Savings Rates - Saffron Building Society

advertisement

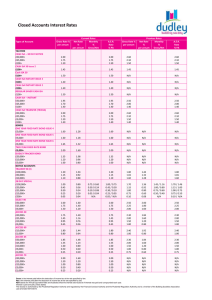

SAVINGS RATE GUIDE 22 Feb 2016 For product details, please see our Savings Brochure In branch 0800 072 1100 saffronbs.co.uk Product Gross p.a./AER* Net p.a.%** CHILDREN’S SAVINGS Ladybird (ISSUE 6) 11 years or under £1 or over £25,000 or over 2.05 2.25 1.64 1.80 Smart Saver (ISSUE 2) between 11 & 17 years inclusive £1 or over £25,000 or over 2.05 2.25 1.64 1.80 £1 or over 0.05 0.04 12 Month Fixed Rate Members’ Regular Saver (ISSUE 3) £10 or over 3.50 2.80 Reward Saver (ISSUE 5) £500 or over £50,000 or over Reward Bonus 0.35 0.40 0.50 0.28 0.32 0.40 Branch Saver £5,000 or over 1.00 0.80 Cashbuild 90 £10,000 or over £25,000 or over £50,000 or over 1.05 1.10 1.15 0.84 0.88 0.92 Members’ 120 Day Notice Account (ISSUE 2) £500 or over 1.35 1.08 Branch Cash ISA (ISSUE 2) £1 or over 1.00 - One Year Fixed Rate Cash ISA £500 or over 1.05 - One Year Fixed Rate Members’ Cash ISA £500 or over 1.15 - Two Year Fixed Rate Cash ISA £500 or over 1.15 - Two Year Fixed Rate Members’ Cash ISA £500 or over 1.25 - Easy Access (previously known as Cashbuild) Product Gross p.a./AER* Net p.a.%** One Year Fixed Rate Bond £500 or over Annual income Monthly income 1.05 1.04/1.05 0.84 0.83 One Year Fixed Rate Members’ Bond £500 or over Annual income Monthly income 1.55 1.54/1.55 1.24 1.23 Two Year Fixed Rate Bond £500 or over 1.15 0.92 Two Year Fixed Rate Members’ Bond £500 or over 1.25 1.00 Charity Deposits £1 or over £250,000 or over 0.10 0.15 - Sports and Social Clubs £1 or over 0.10 0.08 Corporate Deposits £10,000 or over 0.10 0.08 Solicitors’ Undesignated Client Account £1 or over 0.10 - BUSINESS SAVINGS Company & Club Accounts For more information ask in branch, call us FREE on 0800 072 1100 or visit saffronbs.co.uk SBS9767 Products may be withdrawn at any time Individual Savings Accounts (ISAs) pay interest tax-free provided all terms and conditions of the account type are met. On all other accounts, interest will be paid at the net rate after the appropriate standard rate of income tax (currently 20%) has been deducted, or gross on receipt of the required HMRC declaration form. Where interest is paid net, the income tax may be reclaimed from HMRC if the amount deducted exceeds the investor’s tax liability. Net rates are illustrative only and have been rounded to two decimal places. *The gross rate is the rate before deducting tax at the rate applicable to savings income. The Annual Equivalent Rate (AER) is a notional rate which illustrates the contractual rate (excluding any bonus interest payable) as is paid and compounded on an annual basis. ** Net p.a. % - after deduction of basic tax Full details of terms and conditions applying to all Society accounts are contained in the savings, ISA and online account terms and conditions documents, or any product specific terms and conditions. Interest is paid annually, with the exception of our accounts that offer a monthly income option, which is paid monthly and Reward accounts which are paid quarterly from inception. Interest rates of Society accounts not listed in this leaflet are available at your local branch and on the website. Where the interest rate payable on an account is linked to a reference rate (e.g. Bank of England Base Rate), the rate will be amended in accordance with the change in the reference rate, within 28 days. Your eligible deposits with Saffron Building Society are protected up to a total of £75,000 by the Financial Services Compensation Scheme, the UK’s deposit protection scheme. Any deposits you hold above the £75,000 threshold are not covered. Please visit www.fscs.org.uk for more information. Saffron Building Society is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. (Financial Services Register no 100015). Saffron House, 1A Market Street, Saffron Walden, Essex, CB10 1HX. Call our Saffron Direct team free on: 0800 072 1100 9am to 5pm Monday to Friday, Wednesday 9.30 - 17.00 9am to 1pm Saturday SBS9767 Large print, audio and Braille editions of this leaflet are available. Please call 0800 072 1100