Chapter 17 - Savannah State University

advertisement

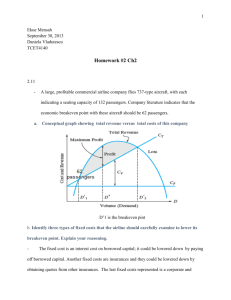

Chapter17 Financial Planning and Control 1 Learning Outcomes Chapter 17 Construct simple pro forma financial statements that can be used to forecast financing and investment needs. Discuss some of the complications that management should consider when constructing pro forma financial statements. Describe and compute (a) operating breakeven and operating leverage, (b) financial breakeven and financial leverage, and (c) total leverage. Discuss how knowledge of leverage is used in the financial forecasting and control process and why financial planning is critical to firm survival. 2 Financial Planning and Control Financial Planning: The projection of sales, income, and assets based on alternative production and marketing strategies, as well as the determination of the resources needed to achieve these projections 3 Financial Planning and Control Financial Control The phase in which financial plans are implemented, control deals with the feedback and adjustment process required to ensure adherence to plans and modification of plans because of unforeseen changes. 4 Financial Planning: The Sales Forecast A forecast of a firm’s unit and dollar sales for some future period, generally based on recent sales trends plus forecasts of the economic prospects for the nation, region, industry, etc. 5 Projected (Pro Forma) Financial Statements A method of forecasting financial requirements based on forecasted financial statements AFN = additional funds needed to support the level of forecasted operations 6 Projected Financial Statements Determine how much money the firm will need in a given period. Determine how much money the firm will generate internally during the same period. Subtract the funds generated internally from the funds required to determine the external financial requirements. 7 Step 1. Forecast the 2011 Income Statement: Unilate Textiles Assumptions: Unilate operated at full capacity in 2010. Sales are expected to grow by 10 percent. The variable cost ratio remains at 82 percent (same as 2010). 2011 dividend per share will be the same as in 2010. 8 Step 1. Forecast the 2011 Income Statement 9 Step 2. Forecast the 2011 Balance Sheet 10 Step 3. Raising the Additional Funds Needed (AFN) Higher sales must be supported by higher assets. Asset increase can be financed by spontaneous increases in accounts payable and accruals and by retained earnings. Any short fall must be financed from external sources--by borrowing or by selling new stock. 11 Step 4. Financing Feedbacks The effects on the income statement and balance sheet of actions taken to finance forecasted increases in assets 12 2011 Adjusted Forecast of Income Statement a b The upper portion of the income statement is not affected by financing feedbacks. The adjustment to RE shows up in the balance sheet as well. 13 2011 Adjusted Forecast of Balance Sheet b c The adjustment to RE shows up in the balance sheet as well. Total AFN = $45.0 million, which equals $42.7 million plus the $2.3 million decrease in RE. 14 Unilate Textiles: Adjusted Key Ratios 15 Other Considerations in Forecasting: Excess Capacity 16 Other Considerations in Forecasting: Economies of Scale Unilate’svariable cost ratio is 82% of sales. Ratio might decrease to 80% if operations increase significantly. Changes in variable cost ratio affect the addition to retained earnings which affects the amount of AFN. 17 Other Considerations in Forecasting: Lumpy Assets Assets that cannot be acquired in small increments, but must be obtained in large, discrete amounts 18 How Different Factors Affect the AFN Forecast. Dividend payout ratio changes. If reduced, more RE, reduce AFN. Profit margin changes. If increases, total and retained earnings increase, reduce AFN. Plant capacity changes. Less capacity used, less need for AFN. Payment terms increased to 60 days. Accounts payable would double, increasing liabilities, reduce AFN. 19 Financial Control Budgeting and Leverage The phase in which financial plans are implemented; control deals with the feedback and adjustment processes required to ensure the firm is following the right financial path to accomplish its goals, and, if not, to make necessary corrections. 20 Operating Breakeven Analysis An analytical technique for studying the relationship between sales revenues, operating costs, and profits Operating breakeven analysis deals only with the upper portion of the income statement—the portion from sales to NOI At the operating breakeven point, EBIT = 0 21 Unilate’s 2011 Forecasted Operating Income 22 Operating Breakeven Chart 23 Breakeven Computation For the proposal to break even, Unilate must sell 57 million units or $855.6 million of product. 24 Operating Leverage The existence of fixed operating costs, such that a change in sales will produce a larger change in operating income (EBIT) 25 Degree of Operating Leverage The percentage change in NOI (or EBIT) associated with a given percentage change in sales 26 Calculating the Degree of Operating Leverage 27 Operating Income/Leverage at Sales Levels of 110 and 121 Million Units 28 Financial Breakeven Analysis Determining the operating income (EBIT) the firm needs to just cover all of its fixed financing costs and produce earnings per share equal to zero At the financial breakeven point, EPS = 0 29 Financial Breakeven Graph 30 Financial Breakeven Computation 31 Financial Breakeven Computation The financial breakeven point for Unilate Textiles in 2011 is: 32 Financial Leverage The existence of fixed financial costs such as interest and preferred dividends when a change in EBIT results in a larger change in EPS 33 Degree of Financial Leverage 34 Degree of Financial Leverage 35 EPS/Financial Leverage at Sales Levels of 110 and 121 Million Units 36 Degree of Total Leverage 37 Importance of Forecasting and Control Functions If projected operating results are not satisfactory, management can reformulate its plans. If funds required to meet sales forecast cannot be obtained, management can sale back projected levels of operations. If required funds can be raised, it is best to plan for their acquisition in advance. Any deviation from projections needs to be handled to improve future forecasts. 38