attempt to comply with Rule 23 of the D.C. Superior Court Rules of Civil

Procedure, did not seek class action certification, and specifically stated that he was bringing his

case as a representative action under the CPPA, the Court concluded that the action was a "separate

and distinct procedural vehicle from a class action." A similar analysis applies here. National

Consumers League v. Flowers, 2014 WL 1391246 at *6 ("Absent the 'hallmarks of Rule 23 class

actions; namely, adequacy of representation, numerosity, commonality, typicality, or the

requirement of class certification,' courts have held that private attorney general statutes 'lack the

equivalency to Rule 23 that CAFA demands.' ... The Court therefore sees no reason to depart from

the well-reasoned conclusion of Judge Bates in Breakman and Zuckman that removal is not

permitted under CAFA's class action provision for actions brought by a private attorney general

under D.C. Code § 28-3905(k)(l) where plaintiff has not brought a "class action" under D.C.

Superior Court Rule 23."); National Consumer League v. Bimbo Bakeries USA, 2014 WL

2536795 at *8 (D.D.C. June 4, 2014)(Court holds that representative suits and class actions are

distinct because of the "conspicuous lack of class certification requirements in the [CPPA]" and

based upon "precedent holding that private attorney general actions are not class actions").

Finally the provision governing remedies in the 2011 amendments has been moved to

section 28-3905(k)(2) and removes any question as to the availability of damages in suits on behalf

of the general public:

(2) Any claim under this chapter shall be brought in the Superior Court of the District of

Columbia and may recover or obtain the following remedies:

23

(A) Treble damages or $1,500 per violation, whichever is greater, payable to the

consumer.

Doctor's Associates Inc., 2013 CA 006549B (Sept. 12, 2014). ("The phrase 'any claim may

recover or obtain the following remedies' at the beginning of§ 3905 (k)(2) indicates that the

remedies listed are available to all litigants.") (emphasis in original).

The law since 2000 has afforded a consumer such as Rotunda a right of action to bring

suit as a private attorney general on behalf of the general public. Rotunda's private attorney

general action is part of the reference to "any claim" for which the enumerated remedies are

available. That right of action is a claim for which recovery of monetary damages -- treble

damages or $1,500 per violation -- is available. The Superior Court erred in holding to the

contrary.

B. The Superior Court Erred in Endorsing Margolis

The Superior Court here endorsed the opinion in Margolis v. U-Haul, 2009 WL 5788369

(D.C. Superior Court Dec. 17, 2009), to find that damages are not available in representative suits

outside the procedural requirements for class certification under Rule 23. But the Margolis Court

made no substantive finding for reading class action procedures into the CPP A. Rather, the Court

simply concludes that "[n]othing in the statute indicates any intention by the legislative branch to

abrogate the requirements of Rule 23." 2009 WL 5788369, III, if20. Beyond that conclusion, the

obverse of which is refuted by the discussion above, the Margolis Court voices a vague concern

that "some measure of due process plainly is necessary to prevent harm to absent third parties."

Id. at 4. Neither the Superior Court in the instant action, nor the Margolis Court makes any

substantive findings specifying what due process rights it contends would be endangered by

24

allowing an award of damages to un-named members of the general public. Further it does not

identify any potential due process risks to a defendant.

Margolis reads out the clear language of the CPPA in favor SCR-Civil 1, which would

apply all civil rules to all civil cases-including SCR-Civil 23 to the case before it. Margolis,

2009 WL 5788369 at 3-4. With that extra-textual foundation, the court held that "[n]othing in the

CPP A itself indicates that the provision permitting representative actions should be interpreted so

as to eliminate Rule 23 in cases where a plaintiff is seeking money damages on behalf of otherwise

unrepresented third parties." Id.

However, nothing in the CPPA mandates SCR-Civil 23 be

grafted whole-cloth onto portions of §28-3905(k) either.

Margolis violates basic principles of statutory construction which hold that, "[w ]hen

engaging in statutory construction, courts are limited to interpreting the language before them;

they may not drastically re-write the statute .... " Act Now to Stop War & End Racism Coalition v.

District of Columbia, 905 F. Supp. 2d 317, 349 (D.D.C. 2012). Moreover, Margolis reads out the

plain language of the CPP A, that representative actions can have additional relief than those

itemized, because it "ignore[s] the plain language of the statute and the 'basic principle of statutory

construction ... that each provision of the statute should be construed so as to give effect to all of

the statute's provisions, not rendering any provision superfluous." Blodgett v. Univ. Club, 930

A.2d 210, 220 (D.C. 2007).

As this Court has noted, when courts review rules of procedure viz-a-viz statutes, they

should attempt to reconcile one with the other so as to not deprive either of its "essential meaning."

Flemming v. United States, 546 A.2d 1001, 1004 (D.C. 1988). In fact, the enabling acts under

which the state rules of civil procedure were promulgated, like 28 U.S.C. § 2072, which authorizes

the Supreme Court to craft rules of procedure for federal courts, caution that such rules should not

25

"abridge, enlarge or modify any substantive right." See e.g., In re C.A.P., 356 A.2d 335, 343 (D.C.

1976)("Congress in enacting§ 11-946 did not intend to grant a power to the Superior Court which

it withheld from the Supreme Court."); Haynes v. District ofColumbia, 503 A.2d 1219, 1223 (D.C.

1986); Gillis v. Clark Equip. Co., 579 S.W.2d 869, 872 (Tenn. Ct. App. 1978). While neither SCRCivil 1 nor SCR-Civil 23 directly "conflict" with the CPPA, Margolis' grafting of SCR-Civil 23

onto representative plaintiffs seeking damages not only ignores the plain reading of the CPP A but

deprives the statute of its "essential meaning" as highlighted by the Alexander Report. Moreover,

Margolis used state rules of procedure, SCR-Civil 1 and 23, to impermissibly abridge the plain

wording of the statute and otherwise modify it.

The basis for the Margolis ruling has been rejected by other courts. The court in General

Mills, found first that representative suits are expressly authorized by the CPPA "without imposing

any requirement that the suit meet the strictures of Rule 23." 680 F. Supp. at 137. The General

Mills Court further noted that "this representative action is authorized by District of Columbia

statute and is a separate and distinct procedural vehicle from a class action." Id., citing Breakman

v. AOL LLC, 545 F.Supp.2d 96, 101 (D.D.C. 2008). Further the Court reasoned that one of the

principle procedural due process concerns on which Margolis rested was unfounded. General

Mills, 680 F. Supp.2d at 138. The Margolis Court stated that unless a representative plaintiff

seeking money damages was required to comply with Rule 23 there was a danger that the

representative would realize a windfall by claiming money intended for absent third parties. 2009

WL 5 7 8 83 69, *8. The General Mills Court rejected that reasoning, stating that " [u]nder the CPP A,

however, damages are payable to the consumer, not to the 'person' who brings the claim, including

a 'person' acting as a private attorney general." 680 F. Supp.2d at 138, citing Grayson v. AT&T

Corp., 980 A.2d 1137, 1155 (D.C. 2009), rev'd on other grounds, 15 A.3d 219 (D.C. 2011) (The

26

Council intended under D.C. Code § 28-3905(k)(l )(A), that any monetary remedy obtained by Mr.

Grayson would be '"payable to the consumer'"). See also, National Consumer League v. Bimbo

Bakeries USA,_ F. Supp. 2d _ , 2014 WL 253 6795 *4 (rejecting argument that public interest

organization suing on behalf of the public would be entitled to statutory damages for itselftotaling

$1,500 per violation, finding that statutory damages are "payable to the consumer" and so the

organization itself would be entitled only to the damages suffered by it personally); Doctor's

Associates Inc., 2013 CA 006549B (Sept. 12, 2014) Slip Op. at 16 (statutory language specifying

"treble damage must be payable to the consumer does not preclude a public interest organization

from recovering them in a suit under the CPPA.

This language simply specifies that such

organizations may not recover treble damages on behalf of consumers and then retain those

damages for their own benefit - they must pass them onto those who have suffered them harm.")

The General Mills Court concluded:

To require a CPP A plaintiff to comply with Rule 23 would not be a construction

that would lead to liberal application of the CPP A to promote its purpose. Rather,

contrary to the goals of 2000 Amendment, requiring compliance with Rule 23

would further limit the universe of plaintiffs permitted to bring claims and make it

more difficult for those plaintiffs to bring them. Consequently, the Court finds that,

at least for CPPA claims brought on behalf of the general public as here, plaintiffs

need not comply with Rule 23.

680 F. Supp.2d at 139.

The Superior Court here attempted to distinguish the circumstances in General Mills from

those in the instant action. (October 31 Order at 4 n. 4). But the "standing" distinction rendered

moot by Grayson II is simply irrelevant to the findings in General Mills regarding satisfaction of

class certification requirements to qualify for an award of money damages. The General Mills

Court was addressing the due process concerns expressed in Margolis, and it was the concern that

a representative plaintiff might realize a windfall that the General Mills Court rejected. 680 F.

27

Supp.2d at 139. Nor does the General Mills Court limit its findings on damages to associational

plaintiffs. The Court refers to "CPPA plaintiffs." Id. A CPPA plaintiff is a "person" who may

act for himself and on behalf of the general public.§ 28-3905(k)(l). Thus the General Mills Court

found generally that to require satisfaction of the requirements of Rule 23 to sue for monetary

damages would constrict rather than expand the application of the CPP A contrary to the intent of

the Council in amending the Act in 2000. 680 F. Supp.2d at 139.

C. The Court Is Empowered to Ensure Due Process

Rights Outside of Rule 23 Procedural Requirements

Rotunda recognizes that the due process rights of absent third parties must be protected in

representative suits. Based on room prices of several hundred dollars and an undisclosed markup

of 5-15%, the actual damages of the vast majority of guests implicated will not exceed statutory

damages of$1,500, even after trebling. Thus, few, if any, "third parties" need to be protected. In

any event, class action procedure is not the only method available to accomplish that end.

There is abundant support for the authority of District of Columbia courts to craft