English Version

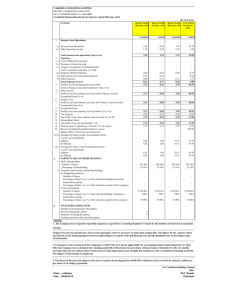

advertisement