Agricultural Machinery Sector Profile

advertisement

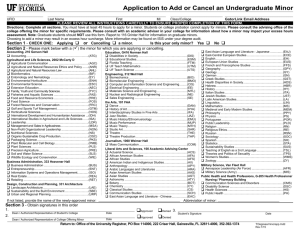

Agricultural Machinery Sector Profile1 - Canadian Embassy in Romania 1. Sector Overview Romania has a territory of 23.8 million hectares, out of which the agricultural area is approximately 14.7 million hectares. The country has some 3.9 million agricultural holdings, representing 32% of the total number of farms in the EU-27. The average surface of an agricultural holding in Romania is 3.4 hectares. The farm structure in Romania is: Farms Farms Farms Farms of of of of fewer than 1 hectare: 54.2% 1 – 10 hectares: 43.6% 10 – 100 hectares: 1.9% over 100 hectares: 0.3% According to latest data, out of the agricultural surface, 64.1% is arable land, 22.5% pastures, 10.7% hayfields and 2.7% vineyards and orchards. The contribution of agriculture, forestry and fishing to the nominal value of the GDP in Romania was approximately 5% in 2012. The population employed in the agriculture, forestry and fishing sectors represent approximately 30% of total employment in Romania. In 2013, the country registered record levels of cereal production. The domestic production of wheat and rye totalled 7.3 million tonnes, the highest level in the last eight years and the second highest in the last 43 years. Compared to 2012, the production of wheat and rye in 2013 increased by 37%. Furthermore, the domestic production of barley recorded 1.5 million tonnes in 2013, the highest level in the last 23 years. In 2012, Romania ranked 5th in the EU taking into account both the wheat cultivated area and the wheat production. Also, in 2012, Romania ranked 1st in the EU in terms of the area cultivated with maize and 3rd place in the EU in terms of the maize production. At the end of 2012, the fleet of agricultural machines in Romania included: 184,446 tractors 147,471 ploughs 24,078 harvesters 90,092 harrows 73,519 seeders The agricultural fleet is insufficient and the majority of the farms in Romania face a very low level of the agricultural equipment mechanisation. Approximately 73% of the tractors in Romania exceeded the recommended operation period of use. For example, 30% of the tractors used in Romania are over 20 years old. The offer of agricultural equipment is diversified in Romania, the market being dominated by imported brands. 1.1 Imports & exports In 2012, the imports of tractors in Romania recorded some 340 million EUR, this representing a decrease by approximately 4% compared to 2011. The imports of agricultural, horticultural or forestry machinery for soil preparation or cultivation (ploughs, harrows, scarifiers, cultivators, weeders, hoes, seeders, planters, transplanters, spreaders) in Romania amounted to over 110 million EUR in 2012, up by approximately 3% compared to the previous year. Romanian exports of tractors recorded some 49 million EUR in 2012. Romanian exports of agricultural, horticultural or forestry machinery for soil preparation or cultivation (ploughs, harrows, scarifiers, cultivators, weeders, hoes, seeders, planters, transplanters, spreaders) recorded approximately 27 million EUR in 2012. 1.2 Main players 1.2.1 Producers of agricultural machinery Since 1990, the production of agricultural machinery in Romania has decreased significantly, the main factors being the fragmentation of arable land and lack of funds. By becoming an EU member in 2007, Romania received funds to be accessed by the farmers that started to revitalize the agriculture, but in the absence of strong local producers, the farmers preferred to acquire imported agricultural machinery. The main local agricultural machinery manufacturers with Romanian ownership are IRUM, Mecanica Ceahlau and MAT Craiova. Set up in 1953, the company IRUM produces agricultural and forestry equipment. The firm has a plant with the surface of 175,000 sqm located in Reghin (Mures county). In the last two years, the company invested over five million EUR in order to modernise its plant. IRUM produces approximately 500 agricultural machines per year, out of which some 10% are exported to Bulgaria, Ukraine and Germany. IRUM recorded in 2012 a net turnover of 14.4 million EUR. At present, the company has some 550 employees. Established in 1921, Mecanica Ceahlau (located in Neamt County) produces various types of agricultural equipment: soil processing machinery, seeding machinery, harvesting machinery, irrigation machinery etc. 30 - 35% of the company’s production is exported to Bulgaria, Ukraine, Sweden, Republic of Moldova, Russia, Hungary, USA, Argentina, Kazakhstan, and Sudan. In 2012, the firm recorded a net turnover of almost seven million EUR and over 200 employees. Mecanica Ceahlau is listed on Bucharest Stock Exchange. MAT Craiova has a tradition of over 135 years. The company produces mainly tractors in its plant in Craiova (Dolj county. The firm recorded a net turnover of five million EUR and some 200 employees in 2012. MAT Craiova is listed on Bucharest Stock Exchange. The main local manufacturer of agricultural machinery with foreign ownership is Maschio Gaspardo Romania. The company is part of the Italian Group Maschio Gaspardo. The firm launched its local plant in Chisineu Cris (Arad county) in 2003. In 2012, Maschio Gaspardo Romania recorded a net turnover of 25 million EUR and over 180 employees. The company will invest ten million EUR in the next three years in order to double its production capacity of agricultural equipment in Romania. The main local producers of agricultural machinery invest in the R&D activities. One example is the local producer IRUM that invested two million EUR in a research and development center for agricultural and forestry equipment. The investment started in 2013 and it is expected to be finalised in 2014. The company intends to increase the number of its engineers in charge with the R&D sector and to establish an effective prototype workshop with modern technology. 1.2.2 Importers and distributors of agricultural machinery The agricultural equipment market in Romania recorded a growing trend in the past years mainly based on imports. Romania imports new and second-hand agricultural machinery and farm equipment from Germany, Italy, USA, Austria, France, Hungary, Bulgaria, Turkey, and China. The Romanian market of agricultural machinery is dominated by imported brands, such as New Holland, John Deere, Fendt, Kuhn, Claas, Massey Ferguson, Case, Horsch, Hardi, Geringhoff, JCB, Pottinger, Hydrac, Vatra, Lemken, Knoche, Rauch, and Fella. The small farmers in Romania – over 2 million small farms of less than 1 hectare - usually prefer to acquire second-hand farm equipment and machinery. The main importers of agricultural equipment in Romania usually offer integrated services to their clients: selling of agricultural machinery, selling of spare parts, service, consulting and financial facilities. Some main multi-brand importers and distributors of agricultural machinery in Romania are: IPSO, Mewi Import Export Agrar Industrietechnik, General Leasing, MAP - Masini Agricole Performante, NHR Agropartners. They have distribution networks covering the entire country. The company IPSO, part of the French Group Monnoyeur, has been present in the Romanian market since 1991. IPSO imports and distributes the brands John Deere, Kuhn, Manitou, Bednar or Franquet. In 2012, the firm recorded a net turnover of 86 million EUR and over 260 employees. Mewi Import Export Agrar Industrietechnik imports and distributes the brands Fendt, Vatra, Geringhoff, Lemken, Horsch, Knoche, Rauch, Fella, Challenger, Merlo etc. The firm is part of the German Group Schröder. Mewi recorded a net turnover of approximately 26 million EUR in 2012. The company reported an increase of its sales by 20% in 2013 compared to the previous year. At present, the firm has almost 100 employees. Established in 1993, General Leasing imports and distributes the brands Massey Ferguson, Laverda, Kverneland, Gallignani, and Gregoire . In 2012, the company recorded a net turnover of approximately 19 million EUR. At present, the firm has some 100 employees. For 2014, General Leasing targets to expand its activity on the domestic market by opening new offices. MAP - Masini Agricole Performante imports and distributes the brands Same, Deutz Fahr, Lamborghini, Venieri. The company recorded a net turnover of approximately 16 million EUR and over 40 employees in 2012. NHR Agropartners imports and distributes the brands New Holland, Pottinger, Hardi, Bogballe, Matermacc, Dondi, Einboeck and Hydrac. The company recorded in 2012 a net turnover of some 12 million EUR and over 150 employees. 2. Market and Sector Challenges (Strengths and Weaknesses) The Romanian agricultural sector has significant potential for growth that is still insufficiently exploited, the agriculture restructuring and the rural economy revitalisation representing important keys for the country’s future economical development. The main opportunity on the Romanian market of the agricultural machinery is the fact that the market needs to be modernised, as the existent mechanisation level is very low and the agricultural fleet is insufficient. The Romanian agricultural equipment market recorded investments over the past years, some of the main contributing factors being: the available EU funds, the special credits for agriculture or the wider use of the second-hand equipment. Within the Axis 1 - “Improving the competitiveness of agricultural and forestry sector”, Measure 121 – “Modernisation of Agricultural Holdings”, the National Rural Development Programme 2007 – 2013 financed investments for the acquisition of agricultural machinery and technologies, the production diversification, the income increasing etc, through EU and national public assistance and private cofinancing. 2,378 projects with the public value of some 972 million EUR have been approved in Romania by 21 November 2013 within the Measure 121. In order to acquire agricultural machinery, farmers collaborate with banks and non-banking financial institutions. In order to facilitate the farmers’ access to agricultural credits, the Romanian Payments and Intervention Agency for Agriculture signed conventions with 12 banks. Furthermore, the main producers and importers of agricultural equipment offer financial solutions for their clients through credits. Despite all these aspects, the banking credits for Romanian farms remain at a low level of 110 EUR / hectares compared to 1,700 - 2,000 EUR / hectares in the EU. The main challenges of the agricultural machinery market in Romania are: the the the the the the internal structure of the majority of the local farms (low sizes and high fragmentation) high number of the semi-subsistence farms insufficient use of the EU funds y/y low increasing rates of the labour productivity in agriculture poor existing infrastructure inadequate access to the information A challenge of replacing aging equipment is the fact that the Governmental Buy-Back Programme for the enhancement of the renewal of the national park of tractors and self-propelled agricultural machines has not been as successful as expected. The programme ended in 2013 and it was managed by the Environment Fund Administration, subordinated to the Ministry of Environment and Climate Changes. According to this programme, owners that replaced an old agricultural vehicle with a new one were able to receive a scrapping premium of up to approximately 4,000 EUR, but without exceeding 40% of the purchasing price (exclusive of VAT) of the new tractor or self-propelled agricultural machine. The small farmers did not have enough financial resources to participate at this Programme and continued to prefer to acquire second-hand agricultural machinery. Entry onto the Romanian market of agricultural equipment and farm machinery can be done via acquisition of a local player (e.g. specialised importer-distributor or local manufacturer with own distribution network). Also, market entry can be done through collaboration with a well-established specialised multi-brand dealer or an importer-distributor of agricultural machinery. The second option would require less up-front financial investment. For all market entry options it is recommended that a trusted local adviser should be involved. 3. Case Study The US dealer Titan Machinery entered the Romanian market in 2011 through the acquisition of the local distributor AgroExpert Capital based in Timisoara. Romania was the first European country where Titan Machinery expanded its activity. Titan Machinery Romania distributes agricultural and construction machinery, the brands Case IH, Case Construction, Great Plains, Maschio, Gaspardo, Vogel Noot and Tecnoma. With a team of over 40 employees, the company covers the entire country. In 2012, it recorded a net turnover of approximately five million EUR. Canadian Government Contacts Canadian Embassy in Bucharest, Romania E-mail: neil.swain@international.gc.ca Internet: canadainternational.gc.ca/romania-roumanie/index.aspx?lang=eng Foreign Affairs Trade and Development Canada 125 Sussex Dr. Ottawa, ON K1A 0G2 Internet: http://www.infoexport.gc.ca The Government of Canada has prepared this report based on primary and secondary 1 sources of information. Readers should take note that the Government of Canada does not guarantee the accuracy of any of the information contained in this report, nor does it necessarily endorse the organizations listed herein. Readers should independently verify the accuracy and reliability of the information.