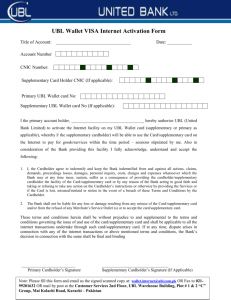

to UBL Internship Report

advertisement