Basel III Brochure

advertisement

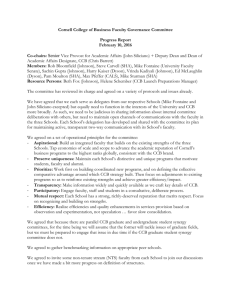

REGULAT O RY C O MPL I A NCE Basel III Capital Planning Model Capital modeling, analysis and planning at your fingertips — and built-in functions that automatically comply with complex Basel III rules. Q. Is your institution’s growth strategy Basel III compliant? Q. Will you maintain adequate capital throughout the entire Basel III transition phase-in? Q. If not, how much additional capital will you have to raise, and when? Q. Does your capital plan allow for the new Capital Conservation Buffer phase-in levels? Q. Will restrictions be imposed on shareholder dividends or bonuses paid to executives? If your capital plan leaves any ANY of these critical questions unanswered, the QwickAnalytics Basel III Capital Planning Tool is a must-have! Save huge amounts of work and planning time. Our experts have dissected the Basel III capital rules and built the requirements into straightforward, easy-to-use models that you can access with a few quick clicks. •Measure your Basel III capital requirements going forward, according to all new rules and phase-in dates •Automatically calculate future limitations on dividends or payouts caused by insufficient Capital Conservation Buffer levels • Eliminate rekeying and uploading of call report data •Easily benefit from time-saving default assumptions and oneclick report access •Quickly customize growth and income assumptions to tailor reports to your needs •Easily assume new capital raises of different types (common, additional tier 1 or tier 2 equity or debt) •Analyze multiple scenarios of growth, earnings and capital raising to compare relative regulatory capital impacts Basel III Summary Projections Your Bank Summary Regulatory Capital Calculations HISTORICAL(a) 2013 2014 Capital Conservation Buffers & Maximum Payouts 2018 2019 $18,478 $18,457 $20,880 $20,700 Additional Tier 1 Capital NA NA $5,604 $5,604 $5,604 $5,604 $5,604 $19,558 $24,346 $24,082 $24,061 $26,484 $26,304 $26,724 Total Risk-Based Capital 2015 PROJECTED(b) 2017 NA Tier 2 Capital Capital Conservation Buffer ("CCB") Reference Table 2016 NA Total Tier 1 Capital Your Bank 2015 Common Equity Tier 1 Capital $21,120 $2,597 $2,770 $3,137 $3,451 $3,929 $7,321 $7,754 $22,155 $27,116 $27,219 $27,512 $30,413 $33,625 $34,478 (a) Calculated using the previous General risk-based regulatory capital rules (b) Calculated using the new U.S. BASEL III revised regulatory capital rules PROJECTED 2017 2016 2018 2019 Transitional Phase-in Rules for Capital Conservation Buffer & Payout Restrictions Capital Surplus/(Deficit) Analysis No Limitation on Payouts of Eligible Retained Income NA CCB > 0.625% CCB > 1.25% CCB > 1.875% 60% Maximum Payout NA 0.625 ≥ CCB > 0.469 40% Maximum Payout NA 0.469 ≥ CCB > 0.313 0.938 ≥ CCB > 0.625 BASEL III Calculation 20% Maximum Payout NA 0.313 ≥ CCB > 0.156 Adequately 0.625 ≥ CCB > 0.313 Capitalized 0% Maximum Payout NA CCB > 2.5% 1.25 ≥ CCB > 0.938 1.875 ≥ CCB > 1.406 CURRENT 03/31/2015 2.5 ≥ CCB > 1.875 1.406 ≥ CCB > 0.938 1.875 ≥ CCB > 1.25 8.81% 7.76% 7.05% 7.06% 6.38% 5.88% 1.25 ≥ CCB > 0.625 $13,040 $11,668 $10,414 $11,479 $9,803 $8,553 $4,010 2015 PROJECTED 2017 2016 2018 2019 Leverage Ratio Tier 1 Capital Surplus/(Deficit): 0.938 ≥ CCB > 0.469 Well Capitalized 0.156 ≥ CCB $10,330 $8,564 $7,002 $7,728 $5,677 7.19% 7.36% 6.69% 5.79% 5.22% Adequately Capitalized $6,835 $7,185 $6,035 $4,654 $2,851 $1,486 Well Capitalized $1,751 $2,166 $514 ($2,558) ($5,082) ($7,240) 0.313 ≥ CCB Tier 1 (CET1) 0.469 ≥ CCB Common Equity Ratio 0.625 ≥ CCB BASEL III Calculation 4.84% CET1 Capital Surplus/(Deficit): Capital Conservation Buffer Calculation Tier 1 Capital Ratio PROJECTED 2017 9.60% 8.72% Common Equity Tier 1 Ratio 7.36% Tier 6.69% 5.22% 4.84% Less: Adequately Capitalized Minimum 4.50% 4.50%Adequately Capitalized 4.50% 4.50% $8,626 4.50% $9,025 $7,498 $4,849 $2,505 $546 Capital Conservation Buffer 2.86% 2.19%Well Capitalized 1.29% 0.72% $3,541 0.34% $4,006 $1,977 ($2,363) ($5,428) ($8,181) Tier 1 Capital Ratio 9.60% 8.72% 7.34% BASEL III Calculation 6.00% 6.00% 6.63% 6.13% 10.55% 6.00% 10.85% 9.97% 8.43% 8.48% 7.90% 2015 Less: Adequately Capitalized Minimum 2016 6.00% Capital Conservation Buffer Total Capital Ratio BASEL III Calculation 9.39% 2018 1 Capital Surplus/(Deficit): 5.79% Total Capital Ratio Total Capital Surplus/(Deficit): 2019 6.00% 6.13% 3.60% 2.72% 1.34% Adequately Capitalized 0.63% 0.13% $6,474 $7,142 $5,428 $1,566 $1,893 ($427) 9.97%Well Capitalized 8.43% 8.48% $1,389 7.90% $2,123 ($93) ($5,646) ($6,040) ($9,153) 8.00% 8.00% 8.00% 8.00% 8.00% Capital Conservation Buffer 2.85% 1.97% 0.43% 0.48% (0.10%) NA 1.97% Well Regulatory Capital Status 0.43% 0.48% Well Capitalized (0.10%) www.qwickrate.com Maximum Payout Calculation Total Eligible Income (b) 6.63% 10.85% Less: Adequately Capitalized Minimum Qualifying Capital Conservation Buffer (a) 7.34% $725 Capitalized Adequately Capitalized 800.285.8626 $586 $659 $797 $877 Maximum Payout Ratio NA 100% 20% 20% 0% Resulting Maximum Payouts ($000s) NA $659 $145 $159 $0 Adequately Capitalized Adequately Capitalized Under Capitalized Copyright © 1985 - 2015 4 (a) Limited to the minimum of the individual CCBs (b) Last 12-months net income, net of any capital distribution not already reflected in net income www.qwickrate.com 800.285.8626 Copyright © 1985 - 2015 5 Learn more about this time-saving planning and compliance tool Basel III compliance can be difficult and complex. Simplify it with the QwickAnalytics Basel III Capital Planning Tool (part of the QwickAnalytics Credit Stress Test). For more information or a sample report, go to www.qwickanalytics.com. Analysis by Monroe Financial Partners www. q wickanaly tics . co m 800.285.8626