Overview of U.S. Federal Taxes

advertisement

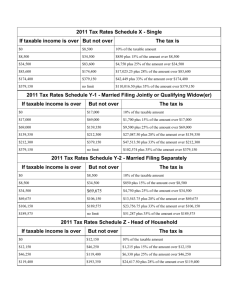

Overview of U.S. Federal Taxes with emphasis on the Personal Income Tax Public Econ Seminar, Econ 398 Joseph Guse History of Federal Budget source: www.whitehouse.gov/omb/budget/Historicals (Table 1.2) Most Common Types of Taxes • Individual Income Taxes. Progressive structure. Levied on all income – labor and capital. • Payroll Taxes. Finance SS, Unemp Ins, Medicare. Levied only on labor income. Regressive structure. • Corporate Income Taxes. • Wealth Taxes. Federal Estate Tax and Gift Taxes. Local Property Taxes. • Consumption Taxes. Federal excise taxes (e.g. gas and cigs) and import tarriffs. Local sales and excise taxes. • Other Revenue Sources. Revenue and Shares by Type Federal Tax 2005 Source: BEA via Slemrod and Bakija Receipts ($Billions) Share of Federal Revenue Share of GDP Personal Inc. Tax 928 41.3% (7.4%) Payroll Taxes (Soc Ins) 855 38.1% (6.9%) Corporate Inc.Tax 326 14.5% (2.6%) Excise Tax,Customs 101 4.5% (.8%) Estate and Gift Tax 25 1.1% (.2%) Total 2247 100% (18%) Total State and Local 1185 (9.5%) Revenue Composition History Source: www.whitehouse.gov/omb/budget/Historicals (Table 2.2) History of Personal Income Tax Summarized from Bakija and Slemrod • Civil War Era Income Tax 1861-1871. • 1894. Income Tax Enacted but Overruled by Supreme Court. • 1913. 16th Amendment. Start of modern Income Tax. • 1914. Graduated Rates (1-7%). Large Personal Exemption: only 0.5% of population has income high enough to have any liability. Still only 6% on eve of WWII. • 1917 Deductions for mortgage interest, local taxes and charitable giving already in place. • WWII. Receipts goes from 1 to 8% of GDP. Percent filing goes from 6% to 34% of population. Employer withholding introduced. Top Marginal Rate History Source: www.taxpolicycenter.org/taxfacts Definition of “Income” • Haig-Simon: “The increase in person’s ability to consume over a given period of time” Income = Consumption + Net Change in Wealth Would include… • Wages • Value of all Employer and Govt benefits • Capital Income (rent, dividends) • Capital Gains/Losses (whether realized or not) in real terms. (appreciate and depreciation). • Domestic production • Value of services from owned durable good. (Rental value of own home, cars, etc) • Subtract cost of earnings (inputs, interest, maintenance costs, etc) Further Discussion of Haig-Simon definition • Problem with measurement. – Timing problems. Lotteries and annuities. Retained corporate earnings. – Uncertainty Problems. E.g. Intellectual property. • Why we care – Taxing only some forms of income lead to distortions and fairness issues. Federal Tax Definition of Income • Tax code “lays out transactions and events that trigger tax liability” • Adjusted Gross Income (AGI) – Wages and Salaries (73%) – Returns to Capital (dividends, interest, cap gains, rent, royalties) – Small Business Income (mixture of the two) Capital Issues • MOST Interest and Dividend Income is exempt (pension plans, tax-free bonds, etc), though some dividend income excluded from AGI may have taxed by corporate income tax. • Only Realized Nominal Gains/Losses counted • Exemptions – Gains held until death – Gains on owner-occupied housing up to $500K • Cap gains are taxed at special rates (15%) • In general cap gains can be taxed once, twice (because of interaction with Corporate Tax) or not at all! – The amount of cap gain included in AGI over 1980 – 2004 is roughly equal to Haig-Simon definition, but that just reflects rough balance of huge “errors” in both directions. • Interpretation: Because of generally lower rates on returns to savings (via exemptions from 401ks, IRAs, and special cap gains rate), our system is really a hybrid of an income tax and a consumption tax. Other Exclusions from Taxable Income • $1 trillion (2004) excluded from AGI due to evasion. • $363B (2004) State and Local Tax Deduction • $340B (2004) Mortgage/Home Equity Loan Interest Deduction. • $166 (2004) Charitable Contributions • $62 (2004) Medical Dental Deductions • Standard Deduction • Personal Exemptions 2012 Marginal Rates (Single) Source: IRS • • • • • • 10% on taxable income $0 to $8,700, plus 15% on taxable income $8,700 to $35,350 25% on taxable income $35,350 to $85,650 28% on taxable income $85,650 to $178,650 33% on taxable income $178,650 to $388,350 35% on taxable income $388,350. Marginal Rates, 2012, Married Jointly • • • • • • 10% on taxable income $0 to $17,400 15% on taxable income $17,400 to $70,700 25% on taxable income $70,700 to $142,700 28% on taxable income $142,700 to $217,450 33% on taxable income $217,450 to $388,350 35% on taxable income $388,350. Tax Credits – Welfare Through the Tax Code • EITC and Child Credit are Refundable • EITC is a wage subsidy that eventually get phased out as income increases. Ramp-up, plateau, phase-out structure. – 2007 example. Married with 2 children. 40% up to $11,790. plateau to $17,390. phase out at 21% rate. EITC is zero above $39,783. • Child Credits. $1000 per kid!