KWAP Annual Report 2012: Retirement Fund Performance

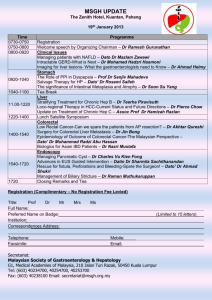

advertisement